Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

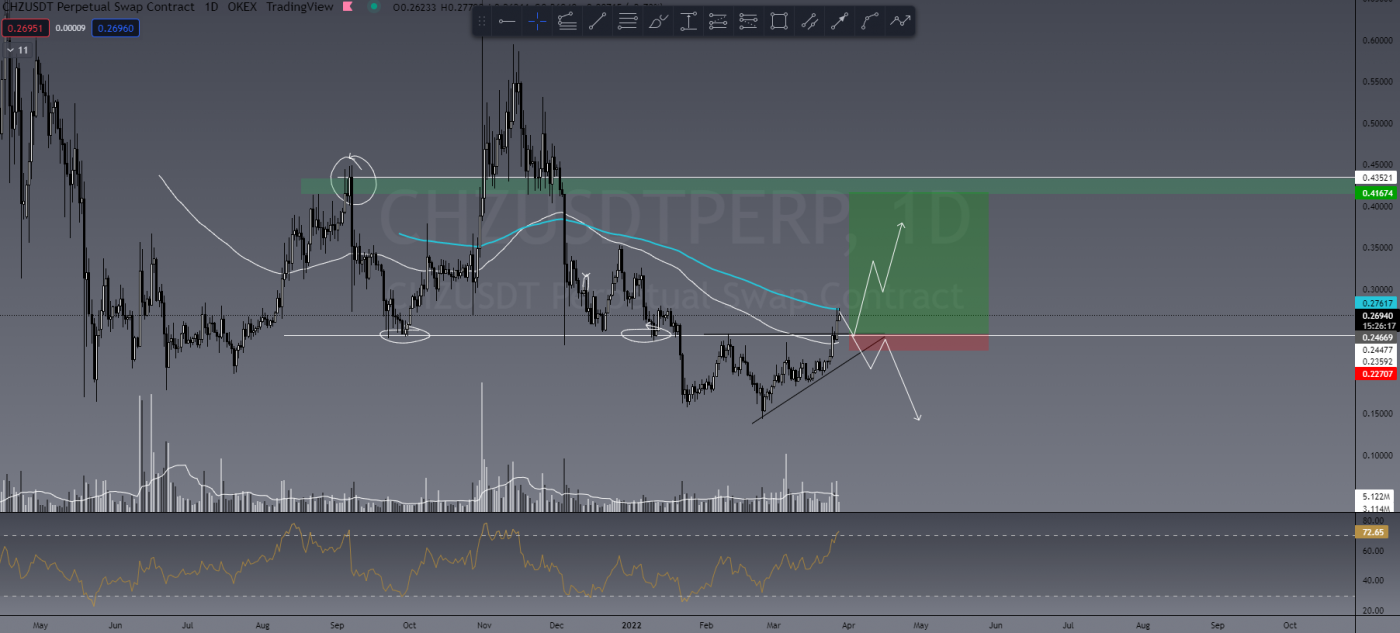

1. Chiliz (CHZ)

Chiliz CHZ is the leading digital currency for sports and entertainment, powering the world’s first blockchain-based fan engagement and rewards platform, Socios.com. Here, fans can purchase and trade branded fan tokens as well as having the ability to participate, influence, and vote in club-focused surveys and polls. Founded in Malta in 2018, the company’s vision is to bridge the gap between active and passive fans, providing millions of sports fanatics with a fan token that acts as a tokenised share of influence.

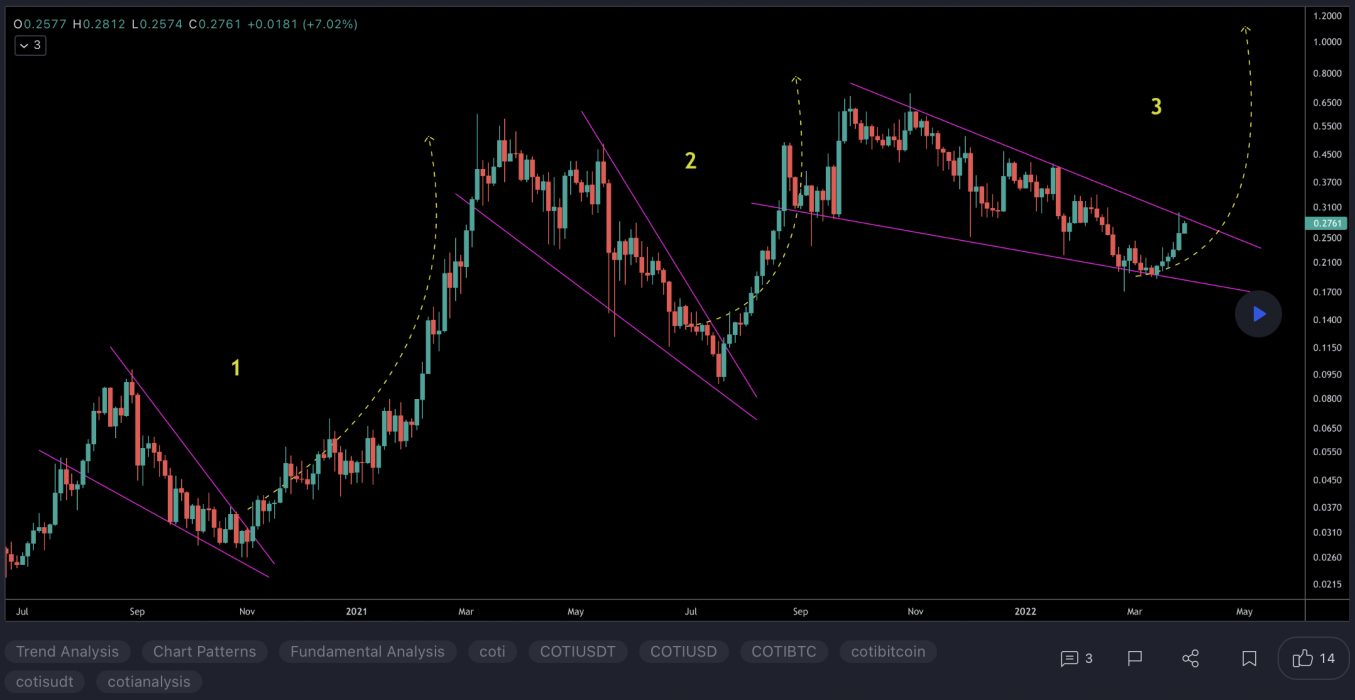

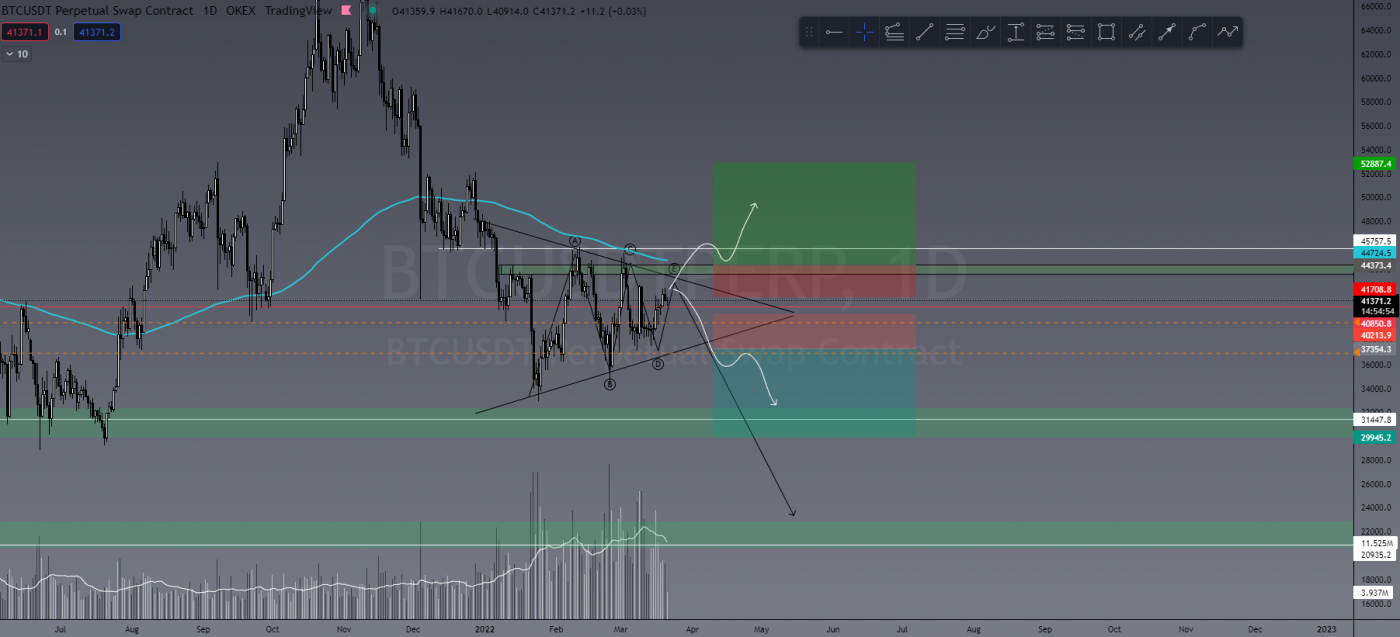

CHZ Price Analysis

At the time of writing, CHZ is ranked the 64th cryptocurrency globally and the current price is US$0.3092. Let’s take a look at the chart below for price analysis:

CHZ‘s stunning rally to $0.5350 plummeted over 70% after December to sweep consolidation lows at $0.2155. This could set the stage for a new bullish cycle to begin.

The price is currently balancing around the January monthly open. A quick stop run into support beginning near $0.2732 could set the stage for a move into the daily gap beginning near $0.2605, potentially reaching resistance near $0.2437.

A sweep of the highs near $0.3258, followed by a sharp sell-off, could hint that bulls are preparing to run the swing high near $0.3547. This run could find the next resistance around $0.3836 in the candle wick that created the monthly high. If the market remains bullish, the price will likely reach into possible resistance near $0.4128.

2. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management. The platform uses two in-house tokens, VET and VTHO, to manage and create value based on its VeChainThor public blockchain. The idea is to boost the efficiency, traceability, and transparency of supply chains while reducing costs and placing more control in the hands of individual users.

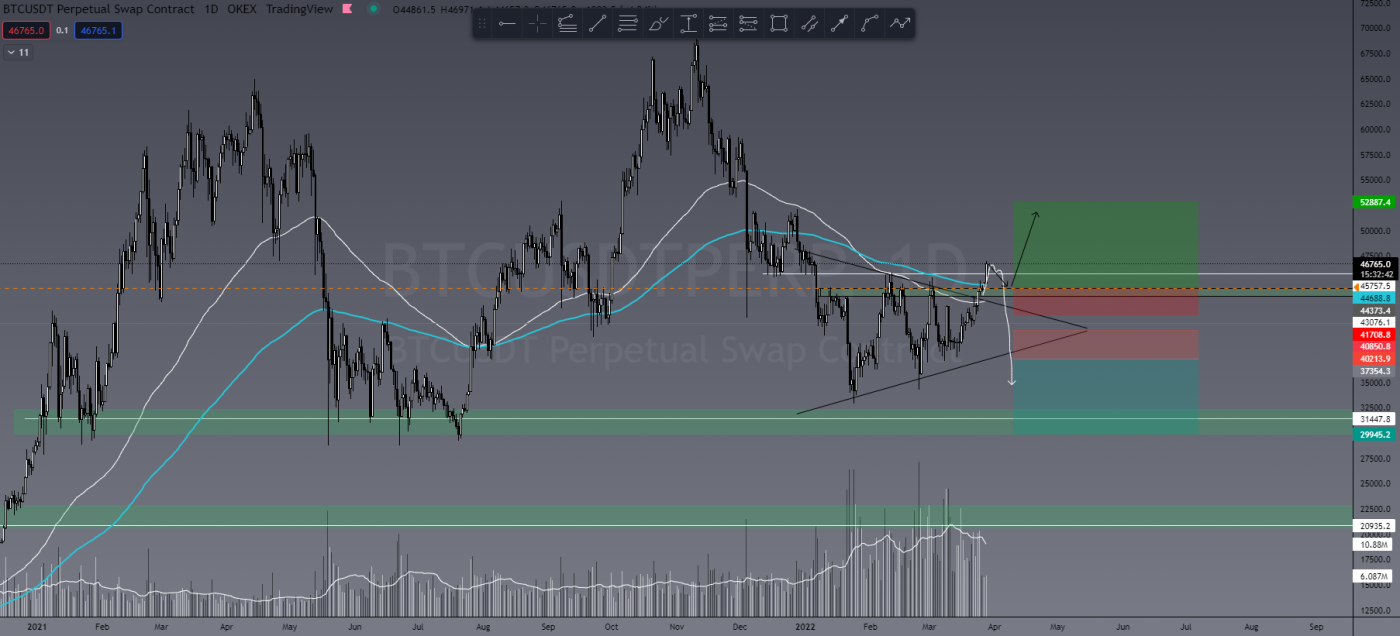

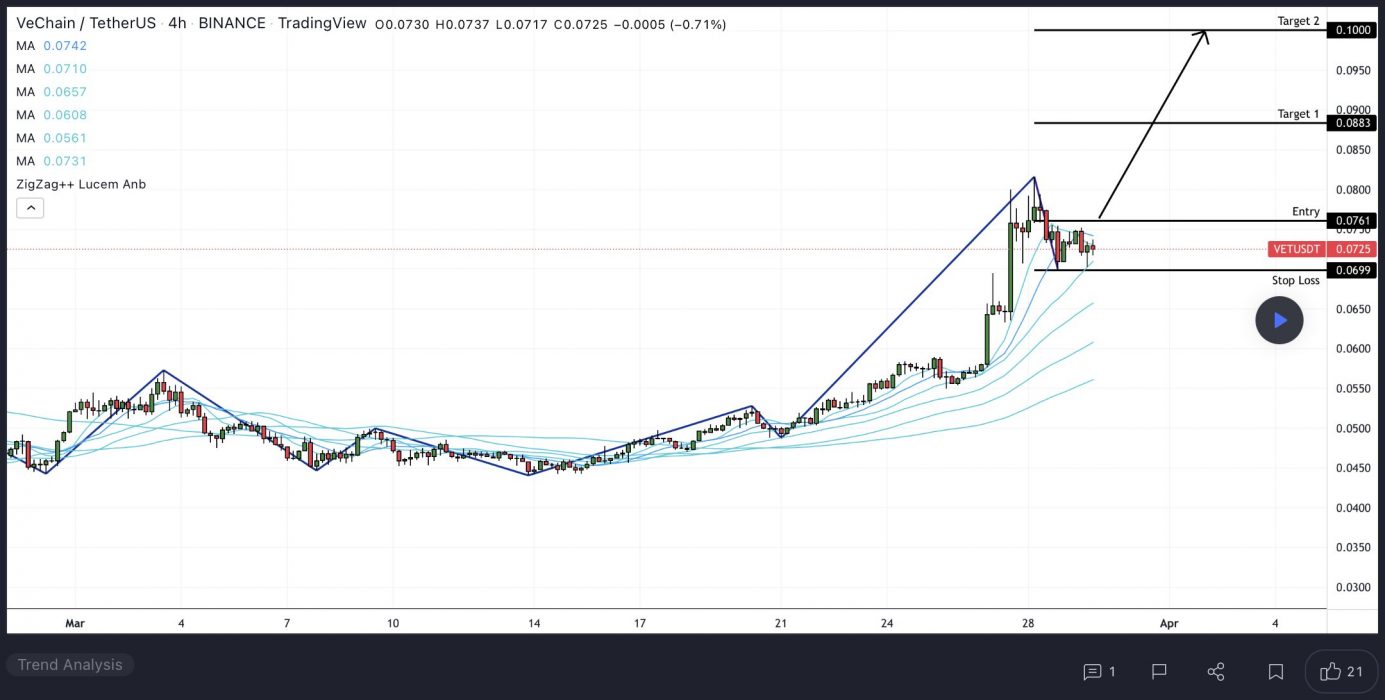

VET Price Analysis

At the time of writing, VET is ranked the 34th cryptocurrency globally and the current price is US$0.08355. Let’s take a look at the chart below for price analysis:

VET‘s 45% move during last week ran into resistance near $0.08420, at the 27% extension of the Q1 swing.

An old high and the 18 EMA have provided support near $0.06833 and might give support again on a retest. This area also has confluence with the 50% and 62.8% retracements of November’s swing.

Just below, near $0.06493, the 55.8% retracement of the current Q4 swing might also mark an area of support.

If the market turns bearish, $0.06172 is unlikely to be revisited but could see interest from bulls during any deeper retracement.

An area near $0.09018, at the 50% extension of the summer’s swing, could see some profit-taking if bulls break the current resistance near $0.09378. Above, old consolidations near $0.09525 and $0.09872 may also provide some resistance before another round of price discovery.

3. Aave (AAVE)

AAVE is a decentralised finance protocol that allows people to lend and borrow crypto. Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a flash loan using this liquidity. AAVE provides holders with discounted fees on the platform, and it also serves as a governance token – giving owners a say in the future development of the protocol.

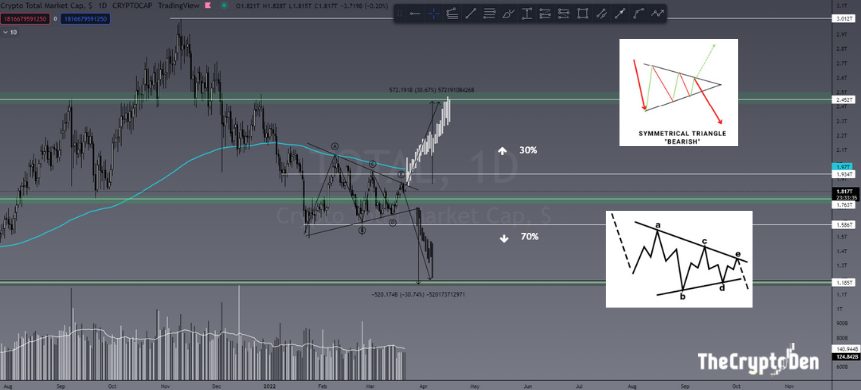

AAVE Price Analysis

At the time of writing, AAVE is ranked the 48th cryptocurrency globally and the current price is US$229.86. Let’s take a look at the chart below for price analysis:

AAVE‘s strong downtrend that began during mid-January has retraced most of its Q1 move, recently sweeping lows near $160.

A sweep of the relatively equal lows near $217 into possible support around $210, combined with bullish market conditions, could be the catalyst that begins to form a bottom. If this level fails, bulls might buy the monthly gap’s low near $198.

The swing high near $248 may form resistance to any sudden pumps as holders unload some of their position. A more substantial move might sweep relatively swing highs into probable resistance near $256, potentially reaching up to the new monthly high near $265 and $280.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.