Norwegian chess grandmaster Magnus Carlsen has been awarded the world’s first non-fungible token (NFT) chess trophy after winning the Meltwater Champions Chess Tour (MCCT).

The tournament minted a couple of NFT trophies and collectibles to preserve the game’s most defining moments. Carlsen has praised the crypto ecosystem for its support of virtual chess tournaments and cited MCCT’s recent partnership with the FTX crypto exchange, which allowed professional chess players to compete for a prize of 2.1825 bitcoin (BTC), worth approximately US$81,079.

Identical Signed Trophy Sells For 6.88 ETH

Carlsen’s trophy is one of two identical NFTs minted on the Ethereum blockchain. Both were signed by the grandmaster and auctioned off to collectors at the new Chess Champs digital marketplace.

The second NFT trophy has already sold for 6.88 Ethereum (ETH), worth US$24,750 at the time of purchase.

At the presentation, Carlsen spoke of his appreciation for NFTs and cryptos in general:

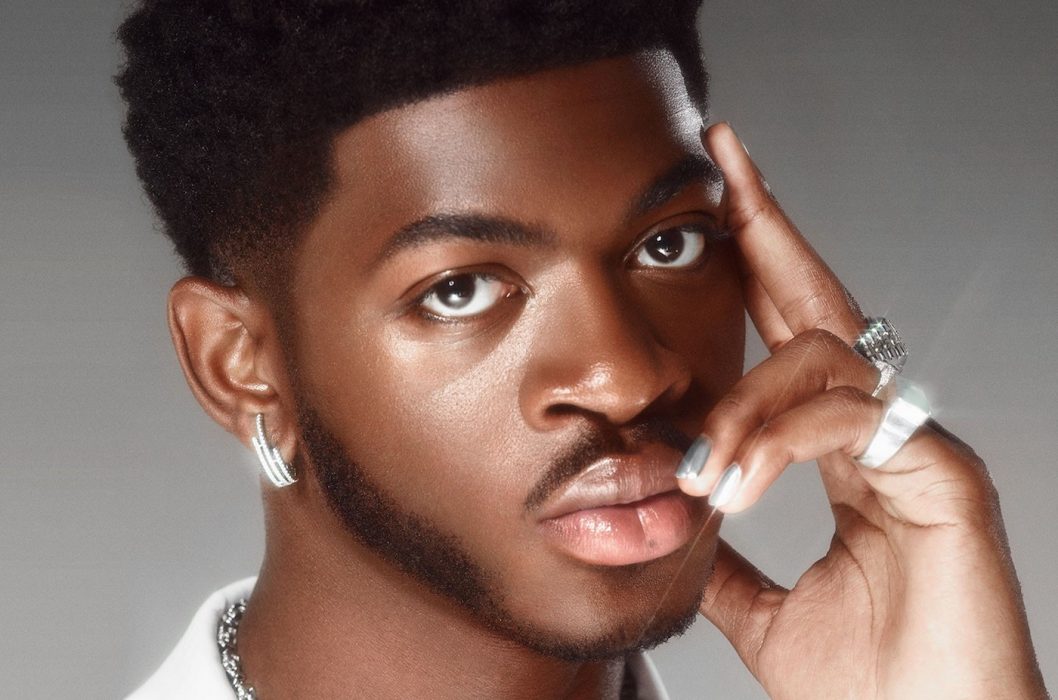

Magnus Carlsen

NFTs help the chess community celebrate great moments and possibly also reward those that have already invested so much time in growing the game. With Chess Champs, this is just getting started and I look forward to seeing it evolve.

Before the chess trophy was unveiled, MCCT director Arne Horvei said: “For the first time in the history of chess we are going to provide a trophy that is an NFT-only trophy and, as far as I know, there is no other competition with professionals that has ever done that.”

To have NFT trophies and copies with a real trophy is one thing but to have an NFT-only trophy, as far as I know, we are the only one to have done that.

MCCT director Arne Horvei

NFTs: Bridging the Gap Between Sports and Digital Entertainment

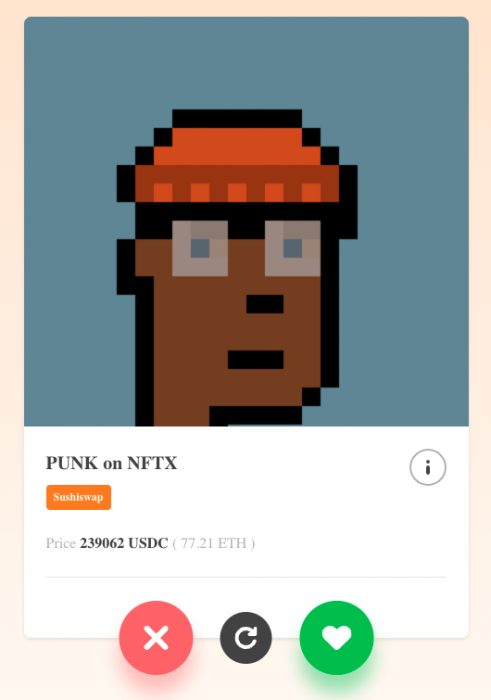

The NFT market is still exploding and there is no sign it will stop any time soon. Current NFT use is only in buying and hoping the value increases, but a company called SynFutures is now allowing investors to short the booming industry.

Sports fans and collectors alike are loving NFTs. In Australia, and all over the globe, people are going crazy over sports NFT trading cards. The NFT market is taking full advantage of fans’ and collectors’ love of the industry, with many now offering sports trading cards that capture famous sporting moments as NFTs.