ApeCoin (APE) has integrated with Polygon, an Ethereum sidechain known for delivering faster and cheaper transactions, as a direct consequence of Yuga Labs’ recent Otherdeeds NFT mint disaster:

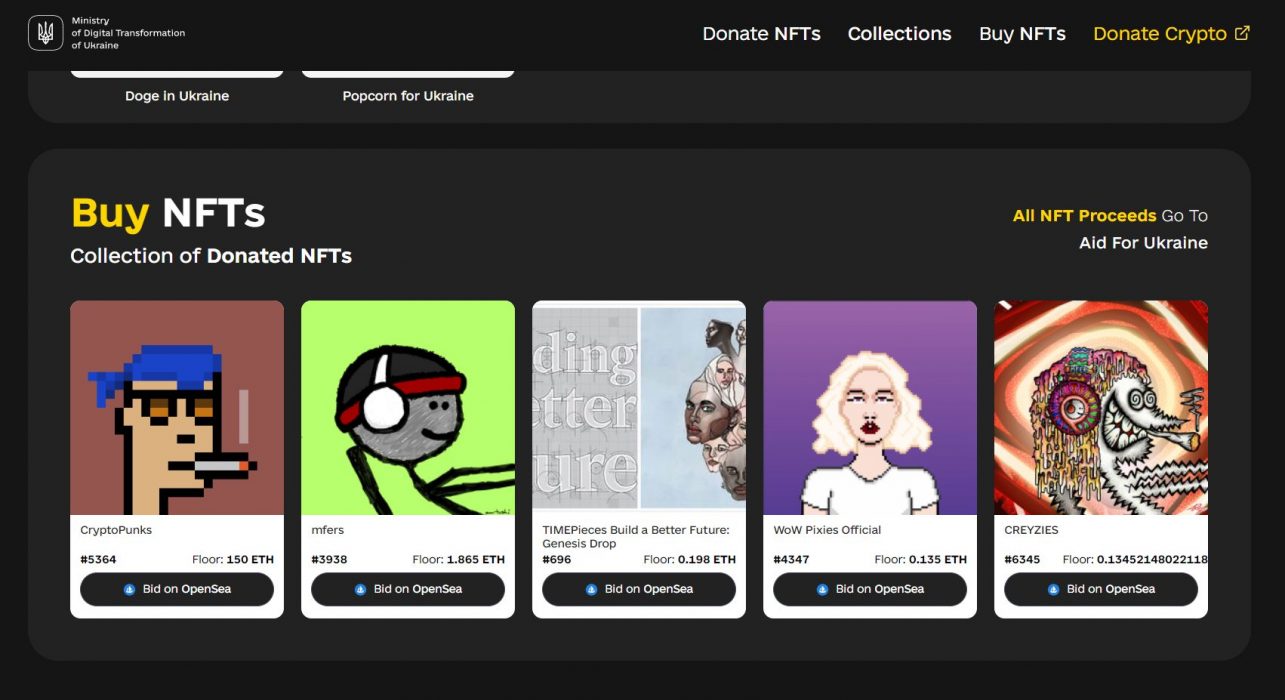

This week, Crypto News Australia reported how Yuga Labs made more than US$550 million with the minting of its virtual lands called Otherdeeds, NFTs belonging to the company’s metaverse project, Otherside.

Ethereum Blockchain Brought to its Knees

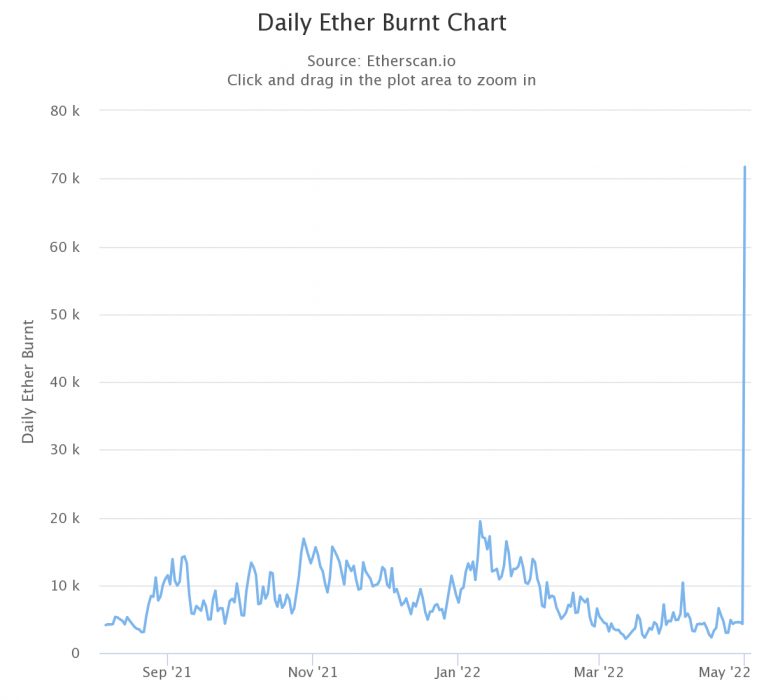

However, the hype and demand for Otherdeeds caused massive congestion on the Ethereum network, leading to a sharp increase in gas fees and practically shutting down the entire Ethereum blockchain.

Some users reported paying up to US$10k to $14k in gas fees to obtain their Otherdeeds NFTs, but some others weren’t so lucky as they paid the gas fee but the transaction still failed. Yuga Labs said it would refund users who had experienced failed transactions for their gas:

‘You Messed Up,’ Says Community

Yuga Labs remarked that the demand was higher than expected, and that Ethereum’s capacity failed to meet the project’s size. However, the community started speculating that this was just a marketing stunt to show that ApeCoin needs its own chain.

ApeCoin DAO board member Yat Siu dismissed the allegations, saying Yuga Labs encourages its DAO to propose ideas for a new chain. Yet it seems the community is not buying it: