The Pendal Group – a Sydney-based investment management firm among the biggest in Australia – has recently come out in support of Bitcoin, lauding the asset’s qualities, especially when compared to government bonds.

No Longer An Asset For “The Tinfoil Brigade”

Vimar Gor – the head of Bond, Income, and Defensive Strategies at Pendal Group – iterated his support for Bitcoin and declared that the Pendal Group will be entering the crypto market via futures contracts.

In order to trade Bitcoin futures, the investment management firm is looking to join longstanding futures markets such as the CME Group Exchange and the Chicago Board Options Exchange (CBOE), among others.

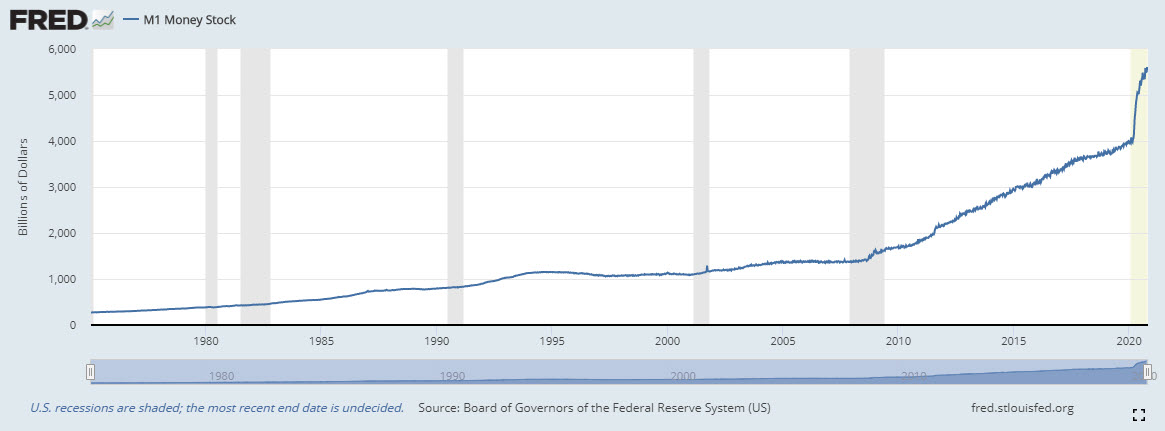

In an interview for the Australian Financial Review, Vimar Gor went on to say that the currently ongoing COVID-19 pandemic has been a catalyst for greater market trends that have been around for a while – and that cryptocurrencies are in the right spot to profit from it. With official interest rates and bonds plummeting and large scale central bank QE programs doing the rounds, Vimar predicts that bond yields won’t be very fruitful in the foreseeable future.

Vimar then went on to explain that cryptocurrency has become the elephant in the room – or rather a cockroach in the room that you can’t really ignore anymore.

“Bitcoin is a cockroach that exists. They can’t ban it out of existence.

We think ultimately that government bonds will turn into a dead asset class, so we now have to imagine what it will be like for other assets classes when bonds are no longer relevant to hold in a portfolio.”

Contrary to notorious naysayers such as Peter Schiff, Vimar Gor sees a bright future for digital assets, owing to their finite supply and high demand.

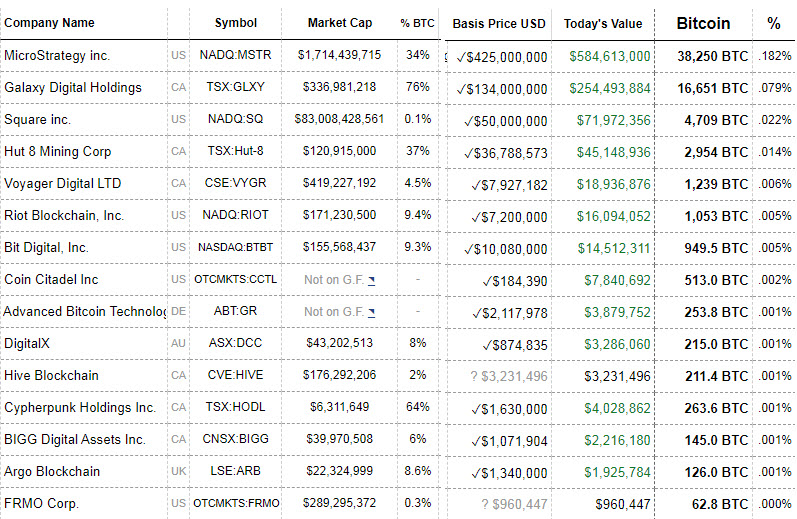

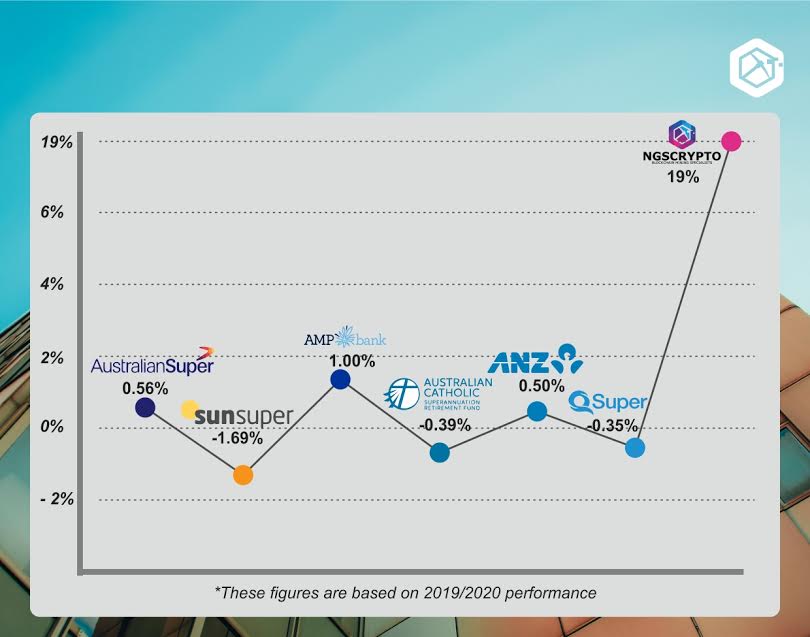

Following the major investments into cryptocurrencies by companies like Square, Paypal, and now Pendal Group, it is not unlikely we will see more and more big-league financial companies hopping on the crypto train.