Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. PancakeSwap (CAKE)

PancakeSwap CAKE is an automated market maker (AMM) – a decentralised finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. PancakeSwap uses an automated market maker model where users trade against a liquidity pool. These pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return. PancakeSwap allows users to trade BEP20 tokens, provide liquidity to the exchange and earn fees, stake LP tokens to earn CAKE, stake CAKE to earn more CAKE, and stake CAKE to earn tokens of other projects.

CAKE Price Analysis

At the time of writing, CAKE is ranked the 45th cryptocurrency globally and the current price is A$23.06. Let’s take a look at the chart below for price analysis:

CAKE‘s 71% decline during May created relatively equal lows near A$23.56 before bouncing over the local range’s midpoint near A$34.60. A bullish altcoin market could help CAKE bulls regain a stronger bullish trend.

Aggressive bulls could look for entries in the daily gap starting near A$20.77. The monthly open aligns with more probable support near A$19.84.

A stop run below the monthly open near A$18.62 might provide a more favourable entry. A more substantial bearish move – perhaps from a sharp drop in Bitcoin’s price – could challenge support near A$16.30, just above the equal lows.

Resistance rests just above, with the zone from A$27.59 to A$31.26 likely to provide a short-term ceiling. A break through this level might target resistance just under the cluster of relatively equal highs near A$33.47.

Beyond these highs, resistance near A$38.15 provides a final challenge before attacking an old daily swing high near A$40.86.

2. Ankr (ANKR)

ANKR originates as a solution that utilises shared resources in order to provide easy and affordable blockchain node hosting solutions. Founded in November 2017, it has since built a marketplace for container-based cloud services through the usage of shared resources. It is a platform that enables the sharing economy, where any customer can access resources at a more affordable rate, while also providing enterprises with the ability to monetise their spare computing power that is not being utilised. It is unique in the way that it is the first to use trusted hardware, and this ensures a high level of security.

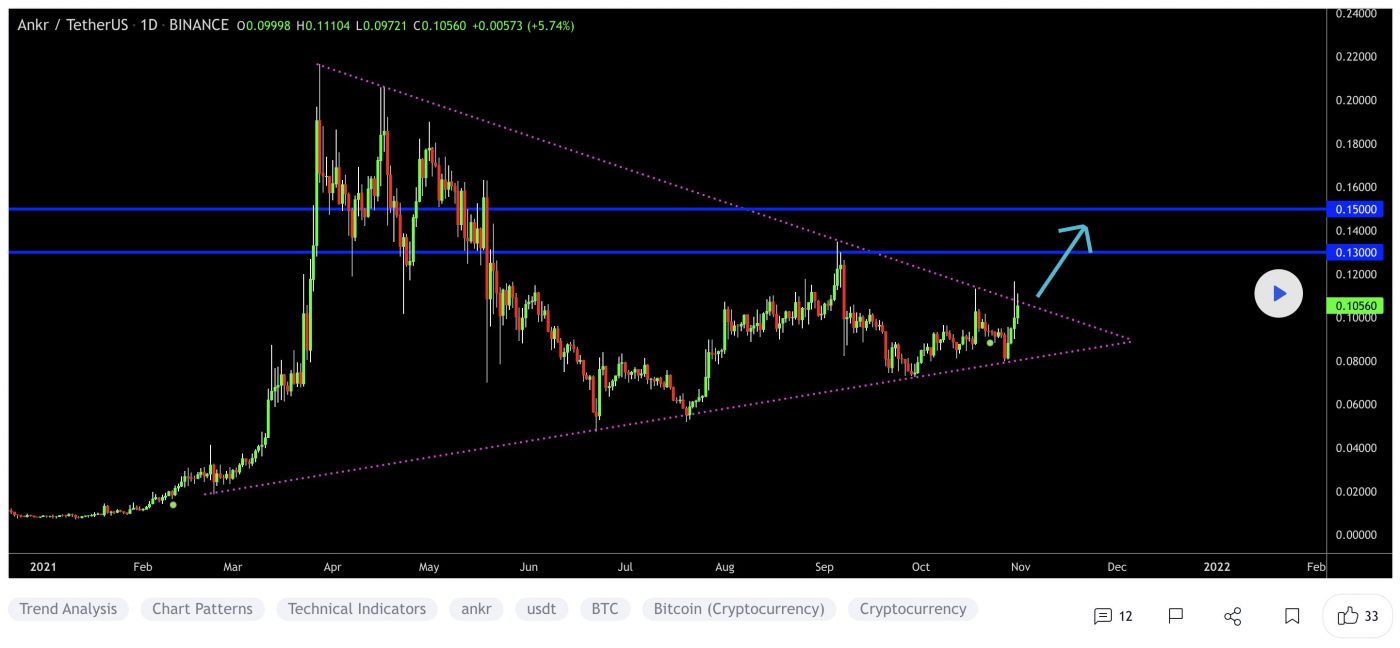

ANKR Price Analysis

At the time of writing, ANKR is ranked the 104th cryptocurrency globally and the current price is A$0.1706. Let’s take a look at the chart below for price analysis:

ANKR continues to set new monthly highs in its chaotic upwards trend.

Support might be found in the daily gap above the October monthly open near A$0.1395. A deeper retracement is likely to target the relatively equal lows into support near A$0.1254.

The daily gap near A$0.1586 could also provide support. However, another gap inside the down candles, around A$0.1424, provides the highest chances of solid support while offering a high risk-reward entry.

There is currently no resistance overhead since the price is in discovery. Extensions hint at the areas around A$0.2166 and A$0.2463 as reasonable take-profit zones.

3. Akropolis (AKRO)

Akropolis AKRO is a company that operates an Ethereum-based decentralised finance protocol that seeks to provide an autonomous financial ecosystem for saving and growing wealth, including through borrowing and lending. To do so, it offers a series of products including AkropolisOS, a framework for developing for-profit decentralised autonomous organisations; Sparta, a platform for uncollateralised lending; and Delphi, a yield farming aggregator and tool for dollar-cost averaging. The project uses an ERC-20 token, AKRO, for protocol governance across its suite of products.

AKRO Price Analysis

At the time of writing, AKRO is ranked the 387th cryptocurrency globally and the current price is A$0.04938. Let’s take a look at the chart below for price analysis:

AKRO holders endured a wild October as the price rallied over 85% before running the month’s lows. This stop run could set the stage for another rally. However, the recent volatility means bulls should be extra cautious with stop placement.

Bulls might find support around the current price near A$0.04355. The next high probability support rests near A$0.03912, below the last two swing lows. A move this deep could sweep monthly lows into an area near A$0.03577.

The price is currently struggling with resistance near A$0.05134 at the previous monthly open. A strong move into this resistance is likely to target the swing high near A$0.05421.

Above this swing high, a monthly high at A$0.05986 is the next likely target, which also marks another wide resistance zone. Volatility inside this resistance could tag a new monthly high at A$0.06532.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.