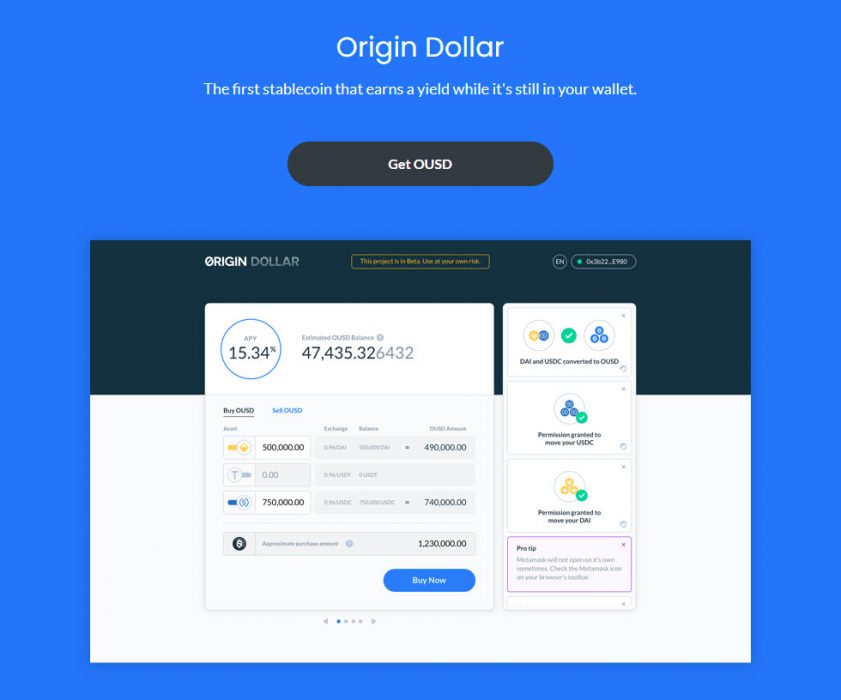

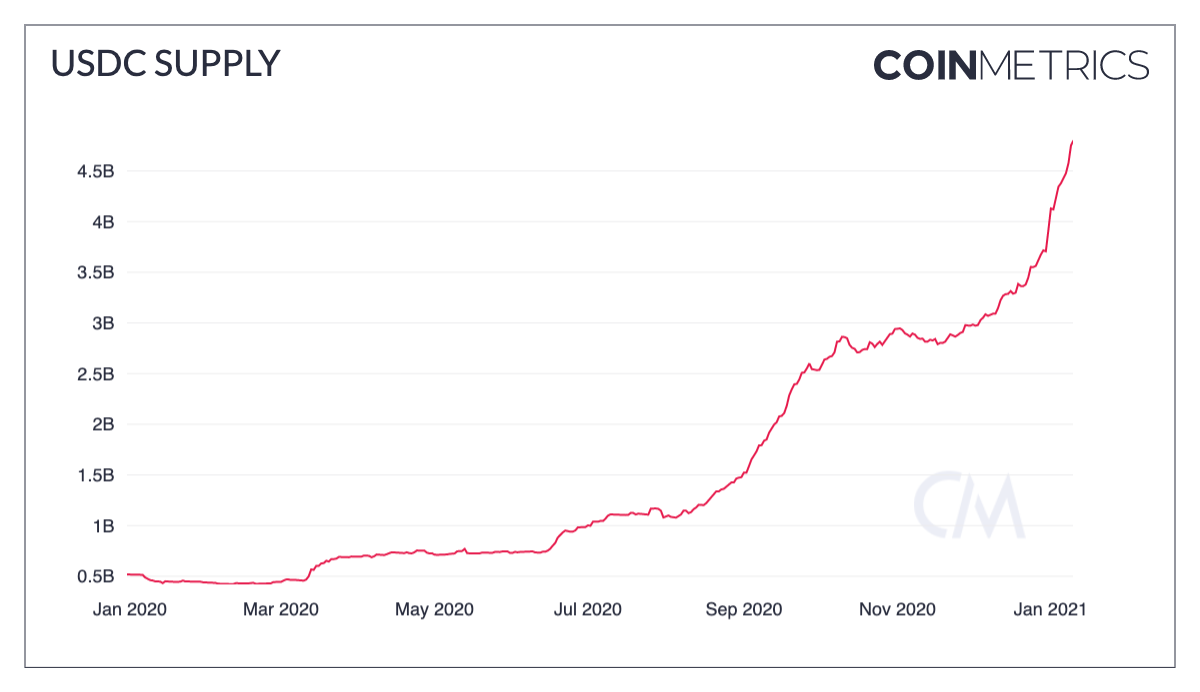

Visa announced on Monday that it now allows partners of its network to clear fiat transactions with the USDC stablecoin using the Ethereum blockchain.

Visa Using Ethereum Blockchain

Visa’s most recent move, will allow them to utilise the Ethereum blockchain, this removes the need to convert digital currency into traditional money in order for the transaction to be settled. Where this would traditionally be the case. For example, Crypto.com won’t have to go through conversions and can settle with Visa directly in USDC.

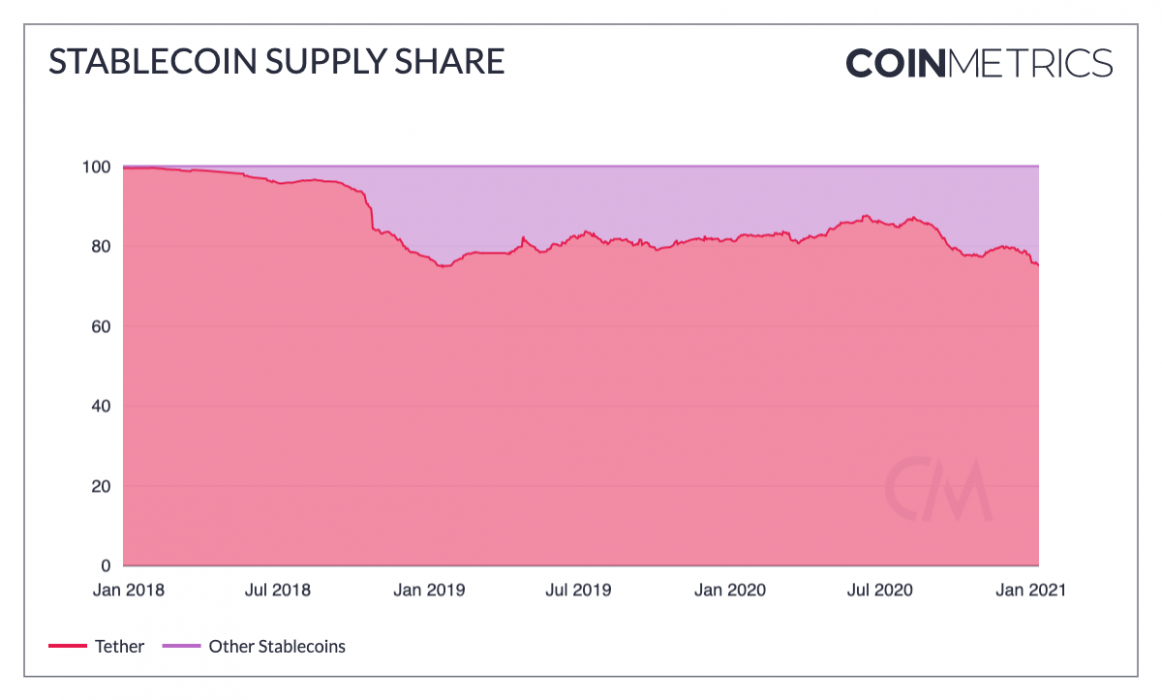

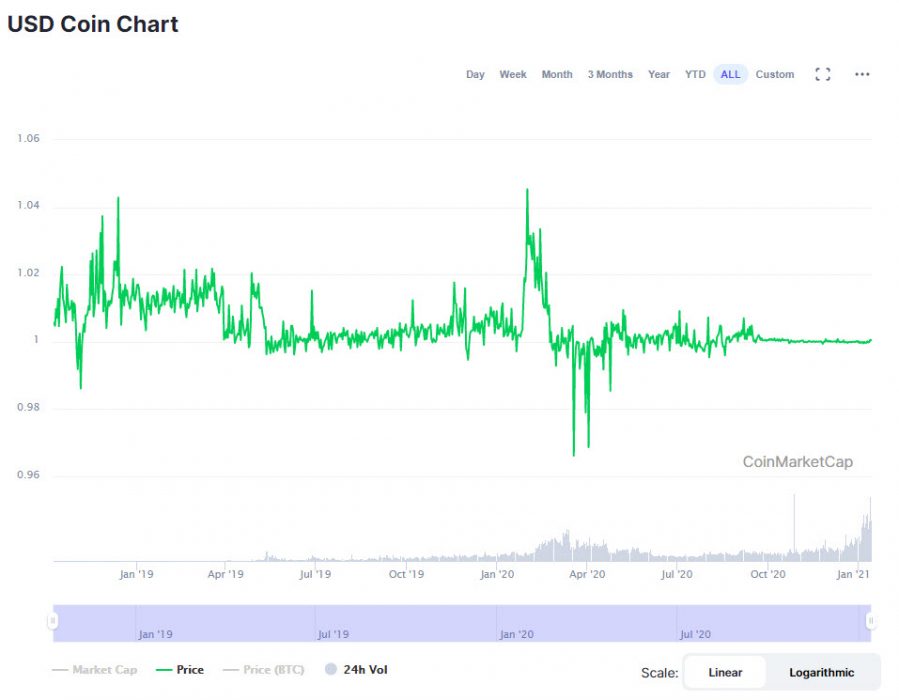

Visa said it has partnered with digital asset bank Anchorage, the first federally chartered digital asset bank, and completed the first transaction this month — with Crypto.com sending USDC to Visa’s Ethereum address at Anchorage. The (USDC) is a stablecoin cryptocurrency, and its value is directly linked to the U.S. dollar.

Visa came to us in 2019 with an idea—make secure, efficient, and seamless settlement payments possible in digital currency by linking Visa’s treasury with Anchorage’s custody platform.

Diogo Mónica, co-founder and president of Anchorage

The credit card giant is already partnering with 35 digital currency platforms, including Coinbase, Crypto.com, BlockFi and Bitpanda, which collectively have more than 50 million active users.

We see increasing demand from consumers across the world to be able to access, hold and use digital currencies and we’re seeing demand from our clients to be able to build products that provide that access for consumers.

Cuy Sheffield, head of crypto at Visa

“Crypto-native fintechs want partners who understand their business and the complexities of digital currency form factors,” said Visa chief product officer Jack Forestell. “The announcement today marks a major milestone in our ability to address the needs of fintechs managing their business in a stablecoin or cryptocurrency.”

The firm said it aims to make this system available to Fintech companies and neobanks dealing in cryptocurrencies including Bitcoin (BTC), Ether (ETH), and USDC. After further testing and additional conversations with its clients, partners, and members of the regulatory community, Visa hopes to launch the USDC settlement capability for other partners as well “in the year ahead.”