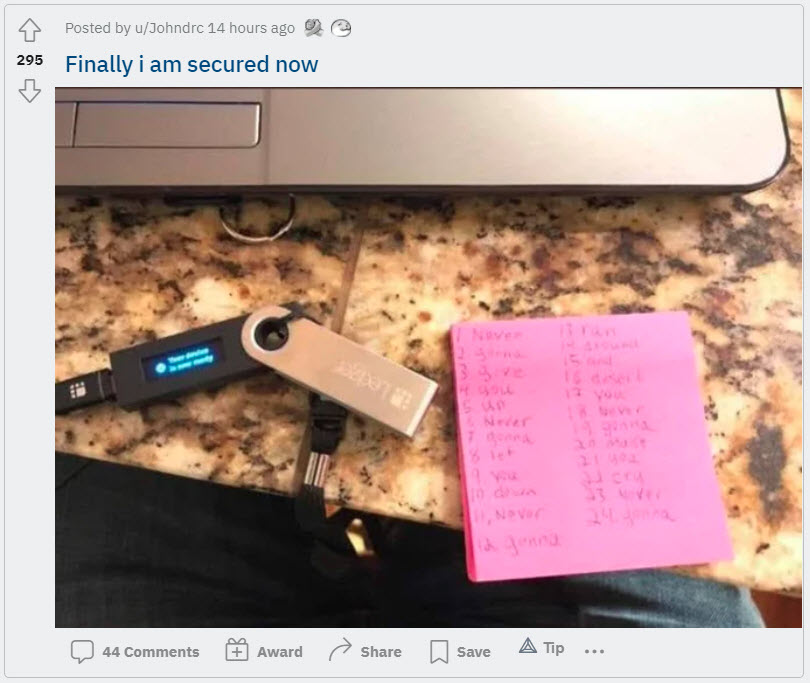

Let’s have a laugh at this week’s topical memes.

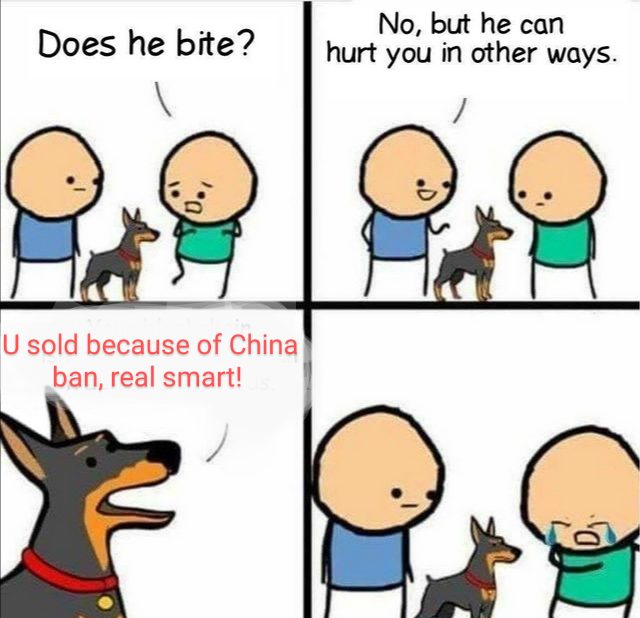

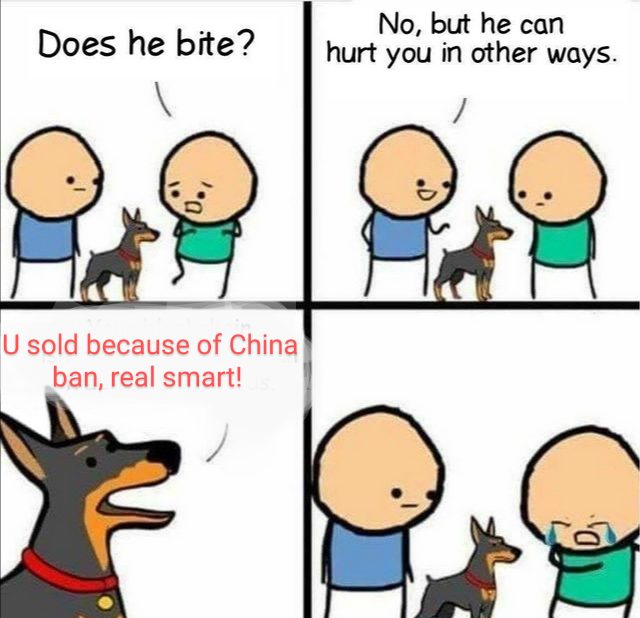

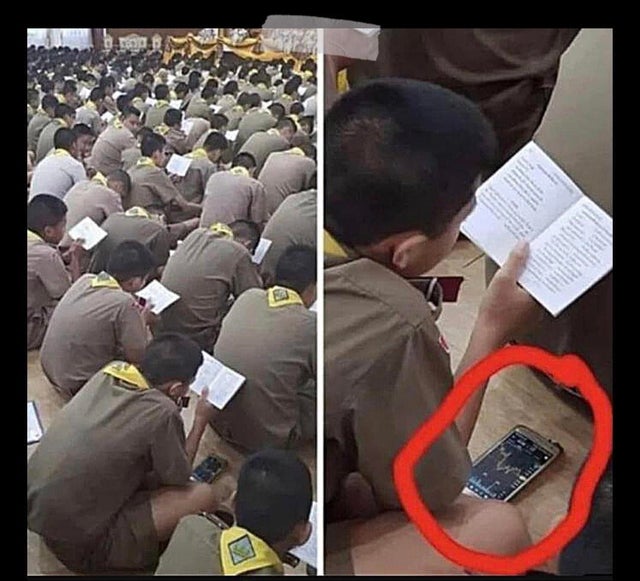

Some countries ban Bitcoin….

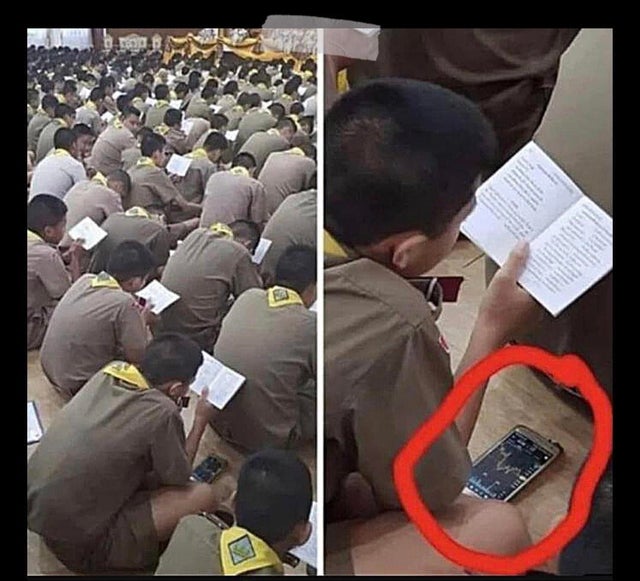

Some countries embrace Bitcoin….

HODL

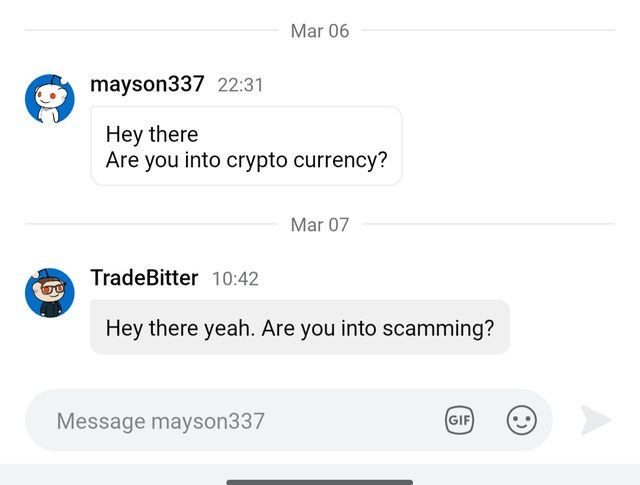

Random memes this week

DOGE meme of the week

Tune in next Friday for more meme mayhem!

Crypto News Australia provides you with the most relevant bitcoin, cryptocurrency & blockchain news.

Let’s have a laugh at this week’s topical memes.

Tune in next Friday for more meme mayhem!

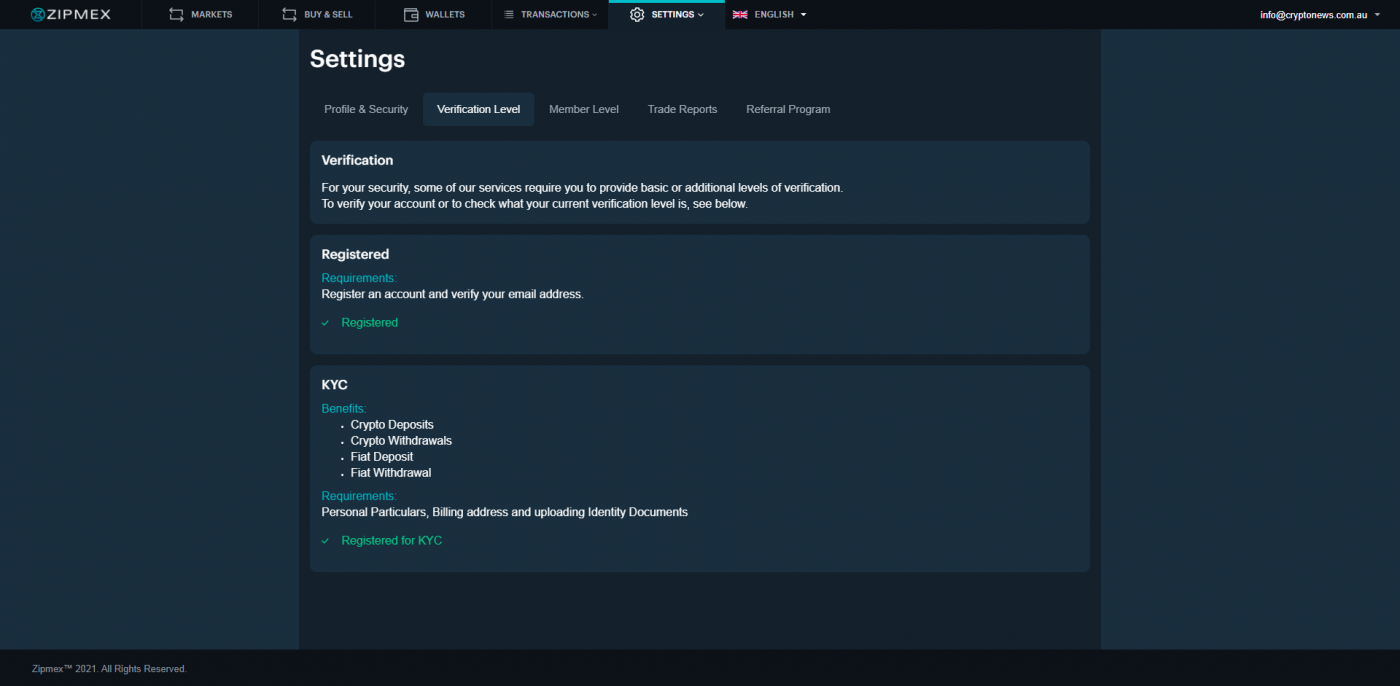

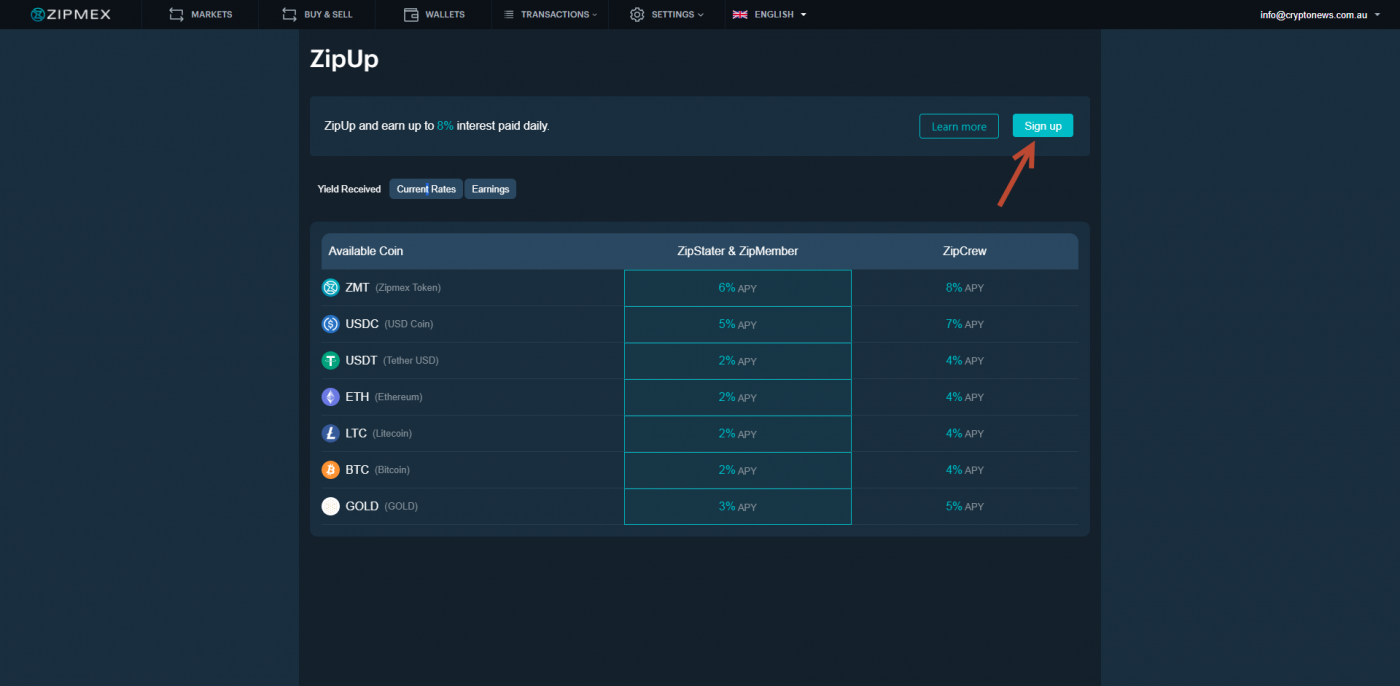

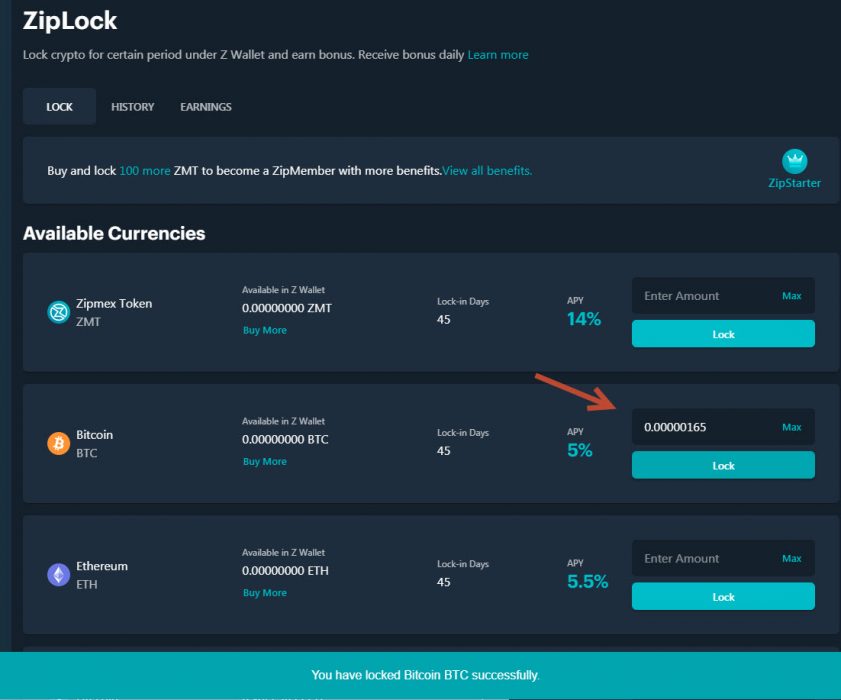

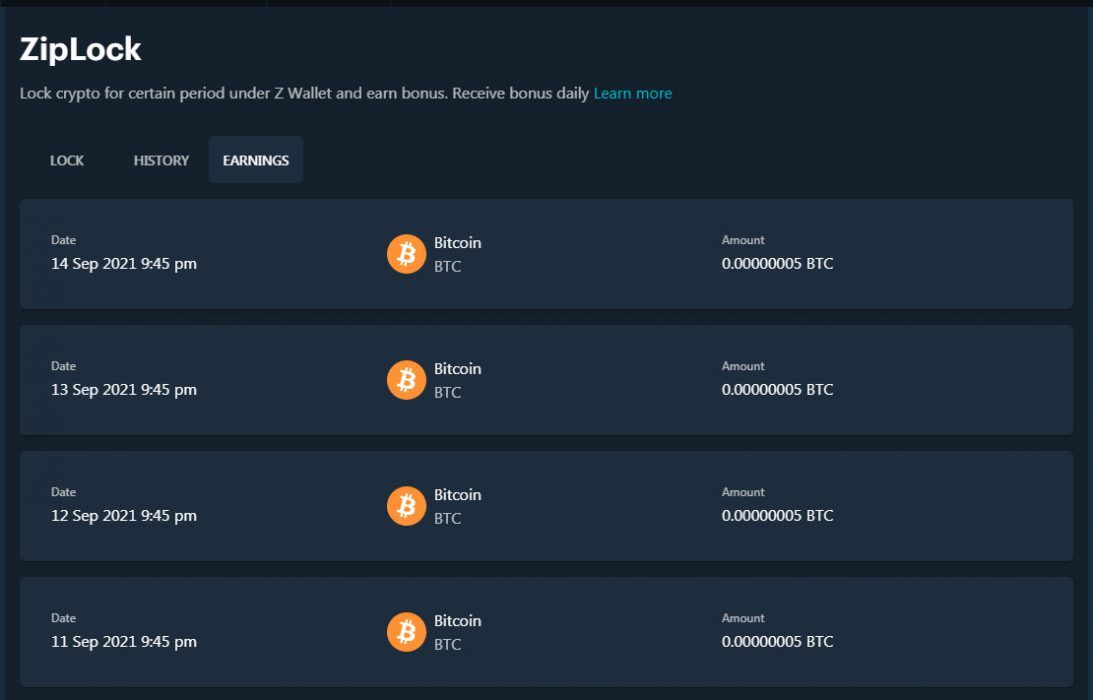

In this guide we’ll take a look at how you can earn interest on your cryptocurrencies using Zipmex Australia. You can earn daily passive income on your cryptos just by storing your coins with Zipmex.

Zipmex is an established and regulated digital asset exchange where you can buy, sell, and earn interest on digital assets 24/7 in Australia. Your digital wallet is insured for up to US$100 million through a BitGo insurance policy. Read our full review on Zipmex.

To stake your coins you’ll need a Zipmex Australia account, which is free to create and takes around 5-10 minutes to complete and get verified.

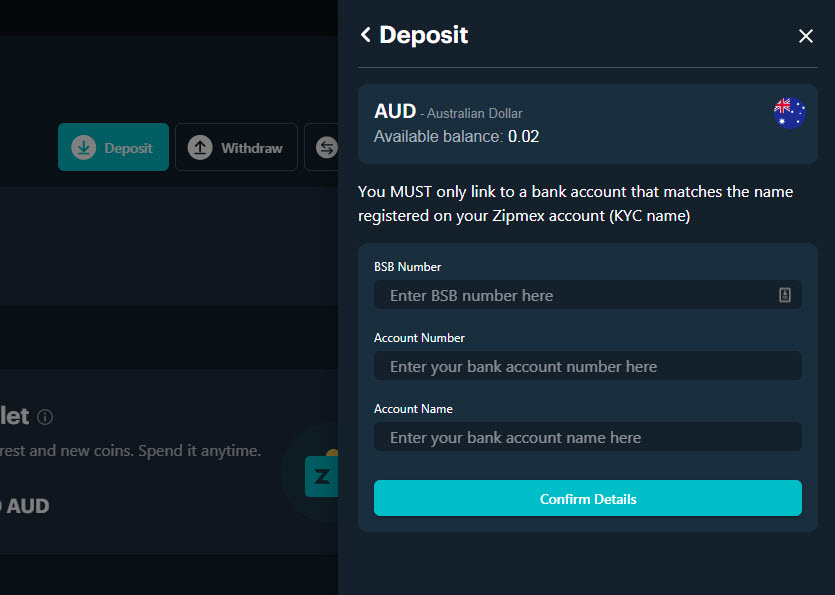

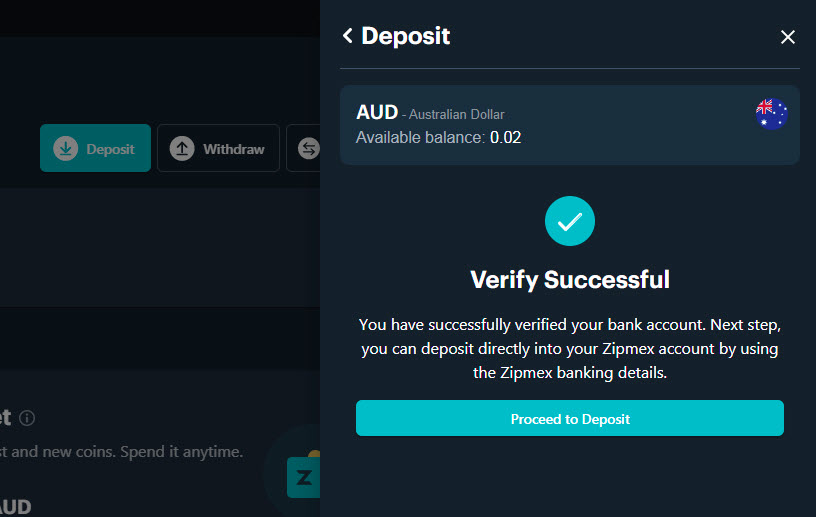

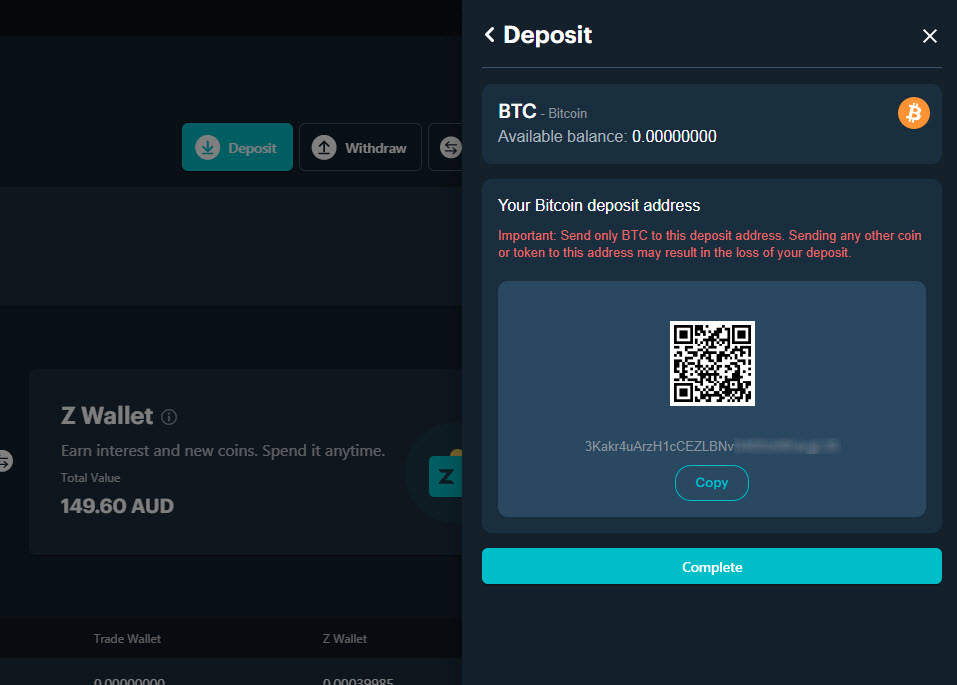

To stake your coins, you’ll need to either buy some or deposit some into your Zipmex account.

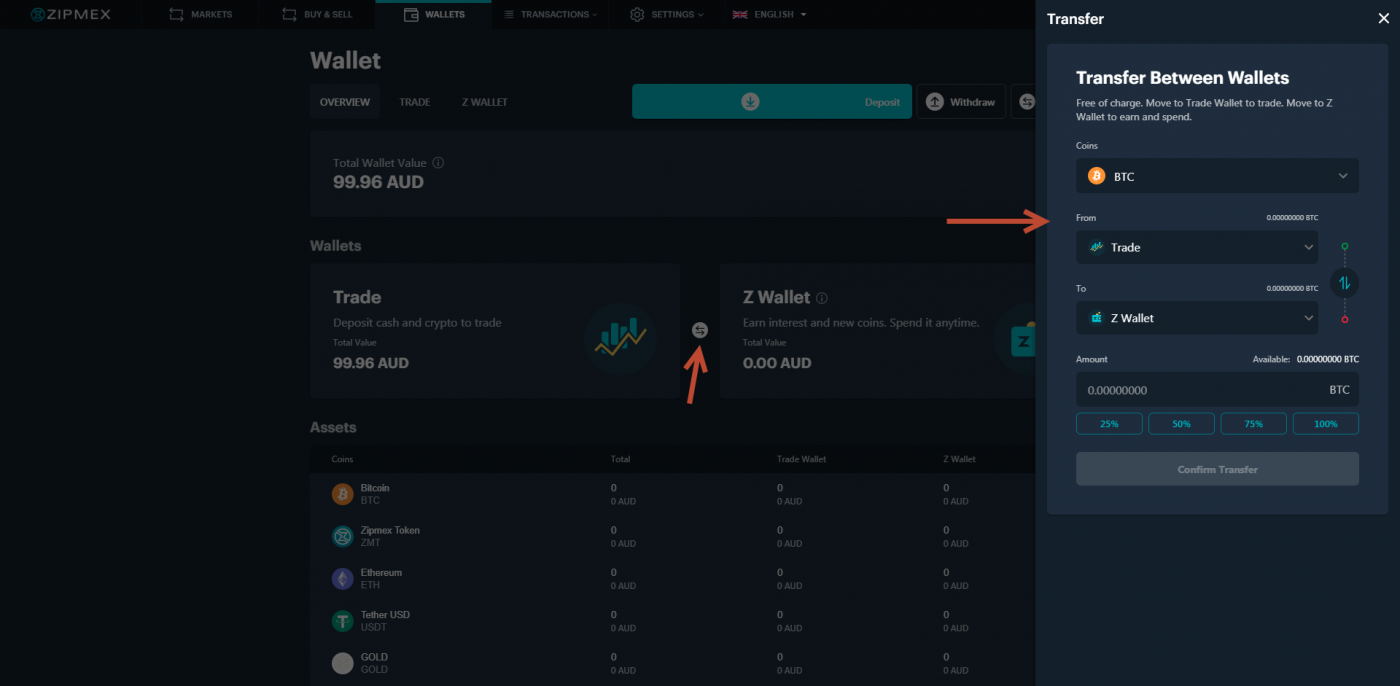

To stake your coins on Zipmex to start earning interest, you’ll first need to move your coins from the Trade Wallet to the Z Wallet free of charge between wallets to start staking.

Get started with Zipmex now and earn interest on your cryptos.

Melbourne, September 30, 2021: Australia’s longest-running cryptocurrency exchange CoinJar has become one of the first in the world to be officially registered by the UK’s Financial Conduct Authority (FCA) as a Cryptoasset Exchange Provider and Custodian Wallet Provider, as per the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLRs).

CoinJar, which is based in Melbourne, is now advocating for a similar licence to be implemented in Australia to help build corporate and consumer confidence and monitor cryptocurrency businesses at large.

The UK is a world leader in fintech and a progressive regulator, so we are very pleased to have received this recognition as part of our commitment to offering people a safe and positive experience of buying and selling digital currencies. With the establishment of the UK-Australia Fintech bridge, we hope that a similar scheme is replicated here via ASIC and AUSTRAC, with learnings from the two-year process taken into account.

Asher Tan, CEO, CoinJar

Tan continues: “As the industry grows and innovates at a rapid pace, it’s vital that legitimate businesses are nurtured further while cowboy operators are swiftly removed to prevent reputational damage to the industry caused by consumer scams and fraudulent behaviour. Cryptocurrency is not the Wild West, it’s here for good. Regulation brings long-term certainty and a wealth of investment and job opportunities to the market.”

With CoinJar embracing innovation and regulation in equal measure, it has been collaborating with the government on future legislation through industry-led submissions. CoinJar is a member of Blockchain Australia, which champions the adoption of blockchain technology by industry and governments across the country, as well as Fintech Australia, the country’s peak advocacy body for fintech.

Tan continues: “While we are willing, ready and organised for cryptocurrency regulation in Australia, until it is brought into effect we aim to set the benchmark for best-practice in self-regulation by adhering to the spirit of the FCA obligations on home soil.”

The FCA approval means that CoinJar will be an attractive partner for more companies and neobanks. Following the recent launch of the CoinJar Card Mastercard, which allows users to spend the crypto in their wallet like cash, online and in-store, a number of ASX 500 partnerships are currently being finalised. A range of new products is also set to be unveiled this year, including a white label service for businesses that will provide state-of-the-art backend digital currency processing.

Last week, CoinJar made its AFL Grand Final debut through its partnership with the Melbourne Demons, whilst in London, it has signed a sponsorship agreement with Brentford Football Club, who have made a winning start in their debut English Premier League season.

To find out more, visit coinjar.com/au.

Following the successful launches of Crypto.com Tax in Australia, Canada and the US earlier in August, Crypto.com has announced that this service is now also available in the UK, with more markets to come.

Crypto.com Tax makes it easy to file complicated crypto taxes in a matter of minutes and at no cost. This service is tailored to meet UK tax requirements and supports more than 20 of the largest wallets and exchanges, including the Crypto.com App and Exchange.

We’re excited to expand our free-to-use crypto tax reporting service to Australia. We have long been committed to offering the most compliant and easy-to-use crypto platform in the world. As part of that commitment, we are proud to offer all Australian crypto investors an easy solution to filing their taxes. More markets will be added soon.

Kris Marszalek, co-founder and CEO, Crypto.com

Crypto.com Tax enables users to quickly generate accurate and organised tax reports, including transaction history and records of capital gains and losses, as well as other crypto-related taxable and non-taxable transactions.

Crypto.com has worked with professional tax advisers to make sure that the calculation logic is consistent with available guidance and laws for filing crypto taxes in the UK.

Helpful Facts About UK Tax Rules

2020/21 Tax Year: April 2020 – April 2021

Paper Returns Deadline: October 31, 2021

Online Tax Returns Deadline: January 31, 2022

UK Tax Logic: Share Pooling

Founded in 2016, Crypto.com today serves over 10 million customers with the world’s fastest growing crypto app, along with the Crypto.com Visa Card – the world’s largest crypto card program – the Crypto.com Exchange and Crypto.com DeFi Wallet. Recently launched, Crypto.com NFT is the premier platform for collecting and trading NFTs, carefully curated from the worlds of art, design, entertainment and sports.

Crypto.com is built on a solid foundation of security, privacy and compliance and is the first cryptocurrency company in the world to have ISO/IEC 27701:2019, CCSS Level 3, ISO27001:2013 and PCI:DSS 3.2.1, Level 1 compliance, and independently assessed at Tier 4, the highest level for both NIST Cybersecurity and Privacy Frameworks.

With over 2,600 people in offices across the Americas, Europe and Asia, Crypto.com is accelerating the world’s transition to cryptocurrency. Find out more at: https://crypto.com

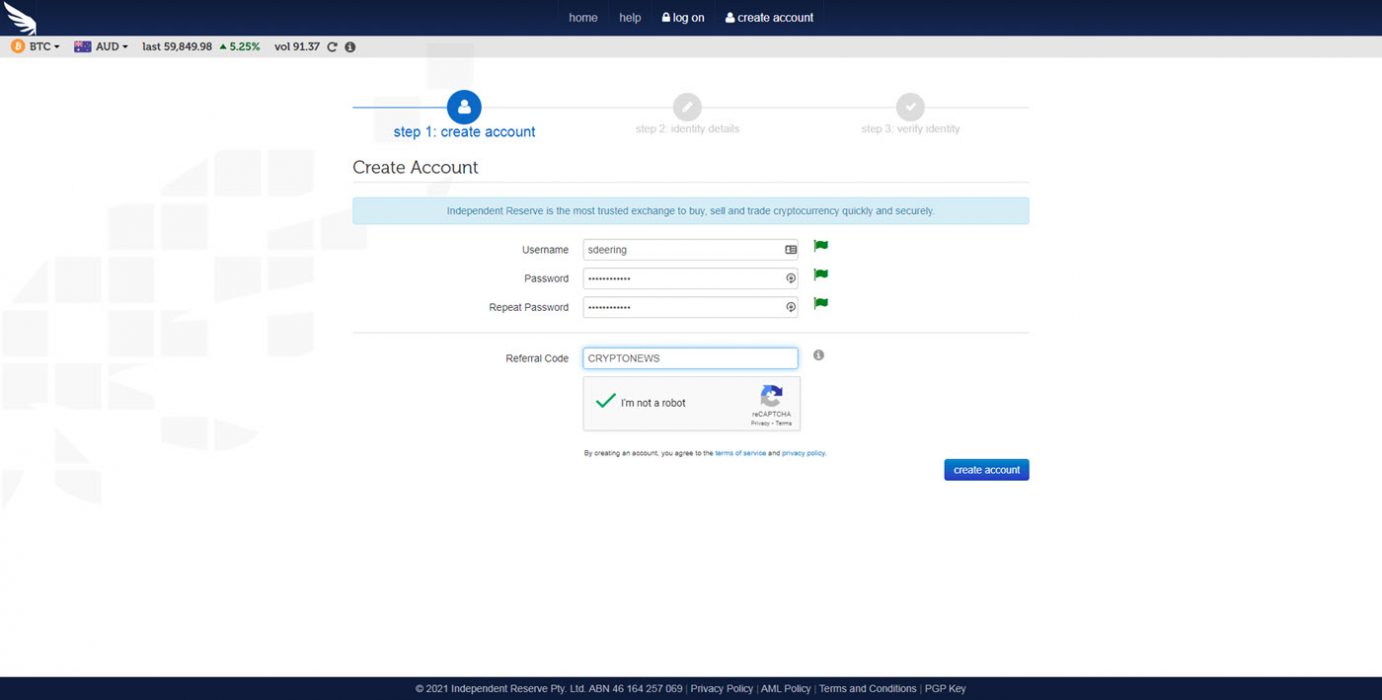

Starting your personal or corporate crypto journey with Independent Reserve is incredibly easy and fast. Follow the steps below to create your account and buy your crypto within minutes.

Click here to sign up and follow the steps below:

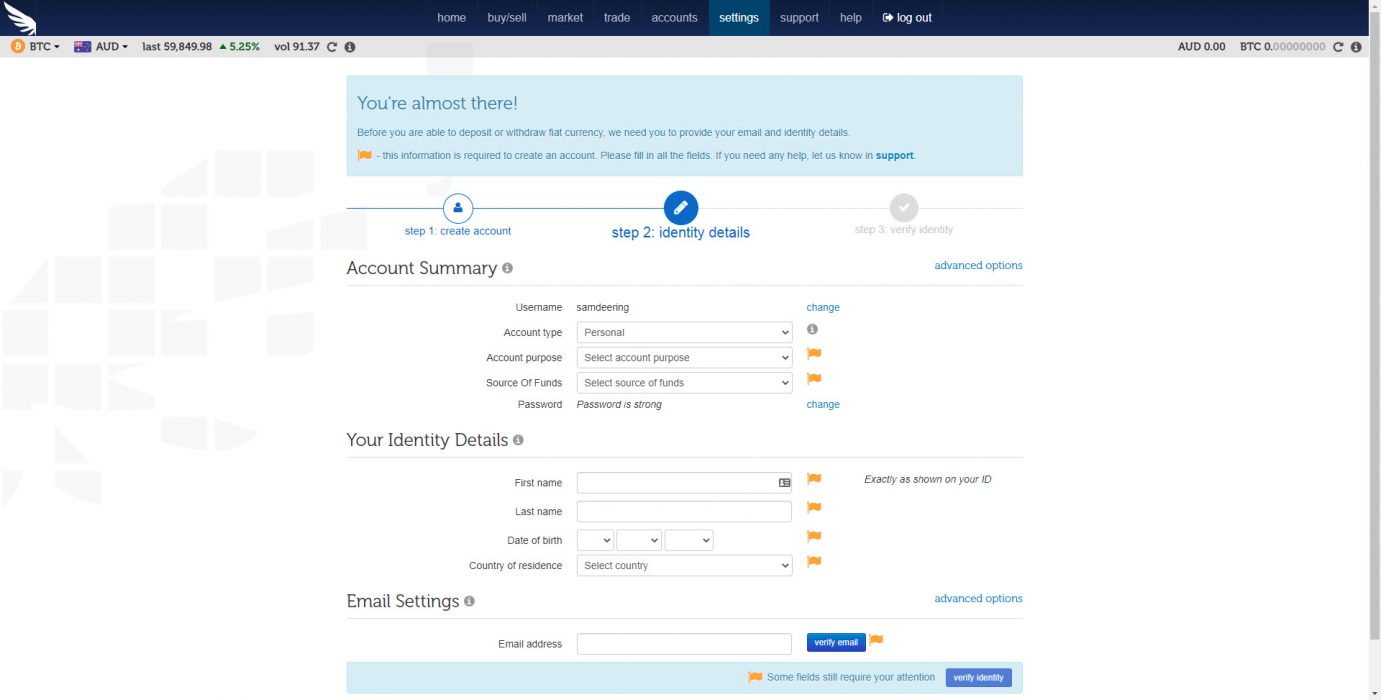

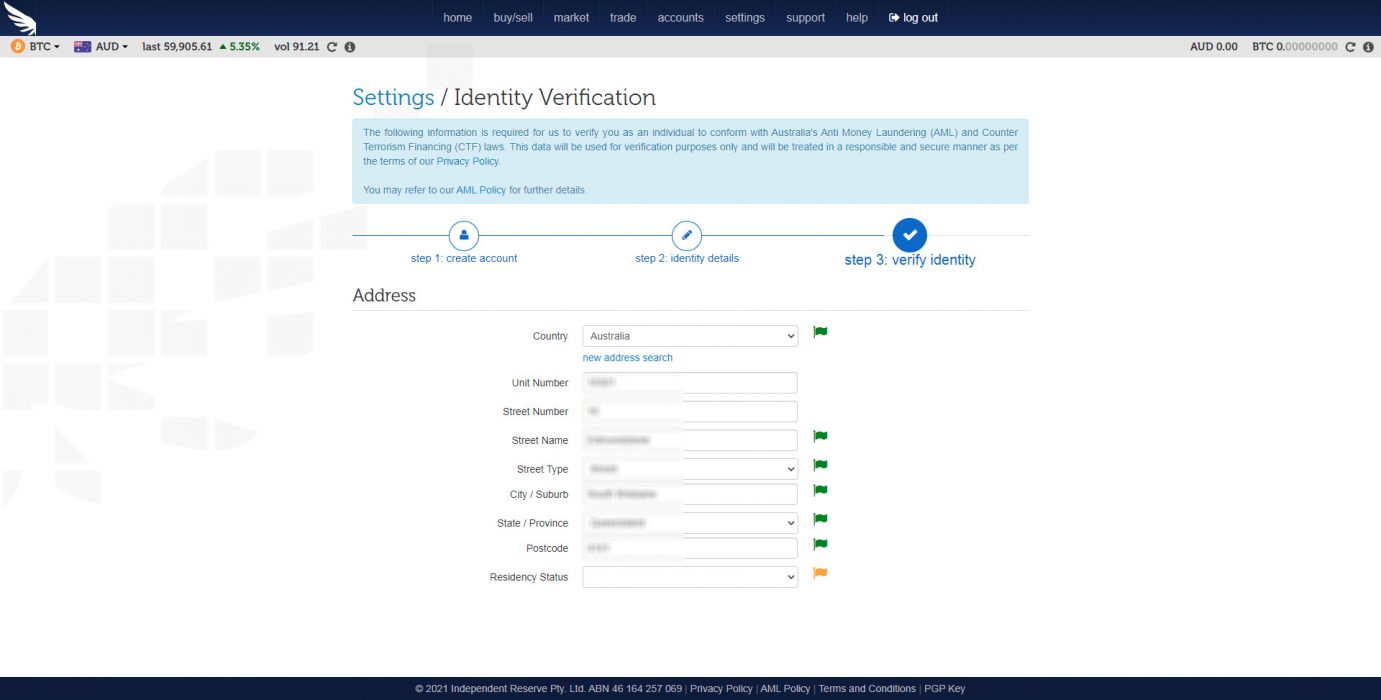

Complete the form with name, email and Australia residential address. Click confirm email, go to your email and copy/paste the code into the box.

Optionally confirm your phone number by SMS and setup your 2-AUTH login.

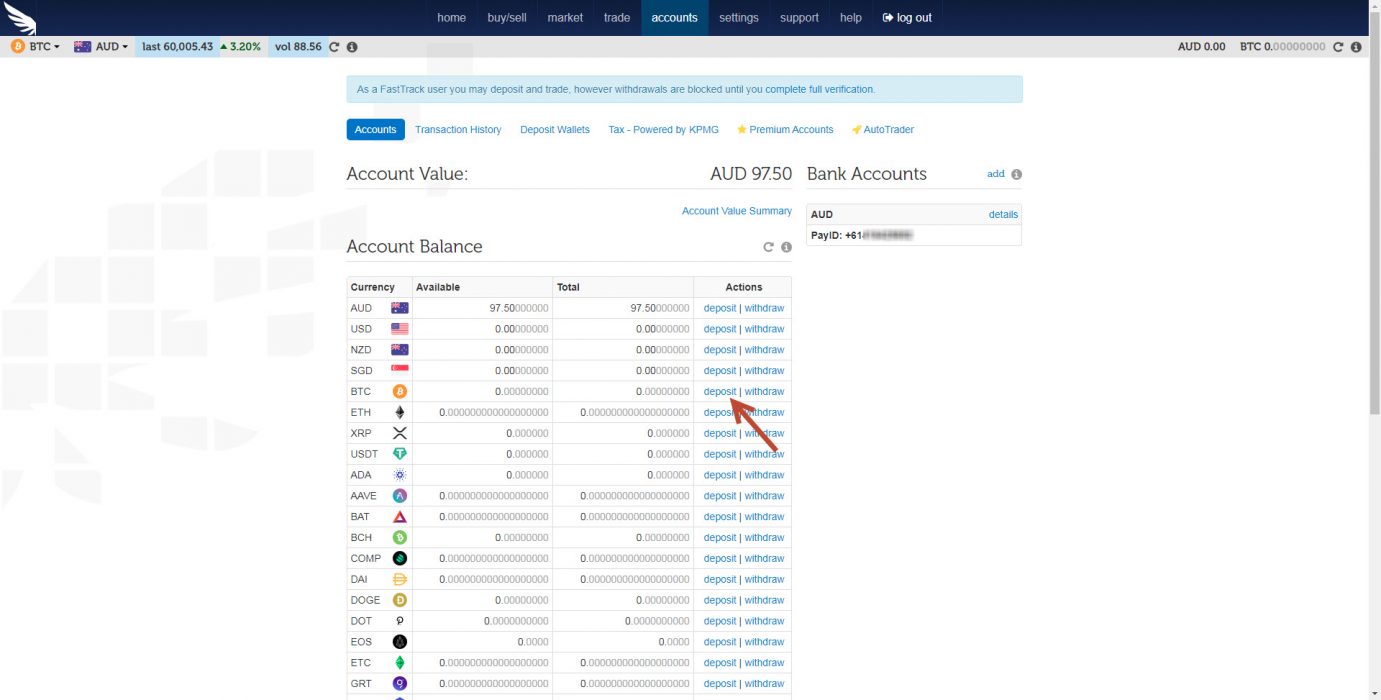

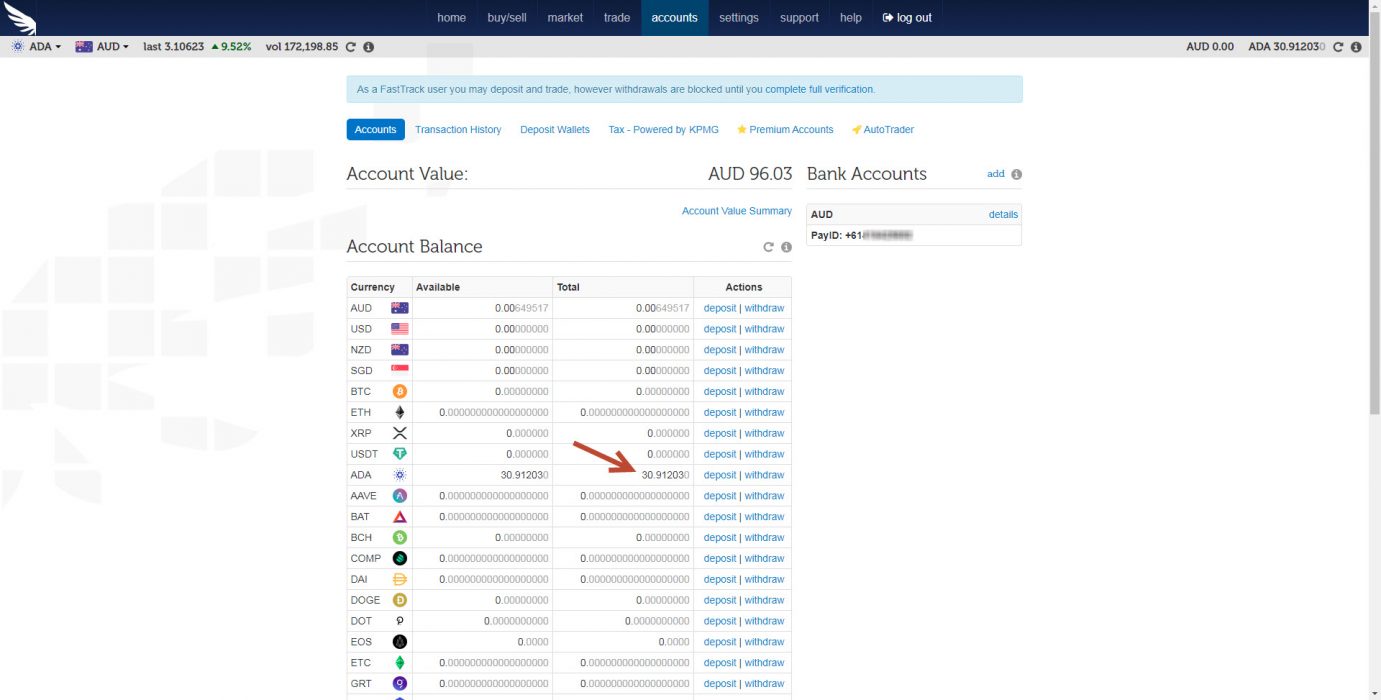

Click FastTrack – this is instant verification. If this works you’ll be able to deposit and trade straightaway; however, you’ll need to complete full verification to do withdrawals.

If this fails you will need to manually upload ID documents and wait for approval before you can start using your account.

That’s it. Now you’re ready to deposit and start trading!

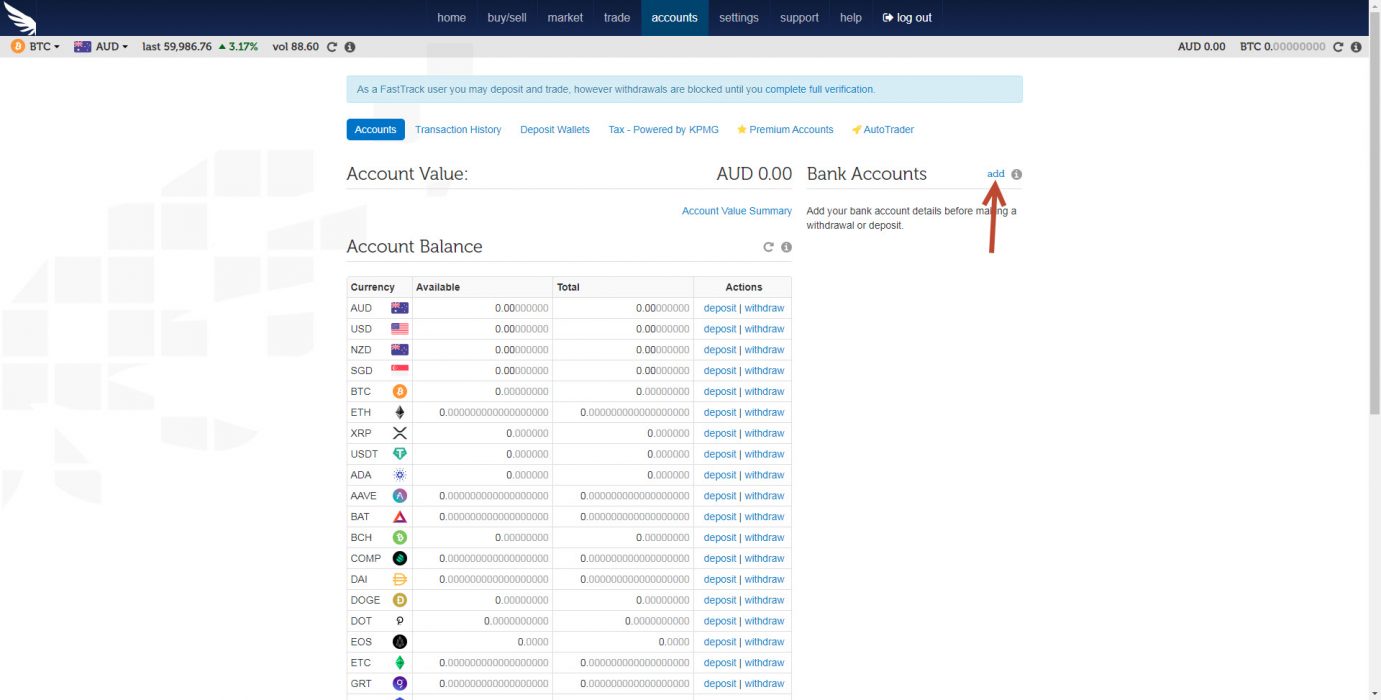

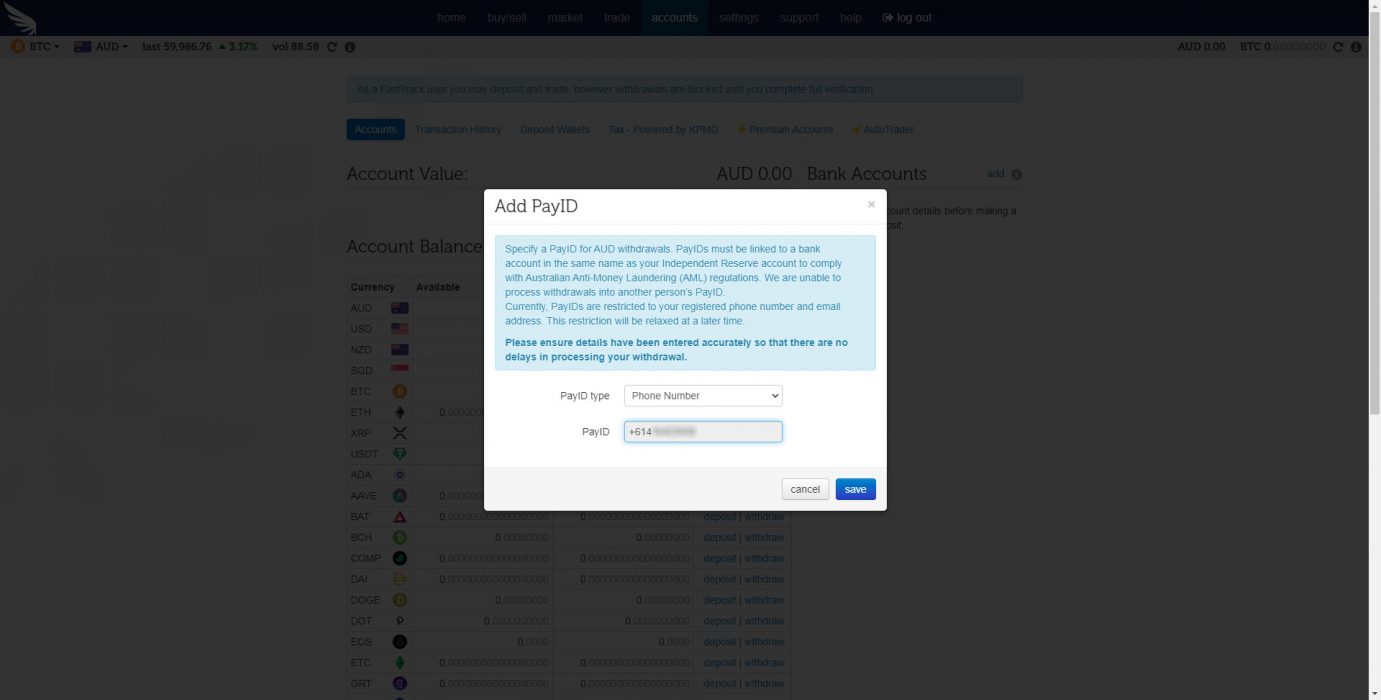

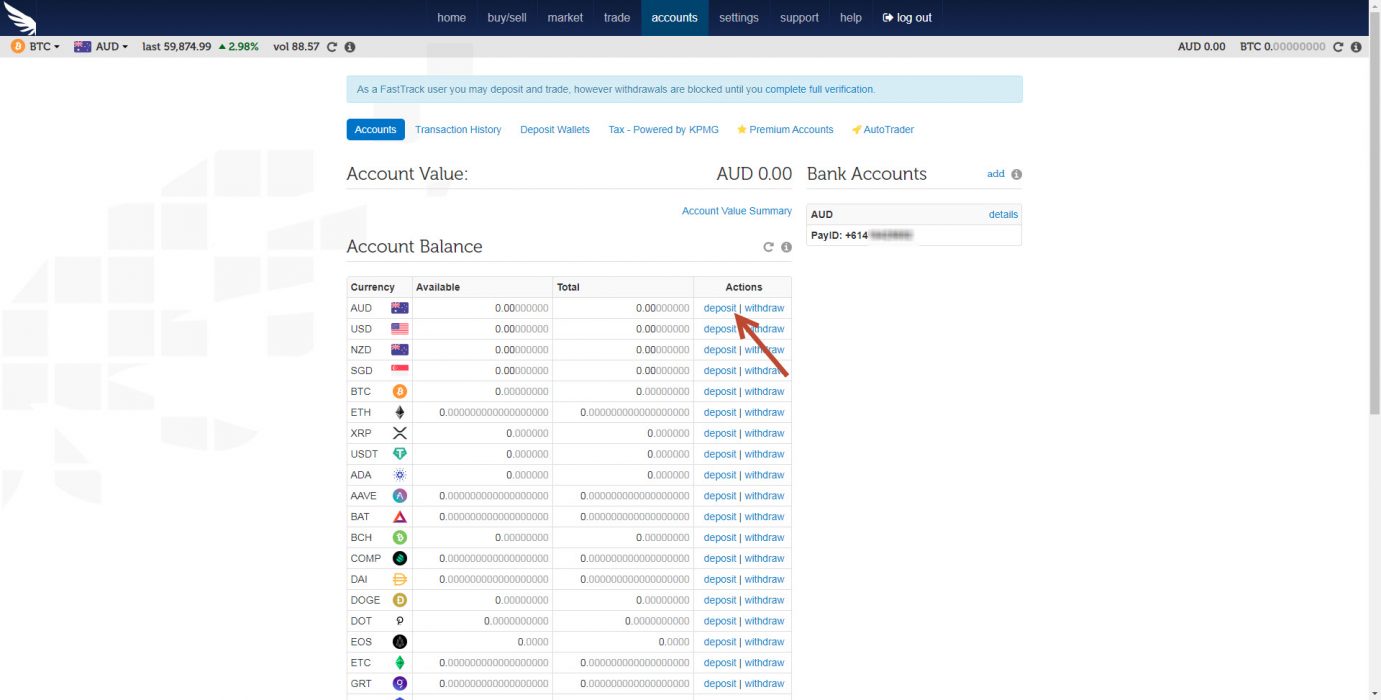

To deposit AUD, you’ll need to add your bank account.

Choose between:

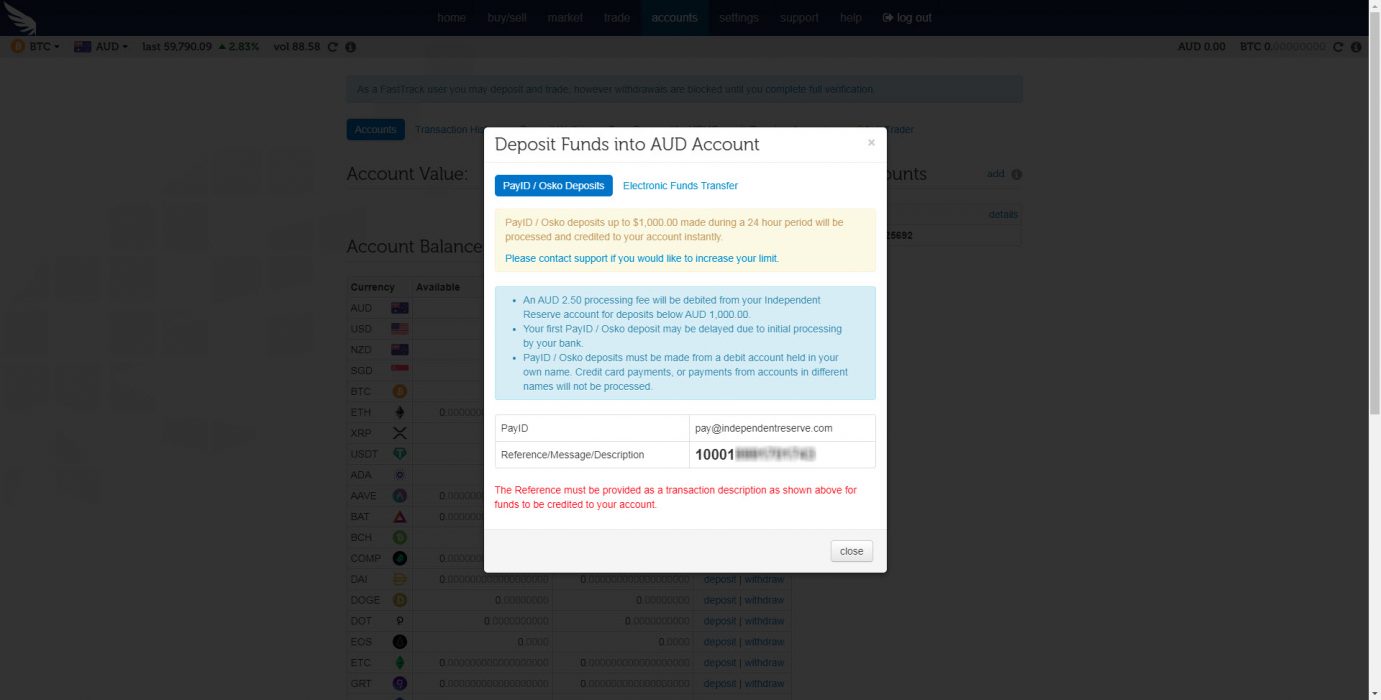

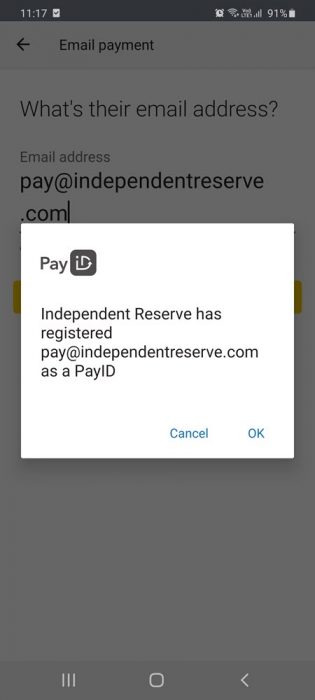

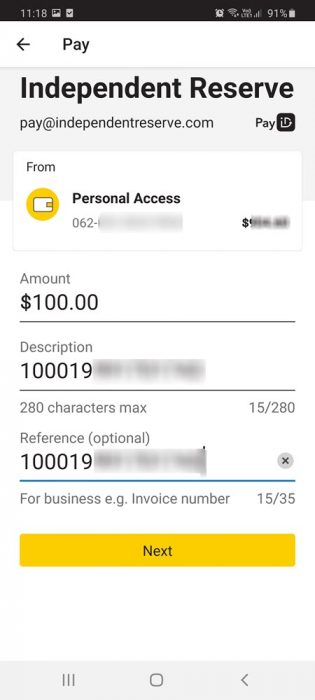

We’ll go with PayID as the deposit processes instantly, whereas a bank transfer usually takes some time. To deposit using PayID, simply add your phone number and click Confirm. Click Deposit on the AUD row in the table, and use your mobile phone banking app to send the amount to the PayID email and reference number. Note there is a $2.50 fee for deposits less than A$1,000.

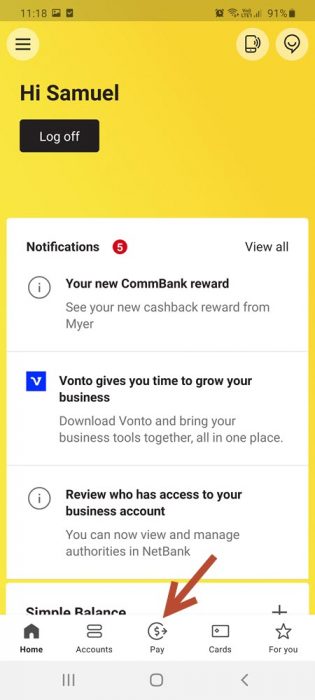

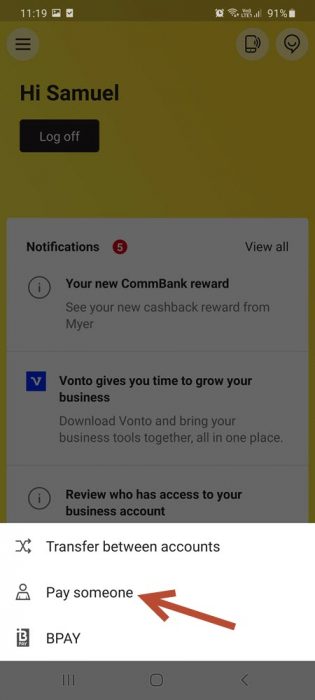

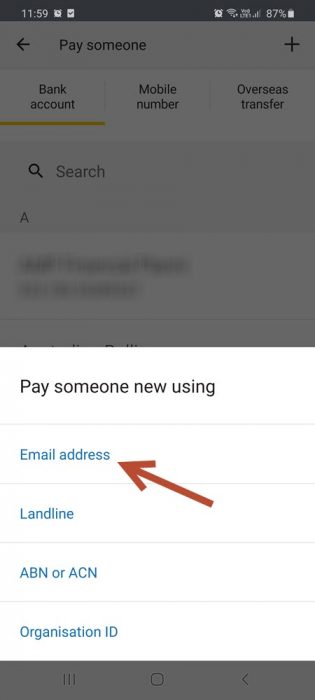

In this example, we’ll use the CBA mobile banking app to deposit into our Independent Reserve account. To do this, open your banking app, select Pay someone, enter their email address, enter the amount you want to deposit and the reference code. The AUD should show in your IR account instantly.

To deposit in crypto, simply click Deposit on the crypto you want. We’ll use BTC in this example. Then send the crypto to the address shown (or via QR code scan).

That’s it! Now you’re ready to start trading.

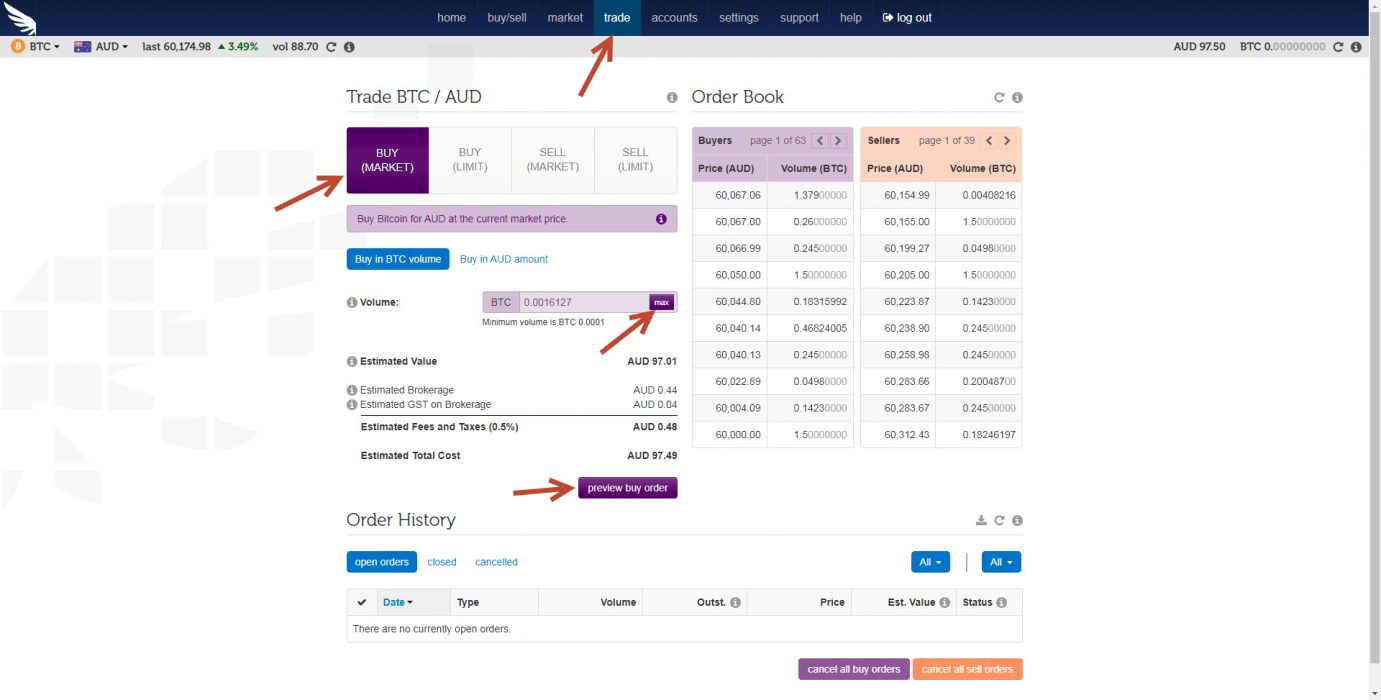

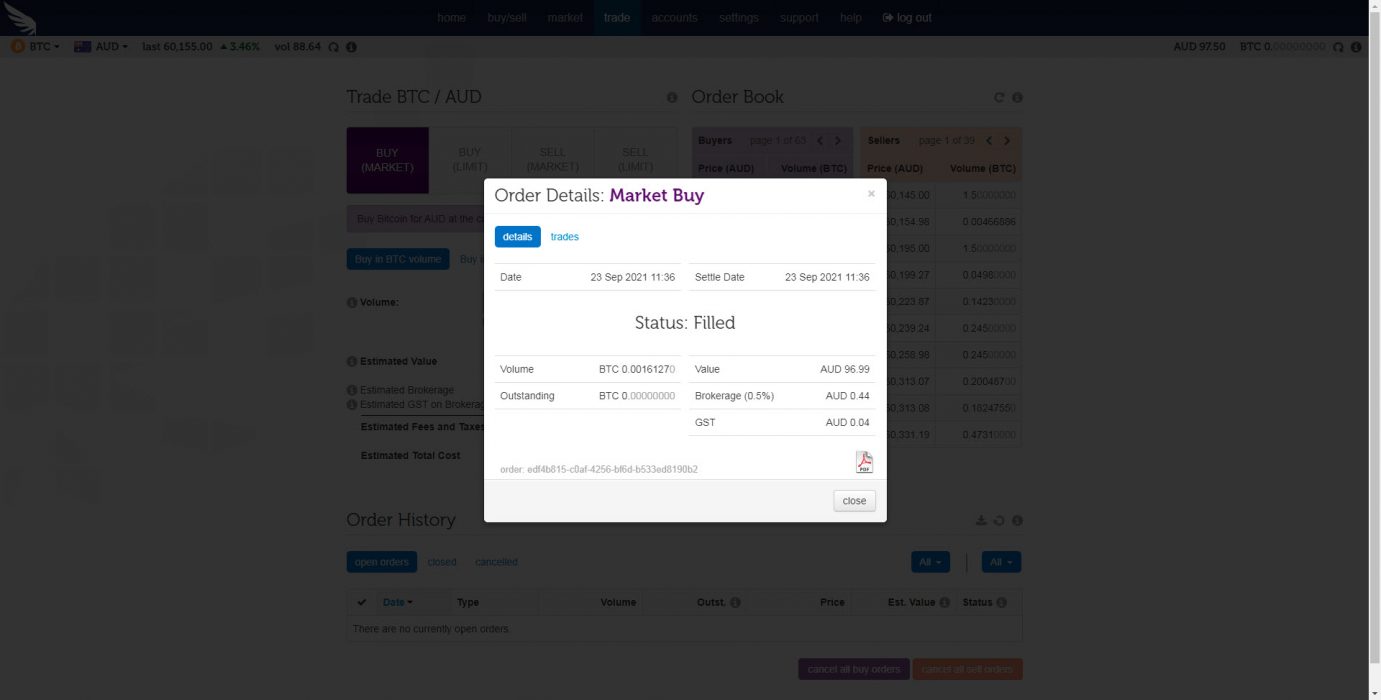

Buying bitcoin (BTC) with your deposited AUD is straightforward. Just click Trade on the main menu. Enter the amount of BTC you want (or AUD equivalent) and click Preview buy order. Then confirm the trade and the BTC balance should appear under Accounts.

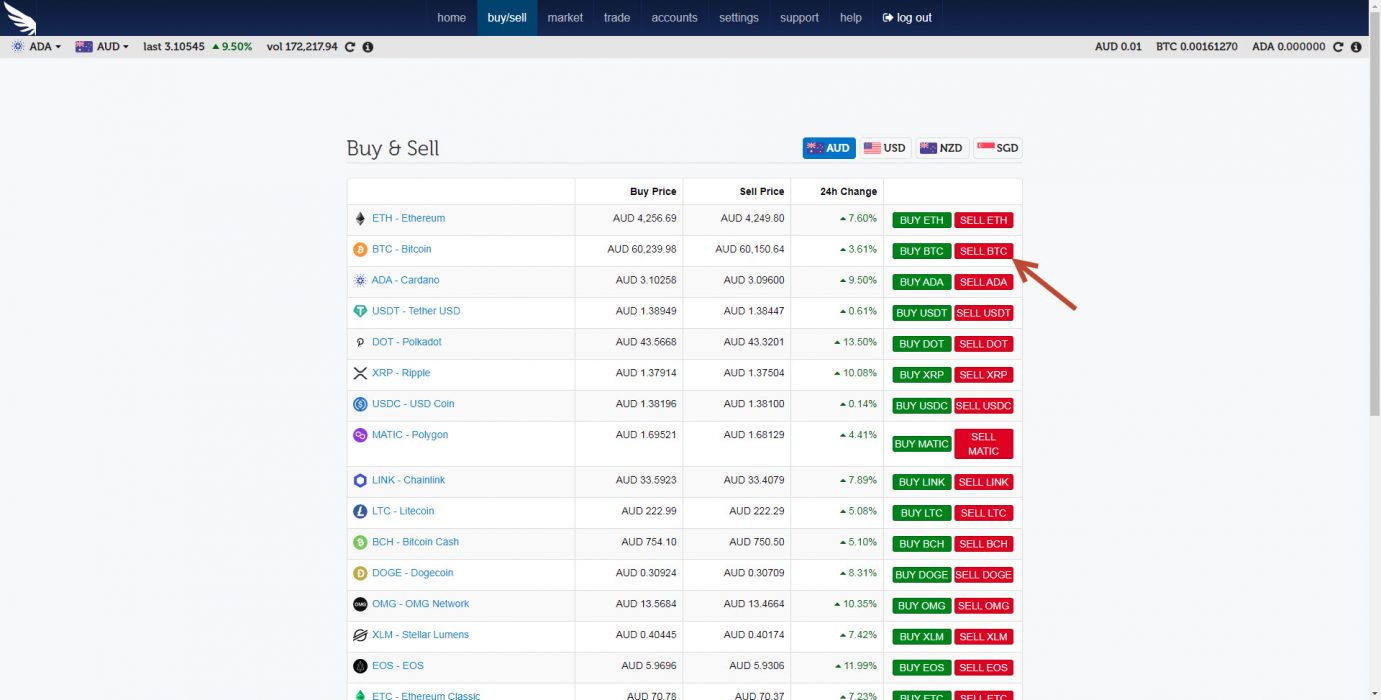

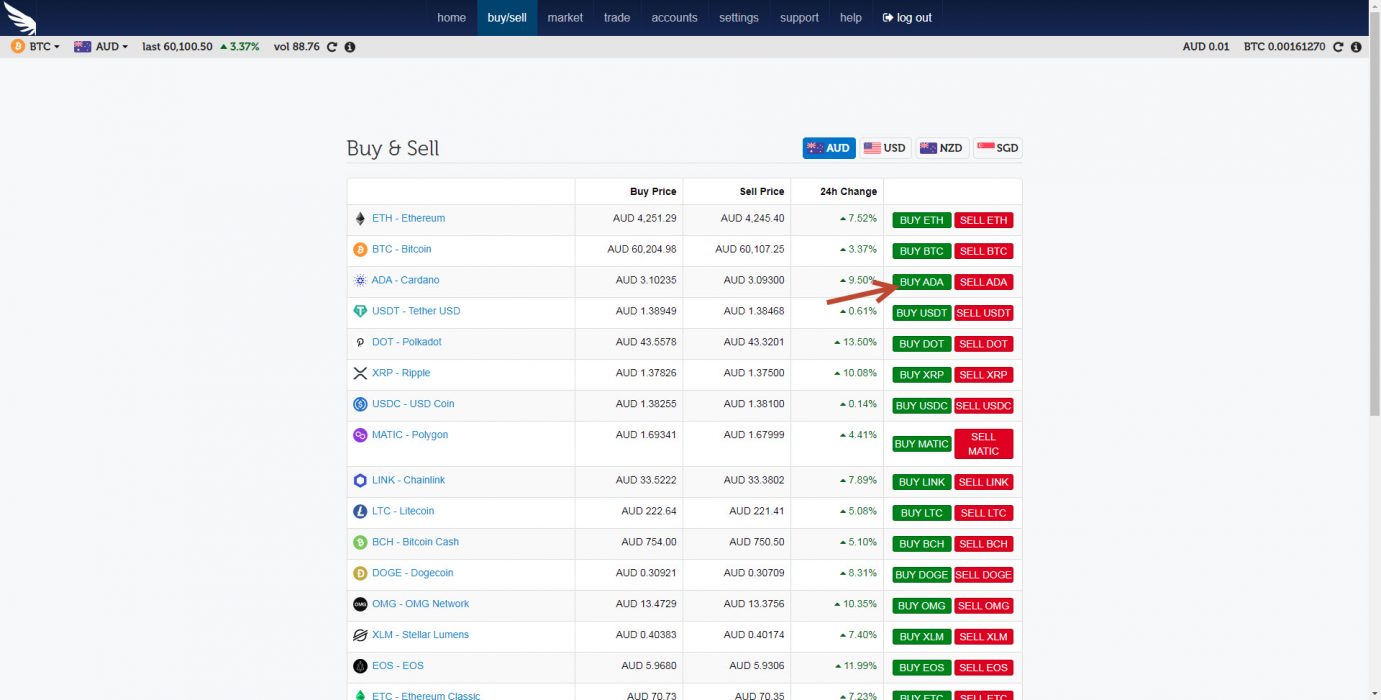

On Independent Reserve you can’t trade directly between different cryptocurrencies. To do this you have to sell back into AUD and then buy the crypto.

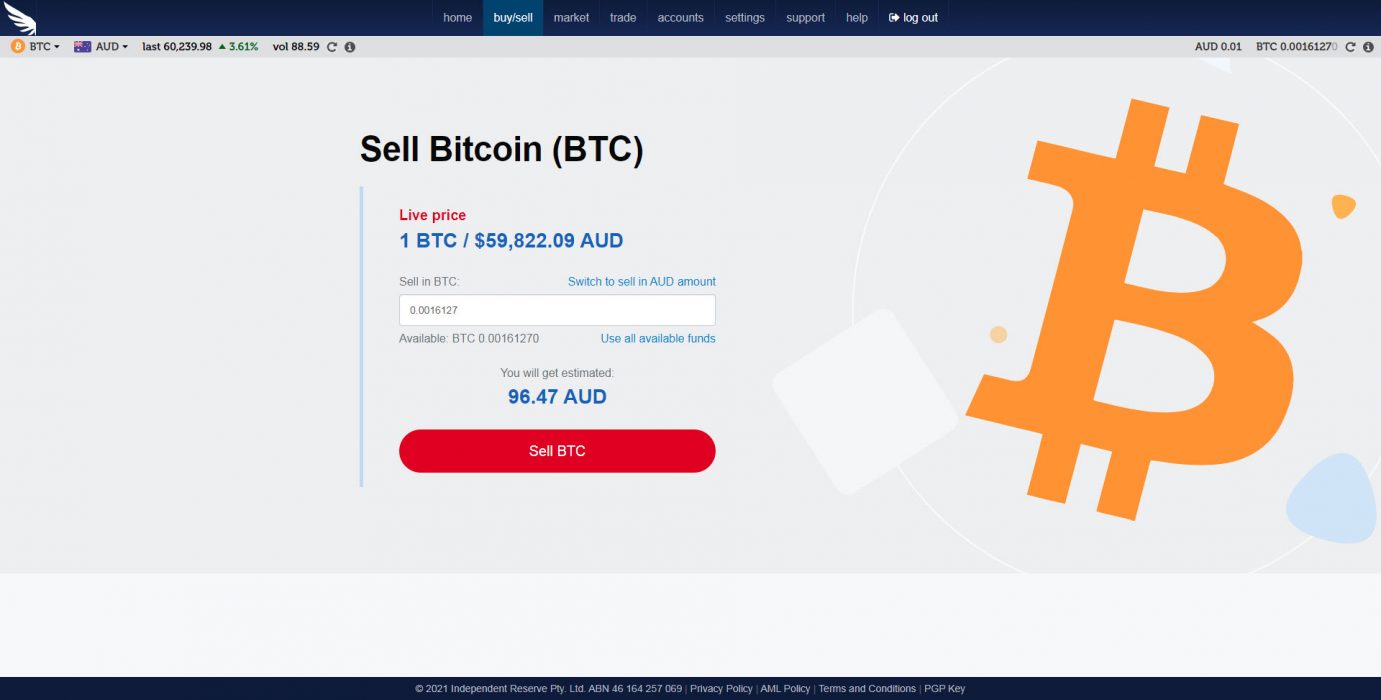

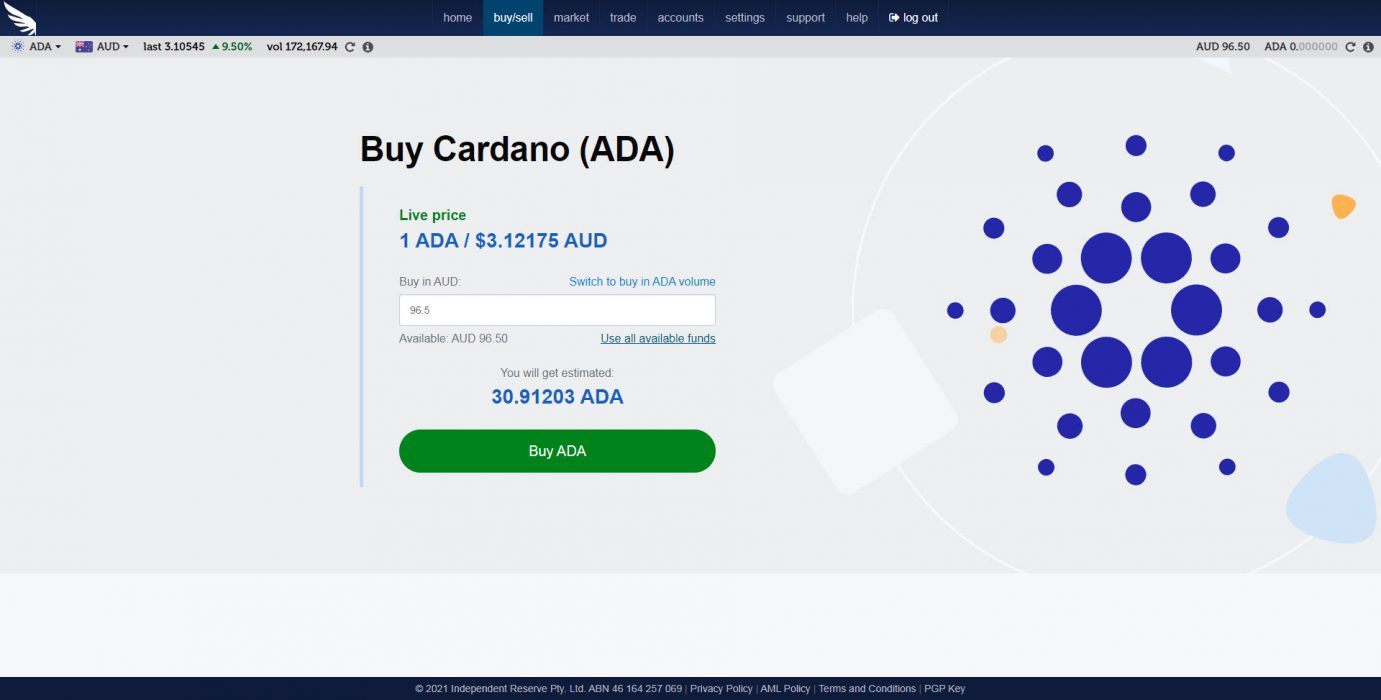

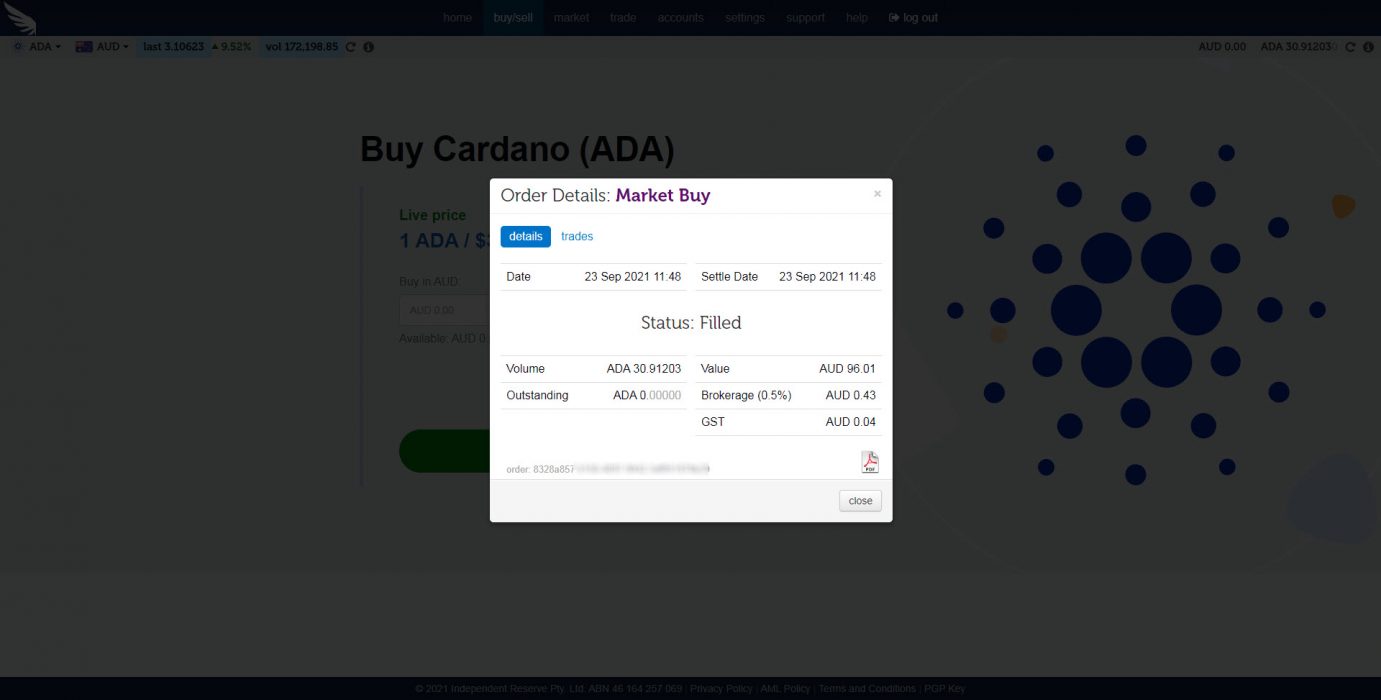

In this example, we’ll sell our BTC back into AUD and then buy Cardano (ADA). To do this, click Buy/Sell on the main menu. Next sell the BTC for AUD, then click Buy ADA and confirm the buy. The ADA balance should now show on your accounts page.

Happy trading!

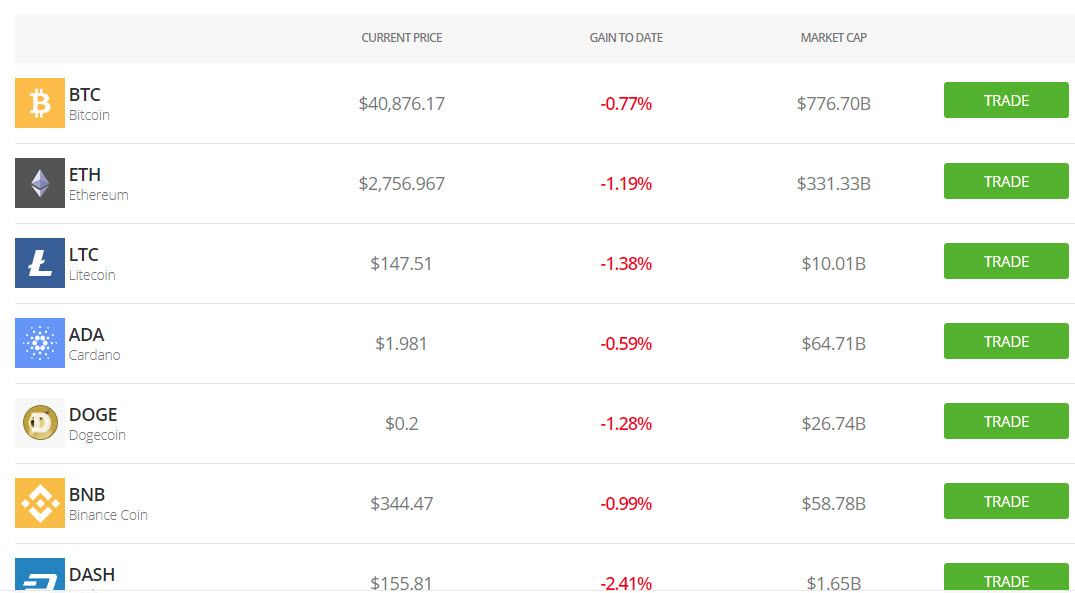

Following a surge in crypto income for Q2, popular social trading platform eToro has launched an additional 29 cryptocurrencies on its Australian trading platform.

Cryptos now available to trade on eToro include: BTC, ETH, BCH, XRP, DASH, LTC, ETC, ADA, MIOTA, XML, EOS, NEO, TRX, ZEC, BNB, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR and SHIB.

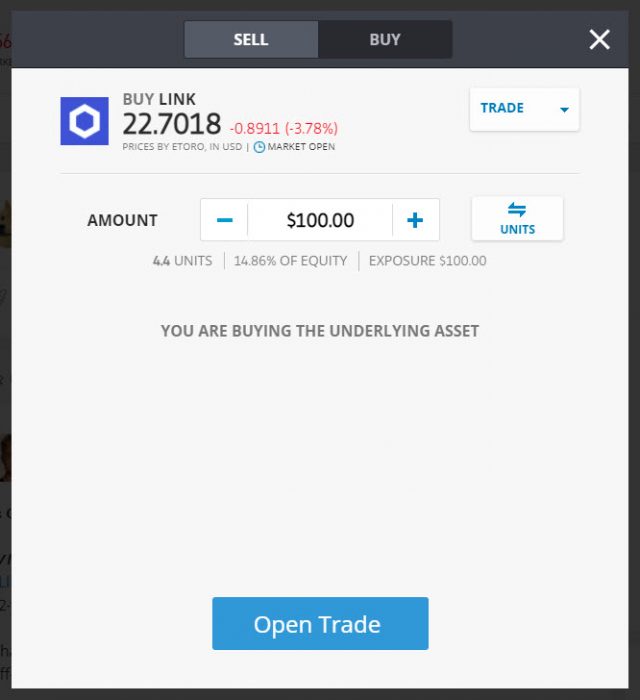

Users can now purchase the underlying crypto assets when buying on eToro, rather than trading a derivative (CFD). This is particularly important as regulators are putting pressure on leveraged products on crypto exchanges worldwide.

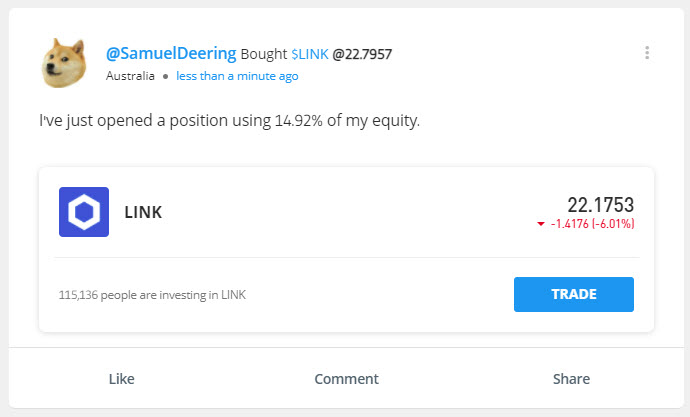

One of the unique features of eToro is the ability to openly share your trades and follow other traders and engage with them socially.

It’s also worth noting that cryptos bought will be held in a segregated custody account and currently you will be unable to transfer your cryptos out of your eToro account. We’ll keep you updated on any developments.

As of September 24, Binance users will no longer be able to use Futures, Options and Leveraged Tokens on the Binance.com platform as per the recent announcement.

To clarify the situation for Australian users, Binance Australia has reported to Crypto News: “We are aware of the recent announcement from Binance.com regarding its service changes for Australian users. The announcement has no direct impact on the services provided on Binance Australia. Our relationship with our users has not changed. Binance Australia is a digital currency exchange platform that enables Australian customers to easily buy and trade cryptocurrencies with the Australian Dollar (AUD). Binance Australia only offers spot conversion of fiat to digital currency and vice versa.”

Last month the company announced plans to restrict its derivative product offerings in Australia to comply with domestic regulations.

“Effective from 2021-09-24 09:00 AM (UTC), existing Australian users will have 90 days to reduce and close their positions for these products. Users will be able to top-up margin balances to prevent margin calls and liquidations, but they will not be able to increase or open new positions”.

Also recently, Binance introduced a mandatory KYC for all Binance users with a deadline of October 19 for any existing users to verify their accounts to continue using its services.

The new appointment of Leigh Travers (DigitalX) as Binance Australia CEO should help Binance establish a stronger framework around regulation in Australia as he has experience in the sector serving on the Board of Australia’s blockchain industry body.

Zipmex has revealed details of the Series B round backed by global investors TNB Aura, B Capital and V Ventures.

Zipmex, a leading digital asset platform in the Asia-Pacific, confirmed its complete list of investors today, following its recent $41M Series B funding announcement, which was oversubscribed.

We are thrilled to announce the final set of our lead investors who are supporting our dream to allow the next billion in Asia to imagine more with digital assets. It is not every day that the crypto industry sees such a strong, diverse group of backers ranging from world-renowned VCs to traditional financial institutions coming together like this. It brings us closer to a future with opportunity, access, and financial freedom for all.

Marcus Lim, founder and CEO, Zipmex

In addition to Australian founder Lim, Zipmex’s executive team includes Australian University of New South Wales (UNSW) alumni Managing Director Kelvin Lam and Chief Product Officer Ken Tabuki. Investors Charles Wong (TNB Aura) and Pinijsorn Luechaikajohnpan (Plan B Media) are fellow UNSW alumni. Rounding out the Australian executive representation are Chief Commercial Jonathan Low (formerly ING) and Chief Technology Officer James Tippett (formerly Airtasker). Zipmex recently opened its Australian office in Sydney, led by Country Manager Nathan Halliday.

With the fresh injection of capital, Zipmex plans to further develop its technological infrastructure, engage in new business partnerships, attract new talent and diversify its offerings.

Founded by Facebook co-founder Eduardo Saverin and Raj Ganguly, B Capital invests in companies transforming large traditional industries across borders and geographies. Leveraging a global team of seasoned experts and a strategic partnership with The Boston Consulting Group (BCG), B Capital helps founders navigate business challenges, raise capital, and attract talented leadership at every stage of the startup lifecycle.

TNB Aura (an affiliate of regional fund manager Aura Group), a leading, Asia-focused, thesis-led, high-conviction venture capital firm, uses data-driven methodologies to identify and invest in select companies that are primed to be category winners. Its portfolio includes dental products company Zenyum, SAAS platform Propzy, Indonesian edtech company CoLearn, and Social Commerce platform Super.

With an exceptional team, clear vision and roadmap, Zipmex offers a seamless and accessible platform for consumers across Asia-Pacific to be a part of the digital asset revolution. We are honoured to be part of their mission to accelerate financial access and inclusion, and look forward to working closely with the company in transforming the way we spend, save and earn.

Charles Wong, co-founder and managing partner, TNB Aura

V Ventures is a Singapore-based VC. The firm invests in both early-stage and late-stage companies across a variety of cutting-edge technology companies, from global e-lending solution design to utilising deep technology in the non-internet sectors. Its portfolio companies include Blender Finance, Cloudbreakr, Creative Ventures, and Owlstone Medical.

Zipmex has evolved quickly from a digital assets platform in Thailand to a regional player in digital financial services and has done so while ensuring compliance with local regulators. The company has a strong and cohesive management team with the requisite experience and innovative approach to digitally transform the financial services industry. We are excited to be a part of Zipmex’s journey and fully support the company in reaching its goals.

Chalermchai Mahagitsiri, general partner, V Ventures

It has been an exciting month since Zipmex announced the Zipmex Card, a new Visa-backed payment card that launches in Australia in late 2021. The Zipmex-Visa gives Zipmex users the freedom to spend their digital assets at the more than 70 million merchants from Visa’s global payments network.

The company has spotlighted important partners-turned-investors and, now, support from world-class venture capitalist firms. As Asia-Pacific’s most trusted digital asset platform, Zipmex has big plans ahead, reaching out to the millions across Australia and South-East Asia and building an ecosystem beyond finance.

Let’s have a laugh at this week’s topical memes.

So cute.

Tune in next Friday for more meme mayhem!

Coinstash has acquired an Australian Financial Services Licence (AFSL) to accelerate the launch of the Coinstash Earn product to Australian customers.

The acquisition involves 100% of the share capital in Brindabella Investment Group Pty Ltd (Brindabella), a company which currently holds a wholesale Australian Financial Services Licence (AFSL) and includes a service agreement with the private seller to act as the responsible manager of the proposed financial product – Coinstash Earn.

The upcoming Coinstash Earn service will allow customers to earn a rate of return on their cryptocurrency holdings.

The acquisition of Brindabella and appointment of the responsible manager means Coinstash is one step closer to offering Australian customers a safe and secure way to earn a rate of return on their crypto holdings. The biggest uncertainty that many Australians face is whether they can trust the overseas, or even local, crypto exchanges holding their crypto. By obtaining an AFSL, Coinstash is increasing the standards and building trust for the many Australians who are looking to earn a rate of return with a licensed provider.

Coinstash CEO, Ting Wang

This announcement follows the Australian Securities and Investments Commission’s (ASIC) recent warning to Aussie citizens to be wary when investing in crypto products through unlicenced entities. ASIC has advised Australians to only make crypto investments if the company offering them has an Australian Financial Services Licence (AFSL) or Australian Market Licence (AML).