According to this announcement by Tether, third-party audit and assurance services provider Moore Cayman has confirmed USDTs in circulation are fully backed.

Over the recent years, many FUD (Fear, Uncertainty, and Doubt) stories have circulated in the cryptocurrency space concerning Tether’s asset reserves. Many people had argued that the company was only posting figures and that its US dollar-backed stablecoin (USDT) were not fully backed.

This controversy was mostly fuelled by the massive number of USDTs usually minted by Tether. Some people were concerned that the cryptocurrency market, especially Bitcoin (BTC), would crash if there were evidence that Tether’s assets are not fully backed. This announcement might help reduce all these FUDs and worries amongst crypto investors.

USDTs are Fully Backed by Tether Reserve

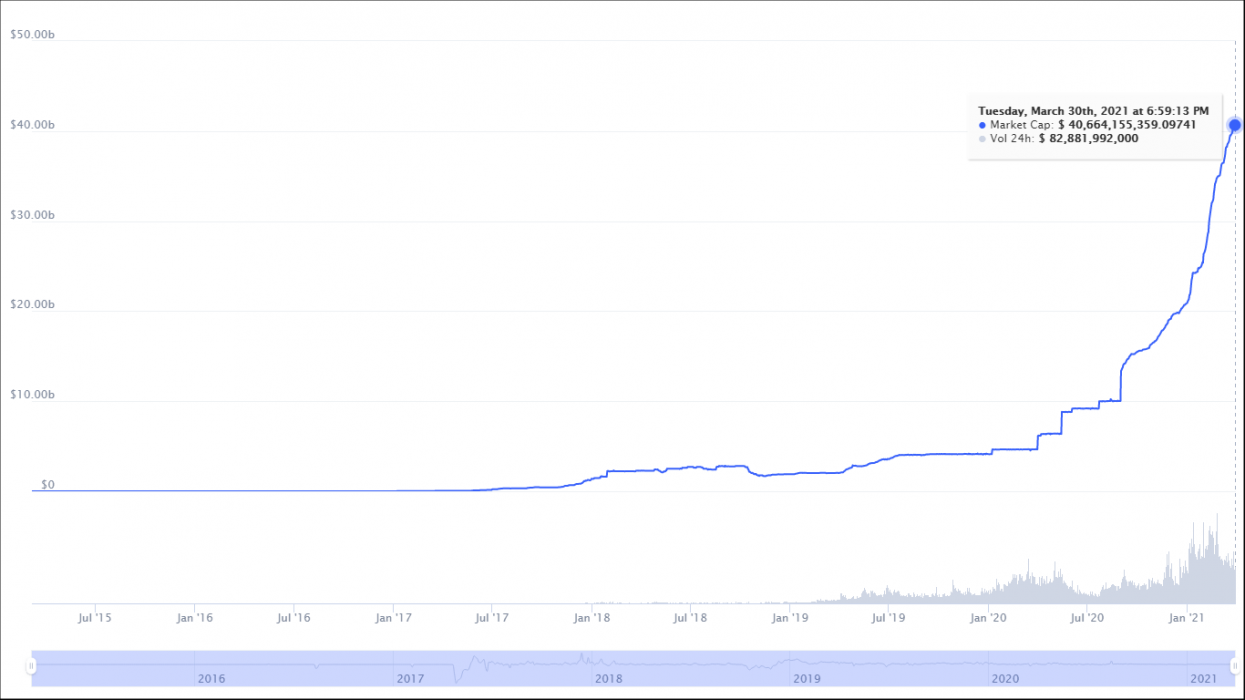

At the time of writing, there were over 40.6 billion USDTs in circulation, according to CoinMarketCap. Judging by Moore Cayman’s assurance report, it’s believed that Tether’s reserves back all these assets.

“Tether has always been fully backed, and the assurance opinion we made available today confirms it once again. As Tether’s growth in the market continues to validate our business, we understand the public’s interest in this matter and are pleased to share this attestation as part of our ongoing commitment to transparency,” Tether noted in the announcement.

USDT Remains the Largest Stablecoin

Stablecoins are backed by an asset, and USDT, in this case, is backed by the United States fiat currency. USDT is the largest and most-traded USD stablecoin in the crypto market. It has a market capitalization of over $40 billion, ranking as the fourth-largest digital currencies.

The USD Coin (USDC) is the second-largest US dollar-backed stablecoin with over $10 billion in market capitalization. Recently, Visa added USDC as a settlement currency.