Kraken CEO Jesse Powell featured on Decrypt’s GM podcast last week, in which he stated that the US exchange is currently exploring broadening its offerings to include stocks. Powell also noted that the so-called ‘super wallet’ appears to be a common goal among many exchanges:

One Wallet, Multiple Assets

During the Decrypt podcast, Powell discussed the future of crypto wallets and the exchanges they belong to. He said that ‘super wallets’ – wallets that allow users to buy and trade varying assets, from crypto and NFTs to stocks – were in the sights of many crypto exchanges right now, with Kraken itself exploring the potential of catering to stocks:

I think we’ve said before that [stocks] are something that we’re exploring, and I think [it] makes sense to do [so].

Jesse Powell, Kraken CEO

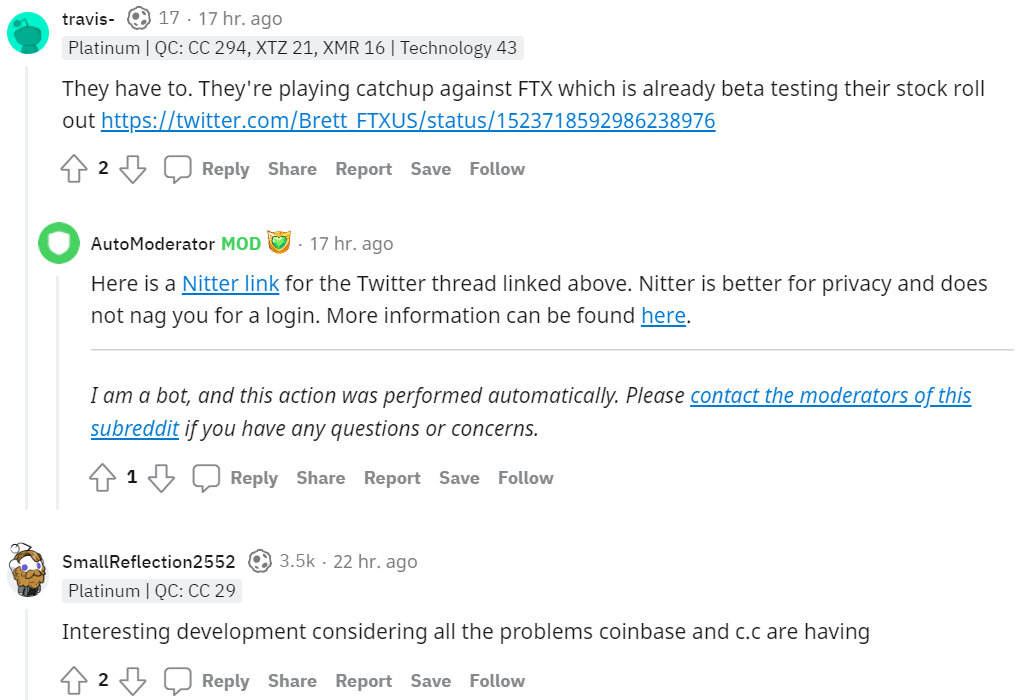

With crypto already being offered alongside other assets by companies such as Robinhood and eToro, crypto brokerages won’t be far behind. Kraken users are already speculating on how this potential addition could unfold:

Kraken Comes to the Aid of Ukraine

Kraken has been making itself visible over the past two years via multiple company moves. The most notable of these has been its dedication to aiding fundraising for Ukraine. In March, the company announced it would be distributing over US$10 million to relief efforts in the wartorn country, along with the waiving of exchange fees for Ukrainian addresses.

In June 2021, the company decided to re-evaluate its launch plans following the poor performance of Coinbase’s IPO, stating that a direct listing might have a long-run “dampening effect” if Kraken continued with its plans to go public.