Another day, another scam in the crypto world. On this occasion, it was a bad actor that managed to rip off would-be investors in a Dogecoin mining scam, according to local media in Turkey.

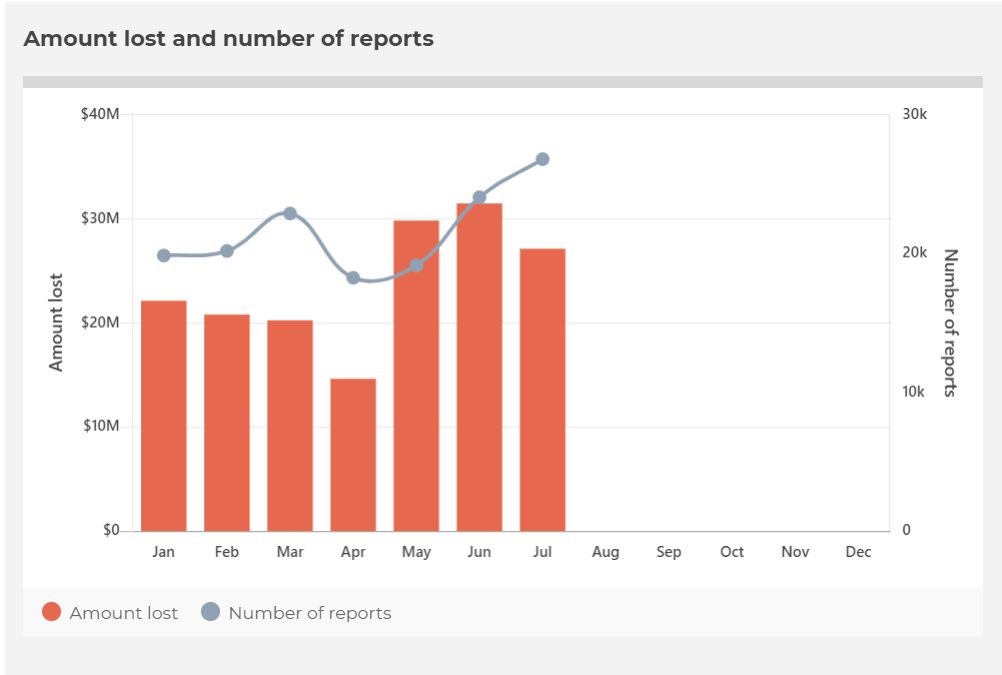

Over US$100 Million Stolen

The scammer, identified as “Turgut V”, together with his team managed to trick investors into buying DOGE and handing it over to him, thereby investing in mining technology and promising 100 percent returns. The scammers managed to steal at least US$119 million before one of the victims filed a complaint with the Chief Public Prosecutor’s Office in Küçükçekmece, a suburb of Istanbul.

Apparently, Turgut V and his team hosted in-person meetings at luxury properties and via Zoom calls trying to lure investors into pouring money into the scam, the report said, quoting the prosecuting lawyer. A court has banned Turgut V and his team from leaving the country while authorities investigate.

Companies like KeychainX could be helpful in this kind of situation. A few weeks ago, a retired US truck driver managed to retrieve 10 million DOGE thanks to KeychainX’s wallet recovery service.

Impersonation Scams and Dogecoin

Dogecoin, being one of the largest market cap tokens, has attracted massive interest from the media, especially thanks to billionaire celebrities and tech leaders like Elon Musk. Scammers usually try to take advantage of the hype to fool newcomers.

It is worth noting there was an impersonation scam that happened five months ago where a man lost A$700,000 to a fake Elon Musk Twitter account. As Crypto News reported, the man was tricked by a link under a purported tweet from Musk, sending him to an event hosted as a giveaway where people were invited to send anything from A$7,700 to to A$1.5 million.