Author Robert Kiyosaki has been outspoken on Twitter, expressing his take on the current economic situation, America’s leadership, and a fear that the world is headed for “the biggest crash in world history”. He urges citizens to buy Bitcoin, Ethereum, gold, and silver.

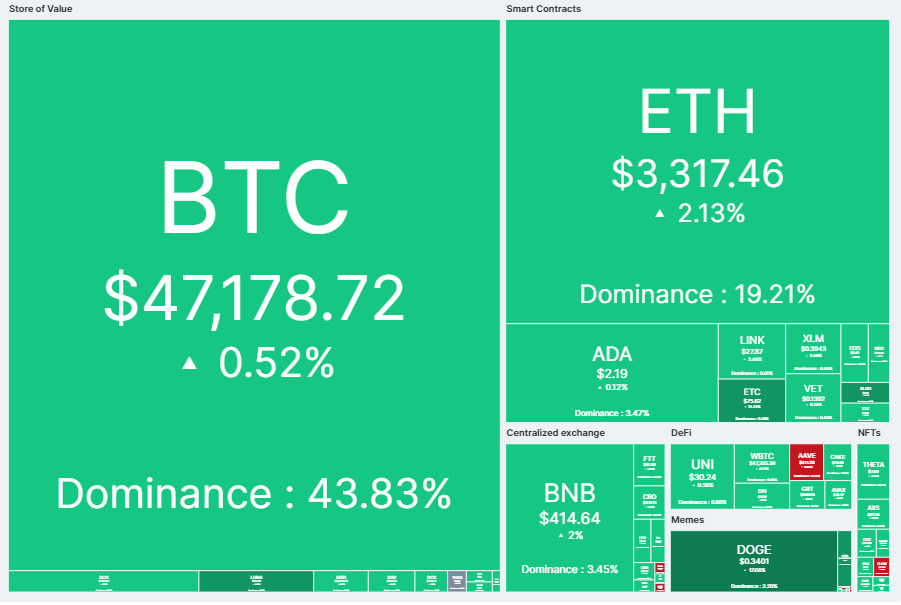

Concerns over US spending and approval of a monumental stimulus package are driving fear and uncertainty over the value of a dollar. Inflation is looming as the US continues to enter money into circulation. Bitcoin and other cryptos are gaining value, while the US Dollar (USD) continues to lose.

In a video posted to YouTube, the author of Rich Dad, Poor Dad expresses his views on the current world economy, his disapproval of US monetary policy, and the benefits of crypto.

US Dollar is Losing Its Purchasing Power – Buy Bitcoin

Since 1900, the USD has lost about 97 percent of its purchasing power. This means that whatever used to cost US$1 now costs US$31 – keep in mind that inflation affects this estimate.

The US recently approved a stimulus package to the value of US$1.9 trillion, which suggests that the purchasing power of the USD against bitcoin may decline even further. When comparing the USD price against the Satoshi, which is 100 millionths of a bitcoin, it appears that since the inception of BTC the USD is losing up to 99 percent of its purchasing value each year. The US$1,400 stimulus cheque that the US Government is handing out to every citizen is likely to continue this trend.

Australia Is Turning to Crypto

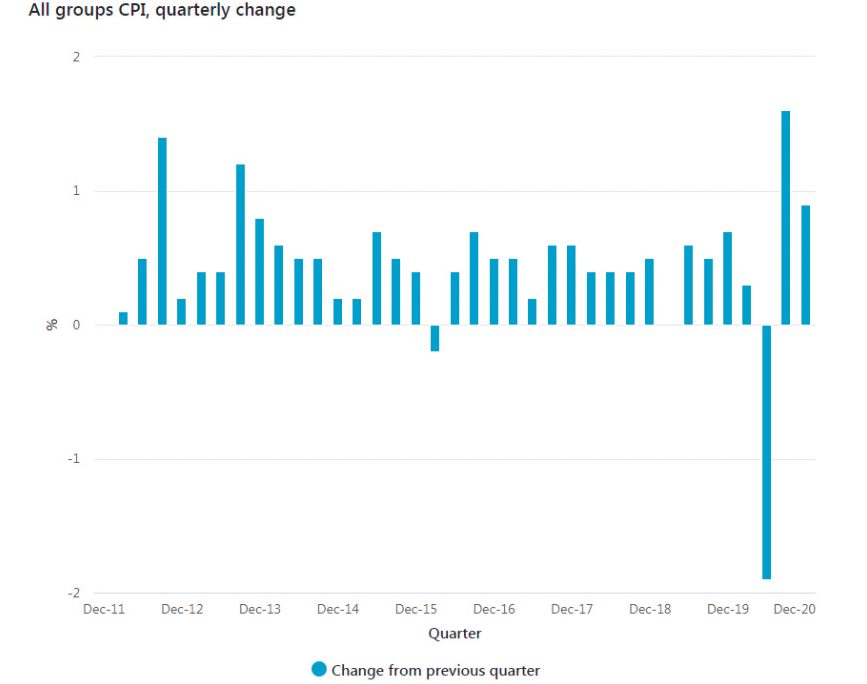

The worrying US economic situation is being observed all over the world, and Australia is feeling it too. Many Australians are turning to crypto as wages fail to keep up with the consumer price index (CPI), the cost of living continues to increase, and job insecurity is at an all-time high.

Figures from Australian Bureau of Statistics indicate that the CPI has been rising consistently over the past 10 years.

The number of Australians turning to crypto to become financially free is on the rise, keeping pace with the demand for workers to be paid in crypto and millennials turning away from traditional avenues of investing, such as property, instead opting for crypto.

Take Note from Venezuela

Venezuela is a prime example of what happens when hyperinflation sets in. The Latin American country’s currency, the bolívar, is the world’s weakest and literally no longer worth the paper it is printed on. Creative artists have instead started turning the notes into bags and wallets, which they can sell for more than the currency is worth.

Venezuela is now ranked third in terms of bitcoin adoption and joins many Latin American countries to take the crypto route. Extremely high levels of inflation are forcing nations to turn to crypto as their native currencies continue to lose purchasing power.