Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Chainlink (LINK)

The Chainlink Network LINK is driven by a large open-source community of data providers, node operators, smart contract developers, researchers, security auditors, and more. The company focuses on ensuring that decentralized participation is guaranteed for all node operators and users looking to contribute to the network. Chainlink allows blockchains to securely interact with external data feeds, events, and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement.

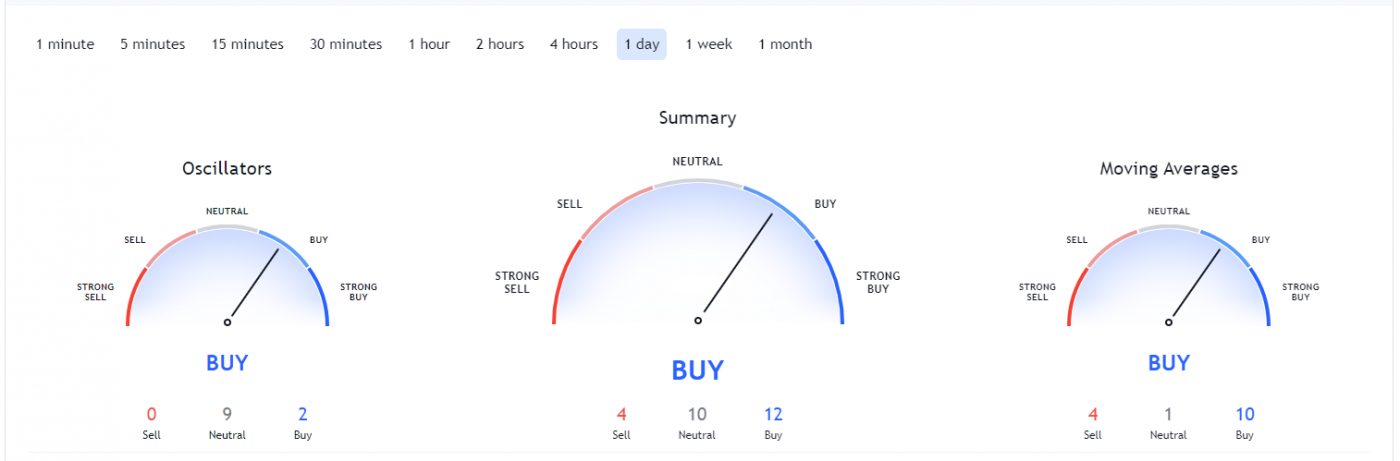

LINK Price Analysis

At the time of writing, LINK is ranked the 14th cryptocurrency globally and the current price is A$26.18. Let’s take a look at the chart below for price analysis:

LINK during Q2 provided respectable 210% gains for bulls who bought at April’s monthly open, with the price finding resistance near A$24.74

If bulls take back control this week, the top of the former gap begins at A$22.14 may provide support for at least a short-term bounce. The top of the consolidation range starting near A$20.32 is more likely to provide substantial support.

The most robust support is likely to be found in the overlapping consolidation ranges between A$18.23 and A$17.46, with a sharp slice through these levels possibly suggesting the end of the bull run.

The region from approximately A$29.81 to the most recent swing high is likely to provide some resistance. The swing high provides a reasonable first target for a possible next leg up.

If this high breaks, the 1.0 extension near A$33.27 and the 2.0 extension near A$38.72 may provide the next primary targets.

2. Dego Finance (DEGO)

Dego Finance DEGO is a decentralized ecosystem that offers a diverse combination of the non-fungible token (NFT) and decentralized finance (DeFi) tools. It is an independent, open NFT ecosystem. Any user is allowed to launch an NFT and initiate mining, auctions, and trading, covering the entire lifecycle of the product. Dego’s NFT protocol is a cross-chain, second-layer infrastructure for Blockchain projects that can be leveraged for user acquisition and token distribution.

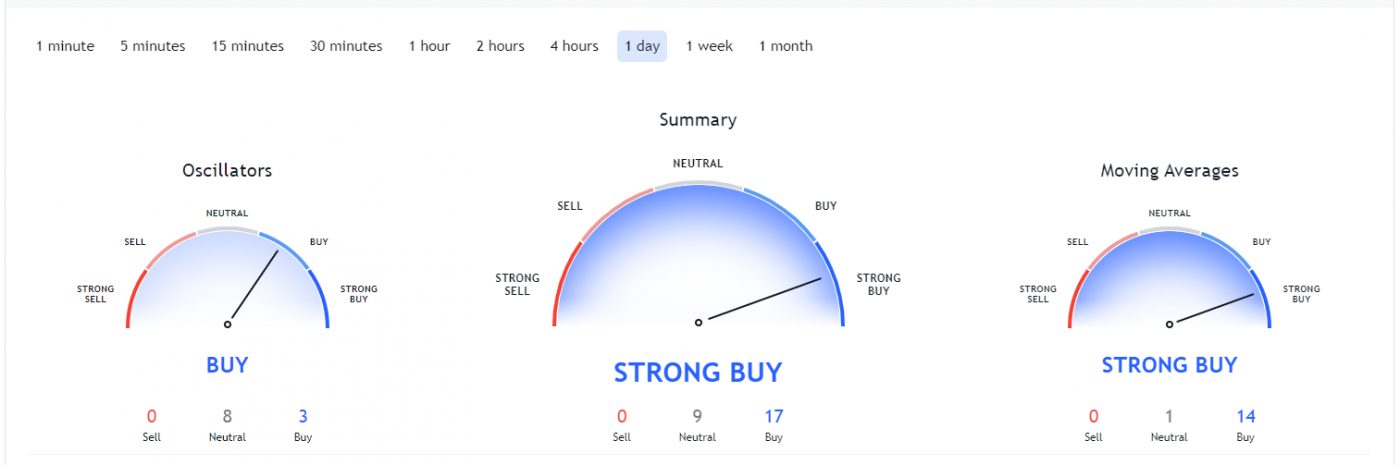

DEGO Price Analysis

At the time of writing, DEGO is ranked the 319th cryptocurrency globally and the current price is A$13.43. Let’s take a look at the chart below for price analysis:

This month’s bulls enjoyed 190% gains at DEGO’s peak before the price confirmed stiff resistance beginning at A$14.37

The 12-hour chart shows that support may be forming between A$9.57 and A$8.89, near the weekly open.

Aggressive bulls could enter in this area, although safer entries may be found much further below near A$8.12 and A$7.56 after a sweep of the current consolidation’s swing lows.

The last swing high near A$16.37 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near A$19.64 and the 2.0 extension near A$23.85 may provide the next major targets

3. Fantom (FTM)

Fantom FTM is a directed acyclic graph (DAG) smart contract platform providing decentralized finance (DeFi) services to developers using its own bespoke consensus algorithm. Together with its in-house token FTM, Fantom aims to solve problems associated with smart-contract platforms, specifically transaction speed, which developers say they have reduced to under two seconds.

FTM Price Analysis

At the time of writing, FTM is ranked the 99th cryptocurrency globally and the current price is A$0.304. Let’s take a look at the chart below for price analysis:

FTM’s 75% last week run retraced almost to its origin, narrowly missing probable support near A$0.2755 before bears swatted down the bounce near resistance around A$0.2587.

With the daily gap between A$0.2344 and A$0.2173 almost filled in a single wick, the price may not need to revisit areas below this level. However, the safer entry is still in probable support between A$0.1925 and A$0.1847, which would also sweep the lows of last week’s bounce.

The relatively equal highs near A$0.3569 provide a likely first target on lower timeframes. However, the resistance beginning at A$0.3741 may initially suppress a further move up.

A clean break through this resistance will need to contend with the next resistance near A$0.3958 under the last swing high. This swing high at A$0.4316 gives a reasonable take-profit area before a possible move to the 1.0 extension near A$0.4833.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.