“It’s more than an inflation hedge” – this is how Soros Fund CEO Dawn Fitzpatrick recently referred to bitcoin, adding that the cryptocurrency market has “crossed the chasm to mainstream”.

In a recent interview with Bloomberg, Fitzpatrick – who’s also the chief investment officer of Soros Fund, a private US investment firm with over US$6 billion in assets under management – discussed the current state of the stock market, Chinese companies in the US, and bitcoin, stating that her company is exploring crypto beyond the inflation hedge narrative.

Bitcoin Has Surpassed the ‘Inflation Hedge’ Narrative

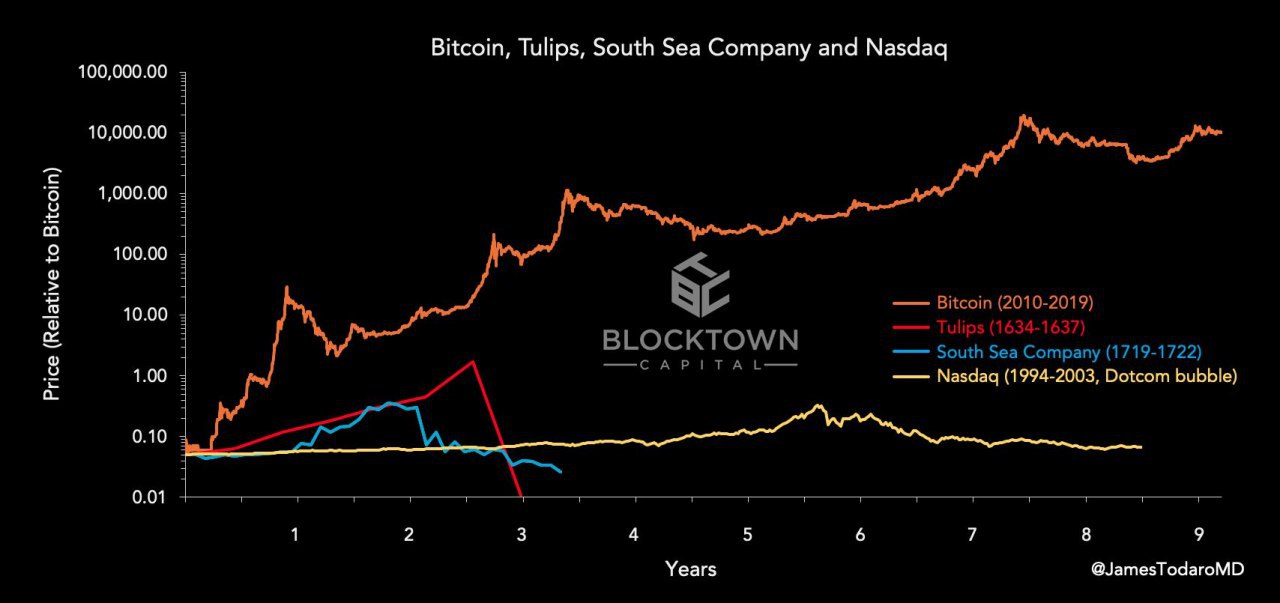

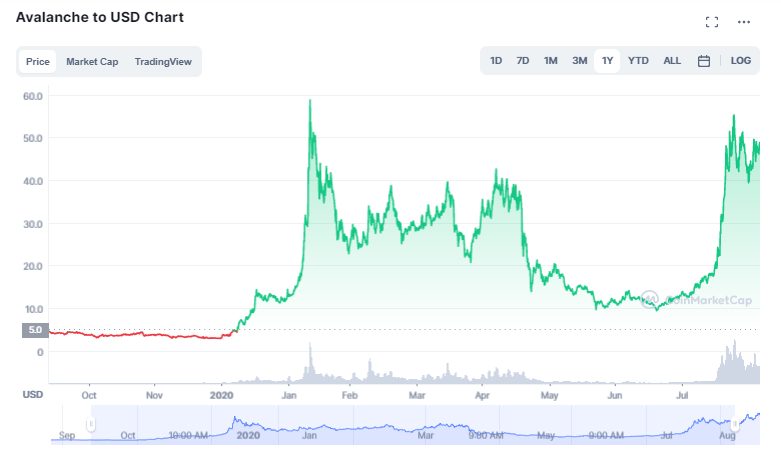

While other institutional investors and billionaires have satanised bitcoin and cryptocurrencies in general – among them Warren Buffet’s right hand man, Charlie Munger – Fitzpatrick points to how the crypto market now has over US$2.3 trillion in market cap and 220 million users globally. To reinforce her point, the number of active crypto addresses reached the 50 million mark two weeks ago.

A ‘Market Crash’ is Getting Closer

During the Bloomberg interview, Fitzpatrick was asked what her fund’s current market strategy was against hyperinflation. She said that a market crash was nearing, and that high inflation combined with low interest rates have pushed the fund to stockpile cash by borrowing against various securities.

I think we’ve all been surprised at how long [high inflation] feels like it’s going to last now.

Dawn Fitzpatrick, CEO and CIO, Soros Fund

Fitzpatrick’s statements echo the words of billionaire Marc Lasry when in June he lamented not buying enough bitcoin. “As more and more people start using bitcoin, it’s going to keep going up. It’s happened a lot quicker than I thought it would. I should have bought a lot more. That was my mistake,” Lasry said.

Other billionaire investors such as the outspoken Chamath Palihapitiya consider that bitcoin has “effectively replaced gold”, as he said earlier this month, and would continue to do so as the cryptocurrency market cap grows.