Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Alpha Finance (ALPHA)

Alpha Finance Lab ALPHA is a cross-chain DeFi platform that looks to bring Alpha to users across a variety of different blockchains, including Binance Smart Chain (BSC) and Ethereum. The platform aims to produce an ecosystem of DeFi products that address unmet needs in the industry while remaining simple to use and access. ALPHA is the native utility token of the platform. Token holders can earn a share of network fees by staking ALPHA tokens to cover any default loans. Other use cases for the token include liquidity mining and governance voting.

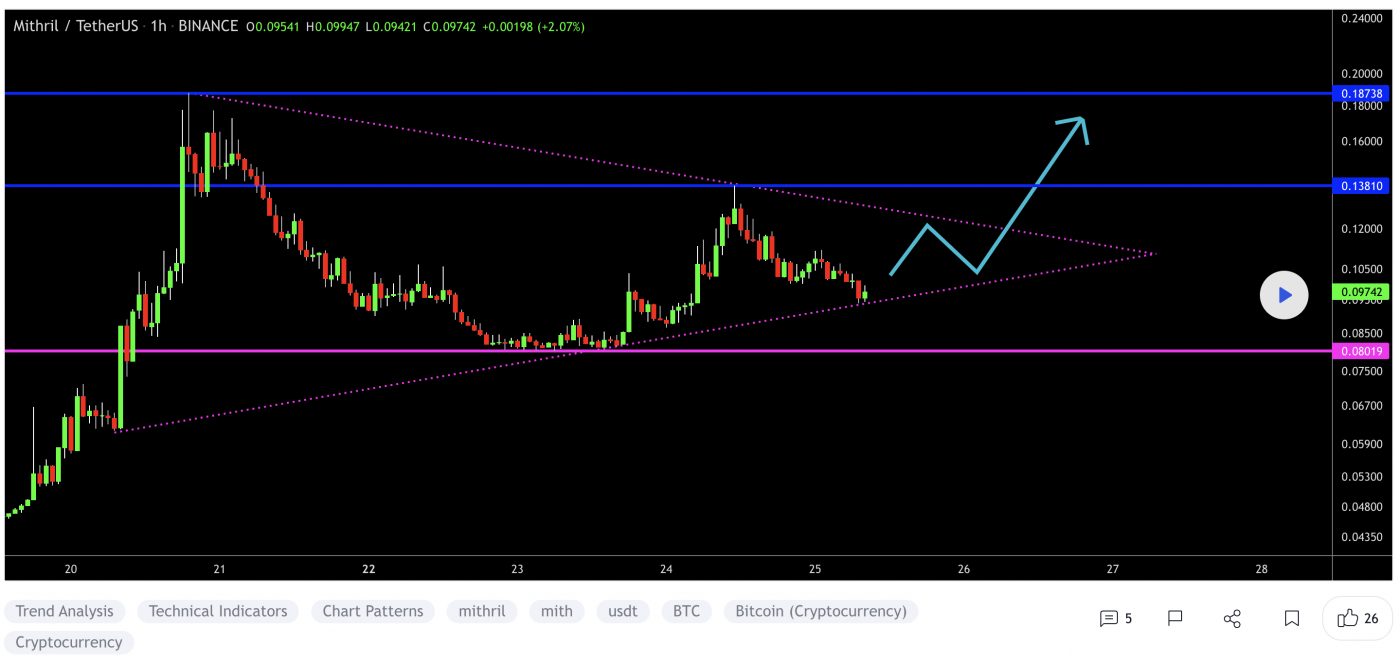

ALPHA Price Analysis

At the time of writing, ALPHA is ranked the 168th cryptocurrency globally and the current price is US$0.7279. Let’s take a look at the chart below for price analysis:

ALPHA‘s 395% rally from its June lows met resistance near the low of H1 2021’s consolidation, near $1.5295, before creating a new range for Q3.

After a bearish flip of the 9, 18 and 40 EMAs, the price broke below $0.8503. This area, which has confluence with multiple swing lows and the December monthly open, may provide resistance on any future retest.

The price might find support near $0.4845 to $0.6749 if the overall market’s conditions turn more bullish. This zone has confluence with the 61.8% to 78.6% retracements and accumulation zone for Q3’s rally.

Failure to find support in this area could drop the price to higher timeframe support near late 2020’s swing high, near $0.3051. However, a drop this low could continue lower as traders sell the news of Wednesday’s mainnet launch on AVAX.

Suppose the price does rally through the probable resistance near December’s open. In that case, the September swing highs and above, near $1.3861, could provide resistance again. A shift back to more bullish market conditions could push the price to the 50% extension of the summer’s swing, near $1.9334.

2. Beldex (BDX)

Beldex BDX is a leading privacy-based ecosystem consisting of privacy-first decentralised applications that include BChat, BelNet, Beldex browser, the Beldex privacy protocol, and the Beldex bridge. The Beldex project is committed to enhancing your privacy online. BDX is a privacy coin and a utility on the privacy-preserving DApps. For privacy lovers, Beldex is the one-stop destination for everything from private messaging to private transactions.

BDX Price Analysis

At the time of writing, BDX is ranked the 379th cryptocurrency globally and the current price is US$0.1114. Let’s take a look at the chart below for price analysis:

With little price action to rely on, BDX‘s near-term future is uncertain. A long tail to $0.0717 could hint at future support near this level. However, bulls will likely wait for more confirmation on lower timeframes before bidding. The midpoint of this wick, near $0.0962, has also shown some interest from buyers and could continue to provide support.

Meanwhile, each rally has been sold into, creating long upper wicks as investors take profits during the current uncertain market conditions. Overlapping swing highs and swing lows near the December monthly open, around $0.1116, may continue to provide resistance if the current downtrend continues.

Any rallies before Friday’s hard fork could find resistance near $0.1264, an area that has seen strong selling on each test. Above, the current highs near $0.1500 may also provide resistance again, especially if the price first wicks above this level.

3. Syscoin (SYS)

Syscoin SYS is a full Layer-1 and Layer-2 blockchain solution built to combine industry-proven technology to support cutting-edge applications all in one network. The project’s goal is to build a protocol that transforms the blockchain experience and combines the best of Bitcoin and Ethereum. Through Bitcoin merge-mining, Syscoin transforms Bitcoin’s Proof-of-Work security and decentralisation into a functional and scalable solution. Syscoin’s token platform currently features custom notary API, Fungible Tokens, NFTs, and Fractionalised NFTs.

SYS Price Analysis

At the time of writing, SYS is ranked the 165th cryptocurrency globally and the current price is US$0.5357. Let’s take a look at the chart below for price analysis:

The 248% parabolic rally from the October SYS lows to December’s high abruptly sold off 50% as the market crashed.

A long wick through possible support between $0.5270 and $0.4690, near the 61.8% retracement and 40 EMA, shows that buyers were interested in this level. It remains to be seen whether this level can support the price again on a retest.

Higher timeframes suggest this possible support down to the origin of the last rally could see buying, with a higher probability level near $0.3600. If the price breaks this possible support, the swing low near $0.3014 is the likely bearish target.

Investors selling the news of Monday’s mainnet launch, combined with the weak market conditions, could mean that the current bullish move is over and the price will continue down into consolidation.

Bulls might find resistance near $0.6500, at the highs of the consolidation preceding last week’s swing high. A stronger impulse, perhaps from a convincing relief rally in Bitcoin, might reach slightly higher to probable resistance near $0.7615.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. You can also buy these coins from different exchanges listed on CoinMarketCap.