Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Solana (SOL)

Solana SOL is a highly functional open-source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

SOL Price Analysis

At the time of writing, SOL is ranked the 5th cryptocurrency globally and the current price is US$227.24. Let’s take a look at the chart below for price analysis:

SOL retraced nearly 45% from its high before finding a low during mid-November. Since then, the price has been sweeping stops on both sides of its local range as the current consolidation sets up the next move.

Aggressive bulls might bid near $218.44, although a sweep of the stops near $205.61 could reach below the next swing low into possible support near $188.12. A continued downtrend might run into the weekly gap near $176.26.

Some bears might add more shorts near $220.87, although a push to $238.66 is reasonable. A daily candle close over the swing high near $250.04 could suggest that a longer-term trend reversal is in play, with bulls possibly entering on a retracement near $276.32 for new high prices.

2. Terra (LUNA)

Terra LUNA is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin, and offers fast and affordable settlements. Terra’s native token, LUNA, is used to stabilise the price of the protocol’s stablecoins. LUNA holders are also able to submit and vote on governance proposals, giving it the functionality of a governance token.

LUNA Price Analysis

At the time of writing, LUNA is ranked the 13th cryptocurrency globally and the current price is US$62.57. Let’s take a look at the chart below for price analysis:

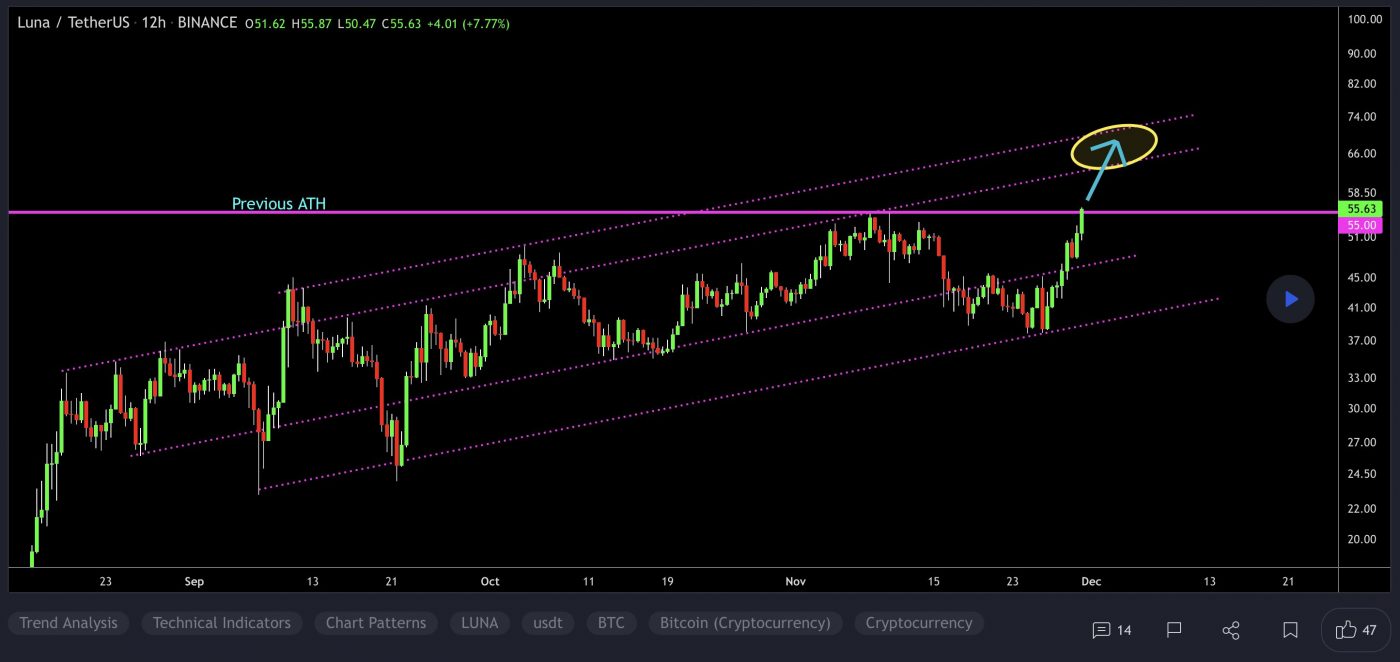

After breaking its November highs, LUNA began a range that has been whiplashing both bulls and bears.

Resistance beginning near $68.35 held the price down for the December monthly opening, although bulls have shown some strength near the 9 and 18 EMAs.

A quick drop to $60.37, or into the zone beginning near $57.87, could give bulls the fuel to push through the nearby resistance. If this resistance breaks, the high near $66.47 provides a reasonable target.

A break of this level could move further into uncharted territory with the nearest probable resistances projected around $72.28 and $75.57.

More patient bulls might be waiting far below the 40 EMA with bids near the higher-timeframe range’s 61.8% retracement, near $49.59.

3. Mask Network (MASK)

Mask Network MASK is a protocol that allows its users to send encrypted messages over Twitter and Facebook. It essentially acts as a bridge between the internet and a decentralised network running on top. Mask Network offers the ability to fund Gitcoin grant campaigns directly from Twitter, and plans to offer peer-to-peer payments and decentralised storage functionality. It is a decentralised portal that also allows users to use DApps like crypto payments, decentralised finance, decentralised storage, e-commerce, digital goods, NFTs, and decentralised organisations (DAOs) over the top of existing social networks without migrating, creating what is referred to as a decentralised Applet (DApplet) ecosystem.

MASK Price Analysis

At the time of writing, MASK is ranked the 250th cryptocurrency globally and the current price is US$15.97. Let’s take a look at the chart below for price analysis:

MASK has retraced 58% of its over 120% rally that began in November.

A large bearish daily candle found support at the 40 EMA in a daily gap, near $13.20, before retracing to its opening price, near $14.36.

The 9 and 18 EMAs near the opening price might provide support if the uptrend resumes. The recent swing low, near $12.87, could also offer support again.

Some charts showed the price rallying into possible resistance near $19.26 on November 27. If genuine and sustained, this resistance could flip to support for a further rally into resistance near $20.18 and $21.56.

If the price reaches beyond these levels, it will enter discovery, perhaps drawing toward possible resistance near $25.44.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

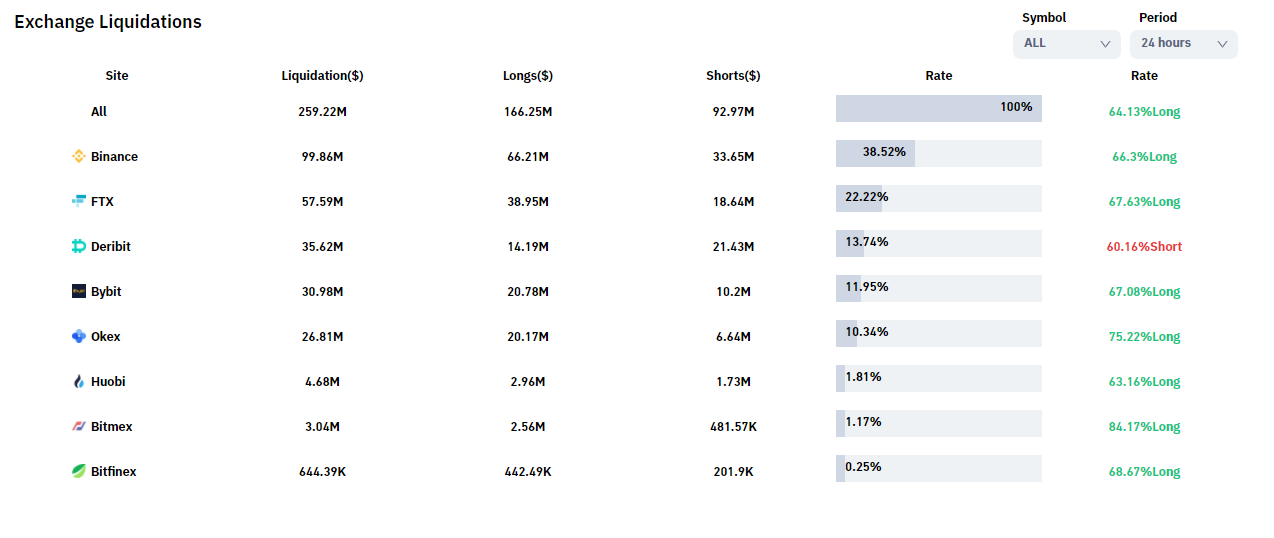

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. You can also buy these coins from different exchanges listed on Coinmarketcap.