In a follow-up to May’s ‘Liquid Summer‘ NFT series whose first drop sold out in under three minutes, American lifestyle brand Playboy is launching a new collection called ‘Playboy Rabbitars‘ that goes all the way back to its roots.

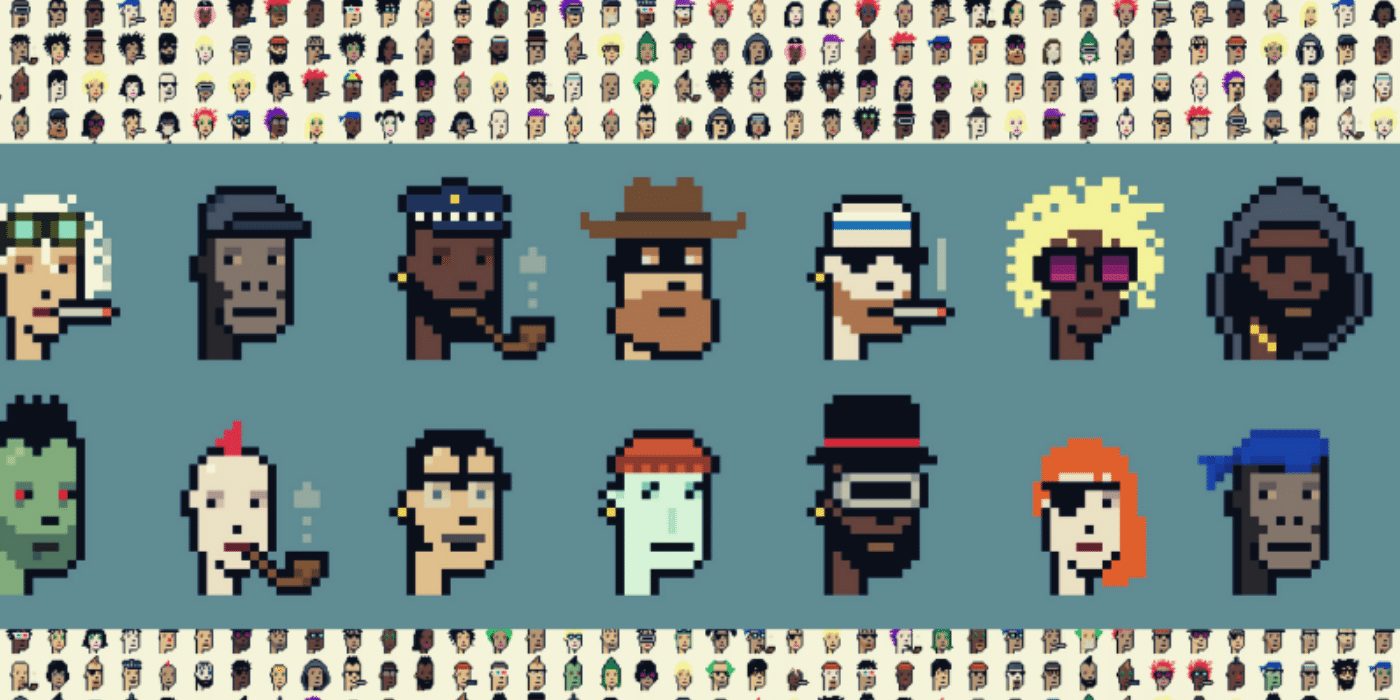

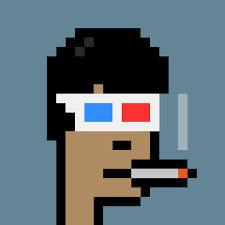

In a nod to its foundation year of 1953, Playboy will release 11,953 unique Rabbitars, 3D rabbit characters in NFT form serving as keys to a reimagined Playboy Club and giving owners access to benefits including members-only events, merchandise, artwork, and exclusive artist collaborations.

The Rabbitars have been created by Playboy’s Web3 Innovation team in partnership with Possible Studios and WENEW, the art studio and blockchain technology company co-founded by Michael ‘Beeple’ Winkelmann and Michael Figge.

In metaverse terms, Rabbitars are NFTs that live on the Ethereum blockchain as ERC-721 tokens hosted on IPFS (InterPlanetary File System, the metaverse’s decentralised file storage system).

Avatars Inspired by Brand Art and Editorial History

Each Rabbitar is generated from a pool of more than 175 traits, including fur, facial features, ears and headwear, apparel, accessories, occupation-related characteristics, and more. Some of the rarer examples are inspired by aspects of Playboy’s art and editorial history.

According to Jamal Dauda, Playboy’s vice-president of blockchain innovation, distributed ledger technology is revolutionising how fans and consumers interact with brands.

At Playboy, we’re committed to moving out of the era of merely acquiring followers and into an era of building thoughtful communities where each member has a voice. Our goal is to deliver meaningful opportunities for ownership and unique value.

Jamal Dauda, vice-president of blockchain innovation, Playboy

Liz Suman, Playboy’s vice-president of art curation and editorial, points out how the brand’s 68-year history began with the rabbit logo:

When it came to visualising the Rabbitar world, our goal was to pay homage to our legacy in the arts, while tapping into the spirit of innovation to create something entirely new for the NFT community.

Liz Suman, vice-president of art curation and editorial, Playboy

Available Across Three Separate Sales

Playboy Rabbitars will be available for purchase for 0.1953 ETH (US$813) on the official Rabbitar site using crypto or USD in three separate sales:

- presale for whitelisted ETH-paying collectors from October 24-26;

- public sale for Fiat/USD-paying collectors on October 26 following the whitelist sale; and

- public sale for ETH-paying collectors on October 27.

All collectors will need an Ethereum wallet whether paying with Ethereum or USD.