Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ethereum Classic (ETC)

Ethereum Classic ETC is a hard fork of Ethereum that launched in July 2016. Its main function is as a smart contract network, with the ability to host and support decentralised applications (DApps). Its native token is ETC. Since its launch, Ethereum Classic has sought to differentiate itself from Ethereum, with the two networks’ technical roadmaps diverging further with time. Ethereum Classic first set out to preserve the integrity of the existing Ethereum blockchain after a major hacking event led to the theft of 3.6 million ETH.

ETC Price Analysis

At the time of writing, ETC is ranked the 30th cryptocurrency globally and the current price is US$48.65. Let’s take a look at the chart below for price analysis:

During October, ETC broke several swing highs that could be the signal for a new bullish trend.

Last week’s break of the most recent swing low could suggest some downside in the short term. It formed probable resistance near $46.32 and may target the swing low and possible support near $43.90.

The swing low and possible support near $40.21 could be the second bearish target if the move down continues. The relatively equal lows near $38.00 and possible support underneath near $36.75 could provide more substantial support.

The last swing high near $52.44 gives a near-term target if bullish continuation continues. However, resistance beginning around $55.80 could cap this move. A break of this resistance might continue to probable resistance near $57.03 and reach above the cluster of relatively equal highs near $62.89.

2. Curve DAO Token (CRV)

Curve CRV is a decentralised exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits.

CRV Price Analysis

At the time of writing, CRV is ranked the 80th cryptocurrency globally and the current price is US$3.68. Let’s take a look at the chart below for price analysis:

Last month, bulls enjoyed 95% gains at CRV‘s peak before the price confirmed stiff resistance beginning at $4.60.

The 4-Hour chart shows that support may be forming between $3.56 and $3.50, near the monthly open. Aggressive bulls could enter in this area, although safer entries may be found much further below near $3.44 and $3.39 after a sweep of the current consolidation’s swing lows.

The last swing high near $3.98 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near $4.29 and the 2.0 extension near $4.52 and $4.65 may provide the next major targets.

3. Dego Finance (DEGO)

Dego Finance DEGO is a decentralised ecosystem that offers a diverse combination of the non-fungible token (NFT) and decentralised finance (DeFi) tools. It is an independent, open NFT ecosystem. Any user is allowed to launch an NFT and initiate mining, auctions and trading, covering the entire lifecycle of the product. Dego’s NFT protocol is a cross-chain, second-layer infrastructure for Blockchain projects that can be leveraged for user acquisition and token distribution.

DEGO Price Analysis

At the time of writing, DEGO is ranked the 554th cryptocurrency globally and the current price is US$7.48. Let’s take a look at the chart below for price analysis:

During October, bulls enjoyed 85% gains at DEGO‘s peak before the price confirmed strong resistance beginning at $10.25.

The 1-Day chart shows that support may be forming between $7.32 and $7.12, near the weekly open. Aggressive bulls could enter in this area, although safer entries may be found much further below near $6.82 and $6.58 after a sweep of the current consolidation’s swing lows.

The last swing high near $7.83 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near $8.15 and the 2.0 extension near $8.40 may provide the next major targets.

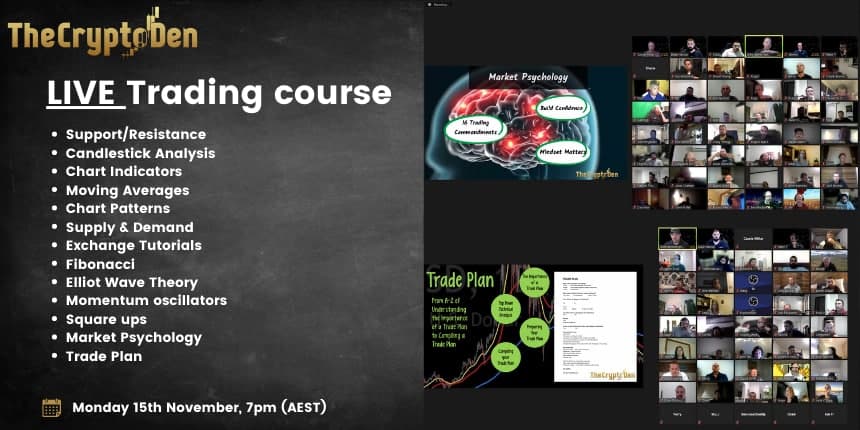

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.