Australian Ethereum layer-2 scaling solution Synthetix has seen its native token SNX balloon 100 percent after linking up with liquidity provider Curve Finance.

The partnership has led to the creation of Synthetic Ether, Bitcoin and USD, providing investors with cheap conversions:

Synthetix Now Ranked #3

The knock-on effect since June 20 has pushed the scaling solution to the position of third-largest protocol. As Synthetix was one of the first protocols launched on Ethereum, investors are pleased to see this positive movement:

The collaboration with Curve Finance has resulted in curve pools for Synthetic Ether (sETH)/Ether (ETH), Synthetic US dollar (sUSD)/3CRV, and Synthetic Bitcoin (sBTC)/Bitcoin (BTC). This tech allows the platform to offer more derivatives tokens.

While these synthetic assets are Synthetix’s main product, it appears that new fundamentals have strengthened the project and played a significant role in the surge of SNX.

Kain Warwick, founder of Synthetix, believes the company’s recent success is down to its willingness to experiment with novel mechanisms to provide stability, and the community’s responsiveness under difficult circumstances.

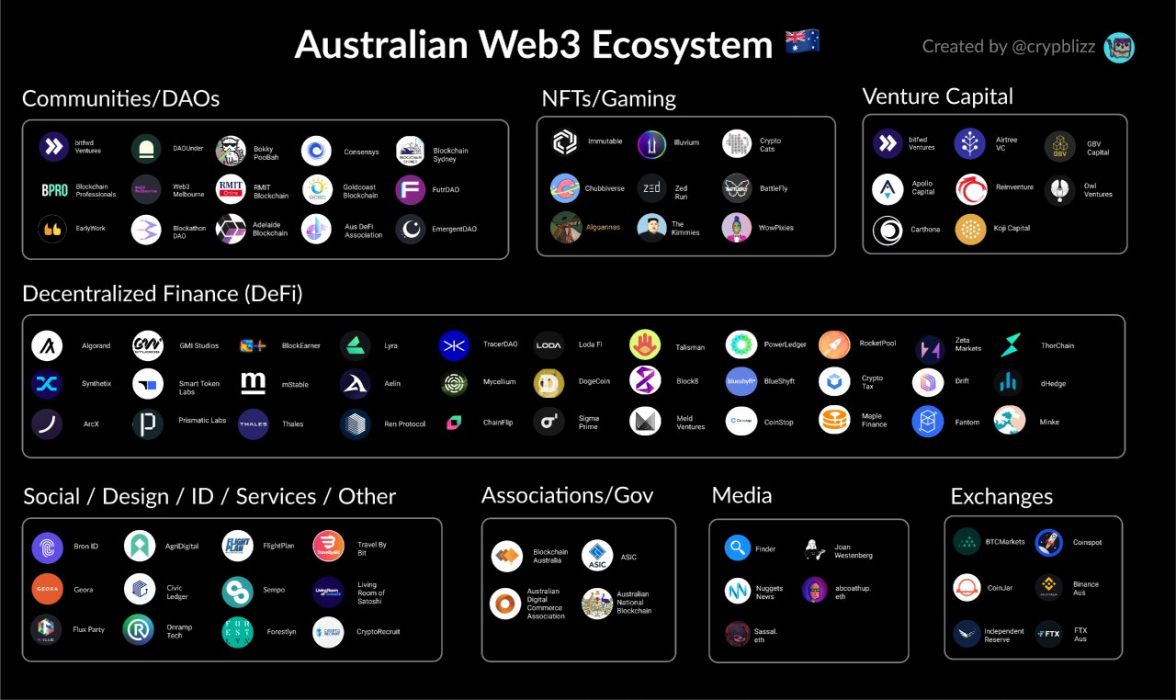

Australian Web3 Witnesses Rapid Development

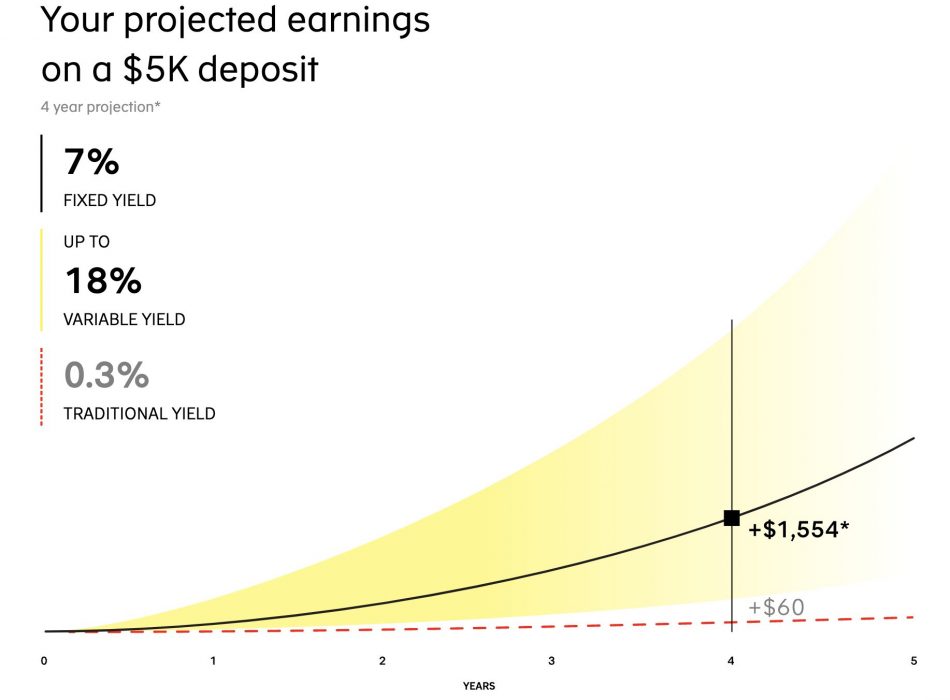

In February last year, Synthetix successfully raised A$12 million with the aid of a handful of venture capital (VC) firms. The funds weren’t sent directly to Synthetix, rather they were raised through the purchase of Synthetix’s native token, SNX. The fundraising supported the notion that a place was developing for VC money within DeFi.

Thanks to the emergence of DeFi, DAOs and NFTs, the Aussie Web3 scene has seen rapid development over the past few years, due in no small part to Synthetix, DAO Under, Immutable, Maple Finance and Sigma Prime, who have all helped foster interest from investors.