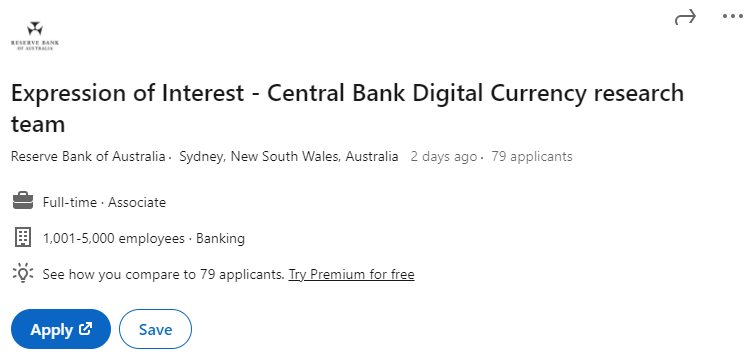

It’s official, according to a recent Linkedin job listing – the Reserve Bank of Australia (RBA) is currently hiring for its “Central Bank Digital Currency Research Team”.

RBA Making Moves

In October last year, Crypto News Australia reported that the RBA was continuing its research into CBDCs despite its reservations. In the following month, we also reported that Commonwealth Bank, National Australia Bank, Perpetual, and ConsenSys Software had joined forces with the RBA to conduct further research into the use of a wholesale CBDC.

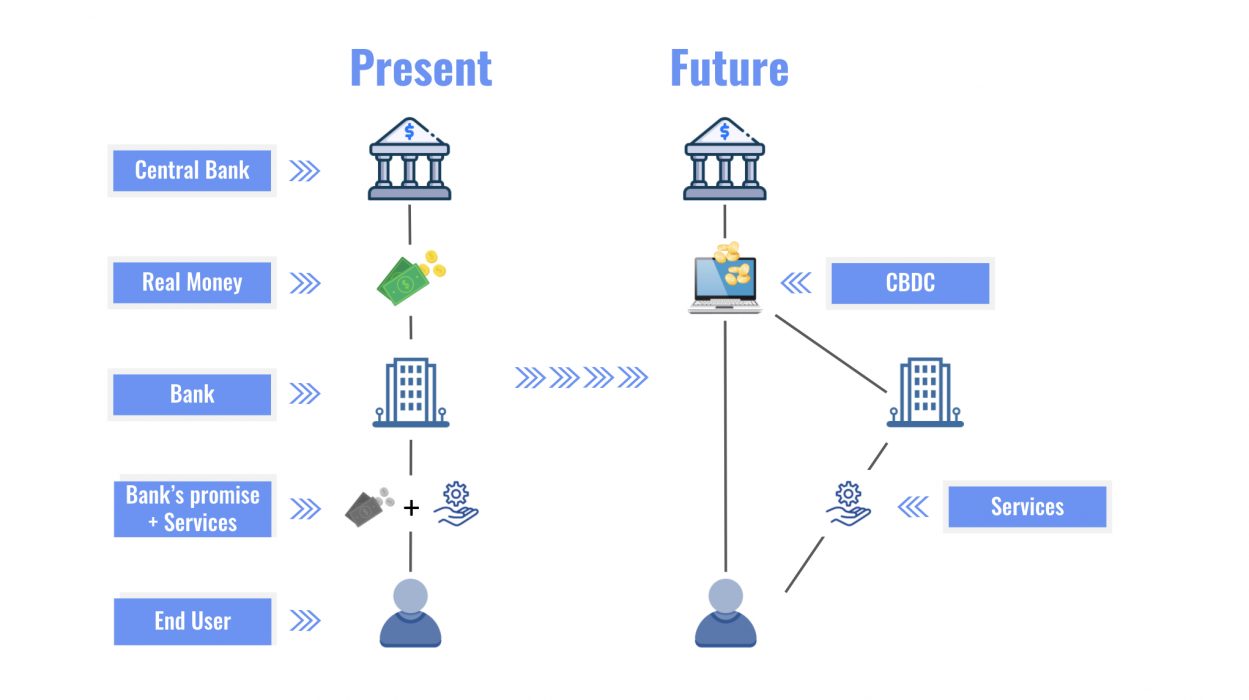

Just recently, the RBA reiterated its position that it does not yet see a policy case for issuing a retail central bank digital currency (CBDC), however it was “researching tokenised CBDCs and financial assets”, as per an announcement last month.

Quite clearly, the RBA is focused for the time being (at least publicly) on wholesale, as opposed to retail, CBDCs. For a short overview on each, be sure to check out our article outlining the differences.

With that said, the latest news of the RBA looking to hire ought to come as no surprise to those who have been closely following the matter.

Insights from the Job Listing

According to the job listing, the role’s primary focus will be to “contribute to research on the future of money in Australia” and engage in “impactful work that helps make a difference to the Australian people”. If it sounds like fluffy stuff, you aren’t alone. According to the listing:

The Reserve Bank of Australia has been researching central bank digital currency (CBDC) for the past few years … We are researching whether there is a case for a CBDC in Australia, and if so, how it might be designed and what benefits and other implications it would have. This work is contributing to one of the RBA’s strategic focus areas on supporting the evolution of payments in Australia.

RBA job listing, LinkedIn

The RBA is said to be creating a new new cross-disciplinary team responsible for “designing, executing and communicating the results from a series of research projects aimed at improving our understanding of the case for, and implications of, issuing a CBDC as well as exploring different technical solutions”. It is expected that the team will work with stakeholders within the RBA as well as external partners on “collaborative projects”.

Time will tell which direction the RBA ultimately takes. In the interim, it’s worth focusing more on what it does rather than what it says.