Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Republic Protocol (REN)

Republic Protocol REN is an open protocol built to provide interoperability and liquidity between different blockchain platforms. The protocol’s native token, REN, functions as a bond for those running nodes which power RenVM, known as Darknodes. Ren aims to expand the interoperability, and hence accessibility, of decentralised finance (DeFi) by removing hurdles involved in liquidity between blockchains.

REN Price Analysis

At the time of writing, REN is ranked the 114th cryptocurrency globally and the current price is A$0.5937. Let’s take a look at the chart below for price analysis:

REN’s explosive Q1 – climbing over 350% – retraced nearly 230% of the move within Q2.

While the price likely needs to cool off before any significant move is higher, stubborn bulls could look for entries in possible support beginning near A$0.5174.

A break below A$0.4736 is likely to continue to an area near A$0.4589. Strong bearish momentum might push the price to possible support near A$0.4236.

In both bullish and bearish scenarios, it’s reasonable (but not guaranteed) to anticipate a retest of resistance near A$0.6734, which would sweep a cluster of relatively equal highs near A$0.6944.

Continued strength above this area could continue to resistance near A$0.7514 and the high near A$0.8435.

2. Balancer (BAL)

Balancer BAL is an automated market maker (AMM) that was developed on the Ethereum blockchain and launched in March 2020. It was able to raise a $3 million seed round by Placeholder and Accomplice. Balancer protocol functions as a self-balancing weighted portfolio, price sensor and liquidity provider. It allows users to earn profits through its recently introduced token BAL by contributing to customisable liquidity pools.

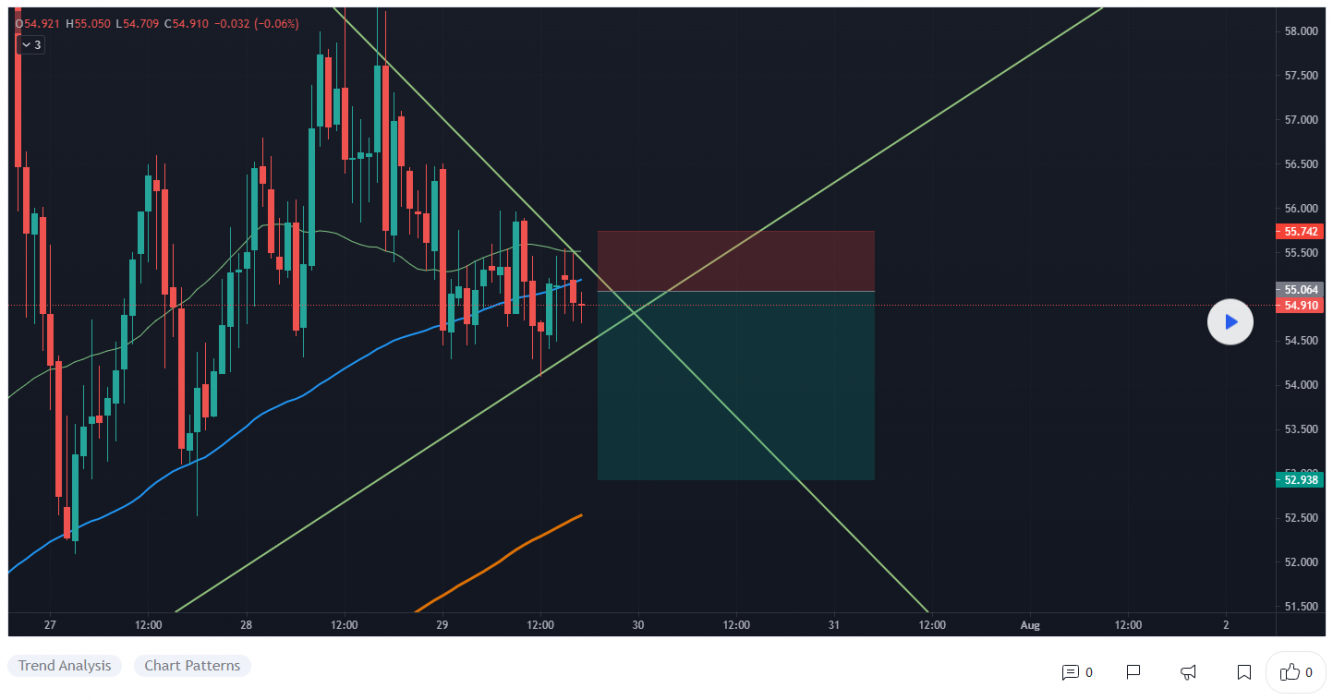

BAL Price Analysis

At the time of writing, BAL is ranked the 184th cryptocurrency globally and the current price is A$32.53. Let’s take a look at the chart below for price analysis:

Since the beginning of Q3, BAL has climbed 65% – a relatively small amount compared to many other altcoins. However, it continues to creep to new all-time highs, suggesting that the consolidation period may be near its end.

Aggressive bulls could look for entries in new possible support between A$29.15 and A$27.48. A dip below this area might also find support near A$24.66. However, a daily close near A$22.87 brings bullish strength into question.

A sudden drop in the market is likely to test possible support beginning near A$20.33. This retracement would create extensions suggesting A$48.85 – A$59.25 as a potential target for bulls.

Currently, extensions indicate a reasonable take-profit zone near A$35.44 to A$39.13, with A$41.55 having the most confluence. If bulls can maintain strength, confluent extensions point to A$43.62 – A$45.27 as a reasonable next target.

3. Curve DAO Token (CRV)

Curve CRV is a decentralised exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits.

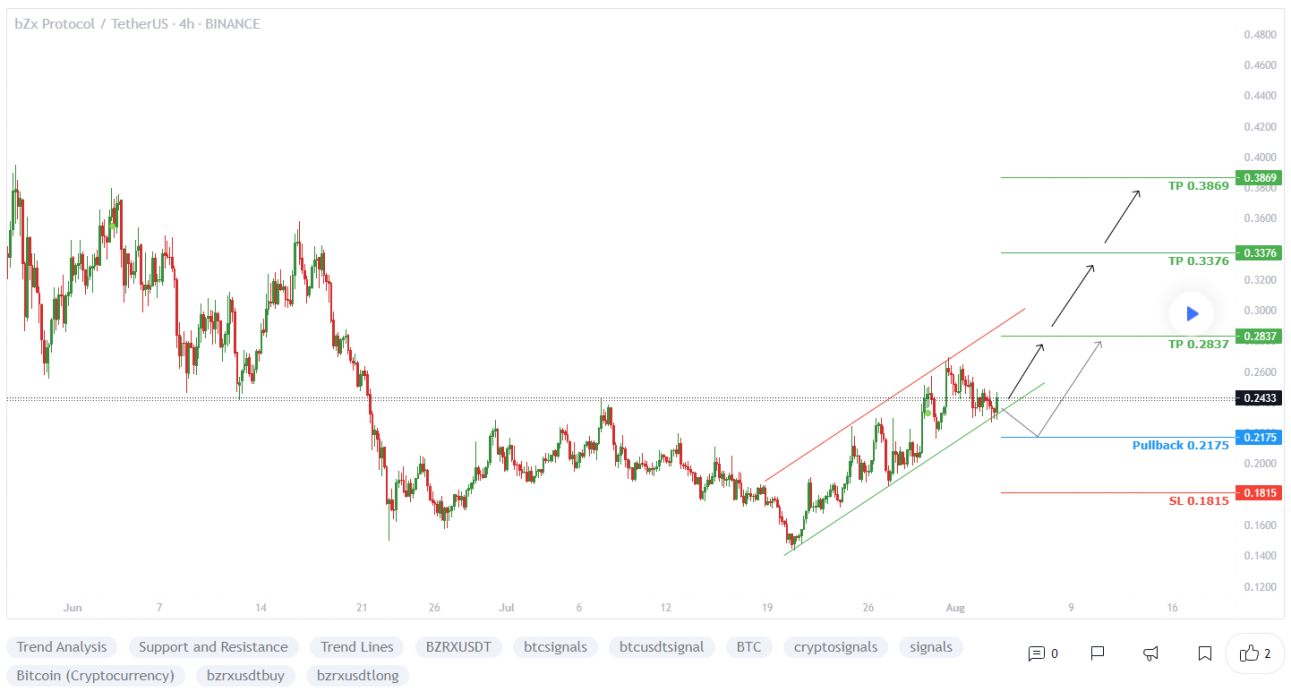

CRV Price Analysis

At the time of writing, CRV is ranked the 104th cryptocurrency globally and the current price is A$2.43. Let’s take a look at the chart below for price analysis:

June 1 spawned a bullish move in CRV, reaching over 122%. Chaotic price action near the top of this move resolved into a nearly 65% retracement.

Multiple breaks of swing lows between sweeps of swing highs suggest that the market structure has turned bearish for the weekend. If the overall market’s conditions remain bullish, this is likely to result in consolidation somewhere below the current price.

Possible support for the start of consolidation rests near A$2.35. A set of equal lows below this level will likely be swept into possible support, beginning near A$2.28.

Another spike upward is possible, but not guaranteed, as the price retraces. The area just under the July monthly open, beginning near A$2.61, gives a reasonable target. Above this resistance, the last swing high near A$2.75 provides the following target.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.