The DATA token —the native-currency of Streamr— soared over 100% in value, as the Ethereum-based DeFi protocol is joining a European Union program called ATARCA, in a new project that seeks to implement new financial technologies for data and market research.

The European Consortium granted $2.5M to this research program, a fusion between Streamr and ATARCA —Accounting Technologies for Anti-Rival Coordination and Allocation— to develop an open-source project and bring in a new token called the “anti-rival” token, which will work with the Ethereum ecosystem.

The project proposes a new market category —accordingly, both companies are creating an exchange platform where the value of goods relies not on supply and demand, but on abundance. This means that the more the goods are share, the more valuable they are.

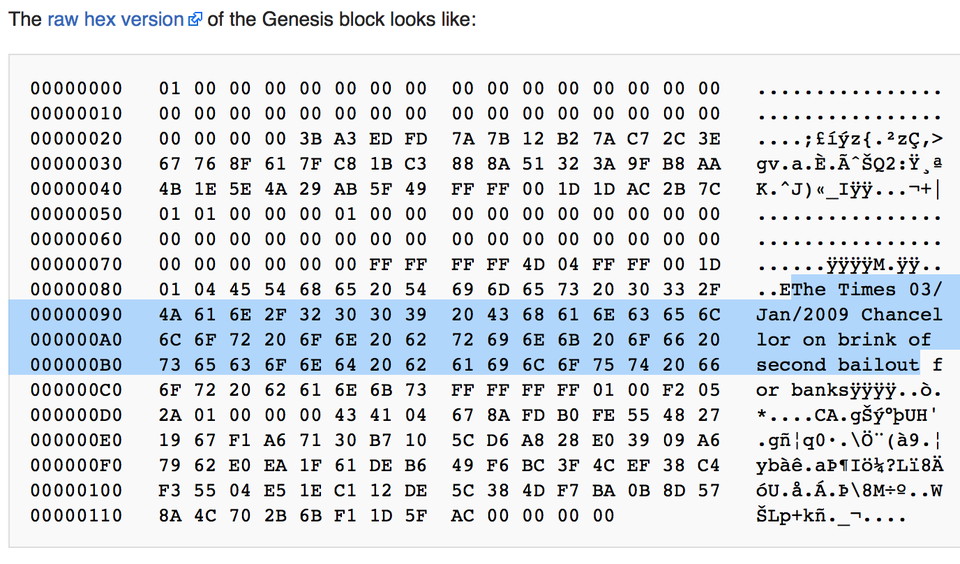

A New Kind of Money

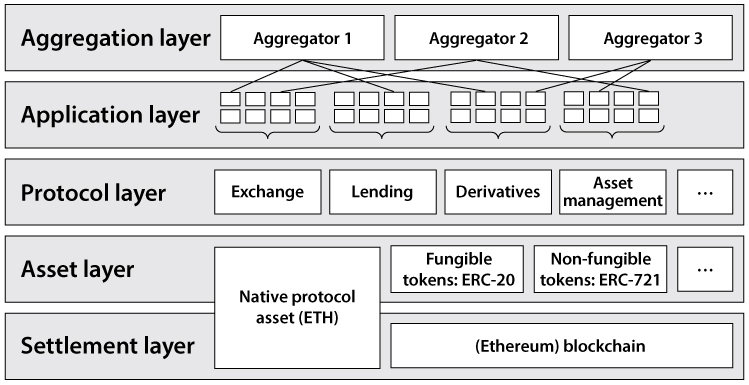

These”anti-rival” tokens are DLT-based —distributed ledger technology — and according to ATARCA, they will set a new category for financial technologies by helping markets globally to organize data and digital goods through community-driven currencies.

The new token will be tested in Barcelona using the REC —Real Economy Currency— a local currency in Spain backed by NOVACT, —Institute for Nonviolent Action—.

The interesting feature of these tokens is that they work as stores of value, collectibles, and a unit of account. But the value relies on sharing, instead of exchanging.

These distributed ledger technology (DLT)-based tokens are used to instantiate a new ‘substance’ of quantified anti-rival value, a medium of sharing. The smart tokens will enable efficient, decentralized, market-style trading and ecosystems for anti-rival goods.

Pekka Nikander, Professor of Aalto University in Finland, will lead ATARCA. According to the professor, the 21st century needs a new economic system that can solve the old problems that the current one still struggles with:

In ATARCA, we create cryptographically protected anti-rival tokens and test their applicability to governing industrial data markets and fostering cooperation in community-driven currencies. If successful, this technology will not only help to properly organize the markets for data and other digital goods but provide the structural fundamentals of a new type of economic growth. This will allow the societies at large to more widely explore structurally new incentives for systemic sustainability and scalable systemic intelligence.

Recently, we have also seen other bullish news for DeFi such as Federal Reserve Bank Researcher Suggests DeFi May Lead To A More Robust and Transparent Financial Infrastructure. As this DeFi market continues to grow it will become harder to ignore as it attempts to reshuffle global economics as we know it today.