Singapore-based decentralised derivatives exchange SynFutures is launching NFTures, a product that will allow users to short, or bet against, the future prices of non-fungible tokens (NFTs) such as CryptoPunks.

Holding NFTs and hoping their value increases so you can resell them for a profit is currently the only way you can make anything out of them. Many are questioning the value of NFTs, with the tokens serving no purpose besides being able to be bought or sold.

SynFutures is looking to change the way we derive profit from NFTs.

The Mania Continues

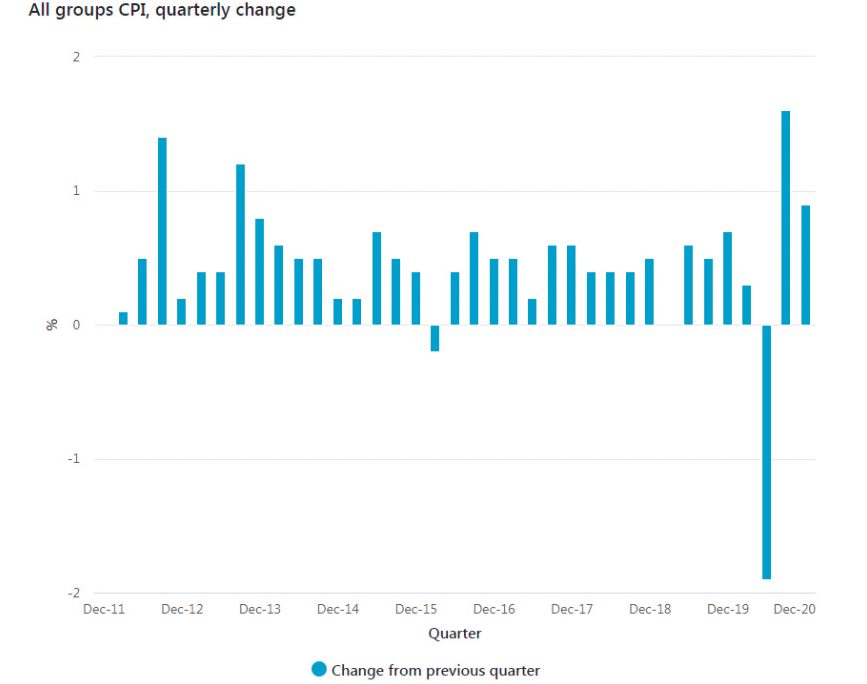

NFTs have realised immense growth in recent months, generating US$10.7 billion in trading volume during Q3, a staggering increase of 704 percent on the previous quarter. Projects like EtherRock, CryptoPunks, and Bored Ape Yacht Club have generated sales worth millions of dollars. Earlier this month, internet personality and investor Gary “Gary Vee” Vaynerchuk sold a handful of NFT doodles worth more than pieces from famous artists such as Andy Warhol and Jackson Pollock.

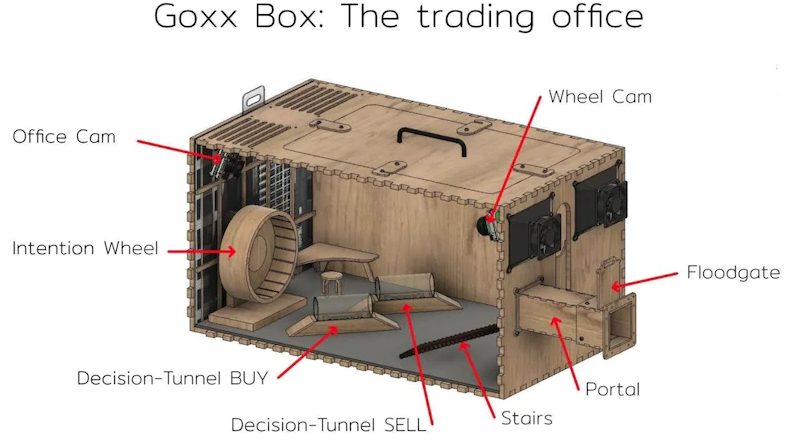

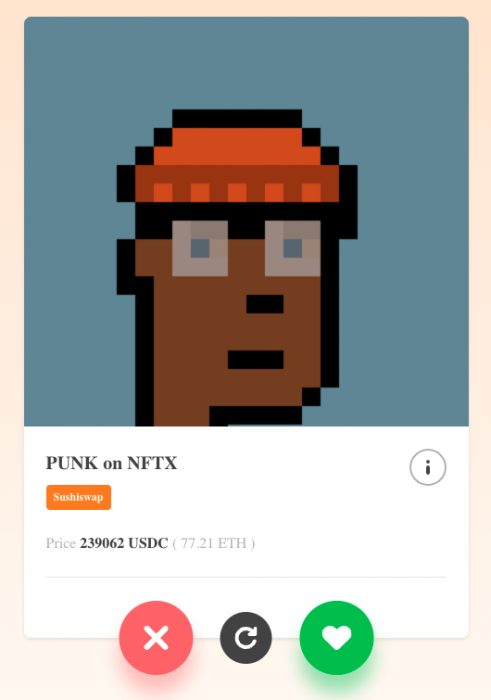

SynFutures is getting on the NFT train with NFTures, a product targeted toward retail investors. It uses a similar user interface to dating app Tinder in an effort to streamline the trading process, while at the same time bringing game-like elements and leverage to NFT markets.

NFTures is a decentralised protocol based on SynFutures’ existing synthetic automatic market maker (sAMM) model to match its competitors.

Allowing Users to Maximise Profits

Rachel Lin, CEO and co-founder of SynFutures, said of the new venture:

Every healthy financial market needs a way for participants to take both sides of the market, and NFTs are no exception … By providing a way for users to take long or short positions in NFTs, we’re enabling more robust trading strategies that allow users to maximise profit opportunities while hedging risk and exposure.

Rachel Lin, CEO and co-founder, SynFutures

The company explained further in a statement that: “Those who wanted to speculate on downward trends had to bet against entire markets, shorting the native tokens of NFT-centric products like Axie Infinity ($AXS) and SupeRare ($RARE).

“With NFTures, SynFutures has created an intuitive platform for traders to long or short specific NFTs at any time and take advantage of better price discovery.”

The Risk Remains as NFT Market Continues to Grow

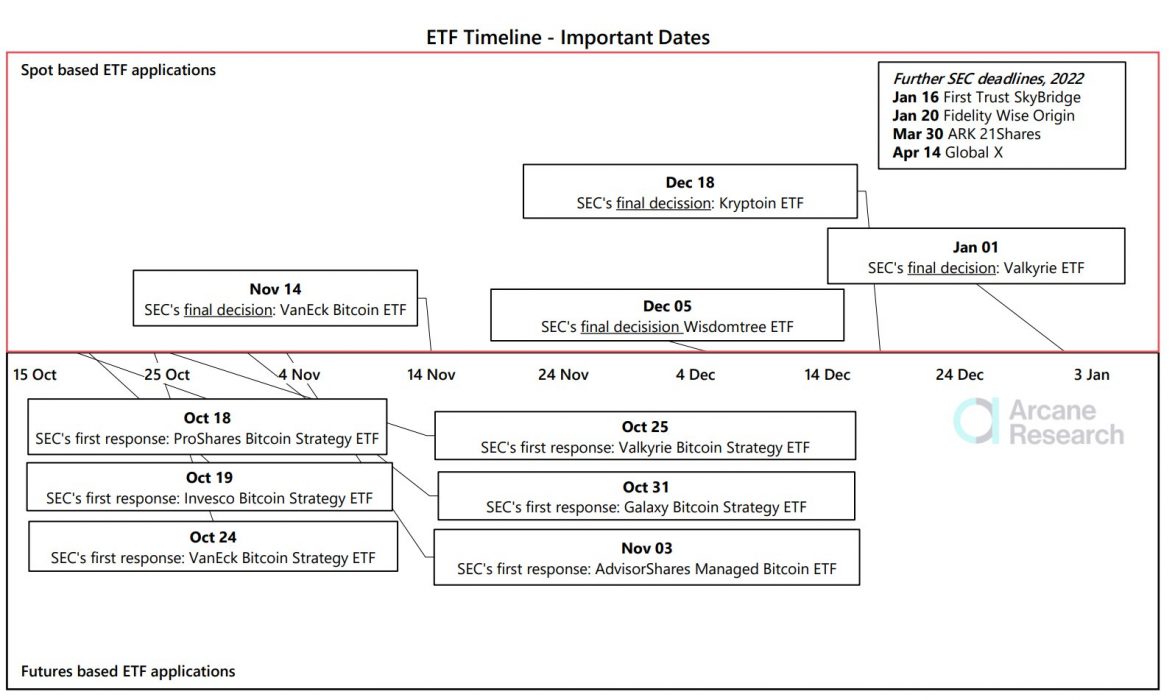

NFTures’ contracts are based on spot price oracles from decentralised exchanges such as SushiSwap and Uniswap, along with NFT fractionalisation protocols including Fractional and Unic.ly.

As with traditional futures markets, the spot and futures prices converge on a set periodic schedule.

Risks of oracle price manipulation remain a concern for many as the budding NFT market continues to grow in size and liquidity. Product designer and Coinbase investor Bobby Goodlatte took to Twitter to provide his take on the future of NFTs:

Albeit with some concerns, NFTures highlights the renewed interest in NFT-related DeFi projects, including the tokenisation of physical assets and NFT-backed collateralised lending. As the popularity of DeFi increases, investors are looking to seize niche markets within the industry.

Earlier this year, SynFutures raised US$14 million in a Series A funding round led by Polychain Capital. Investors included Pantera Capital, Bybit, Framework Ventures, Kronos, and IOSG Ventures. SynFutures indicated that it aims to focus its entire platform on derivatives and wants to eliminate the barriers to entry to the derivatives market.

Lin has stated that SynFutures’ overall goal is to “democratise the futures market”, and added:

We’re aiming to level the playing field for the average investor by cultivating a free and open market for derivatives trading.

Lauren Stephanian of Pantera Capital also said:

NFT-specific derivatives products will add more depth to the nascent NFT market, just as options and futures contracts play an important role in established financial markets.