A survey of more than 1,000 institutional investors from across the US, Europe and Asia found that most believe digital assets have a place in a portfolio and were interested in crypto-based products such as ETFs.

Respondents to the survey, conducted by Fidelity Digital Assets in early 2021, included financial advisers, high-net-worth investors, family offices, and professionals working for hedge funds, pension funds and venture capital firms.

Over half (52 percent) were already invested in digital assets (predominantly Bitcoin and Ethereum) and nearly nine in 10 said they found crypto appealing, especially in terms of its high potential upside.

Key barriers to investment in crypto cited by investors include price volatility (54 percent), lack of fundamentals to gauge appropriate value (44 percent), and market manipulation (43 percent).

Key Findings of Institutional Investor Research

- 70% of all investors surveyed had a neutral-to-positive perception of digital assets;

- 84% of US and European investors, and 90% of Asian investors, said they’d be interested in institutional investment products that hold digital assets;

- 62% of US investors expressed a neutral-to-positive view about a potential bitcoin ETF;

- Nearly eight in 10 investors surveyed felt digital assets have a place in a portfolio; and

- 43% of investors surveyed identified digital assets as part of the alternative asset class.

Regional Differences in Crypto Investment

The research provides insights into how digital asset adoption varies by region:

For the second year in a row, the survey found that European investors have a more progressive view towards digital assets than Americans when comparing the responses across all categories. Even so, Asian investors, who we surveyed for the first time this past year, are by far the most accepting of digital assets, with more than 70 percent of investors surveyed currently invested in digital assets.

Jack Neureuter, Fidelity Digital Assets

Compared to previous surveys, more US investors said they’d bought digital assets through an investment product in 2021 while 30 percent of US respondents said they’d prefer to buy an investment product in future – which the report speculates could signal investors’ hopes that a crypto ETF will be approved by regulators.

While investment products were popular among European and Asian investors, they were more likely to buy digital assets directly.

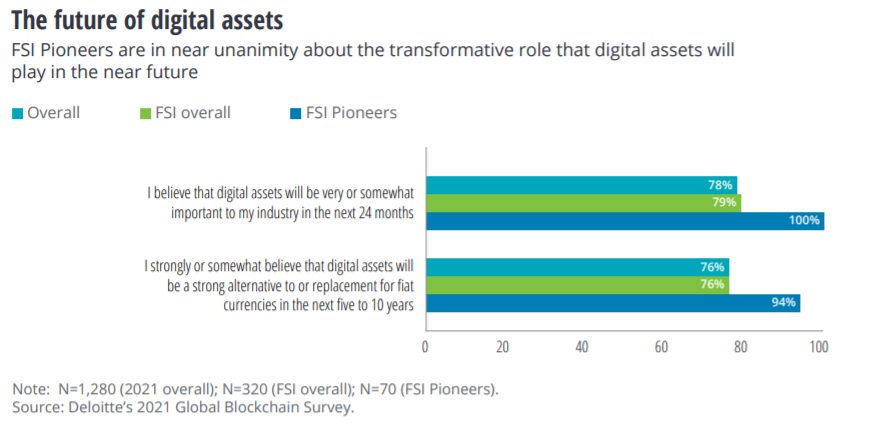

Fidelity Digital Assets’ survey results reinforce the views of finance professionals surveyed by Deloitte earlier this year – 76 percent of those respondents said they believed crypto would be a strong alternative to, or outright replace, fiat money within the next decade.

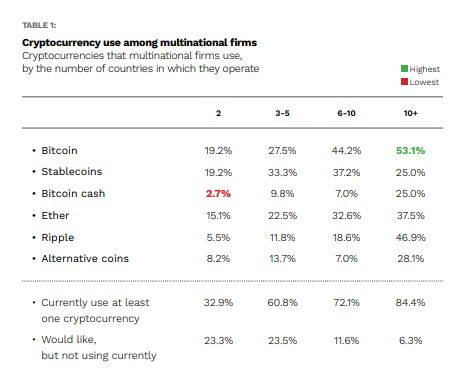

Another report released this month found that six in 10 multinationals are already using crypto and blockchain technology, although typically for transactional purposes rather than as investment assets.