Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Tezos (XTZ)

Tezos XTZ is a blockchain network that’s based on smart contracts, in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced – meaning it can evolve and improve over time without any danger of a hard fork. This is something that both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

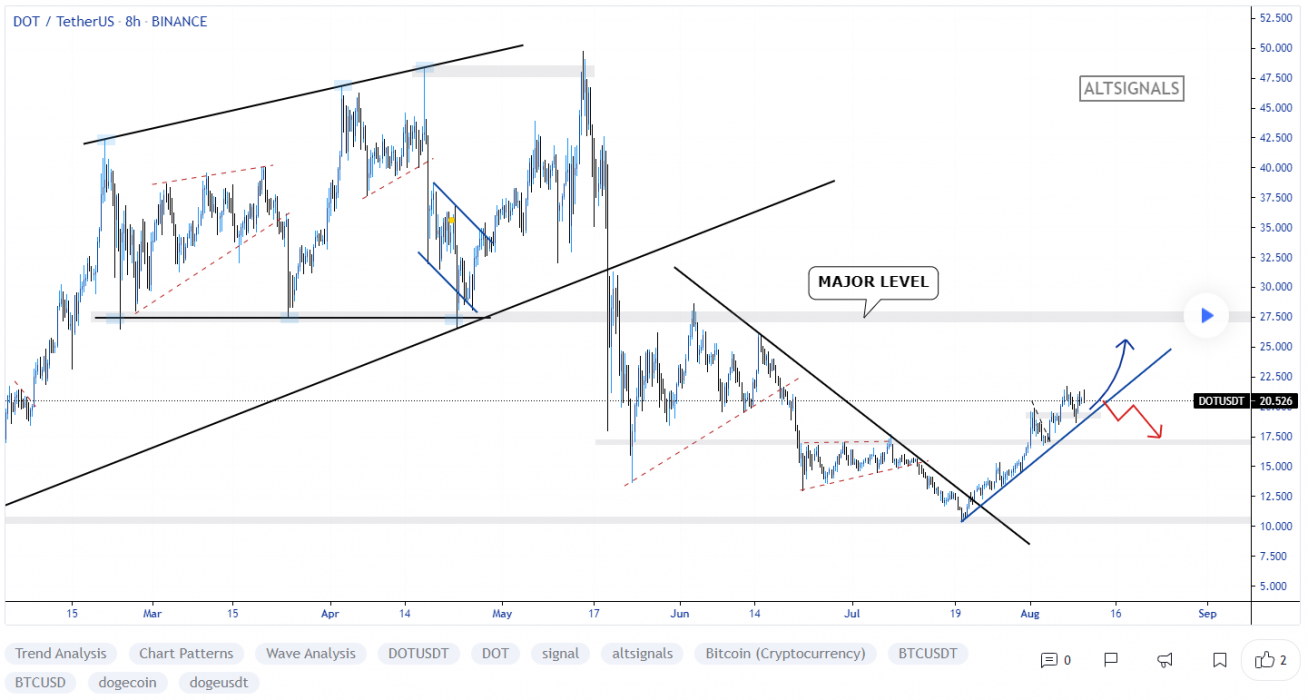

XTZ Price Analysis

At the time of writing, XTZ is ranked the 41st cryptocurrency globally and the current price is US$5.19. Let’s take a look at the chart below for price analysis:

XTZ‘s 105% rally since late September saw a second leg after last week’s market-wide drop ran the previous consolidation’s stops.

The level near $5.65 is providing some resistance. However, continuation through the monthly high at $6.13 is not out of the question. Aggressive bulls might bid in the current region near $6.32.

If the price runs the recent swing low, bulls might bid in the gap near $5.06. A deeper retracement could reach near the mid-August level and a gap near $4.90. The region near $4.73 and $4.35 may also provide some support during a deeper retracement.

2. Eos (EOS)

EOS is a platform designed to allow developers to build decentralised apps. The project’s goal is relatively simple: to make it as straightforward as possible for programmers to embrace blockchain technology and ensure the network is easier to use than rivals. As a result, tools and a range of educational resources are provided to support developers who want to build functional apps quickly. EOS also aims to improve the experience for users and businesses. While the project tries to deliver greater security and less friction for consumers, it also vies to unlock flexibility and compliance for enterprises.

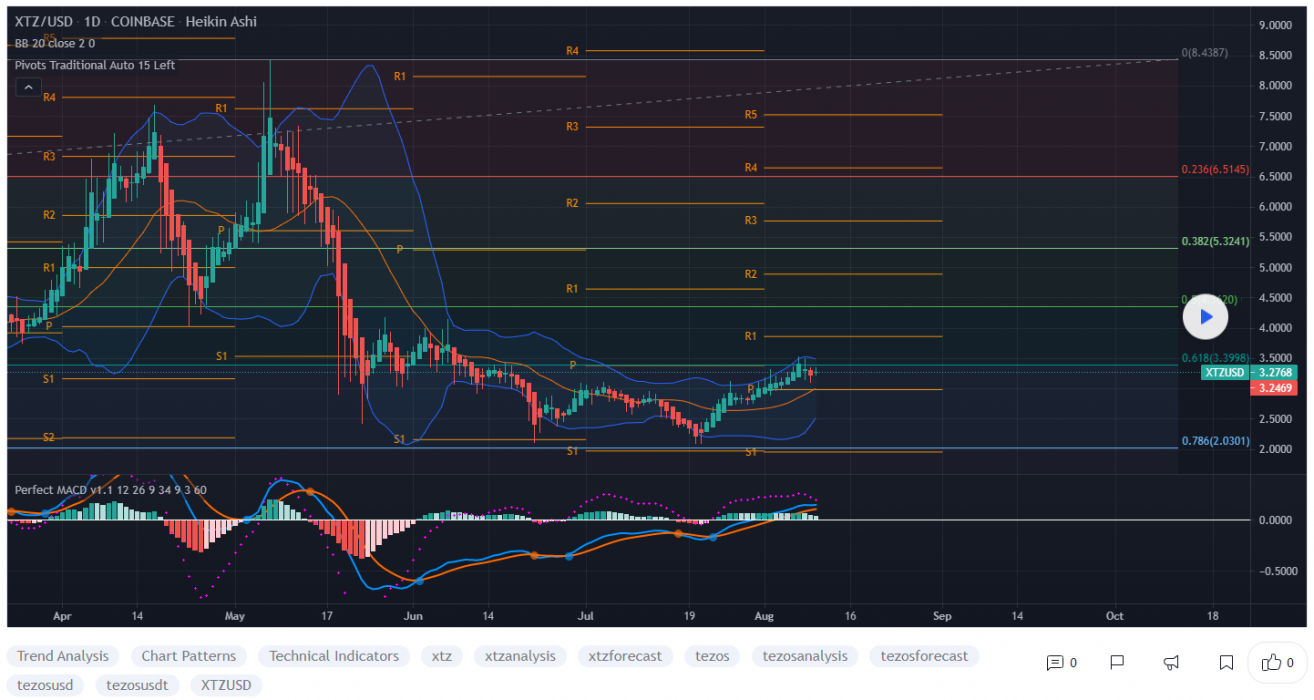

EOS Price Analysis

At the time of writing, EOS is ranked the 50th cryptocurrency globally and the current price is US$3.34. Let’s take a look at the chart below for price analysis:

After an 81% decline from mid Q2, EOS has ranged between $3.25 and $4.95. The recent rally is approaching probable resistance near $3.99 – but could be aiming for stops above the relatively equal highs near $4.17. Continuation of the bullish move could target the daily gap near $4.46.

Aggressive bulls might add to positions near $3.21 and $3.10. Price action near $3.00 may be more likely to provide support – if the price reaches it – during any retracements.

Relatively equal lows clustered around $2.90 seem likely to be swept if the bearish trend resumes. If this move occurs, the price might find support at the significant higher-timeframe level near $2.82.

3. Linear (LINA)

Linear LINA is a decentralised delta-one asset protocol capable of instantly creating synthetic assets with unlimited liquidity. The project opens traditional assets like commodities, forex, market indices and other thematic sectors to cryptocurrency users by supporting the creation of “Liquids”, Linear’s synthetic asset tokens. LINA is an ERC-20 token built on the Ethereum network whose main purpose is as collateral for Liquids (using Buildr), and for community governance of the protocol.

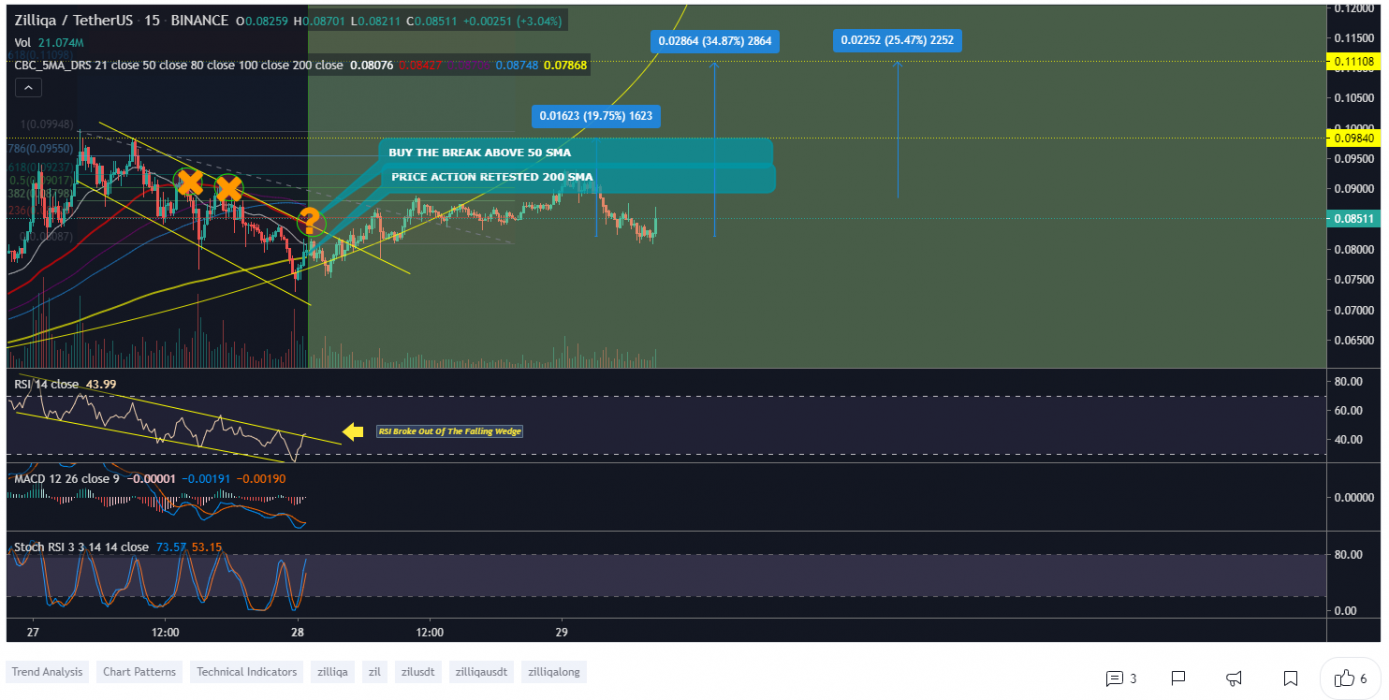

LINA Price Analysis

At the time of writing, LINA is ranked the 335th cryptocurrency globally and the current price is US$0.04029. Let’s take a look at the chart below for price analysis:

During November, LINA also turned the corner, breaking a key swing high early to mid-month. This move could suggest a longer-term bullish trend.

The swing high near $0.05436 stands out as a bullish target and marks an area of probable resistance. Further continuation could reach into possible resistance starting near $0.06157.

Even if the bearish trend continues, a stop run at the recent swing low near $0.04012 into possible support beginning near $0.03845 is reasonable. If the price reaches further down, the swing low and possible support near $0.03587 might provide another downside target.

The area near $0.03315 could also provide support. However, a drop this far could suggest a stop run below the higher-timeframe relatively equal lows near $0.03193 into possible support beginning around $0.03029.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.