Queensland-based Australian crypto dispute specialist law firm Salerno is preparing a A$100 million class-action suit against the issuers of Qoin, a controversial token promoted by the backers of Bartercard, a 30-year-old trading exchange based on the Gold Coast.

Salerno Law began collecting expressions of interest just a week ago, seeing more than 100 merchants, agents, consumers and other clients declare their intention to join the class action.

The firm says it is investigating potential breaches of the Corporations Act, the Australian Securities and Investments Commission (ASIC) Act, and Australian consumer law, including (as quoted):

- misleading and deceptive conduct;

- making false or misleading representations;

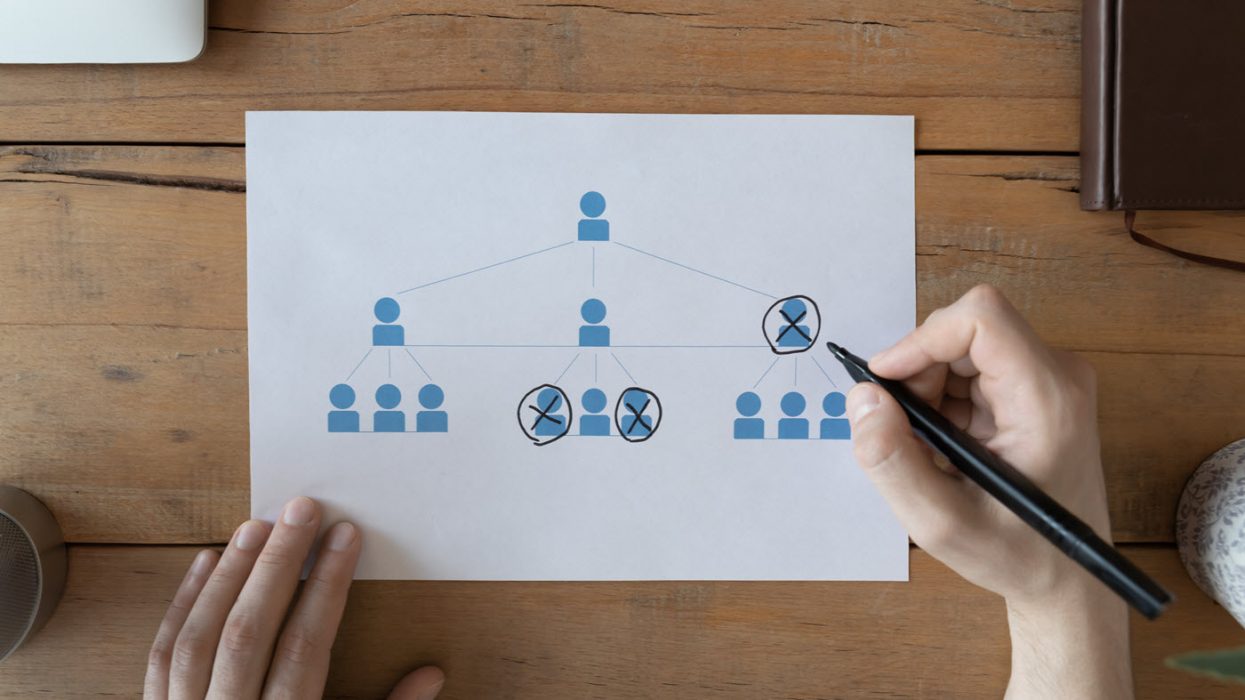

- pyramid selling of financial products;

- failure to comply with financial services obligations and consumer guarantees; and

- fraud.

Bartercard Australia Directors Linked to Lawsuit

The lawsuit targets Southport-based BPS Financial Limited, controlled by co-directors Tony Wiese and Raj Pathak who also oversee Bartercard, a firm that allows businesses to exchange goods and services without direct cash payments.

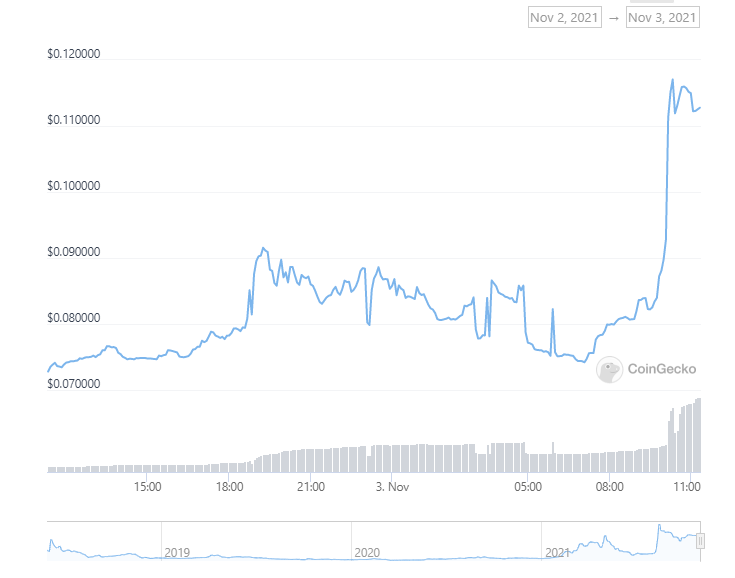

BPS launched Qoin in late 2019 and claims to have more than 35,000 merchants signed up, along with 50,000-plus “wallet holders’’ who have acquired the digital product. It’s estimated that in excess of A$20 million worth of Qoin has been transacted since.

Qoin tokens can be swapped as a digital currency only via Block Trade Exchange Limited, aka the BTX Exchange, which is linked to BPS and has the same two directors, Wiese and Pathak. Critics allege this is a closed system that creates a potential conflict of interest.

According to Salerno’s website, “Qoin has entered into an exclusive trading arrangement with BTX Exchange which, according to its terms, limits users to one daily transaction with a $125 sell limit per day per person, subject to buyer demand.

It has been alleged by holders and merchants that they are either unable to accept Qoin payments or exchange the token for fiat currency due to the terms of BTX Exchange, leaving them with a token of no utility. For merchants, this is alleged to have caused a significant loss in revenue.

salernolaw.com.au

BPS Executive Denies Wrongdoing

Senior BPS executive Andrew Barker denies the company has done anything wrong and blames the impending lawsuit on a single disgruntled merchant. “We have reviewed the alleged potential grievances and consider them baseless,” the company stated on its own website. “We have received no direct communication and therefore have no further comment to make at this time.”

The threatened lawsuit follows Qoin’s expulsion earlier this year by Blockchain Australia (BCA), who in a statement in February asked for its name and logo to be removed from Qoin marketing material but did not provide details as to why.

Qoin’s issuers responded angrily that the timing of BCA’s statement “aligns with the emergence of false and misleading comments … made by certain antagonists on social media platforms, including a previous board member”. This was in reference to a former BCA director who had previously alleged in a tweet that Qoin was the nation’s “biggest crypto scam’’.

Qoin Clients Voice Concerns on TrustPilot

Consumer review website Trustpilot lists several more recent Qoin critics, among them former clients and representatives:

QOIN are basically worthless. Don’t believe me? Try selling some through BTX exchange as directed to by Qoin. BTX don’t want them either. Not many retailers accepting them in NSW. They wiped my wallet clear and kept my money after I complained. RUN a mile … and keep running.

Peter, Trustpilot.com reviews

Can’t cash out and the local “recruiter” was rude and forceful. His sales pitch was basically telling you to avoid paying tax by trading a dodgy QOIN you can’t sell.

Jackson, Trustpilot.com reviews

Absolutely a Ponzi scheme. Can’t sell. If you are lucky enough to it’s at half the value … Disgraceful they are allowed to continue operating in this country.

Jih, Trustpilot.com reviews

Crypto News urges Australian and New Zealand retailers and local businesses to stay vigilant and do your research before getting involved in any new ventures offering “free” cryptocurrency.