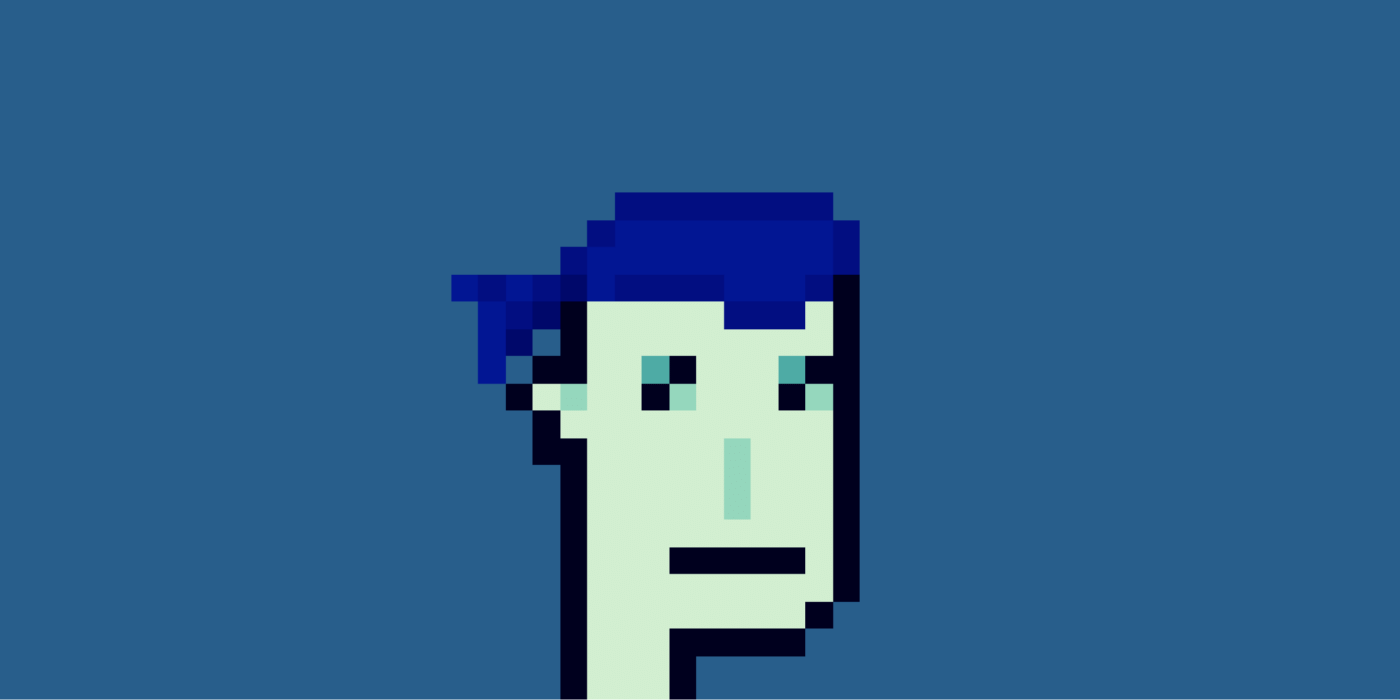

Having bought a decentralised .eth URL from the Ethereum Name Service (ENS), Puma has duly followed rival sports brands Nike and Adidas into the metaverse. As a full signal of intent, it has even renamed itself puma.eth on Twitter.

Puma Partners With Gutter Cat Gang … More to Come?

Fuelling rumours of associated partnerships, Puma has also purchased a catalogue of cat-related NFTs, which include Cool Cat #32 (bought for 14 ETH, roughly US$36,000 at the time of writing); a Gutter Cat worth about US$20,000; a pair of pudgy pussies from the CatBlox Genesis collection, and a Lazy Lion.

As for the German multinational’s move into the metaverse, the company is looking to hire a “Digital Culture Manager” and an associate creative director, both positions listing knowledge of the metaverse as a prerequisite. As the ad on Puma’s website specifies, candidates are required to have an “understanding of web3 including NFTs, gaming, metaverse, cryptocurrencies, and DAOs”.

Puma Debuts at #13 on the .ETH Leaderboard

At the time of writing, Puma ranks 13th on the .eth Leaderboard, which lists the most followed Twitter accounts with .eth names. Leading the pack are parishilton.eth and shaq.eth, owned by socialite heiress Paris Hilton and former NBA star Shaquille O’Neal, respectively.

Besides Puma, another major corporation sporting an .eth domain is beer brand Budweiser, which bought the Beer.eth domain name for 30 ETH (around US$100,000 at the time) in August last year.