Australia is the fourth most crypto-obsessed country in the English-speaking world, according to a new study conducted by cryptocurrency price tracker CoinGecko.

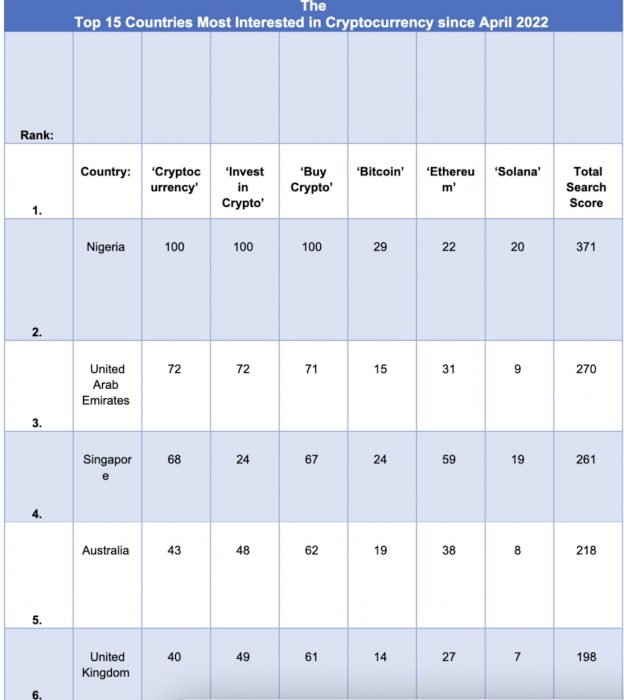

The research underpinning the study examined Google Trends data of search terms frequently used by people interested in cryptocurrency. These terms were then tallied to give each English-speaking nation a “total search score” to ascertain which of them had been the most interested in cryptocurrency since the recent market decline, which began in April 2022.

Nigeria, Kenya Lead African Charge

With a total search score of 371, Nigeria topped the list for its population registering the highest search levels for the phrases “cryptocurrency”, “invest in crypto” and “buy crypto” worldwide. Additionally, the third-highest number of searches for “Solana” were also made from within Nigeria. This was not surprising considering the West African nation’s central bank ordered financial institutions to ban crypto firms from the banking sector in February last year.

Kenya was the highest-ranking English-speaking country in Africa after Nigeria, with a score of 143 placing it at number 15 overall.

UAE, Singapore Top UK, US Well Down the List

Crypto hotspot the United Arab Emirates (UAE) ranked second in the study with a total search score of 270 – more than 100 points behind Nigeria. The UAE edged out Singapore for its searches of “cryptocurrency” and “invest in crypto”.

Singapore had the third-highest level of searches for the term “buy crypto” and its citizens searched for “Ethereum” more than anyone else, with the South-East Asian city state recording a total search score of 261. Australia (218) crept into fourth spot with a strong showing in the search terms “invest in crypto” and “buy crypto”.

Next in the rankings was the UK (198), with the US surprisingly well down the list in 12th place overall (total score 157), ranking 10th in search levels for the term “buy crypto” and sixth in its interest in “Solana”. As for the UK, Bitcoin, Ethereum and Polygon were the highest trending crypto terms.

Bobby Ong, chief operating officer and co-founder of CoinGecko, noted a major correction from previous bull cycle highs, resulting in what he termed significant price drawdowns in an unforgiving macroeconomic environment.

This study provides interesting insight into which countries remain most interested in cryptocurrency in spite of market pullbacks. The countries at the top of this list appear to be keenest to buy the dip and highlight their long-term outlook for cryptocurrencies.

Bobby Ong, chief operating officer and co-founder, CoinGecko

Topsy-Turvy Results on Surveys Front

To compare and contrast, it’s interesting to note Australia’s performance in two other recent crypto surveys, results of which were published last month:

- The country ranked fifth among the world’s top crypto-friendly economies, according to the latest quarterly rankings released by analytics firm Coinclub.

- However, data from the United Nations Conference on Trade and Development, released a week earlier, showed that only 3.4 percent of Australians own crypto, placing the country last in a list of 20.