Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

At the time of writing, LTC is ranked the 22nd cryptocurrency globally and the current price is US$102.67. Let’s take a look at the chart below for price analysis:

After setting a low last month, LTC kicked off a recovery trend that gained nearly 23% to break the weekly highs.

The following 55% plummet found support near $96.36, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at $110.53.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $120.12, where aggressive bulls might begin bidding. The level near $133.98, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $149.13.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $96.18 could provide at least a short-term bounce. If this level fails, the old monthly lows near $89.23 might also give support and see the start of a new bullish cycle after retesting these support levels.

2. Algorand (ALGO)

The Algorand ALGO blockchain is a permissionless, pure proof-of-stake blockchain protocol. Unlike Proof-of-Work (PoW) blockchains, where the root block must be validated by randomly selected validators (using computing power), in the pure proof-of-stake approach all of the validators are known to one another and only have to agree on the next block in order to create a new block. Algorand was invented to speed up transactions and improve efficiency in response to the slow transaction times of Bitcoin and other blockchains.

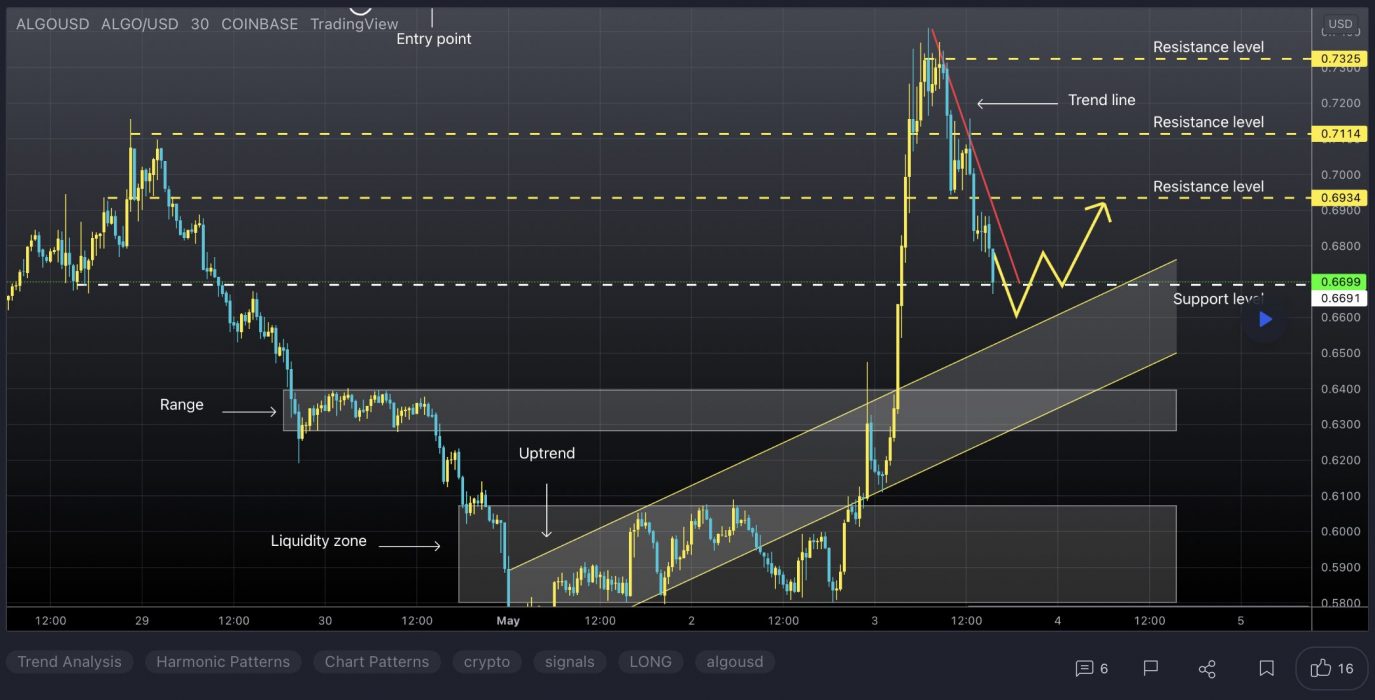

ALGO Price Analysis

At the time of writing, ALGO is ranked the 30th cryptocurrency globally and the current price is US$0.6615. Let’s take a look at the chart below for price analysis:

After creating a second equal low during last month, ALGO gained nearly 20% into resistance that starts near $0.7522.

Swing traders looking for a continuation to the nearest cluster of relatively equal highs around $0.8412 might look for bids near $0.9036. More significant resistance rests above, near $0.9815. A group of significant swing highs at $1.10 and $1.16 give possible targets if this resistance breaks.

A stop run on the recent low at $0.6533 into possible support beginning near $0.6130 might see stronger bidding. This area also has a confluence with the recent monthly lows.

3. Alpha Finance (ALPHA)

Alpha Finance Lab ALPHA is a cross-chain DeFi platform that looks to bring Alpha to users across a variety of different blockchains, including Binance Smart Chain (BSC) and Ethereum. The platform aims to produce an ecosystem of DeFi products that address unmet needs in the industry while remaining simple to use and access. ALPHA is the native utility token of the platform. Token holders can earn a share of network fees by staking ALPHA tokens to cover any default loans. Other use cases for the token include liquidity mining and governance voting.

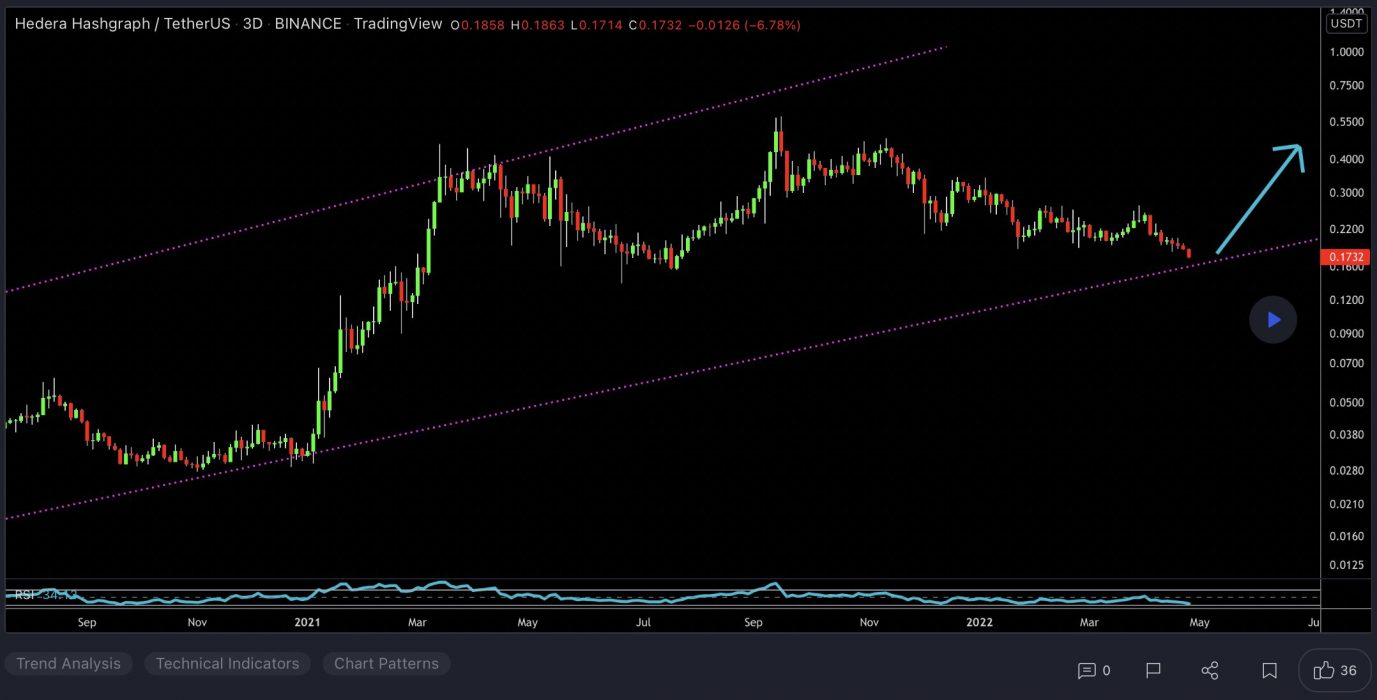

ALPHA Price Analysis

At the time of writing, ALPHA is ranked the 306th cryptocurrency globally and the current price is US$0.2847. Let’s take a look at the chart below for price analysis:

ALPHA‘s 60% rally from its Q1 lows met resistance near $0.5995, before creating a new range for Q2.

After a bearish flip of the 9, 18 and 40 EMAs, the price broke below $0.4310. This area, which has confluence with multiple swing lows and the February monthly open, may provide resistance on any future retest.

The price might find support near $0.3045 to $0.2549 if the overall market’s conditions turn more bullish. This zone has confluence with the 61.8% to 78.6% retracements and accumulation zone for Q1’s rally.

Suppose the price does rally through the probable resistance near December’s open. In that case, the January swing highs and above, near $0.4561, could provide resistance again. A shift back to more bullish market conditions could push the price to the 50% extension of the summer’s swing, near $0.5034.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.