China has created its own version of non-fungible tokens (NFTs), which are in no way linked to any cryptocurrencies or public blockchains and will be running on its state-backed Blockchain Service Network (BSN).

China’s Blockchain to Support NFTs

According to the South China Morning Post, BSN will be rolling out a new infrastructure that will support the use of NFTs called BSN-Distributed Digital Certificates (BSN-DDC).

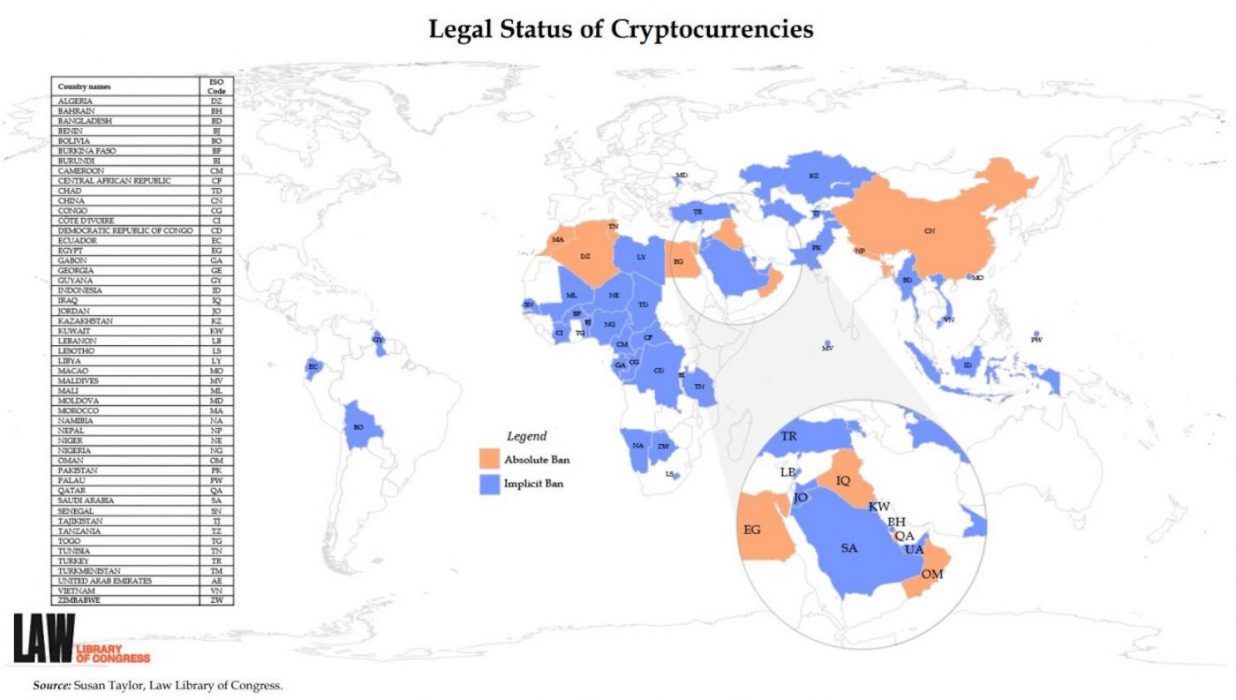

The ban on cryptocurrencies in China doesn’t necessarily affect the use of NFTs, with one of the technical advisers to BSN stating that NFTs “have no legal issue”. Mainly it’s important that they do, however, distance themselves from cryptocurrencies.

The platform is poised to launch by the end of the month and only Yuan will be permitted for transactions. The main reason public blockchains have been outlawed is that regulators cannot intervene in events classified as illegal, as well as the fact that the state requires all internet systems to verify user identities, which usually isn’t the case with public decentralised applications.

BSN-DDC Could Disrupt the Industry

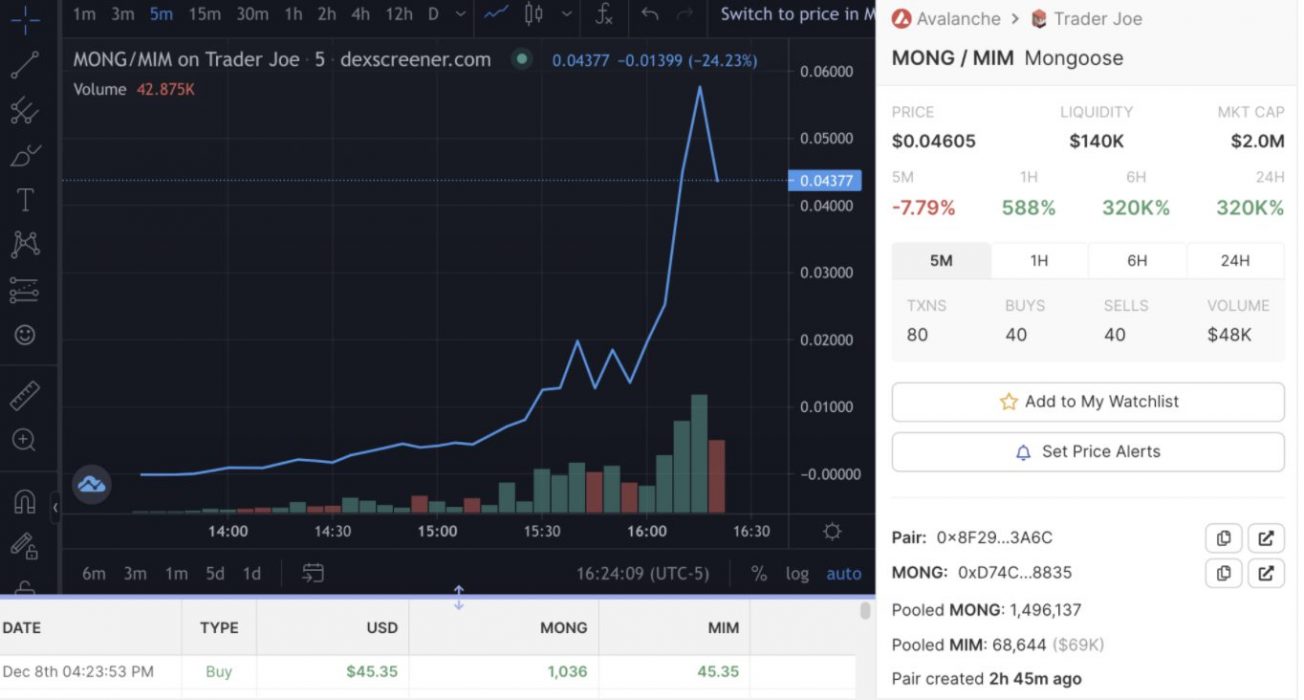

The BSN-DDC is compatible cross-chain and according to the report, issuing an NFT could cost as little as 0.05 yuan (A$0.01). At the moment the biggest NFT market is for digital art, but China is looking more at using it for certificate management.

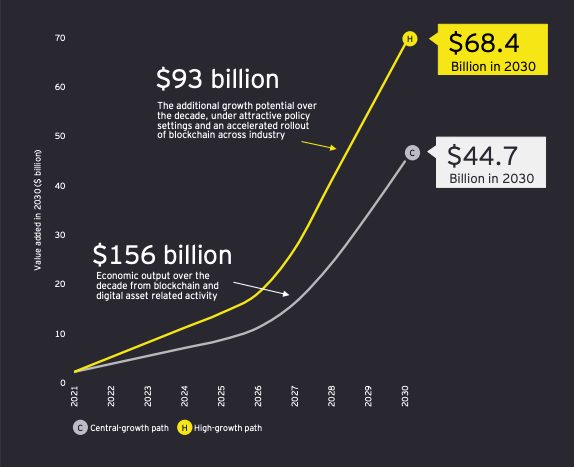

NFTs in China will see annual output in the billions in the future.

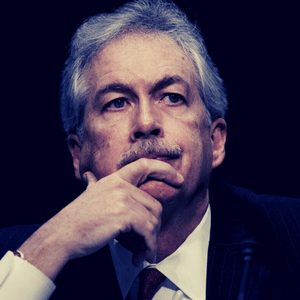

He Yifan, chief executive officer, Red Date Technology

The expected rise of NFTs in China is in part also due to the platform that will “offer application programming interfaces for businesses or individuals so they can build their own user portals or apps to manage NFTs”.

China’s Solution to Monitoring Chains

According to the report, Red Date, a technical support provider to BSN, has come up with a solution to govern blockchains in China. By connecting them to the open permissioned chain run by China Mobile, China UnionPay and State Information Centre public chains can be “localised”.

Red Date CEO He Yifan also added that since 2018, more than 20 public chains have undergone this process and with the new BSN-DDC another 10 will be integrated including “the adapted version of Ethereum and Corda, plus domestic ones like FISCO BCOS”.

China has long been working on blockchain technology and was even one of the first countries to start research on CBDCs. The Digital Yuan will even be controlled by Smart Contracts, with China’s mobile CBDC wallet launching ahead of the Winter Olympic Games.