Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

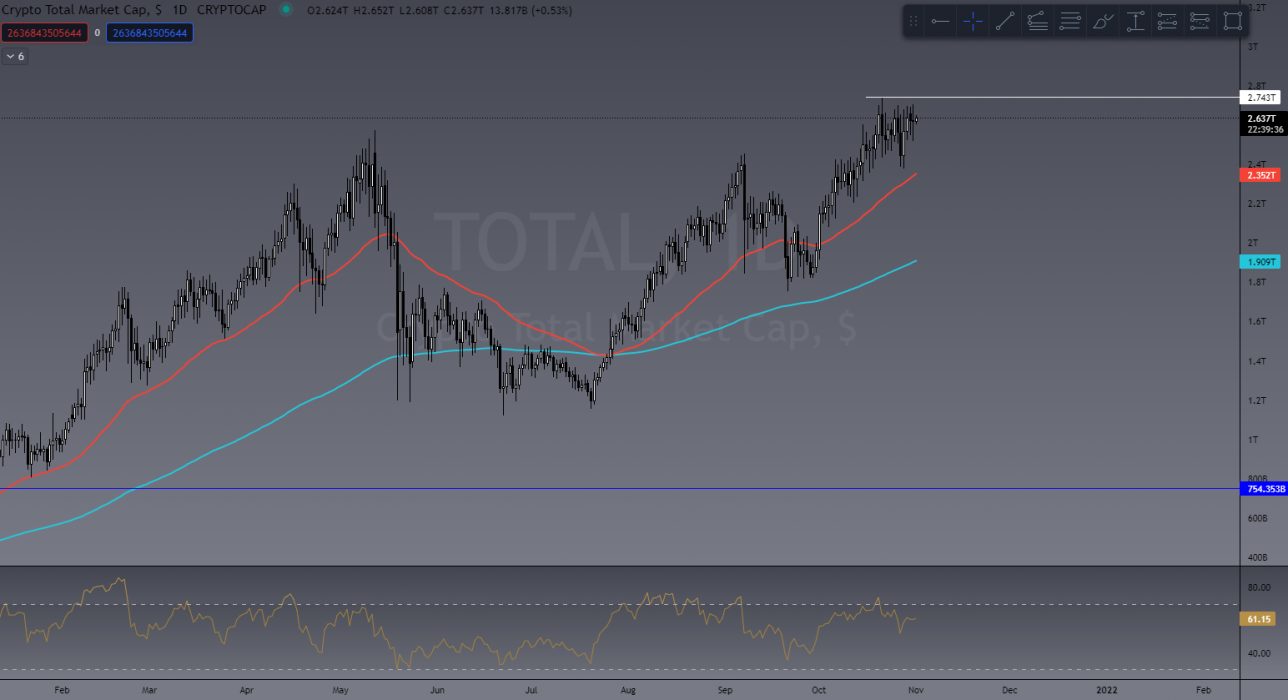

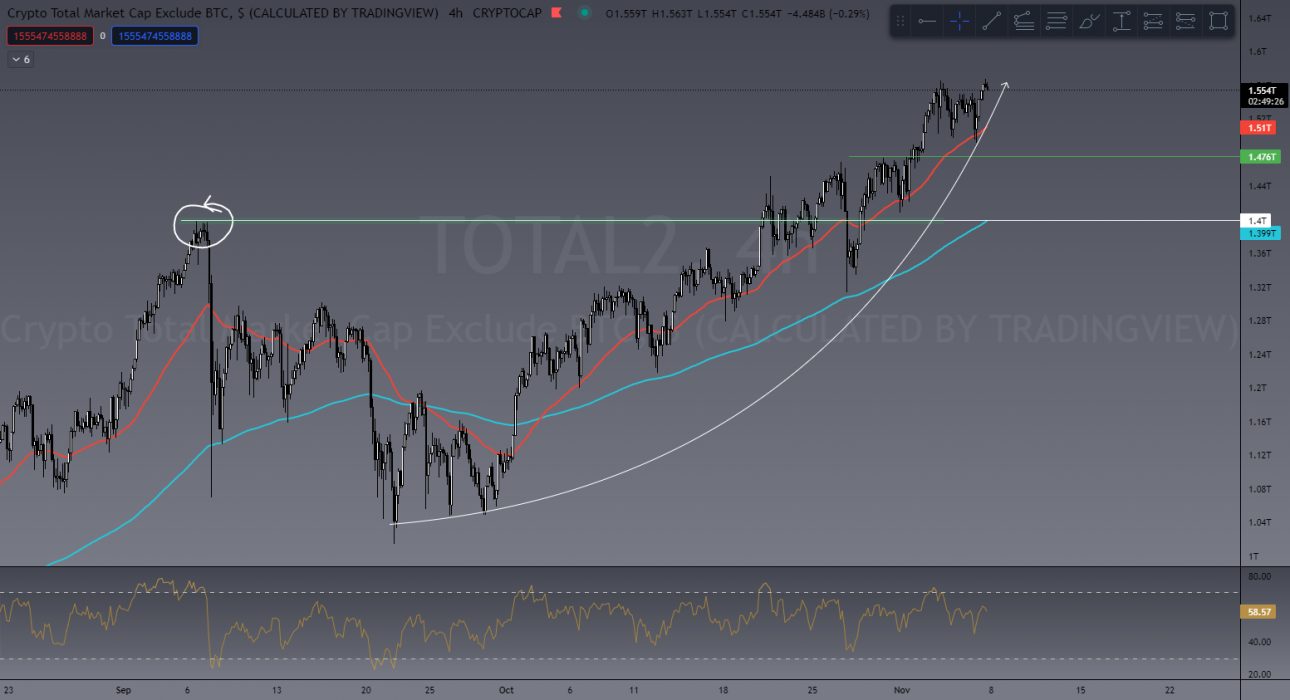

Last week the overall Crypto Market Cap (TOTAL) sat steady at the US$2.6 trillion area and this week is still holding strong, currently at US$2.7 trillion. The flow of money into ALTS has shown some serious bullish price action across the board all week with near perfect conditions as a trader.

Bitcoin dominance is still dropping. Over the past seven days it’s dropped from 44% to 42%, while the ALT market added almost US$100 billion (6% growth).

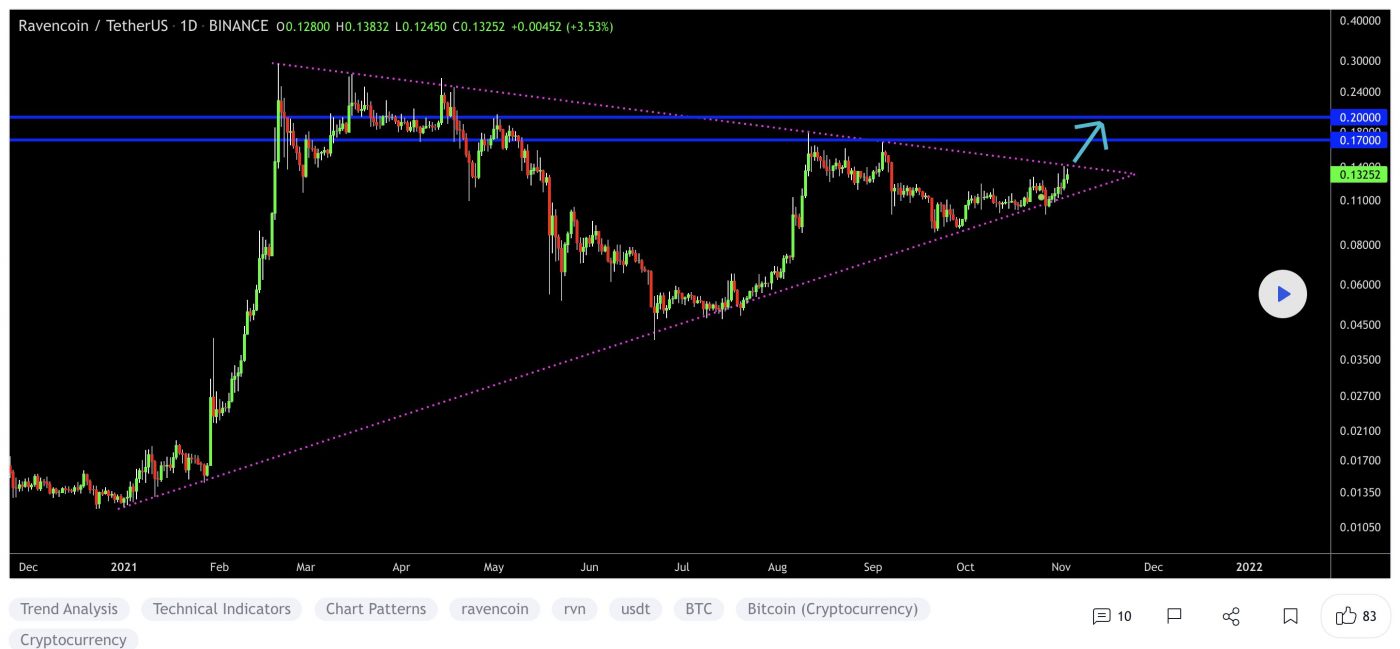

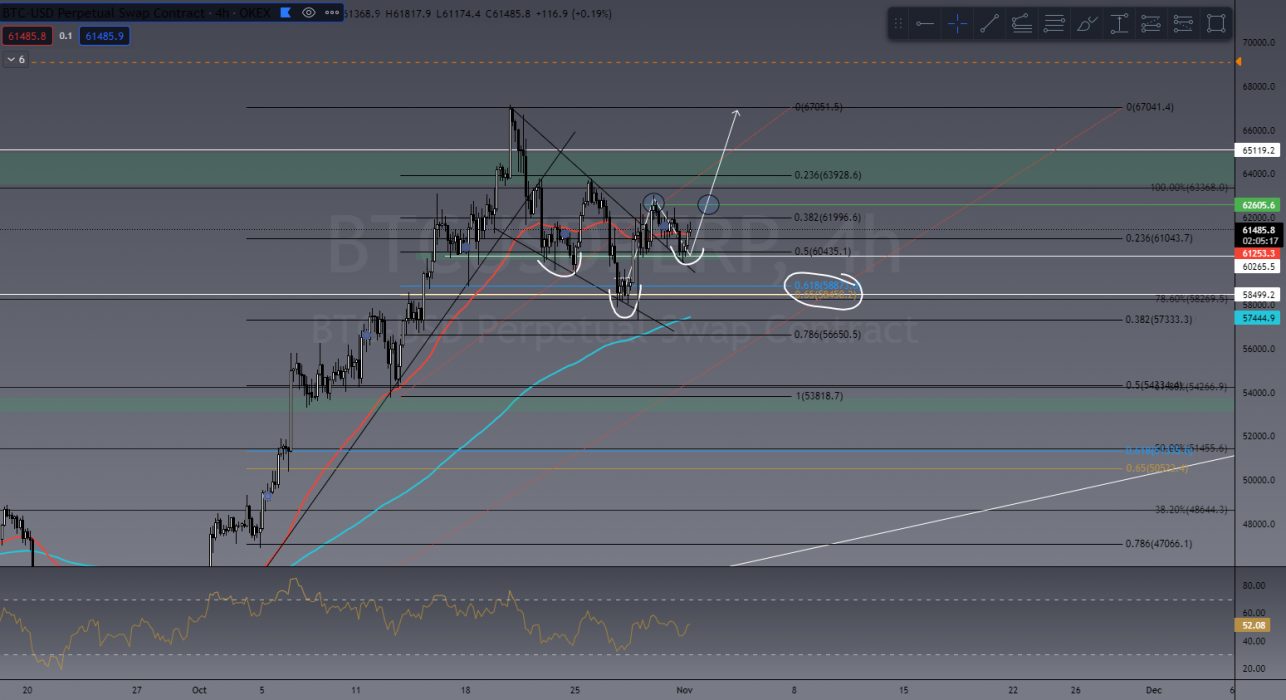

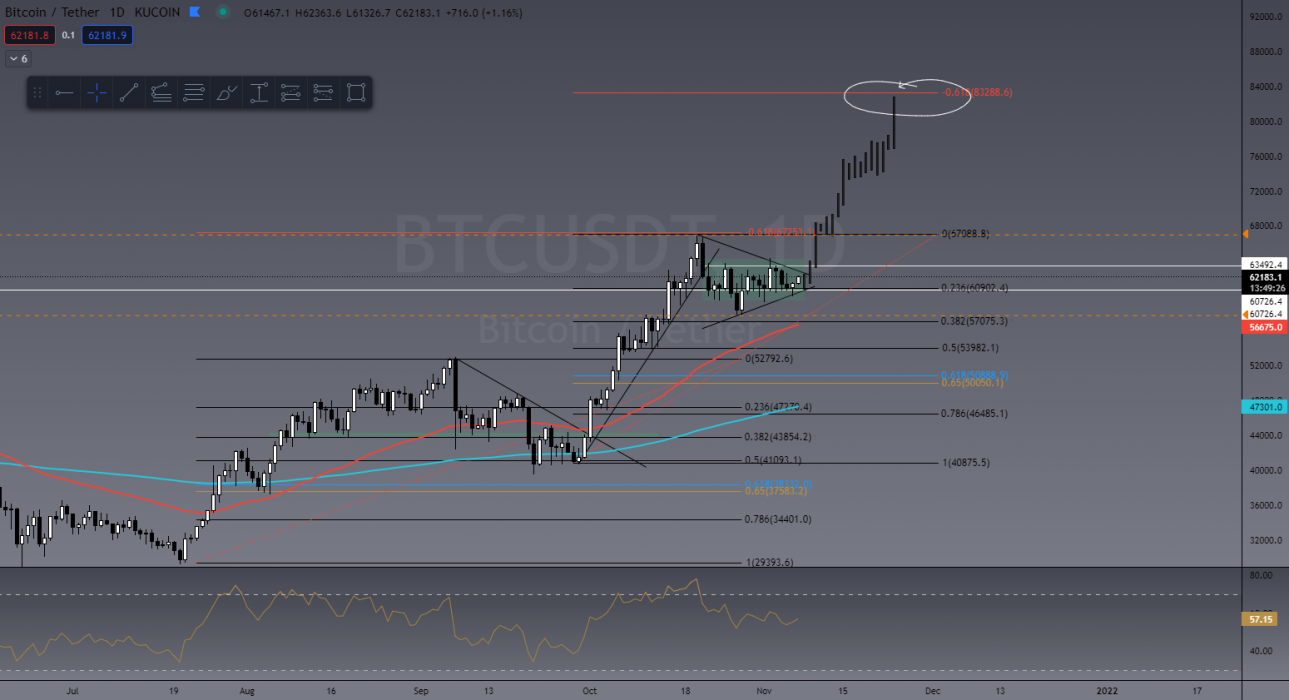

Looking at BTC, we are seeing a few key points of interest.

First, since last week BTC has been ranging. Despite the BTC.D dropping further, this isn’t a bad thing. Holding steady above US$60,000 and ranging up to US$64,000 shows a bit of consolidation.

After its ATH push, it’s retraced into a golden pocket (61.8% FIB) from its previous level of consolidation, with a series of Lower Highs (LH) and Higher Lows (HL) forming a symmetrical triangle (usually a bullish continuation pattern with a 70% chance of continuing with existing trend).

Our first target in the TradeRoom still sits at US$78,000. As traders we move with the market and change our bias to suit, and at the moment the general consensus is bullish!

Something to keep an eye on, however, is the BTC monthly chart. At the moment it’s showing a bit of indecision (Doji Candle) and while there are still three weeks of the month to go, it’s worth keeping in mind. We expect this to change but it’s worth noting.

Last Week’s Performance

SOL/USDT

For the third week in a row, Solana (SOL) has made the top of my list. Why? Because it’s a money-making machine! With another 25% growth in the last week, there just seems to be no stopping it. Painting a bit of a daily Doji candle at the time of writing, however, if BTC does in fact take off I expect SOL won’t be far behind.

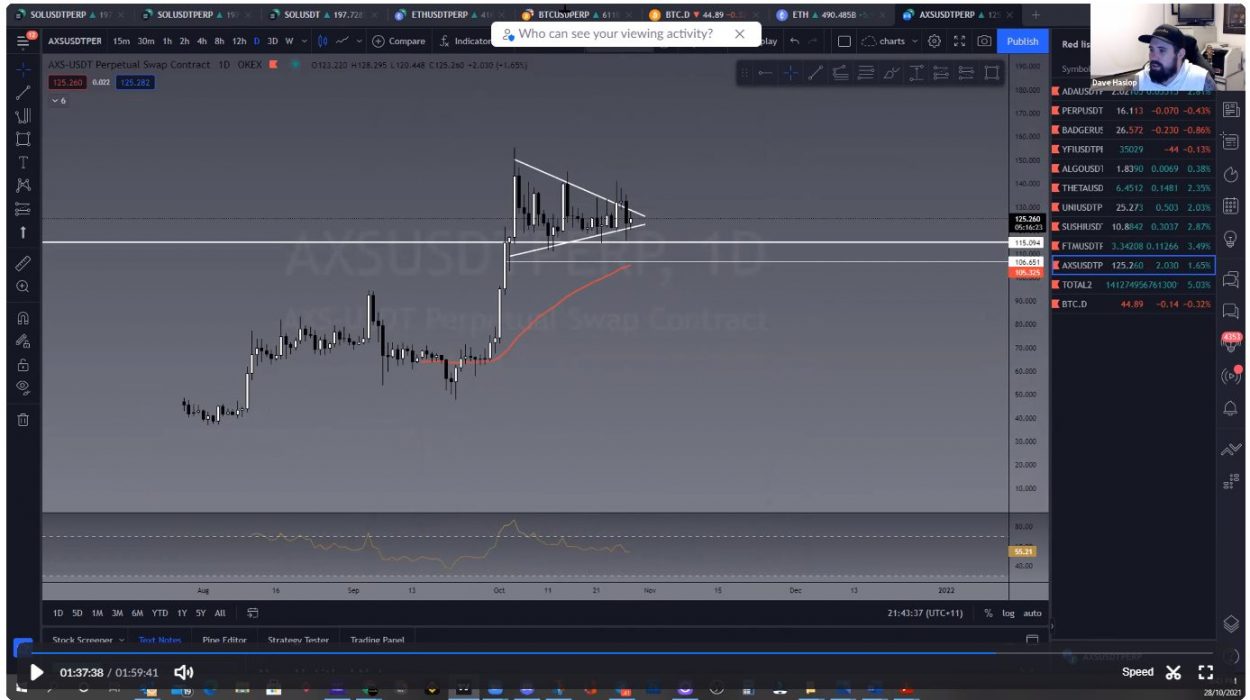

AXS/USDT

Another trade setup I mentioned in last week’s article is AXS. Since breaking out of its symmetrical triangle, AXS peaked out at 35%, which those of you who leverage trade will know is a significant move, even on a 10x trade.

This Week’s Trades

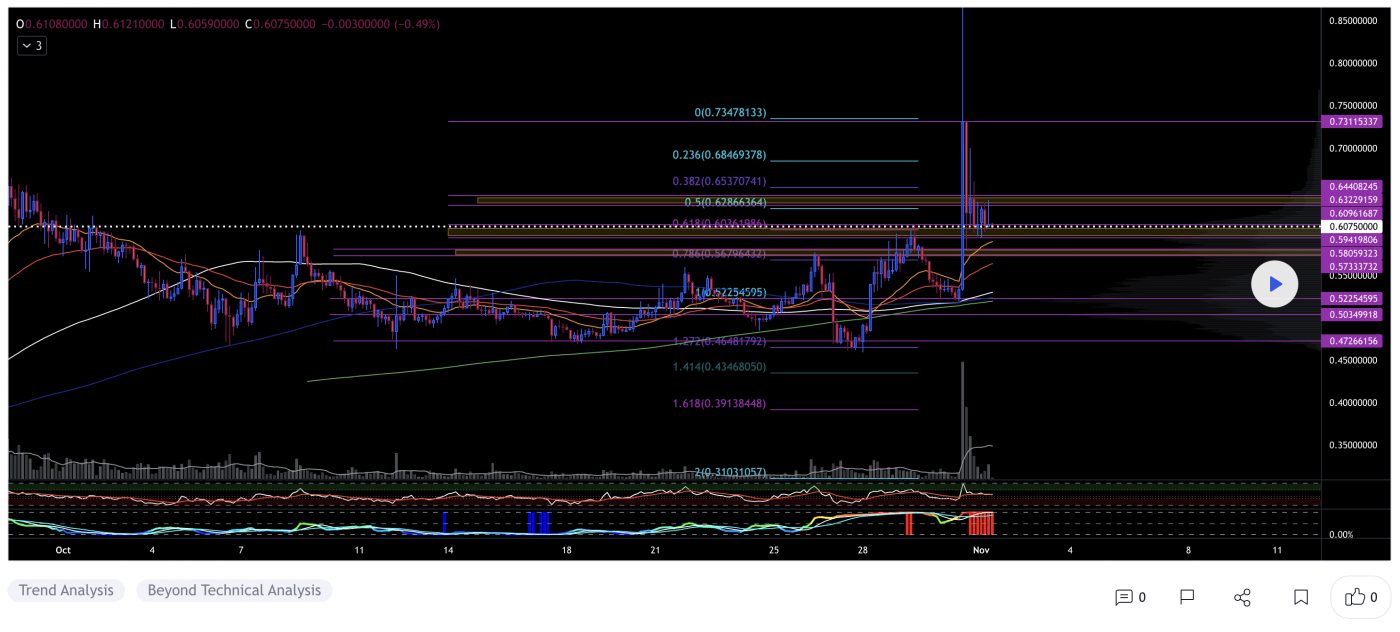

BTC/USD

Let’s go back to BTC. If the bullish sentiment plays out, I’m expecting to see something like this:

You can see in its previous run up, BTC peaked at the “future 618” Fib (a common target fib) after retracing 50% of its last push before that. Now, it’s not uncommon for momentum to pick up and only see retraces of 38.2% in a continuation trade. If it follows the same pattern, a target of US$83,000 is likely. Our initial target for BTC is still US$78,000.

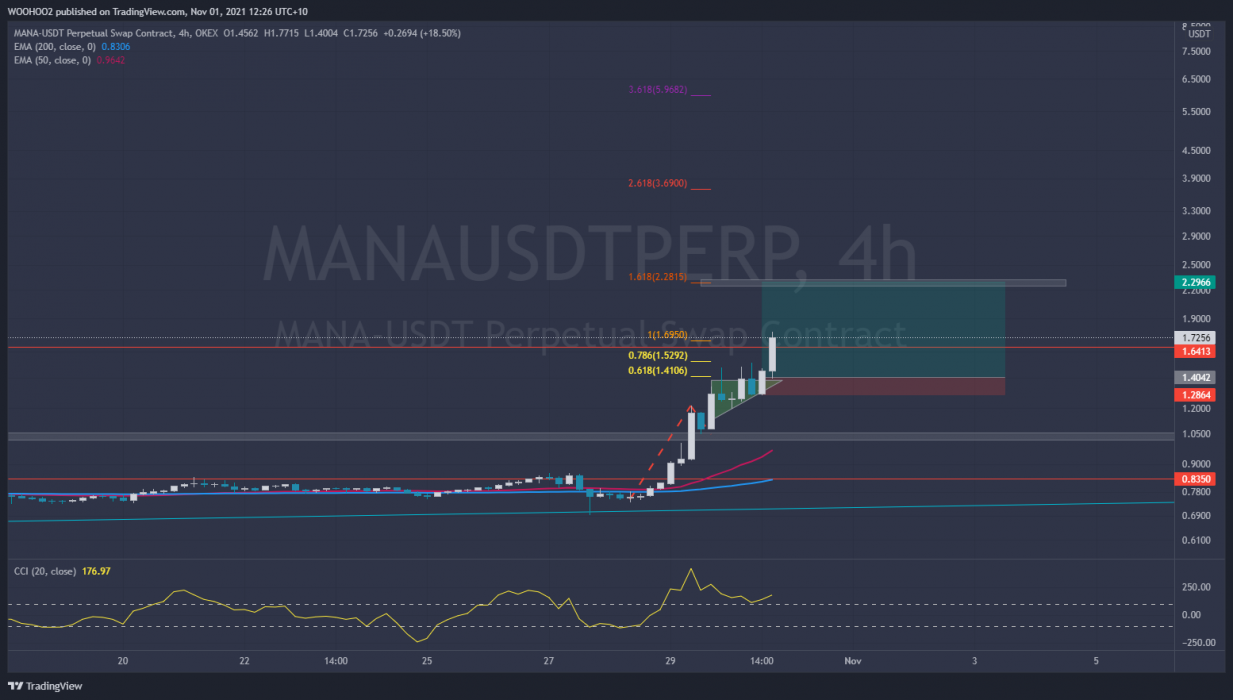

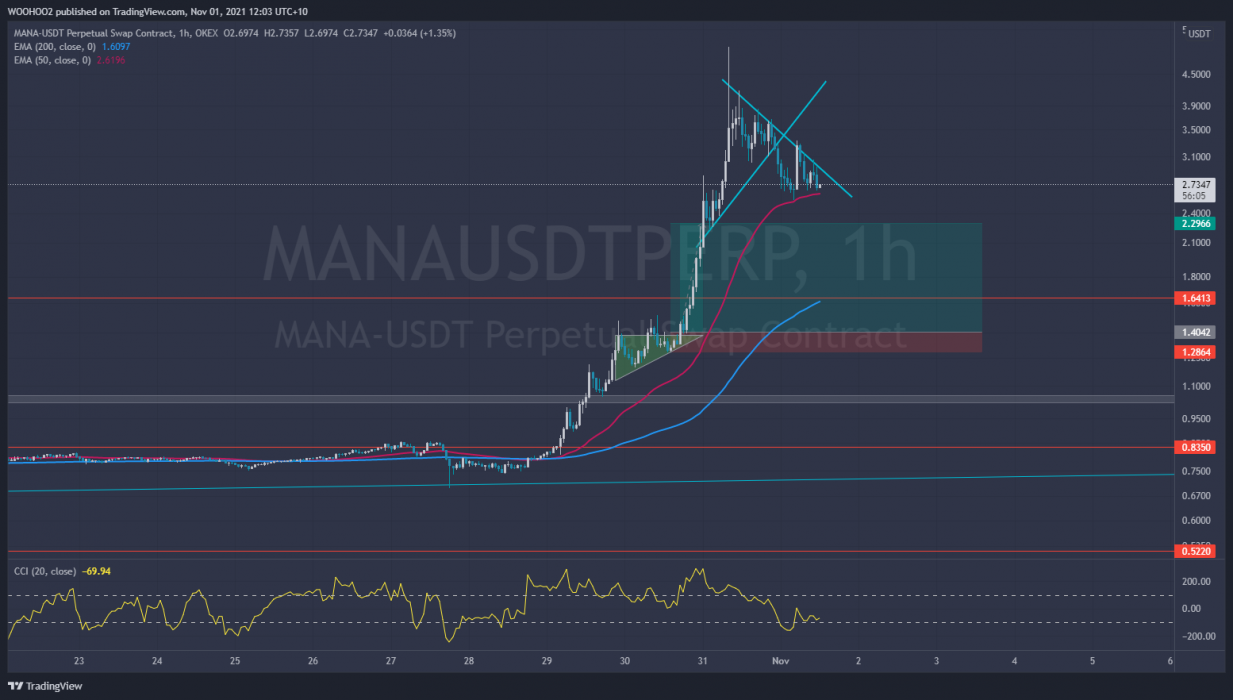

MANA/USDT

One of the biggest coins to watch for this week, I think, will be MANA (Decentraland). The momentum is too high to ignore and with all the hype around the metaverse tokens, this has been one nice little performer.

We charted this in the TradeRoom last week and collectively made over 1000% RIO in a matter of hours!

From a technical standpoint, MANA has retraced to the golden pocket (common retrace level based on Fibonacci), bounced off the pocket and the 50 Exponential Moving Average (EMA), and is currently in a descending wedge pattern. This is another bullish continuation pattern we teach in our trading course.

It’s important to remember that when trading ALT coins, their price action is heavily dependent on BTC. If BTC takes a bullish path, ALTS will likely follow. If BTC turns bearish, then ALTS will likely dump in price even harder!

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

>> Take our Free Beginners’ Trading Course

>> Join our Trading Community for your 7-day free trial

>> If you’d like to learn how to read and analyse charts, our LAST live trading course of the year starts Nov 15!

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!