In a first for the Australian market, energy retailer 1st Energy will begin allowing cryptocurrency as a form of payment following a new partnership with crypto payment platform BitPay.

From March 4, 1st Energy customers will be able to pay their power bills using a range of popular cryptocurrencies including BTC, BCH, ETH, DOGE, SHIB and XRP.

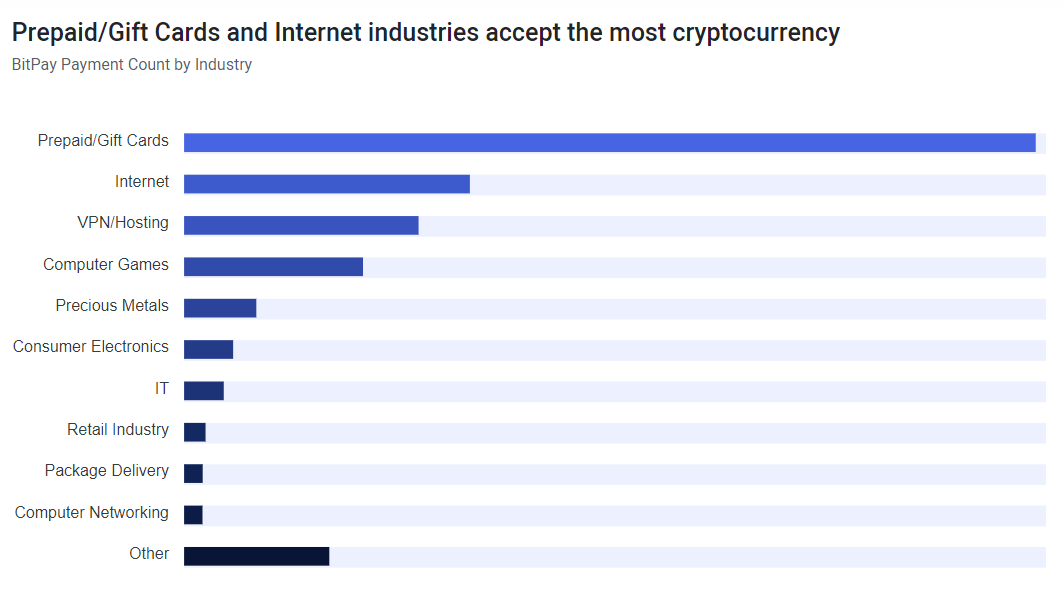

Crypto payments will be made via BitPay, which is currently the largest crypto payment provider globally and has been used by several large companies including AT&T, Microsoft and WeWork.

How Does It Work?

Payments can be made using the BitPay wallet app, crypto debit card (which will launch in Australia soon), or Chrome browser extension.

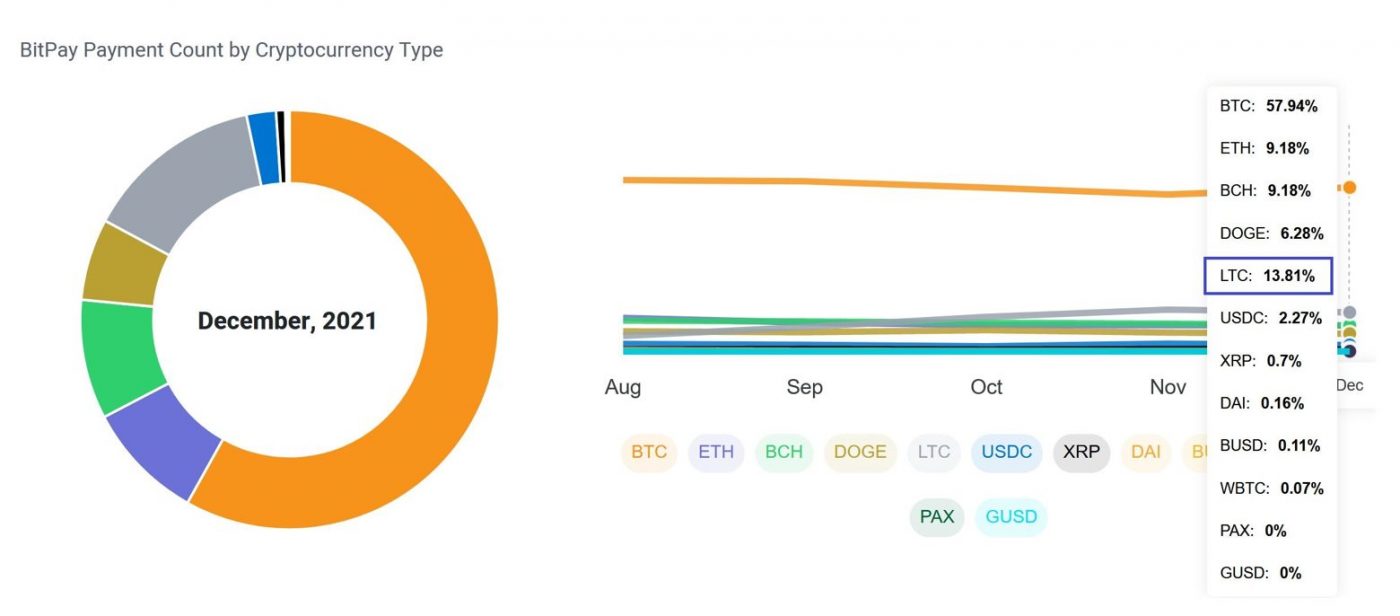

Customers who choose to pay their 1st Energy bills using BitPay, firstly need to select which crypto to make payment in: currently there’s support for 13 cryptocurrencies and five stablecoins.

1st Energy customers are then presented with a QR code, which can be scanned using the BitPay wallet app. They can then see the exact amount of crypto needed to pay their bill. The bill amount will be locked for 15 minutes so that fluctuations in the value of the crypto don’t change the figure a person owes.

Crypto Payments a Competitive Advantage

The adoption of crypto as a payment method is a reflection of the increasing mainstream adoption of the technology.

1st Energy believes providing crypto payment options offers a competitive advantage over its larger and slower-moving competitors:

As a smaller retailer, we are all about choice, and part of that is giving customers the option to pay the way they want.

Felix Baillie, 1st Energy representative

Is Paying With Crypto Worth It Right Now?

Of course there are also downsides to paying with crypto – everyone knows about the guy who spent 10,000 BTC on a couple of pizzas. Bitcoin, in particular, recently has fallen out of favour as a means of payment, with many preferring to HODL – BitPay reports that BTC now accounts for only around 65 percent of payments on its platform, down from 92 percent in 2020.

The desire to HODL in addition to the murky regulatory environment in Australia may reduce the number of customers willing to pay using crypto, but seeing more companies add the option is undoubtedly a positive sign for crypto adoption in Australia.