Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. SKALE Network (SKL)

Skale SKL is described as an elastic network that’s designed to bring scalability to Ethereum. As well as boosting transaction capacity, the decentralised project aims to reduce latency and ensure that payments can be made as cheaply as possible. SKALE Network is geared towards improving both the security and decentralisation of Ethereum-based apps. Token holders on the SKALE Network are incentivised and earn rewards by helping to improve the scalability and security of the platform by serving as validators.

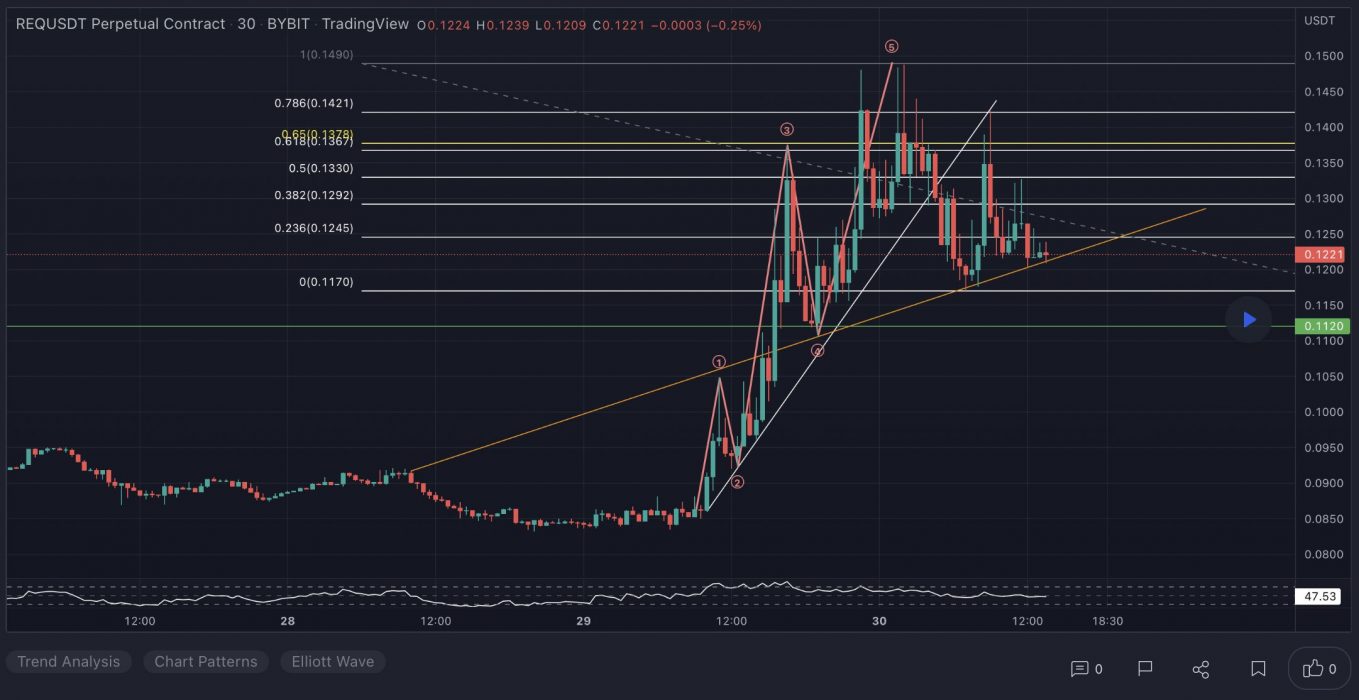

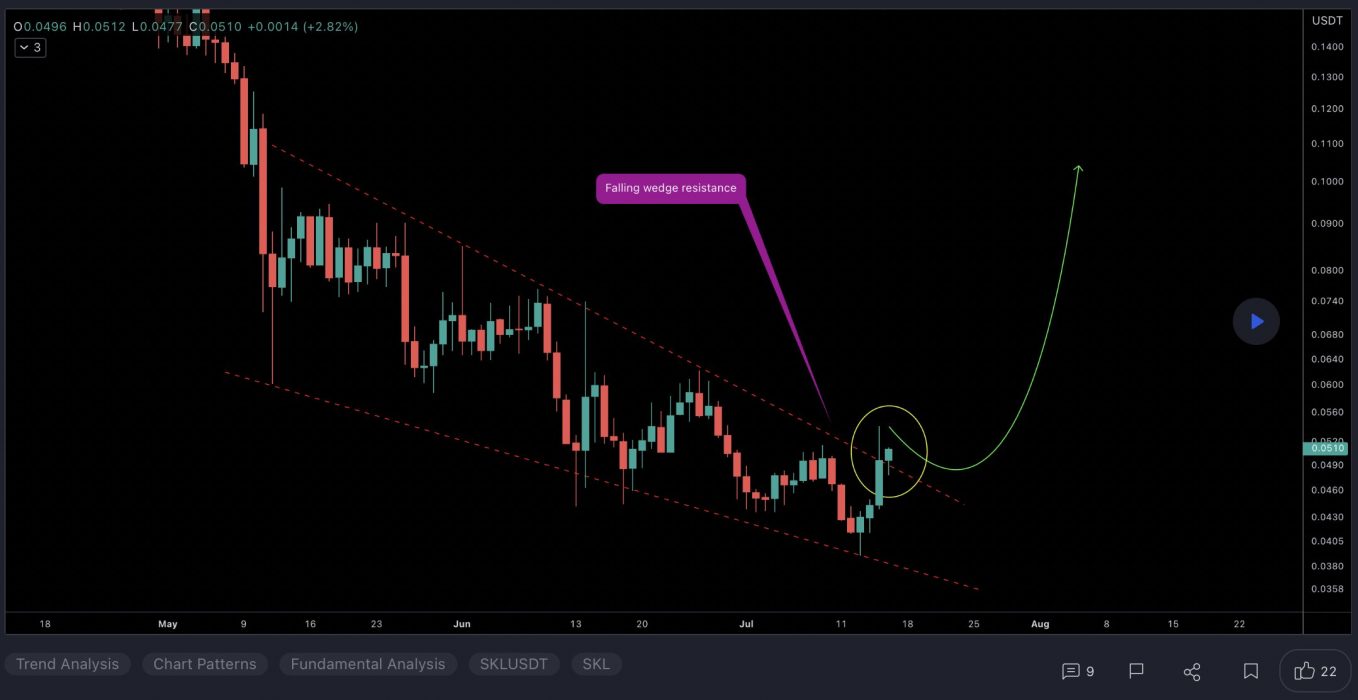

SKL Price Analysis

At the time of writing, SKL is ranked the 150th cryptocurrency globally and the current price is US$0.05101. Let’s take a look at the chart below for price analysis:

Since the beginning of Q2, SKL has been in a gentle downtrend. The future likely holds more stop runs and erratic volatility until the chart forms more substantial high-timeframe levels.

A retracement might uncover support near $0.05020, which is the daily high of the last swing low. The high of the wick beginning near $0.04671 may also provide support. However, bulls will likely remain wary of the current downtrend, making the low at $0.04130 the likely next bearish target.

Just above, the daily gap beginning near $0.05788 may provide resistance to bulls, possibly marking a future range high. A push through this level is likely to target the swing high near $0.06293 – perhaps running to probable resistance near $0.06544. Strength above this level might signal the start of a bullish trend, encouraging bulls to “buy the dip”.

2. Harmony (ONE)

Harmony ONE is a blockchain platform designed to facilitate the creation and use of decentralised applications (DApps). The network aims to innovate the way decentralised applications work by focusing on random state sharding, which allows creating blocks in seconds. Harmony was expected to introduce cross-shard contracts and a cross-chain infrastructure by the end of 2021.

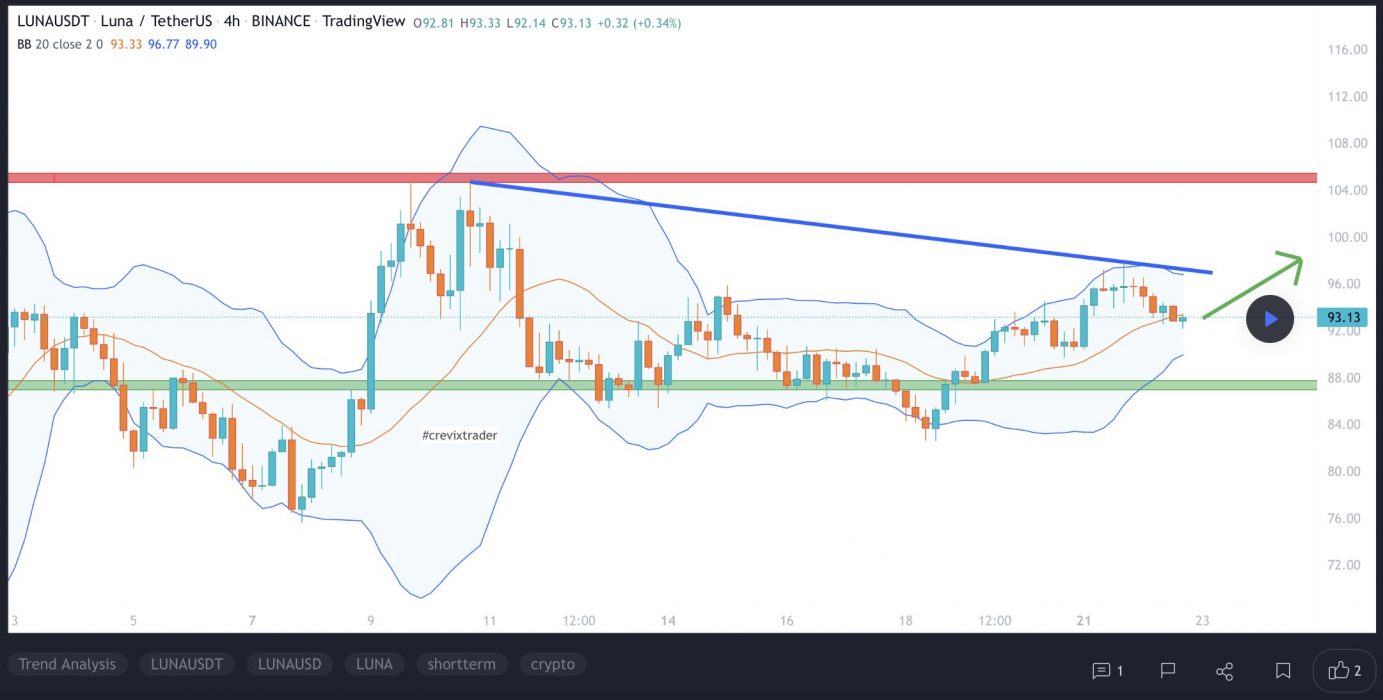

ONE Price Analysis

At the time of writing, ONE is ranked the 108th cryptocurrency globally and the current price is US$0.02152. Let’s take a look at the chart below for price analysis:

ONE bulls have had to endure a 85% drop since early Q2 until the price set a low and began a range in June.

Currently, the price is aggressively moving toward possible resistance, beginning near $0.02951. Stops above the swing high at $0.03325 might be the target before a downwards retracement. Multiple old lows mark this resistance, which is near the 78.6% retracement level of a recent significant bearish swing.

If the price continues through this high, it could be reaching for an inefficient area near $0.03742. Moving to this level would run bears’ stops above the swing high at the same level. A more substantial rally might reach an old swing high and inefficiently traded area between $0.03975 and $0.04038, which surrounds the yearly open.

If the price stays above the weekly low of $0.02095, this price could support a run above the $0.01935 swing high. Just below, at $0.01854, bulls might eye the consolidation high as more substantial support. This zone contains the 9 and 40 EMAs.

A deeper retracement might retest the accumulation area between $0.01725 and $0.01680. If this level breaks, bears may be targeting an inefficiently traded area on higher timeframes beginning near $0.01480. This area overlaps the 47% extension of a recent significant bearish swing.

3. Zcash (ZEC)

Zcash ZEC is a decentralised cryptocurrency focused on privacy and anonymity. It uses the zk-SNARK zero-knowledge proof technology that allows nodes on the network to verify transactions without revealing any sensitive information about those transactions. Zcash transactions, on the other hand, still have to be relayed via a public blockchain but, unlike pseudonymous cryptocurrencies, ZEC transactions by default do not reveal the sending and receiving addresses or the amount being sent.

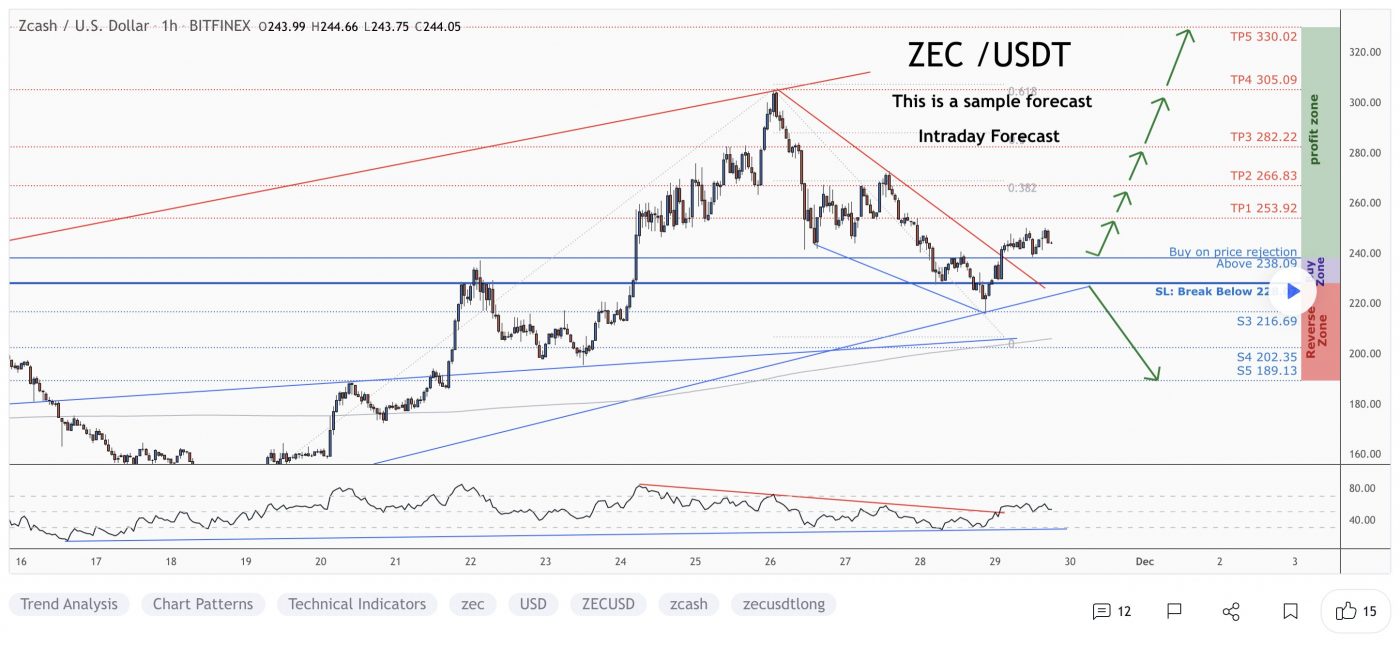

ZEC Price Analysis

At the time of writing, ZEC is ranked the 52nd cryptocurrency globally and the current price is US$60.44. Let’s take a look at the chart below for price analysis:

ZEC‘s recent bearish flip of the 9, 18 and 40 EMAs may cause bulls to be less aggressive in bidding. However, possible support near $52.47 and $44.96 – between the 41.8% and 58.6% retracements – could see at least a short-term bounce.

Last year’s long-term consolidation suggests that the areas near $83.23 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $75.50, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $88.12, the start of the bearish move.

If an aggressive bullish move does appear, trapped buyers in the probable resistance beginning near $97.32 may provide a ceiling for this impulse.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.