Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Boson Protocol (BOSON)

Boson Protocol BOSON is a trust minimised and cost minimised protocol that automates digital to physical redemptions using NFTs encoded with game theory. Boson Protocol’s vision is to enable a decentralised commerce ecosystem by funding and accelerating the development of a stack of specialist applications to disrupt, unbundle and democratise commerce. Boson provides a commerce interface between the Metaverse and the physical world.

BOSON Price Analysis

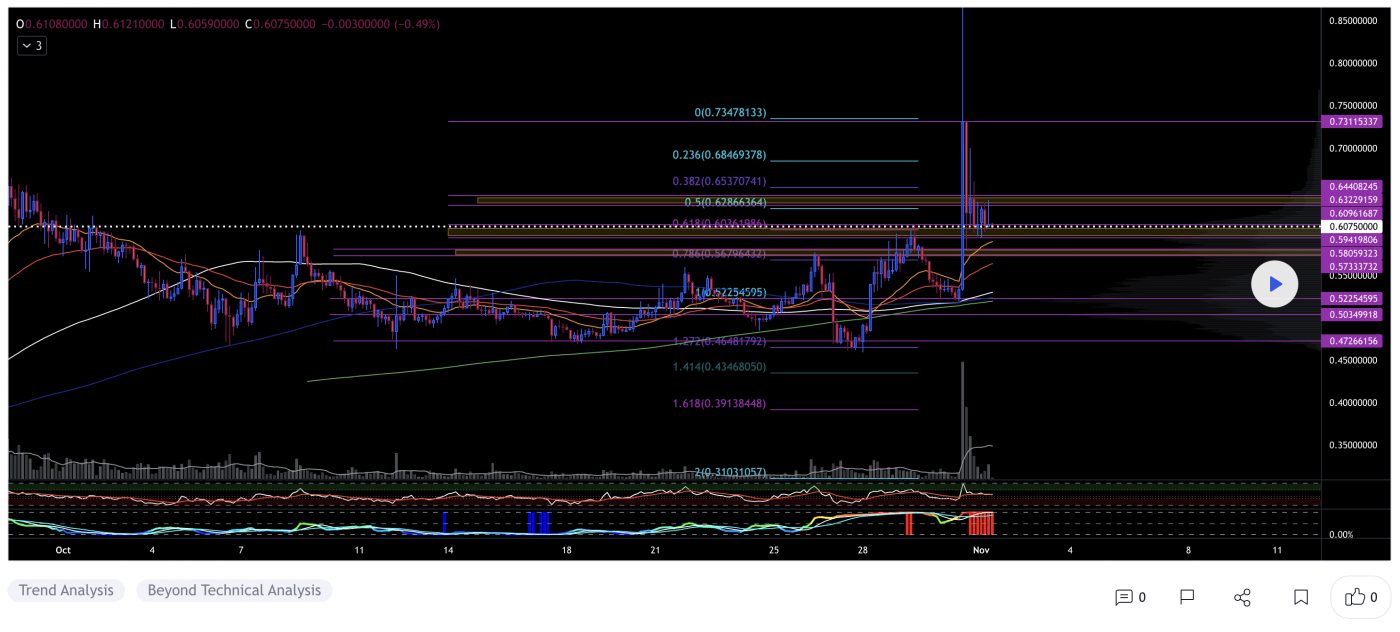

At the time of writing, BOSON is ranked the 365th cryptocurrency globally and the current price is A$3.86. Let’s take a look at the chart below for price analysis:

BOSON‘s 305% rally from its September lows ran into resistance at an old swing low near A$4.04.

After November 4’s mainnet release, the retracement to the last significant swing high found some support near A$2.96. This level could provide support again on a retest since it has confluence with the 18 EMA and the current move’s 50% retracement. If the price consolidates or fails to convincingly break October’s high before the portal launch, traders might “sell the news” into this possible support level.

Bulls waiting for a higher risk-to-reward entry might wait for the price to revisit the 61.8% retracement level near A$2.35. This level could provide support, given its confluences with multiple previous swing highs. However, it may not be revisited for some time if the overall market remains bullish.

If bulls flip the current resistance near A$4.04 to support, old consolidation highs near A$4.79 might provide the next resistance. However, the 100% extension of the summer’s swing is a likely target. This extension aligns with multiple old highs from A$5.53 to A$5.83.

2. Crypto Coin (CRO)

Crypto.com coin CRO is the native cryptocurrency token of Crypto.com Chain – a decentralised, open-source blockchain developed by the Crypto.com payment, trading and financial services company. Crypto.com Chain is one of the products in Crypto.com’s lineup of solutions designed to accelerate the global adoption of cryptocurrencies as a means of increasing personal control over money, safeguarding user data, and protecting users’ identities. The CRO blockchain serves primarily as a vehicle that powers the Crypto.com Pay mobile payments app.

CRO Price Analysis

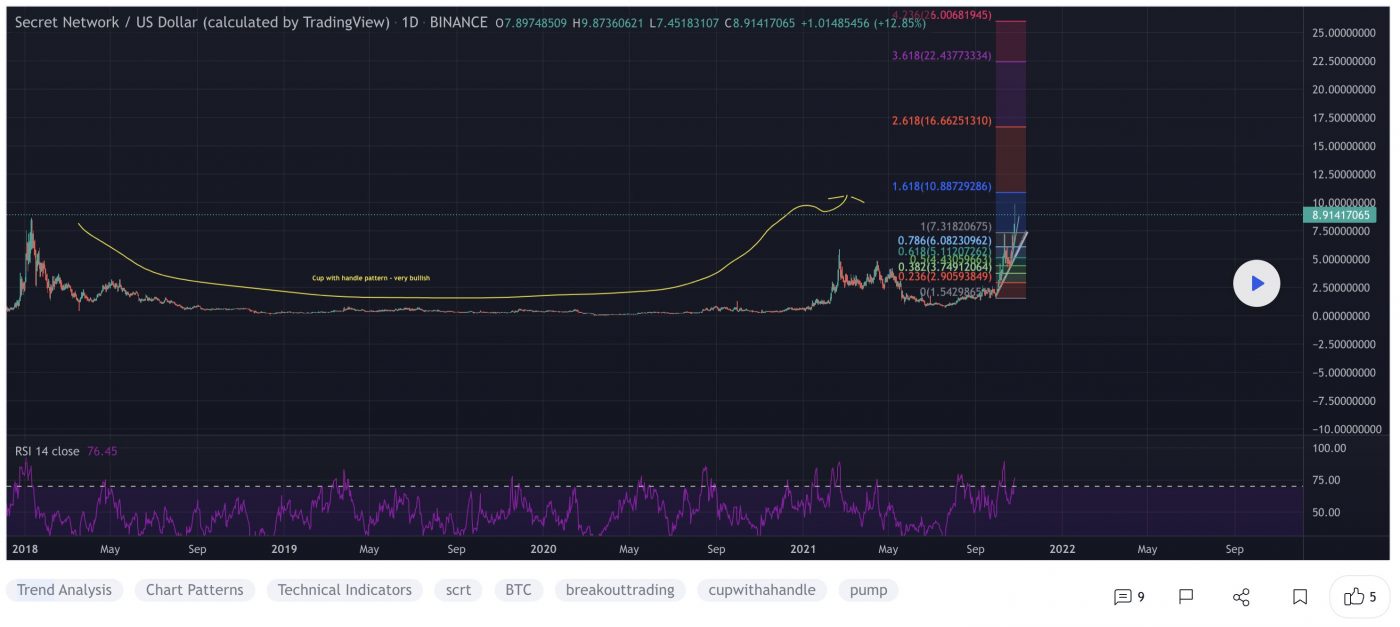

At the time of writing, CRO is ranked the 23rd cryptocurrency globally and the current price is A$0.5296. Let’s take a look at the chart below for price analysis:

CRO went parabolic from November 1, reaching nearly 105% percent within eight days as it blasted through its old all-time high.

This fast move left little compelling higher-timeframe support near the current price. A level near A$0.4322, which has confluence with the 8 EMA and 127% extension of H1 2021’s swing, could provide support while traders riding hype from today’s mainnet launch take profits on their positions.

Further below, near A$0.3791, 2021’s previous all-time high could also provide some support on a retest. The last consolidation before the breakout, near November’s open, might give the most substantial support. However, this would require significant retracement from the current price point.

While final targets are impossible to predict, extensions from H1 2021’s move suggest that the 100% extension, near A$0.6075, could provide some resistance. Above this level, the 150% extension near A$0.7428 could also trigger bulls to take profits.

3. Polkadot (DOT)

Polkadot DOT is an open-source sharding multichain protocol that facilitates the cross-chain transfer of any data or asset types, not just tokens, thereby making a wide range of blockchains interoperable with each other. Polkadot’s native DOT token serves three clear purposes: providing network governance and operations, and creating parachains by bonding. The Polkadot protocol connects public and private chains, permissionless networks, oracles and future technologies, allowing these independent blockchains to trustlessly share information and transactions through the Polkadot relay chain.

DOT Price Analysis

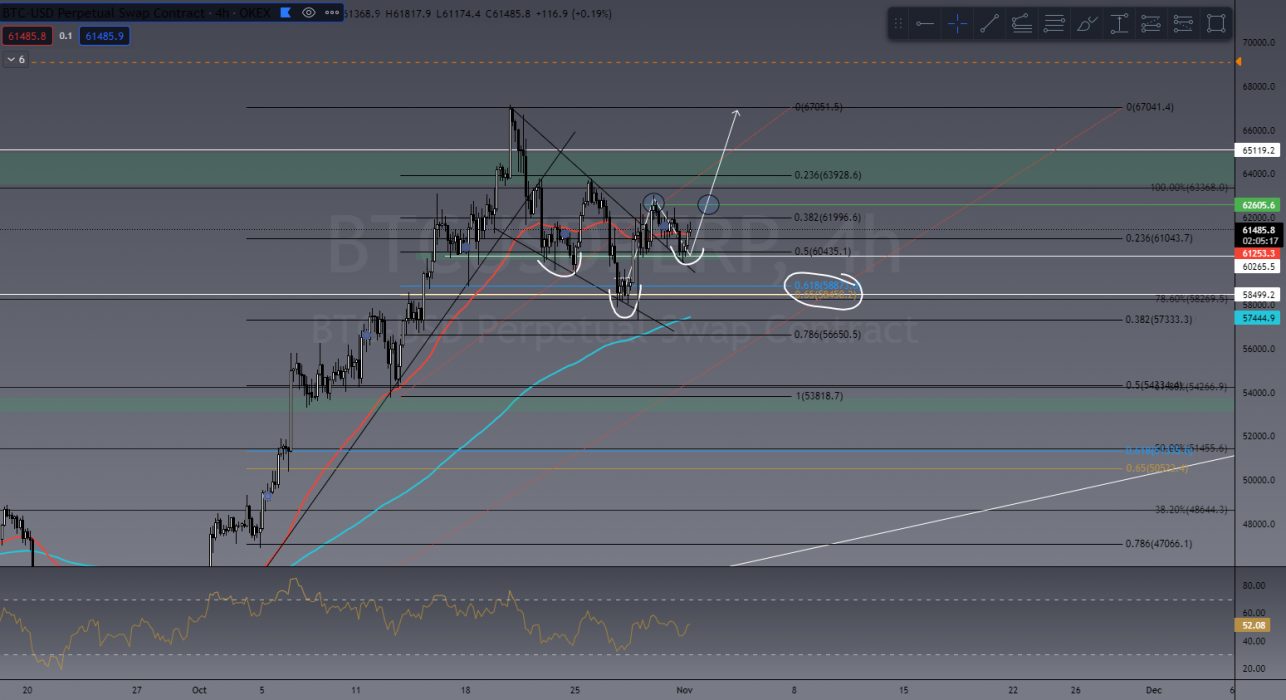

At the time of writing, DOT is ranked the 8th cryptocurrency globally and the current price is A$71.98. Let’s take a look at the chart below for price analysis:

As the long-awaited Parachain Auctions approach, DOT consolidates between A$69.72 and A$72.51 at the 100% extension of September’s consolidation, after a sharp move up through all-time highs on November 1.

The current consolidation could provide support if the price breaks the zone’s high near A$72.51. A better risk-to-reward entry could present itself near the daily candle bodies of the last swing high near A$64.67, which also has confluence with the 18 EMA and the 61.8% retracement. This potential drop could reach to possibly support the November open and 78.6% retracement, near A$59.68.

A sharper downturn in the market could send the price as low as A$53.89, near the last significant swing high in this leg, although a move this low could signal the start of a bearish trend.

Extensions from September’s consolidation indicate that the 150% extension, near A$84.78, and the 200% extension, near A$95.62, could be the next significant targets.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. You can also buy these coins from different exchanges listed on Coinmarketcap.