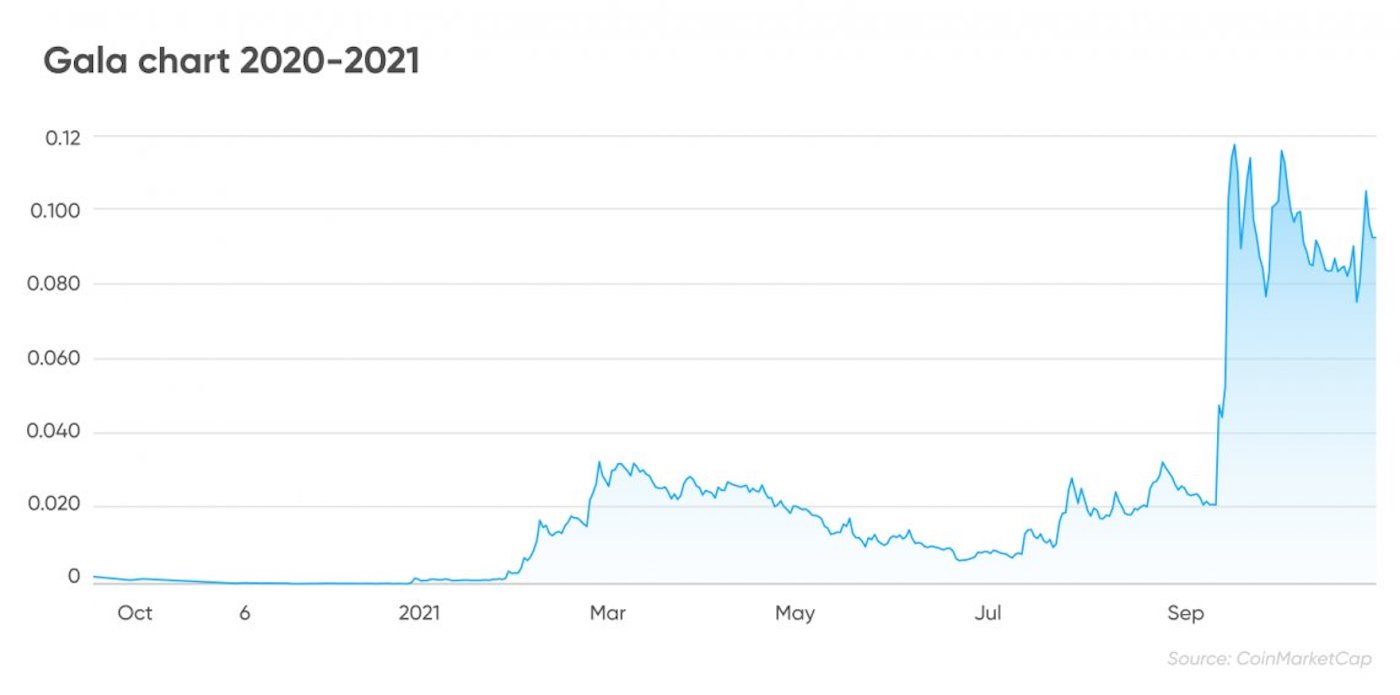

Gala Games (GALA) has gone ga-ga, with the gaming token’s price skyrocketing by over 360 percent in seven days. The surge comes as investors welcome exploding interest in decentralised games, non-fungible tokens (NFTs) and the metaverse sector.

The main driver of Gala’s price hike is its impending Miranda VOX drop, due December 6. The NFT series contains “magical creatures from the realm of Mirandus”: elves, rogue halflings, fierce orcs, stalwart dwarves, plus “surprise” creatures from the Mirandus bestiary will emerge from Gala’s mysterious VOX boxes on the due date.

Instead of being sold through the CollectVOX website, these VOX boxes will be purchasable directly from the Gala Games store, thus avoiding the usual Ethereum gas wars.

If you’re new to Gala Games, you’ll need to create an account, and then purchase some GALA tokens and some ETH (for network fees).

‘Blockchain Games You’ll Actually Want to Play’: Gala

With its stated mission being to to make “blockchain games you’ll actually want to play”, Gala Games claims to give players control over their virtual domain. GALA is used as a means of exchange between gamers and the coins can be used to pay for items within the platform.

Created in 2019 by Eric Schiermeyer, one of the co-founders of mobile games company Zynga, which developed the likes of Mafia Wars and Farmville, Gala has 1.3 million active users. According to the company manifesto:

We are truly building the largest decentralised gaming platform in the world. Decentralisation means putting the power, the responsibility and the rewards into the players’ hands.

Gala Games

Gala players are able to own NFTs that allow them to vote on new games and thus influence how they are run. The GALA token can be used to purchase these NFTs, as well as in-game items.

What’s Behind GALA’s Surge in Price

According to the Global Gaming Market 2021-2025 report published by ReportLinker, the gaming sector is expected to grow by US$125.6 billion from 2021 to 2025, which will favour the likes of Gala.

Many have attributed Gala’s breakout performance to its being listed on major cryptocurrency exchanges including Binance, Mandala, OKEx, Huobi Global and Bitget.

Last week, Crypto News Australia reported how another NFT and gaming token, WAX, had soared 215 percent in a month on the back of unprecedented user growth.