Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Stellar (XLM)

Stellar XLM is an open network that allows money to be moved and stored. When it was released, one of its goals was boosting financial inclusion by reaching the world’s unbanked but soon afterward, its priorities shifted to helping financial firms connect with one another through blockchain technology. The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers, who often charge high fees for a similar service.

XLM Price Analysis

At the time of writing, XLM is ranked the 25th cryptocurrency globally and the current price is A$0.3904. Let’s take a look at the chart below for price analysis:

After climbing nearly 280% since the beginning of the year, a 115% range has trapped XLM between A$0.4268 and A$0.3544 during Q3.

A consolidation near A$0.3876, visible on the weekly chart, provided support on the last touch. This level could provide support again on a stop run under the A$0.3688.

A deeper run-on stop at A$0.3479 might reach the top of a higher-timeframe gap at the same level. However, a push this low reduces the chance of a new monthly high soon. Below, little significant support exists until A$0.3218.

Higher-timeframe levels overlapping with a daily gap beginning at A$0.4169 are likely to provide resistance, perhaps on a sweep of the equal highs near A$0.4485. Breaking this resistance makes the relatively equal highs near A$0.4821 and the recent monthly high at A$0.5318 the next probable targets.

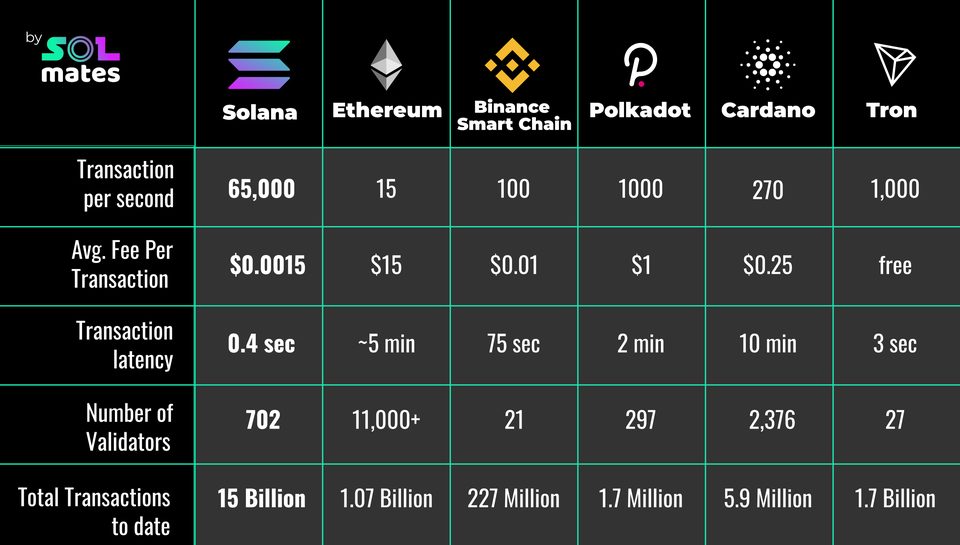

2. Solana (SOL)

Solana SOL is a highly functional open source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

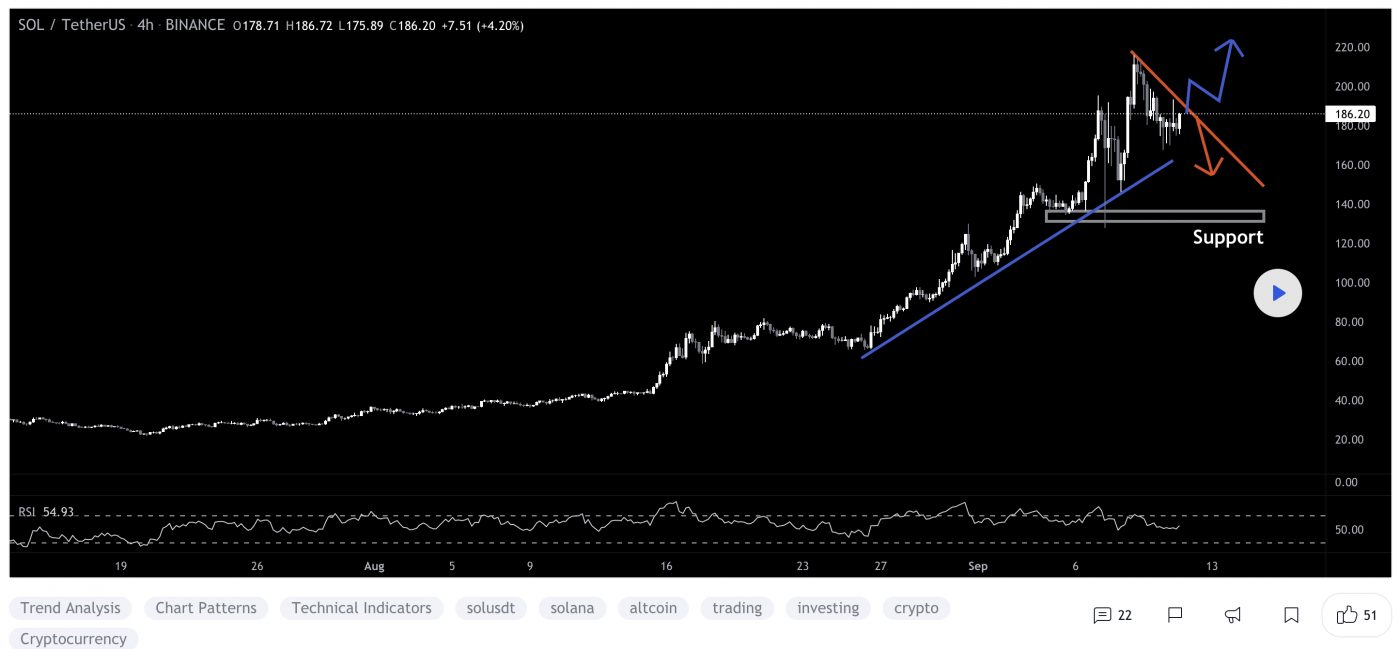

SOL Price Analysis

At the time of writing, SOL is ranked the 7th cryptocurrency globally and the current price is A$187.33. Let’s take a look at the chart below for price analysis:

SOL‘s euphoric mid-August pump turned into a September dump, with little higher-timeframe support for bulls to justify entries.

Currently, the price is distributing at the 52% retracement level. A small consolidation near A$185.66 is visible on the 12-Hour chart, with a clearer consolidation at a higher timeframe. This area does have some confluence with the 69% retracement level and could offer some support in the future.

The daily gap’s midpoint near A$198.34 has suppressed the price, although a push through this level could fill the daily gap up to A$215.39. A lack of sensitivity at this resistance could suggest a minor retracement before a possible move to new all-time highs.

3. Mina (MINA)

MINA Protocol is a minimal “succinct blockchain” built to curtail computational requirements in order to run DApps more efficiently. Mina has been described as the world’s lightest blockchain since its size is designed to remain constant despite growth in usage. Furthermore, it remains balanced in terms of security and decentralisation. The Mina network has a size of only 22 KB, which is minuscule when compared to Bitcoin’s 300 GB blockchain.

MINA Price Analysis

At the time of writing, MINA is ranked the 81st cryptocurrency globally and the current price is A$6.43. Let’s take a look at the chart below for price analysis:

MINA‘s 285% pump during Q3 ran into resistance near A$8.26 on September 15. Since then, the price has been consolidating between A$6.38 and A$7.12.

Just below the Monthly open, A$5.89 is the first level likely to provide substantial support. If the price breaks down through this level, overlapping levels near A$5.72 might cap a run on the lows near A$5.46 and A$5.08.

The higher-timeframe analysis points to the area near A$6.89 as the next substantial resistance. Significant selling has been occurring here on the daily chart. If this level breaks, the swing highs near A$7.28 and A$7.54 may be the next targets.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.