Star Atlas is one of the most anticipated play-to-earn games in the crypto gaming space, with users already owning thousands of dollars’ worth of in-game assets. However, while the project boasts a beautiful website and fully functioning marketplace, there’s no game or even Alpha build to be seen.

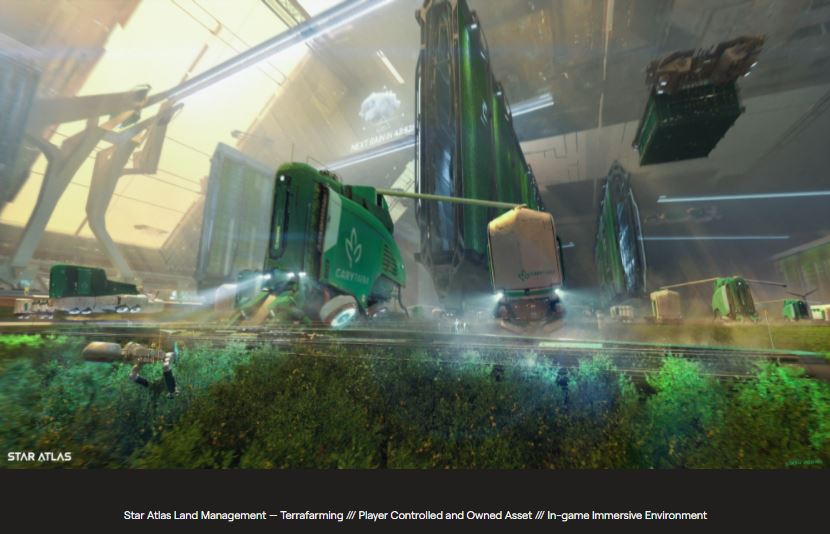

Hosted on the Solana (SOL) blockchain, Star Atlas has attracted considerable hype based on the concepts and possibilities of what’s quite literally a game-changer. The game incorporates some of the latest graphical innovations, such as Unreal Engine 5 and Nanite technology that allows for the creation of worlds at unprecedented scale and detail. Players can own in-game assets (planets, ships, parts/items, in-game resources) with real-world value, either to be used in the game or sold on the marketplace.

The fact that there is no actual game build to be seen leads some to believe the game might end up the same way Earth 2 did. In that case, developers made claims of creating an exact virtual replica of Earth, comparable to a metaverse like “Ready player one or the Matrix”, allowing people to buy virtual land that might attract future value. Yet years later, the game is still in development and has been called a scam and Ponzi scheme by many.

Technology May Be Still Some Way Off

BigFry, a prominent YouTuber best-known for talking about “shady” developers and publishers in the gaming space, has taken a crack at Star Atlas, pointing out some of the aspects that could be an indication of a scam. As he says, it’s much easier to start a marketing campaign than to build a metaverse. Many times in the past developers have over-promised and under-delivered, with BigFry also stating that he thinks the technology required to build a game like this is still far away.

Star Atlas Is Not Your Average Game

Star Citizen had the same problem with lots of content but no game builds ever piercing the veil, with some some believing Star Atlas could be on the same road. There are more than 250 players already on the leaderboards, with the top-ranking player owning over US$800K in total in-game assets.

According to a YouTube interview with Star Atlas founder Michael Wagner, the project aims to break the mould in the industry by creating a metaverse where the aim is not just to play a game, but to construct an economy where gamers, entrepreneurs and people who want to work to earn money can come together and empower each other.

This is one of the main reasons why the game is being developed economy first, to allow players to understand the mechanics as well as to build all the systems from scratch on the blockchain. After slowly onboarding players to the marketplace and intricacies of the economy, actually playing the game comes next. At the moment there is a mini-game available where players can craft loot. Additionally, Wagner says that one of the first gameplay mechanics to be released will be the ship mission, available on May 31, 2022.

There are other works in progress such as character models and environments which can show for something, but that’s an easy task for a team of designers. Wagner says that in January 2022 there will be a digital showroom with interactable character models created with the new gaming engine, and where players can view their created NFTs.

In the meantime, the company has published a roadmap to assure investors and future players that everything is still on track:

It remains to be seen how the project will develop, but according to the roadmap the game’s 3D browser version is a “fully charted game map [Star Atlas] viewable and playable in-browser. This also unlocks coordinates for ship missions, exploration, and mining actual owned land claims”, scheduled for release on July 31, 2022.