PayPal Coin is the new soon-to-be-released stablecoin from Paypal Holdings Inc, as revealed to Bloomberg News by Jose Fernandez da Ponte, PayPal’s senior vice-president of crypto and digital currencies.

Stablecoin Development Code Found Inside the PayPal App

In an interview with Bloomberg, Fernandez da Ponte said: “We are exploring a stablecoin; if and when we seek to move forward, we will, of course, work closely with relevant regulators.”

As per the report, it was PayPal developer Steve Moser who found the hidden code of a stablecoin already in development inside the PayPal app. Moser also found a logo image that read: “PayPal Coin”.

However, the code and the image were the products of a recent PayPal internal hackathon – a type of internal gathering frequent in tech companies where employees such as software developers engage and collaborate to promote new products and projects. This means that the final product could change.

Stablecoins Facilitating Payment Systems

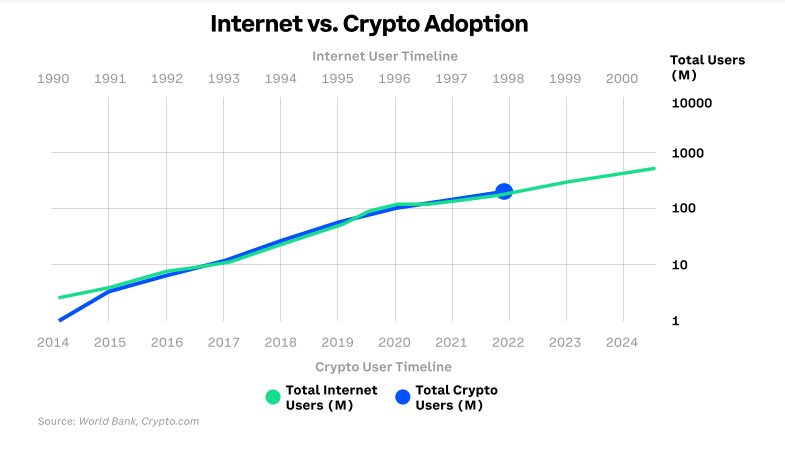

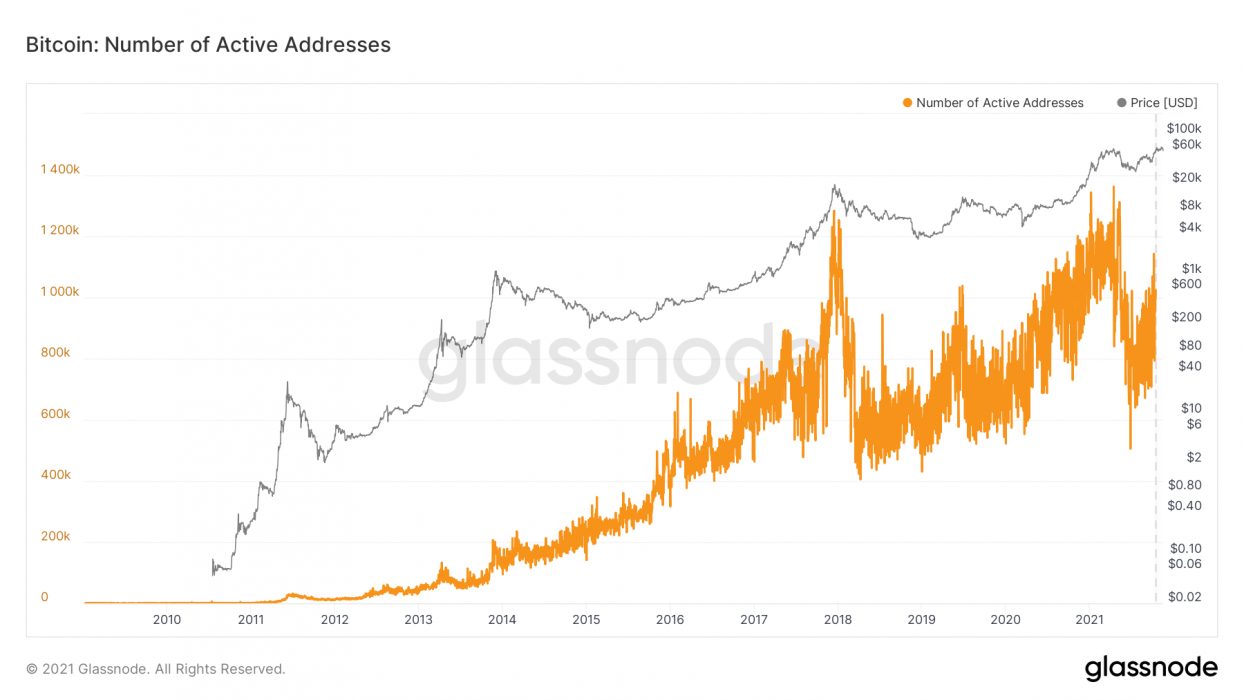

PayPal’s effort to engage with the crypto market was one of the main drivers behind the Bitcoin price rally that started in mid-2020 – a year that saw the emergence of the institutional interest in cryptocurrencies.

While most financial institutions were hoarding high market-cap currencies such as bitcoin and ethereum in 2021, the interest in stablecoins quickly took over as they facilitate USD transactions for businesses. On December 13 it became apparent that Novi, Meta’s digital wallet, was on the move to start a stablecoin payments trial by simply sending a text message on the WhatsApp chat app, instantly and with no fees.

However, the stablecoin market has its downside – there is no deposit insurance for holders, for one. But as Crypto News Australia reported last October, the US Government has been studying the possibility of a US$250,000 coverage for holders of these tokens.