Non-fungible token (NFT) marketplace OpenSea has seen an exponential increase in volumes following the recent frenzy in the NFT market.

Several metrics including trading volume, monthly sales, fees and active traders on the platform have surged significantly since the beginning of August, according to analytics data.

OpenSea Sees 546% Increase in Volume

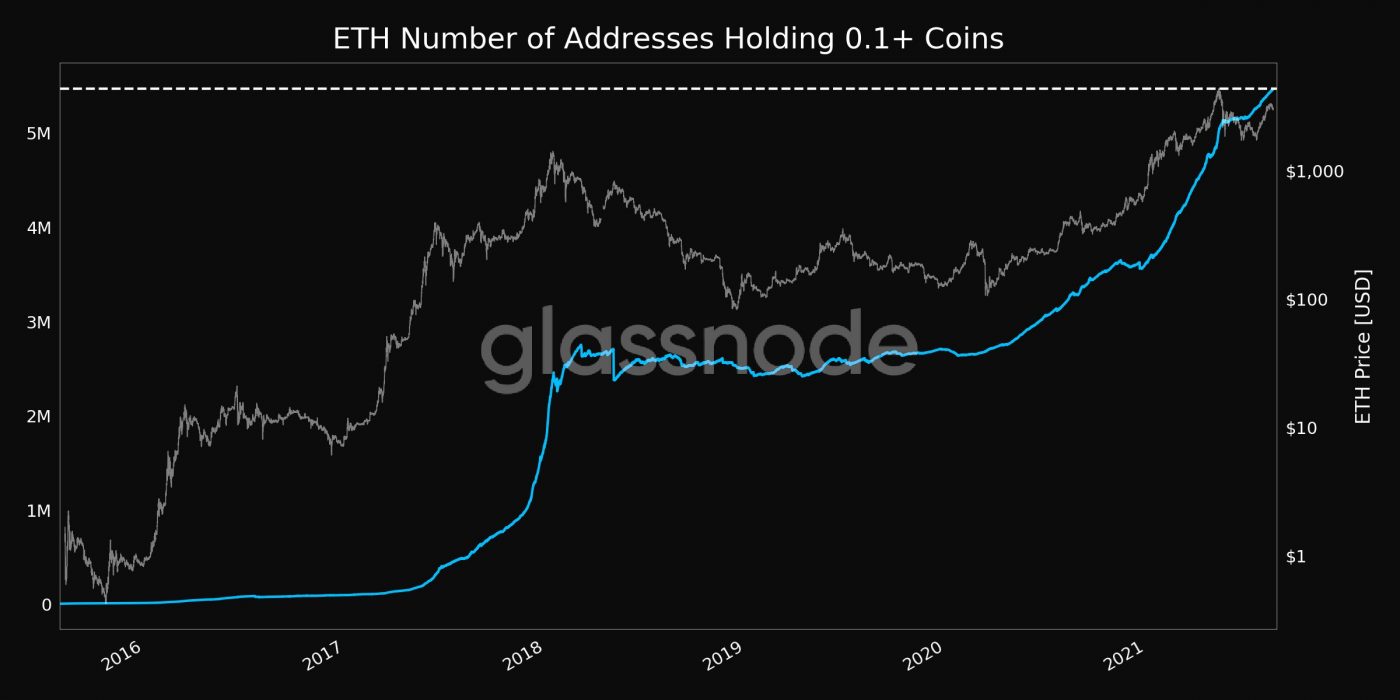

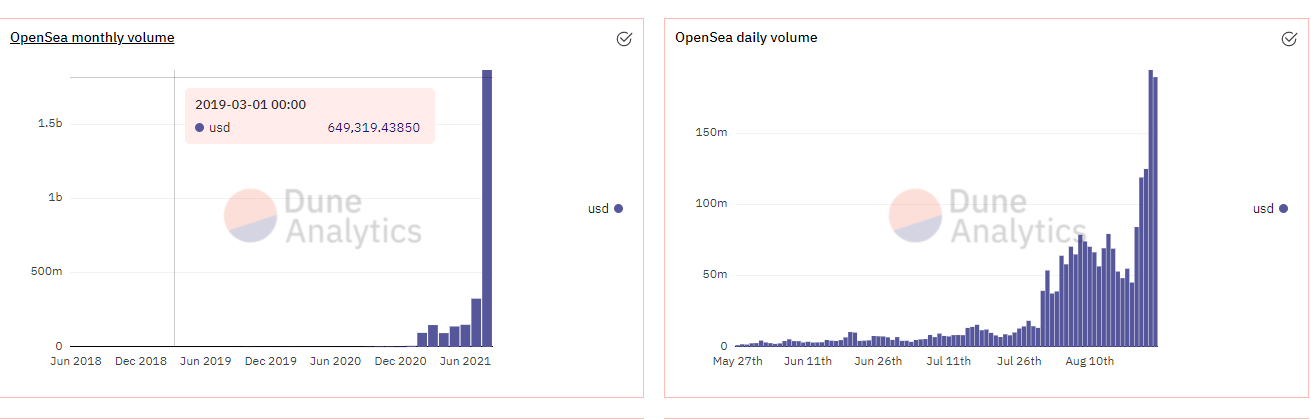

At the time of writing, OpenSea gained over US$1.8 billion in monthly trading volume, which represents about a 546 percent increase from the previous volume in July. The record today is significant given that OpenSea only saw about US$284 million in July trading volume. This is over 60 percent of the US$2.7 billion all-time volume on the platform.

Additionally, OpenSea has done over 1.1 million in NFTs sales since the start of August, and only 458,052 NFTs were sold on the platform in the previous month, as per Dune Analytics. The number of registered users on the platform also increased significantly, which shows more people are still jumping into the NFT market.

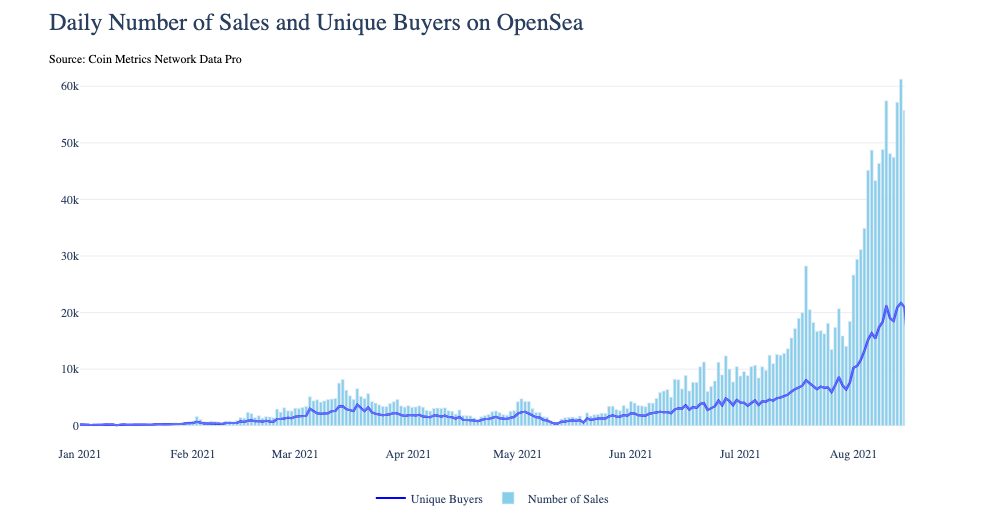

The number of sales on OpenSea, the largest NFT marketplace, reached a peak of over 60,000 per day over the last week, which is close to 8x the peak reached in March, according to a report by Coin Metrics.

Going by the 30-day volume, OpenSea is the largest NFT marketplace, followed by Axie Infinity, CryptoPunks, NBA Top Shot and many others.

NFT Mania is Only Getting Bigger

The massive increase in user activities on OpenSea coincides with a growing interest in NFT trading. More people are joining the NFT market and millions of dollars are being traded on a daily basis, featuring content from musicians, artists and celebrities.

Crypto News Australia recently reported that the latest edition of Floyd Mayweather’s NFT collection was launched on August 13. The retired boxer also claimed that a substantial portion of his portfolio worth “over a billion dollars” is invested in digital currencies.

German automaker Audi is among the few big-name companies to launch an NFT collection and aggregator platform for car NFTs.