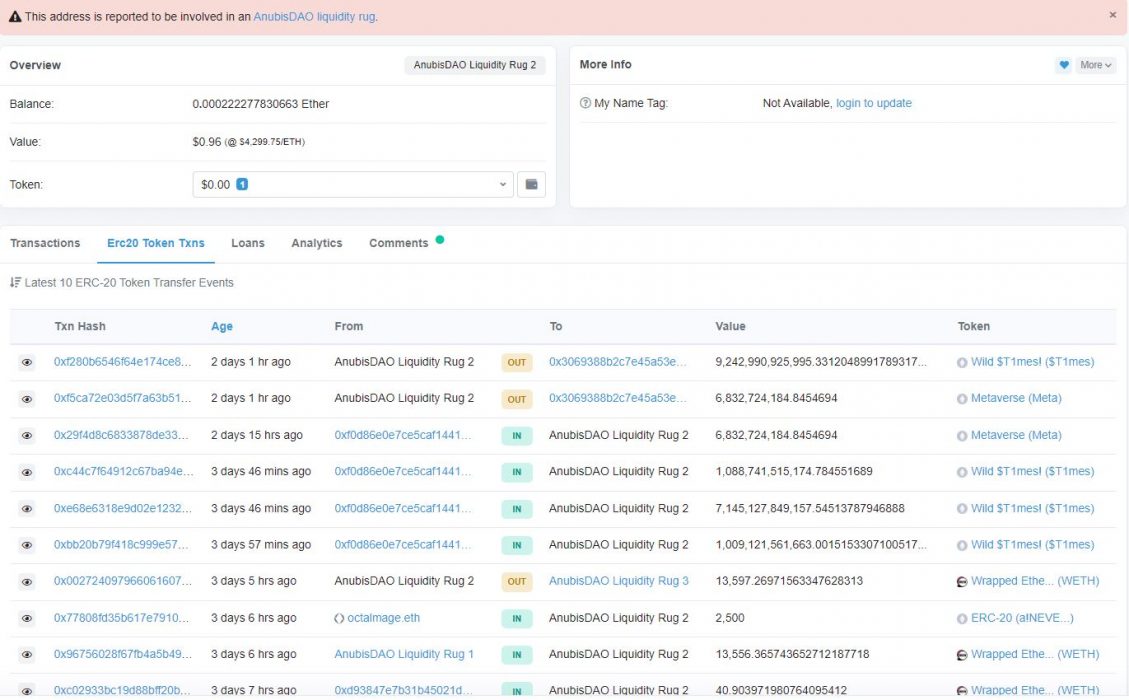

Investors looking for the next Dog-themed memecoin have found themselves on the backside of a rug pull, draining an estimated US$60 million from the project’s liquidity pool.

Participants in a brand-new project called AnubisDAO contributed ETH in exchange for ANKH-tokens that would have been distributed as soon as the sale ended. The sale started on October 28 and attracted considerable interest from investors, who contributed 13.6K ETH (US$60 million) in under 24 hours.

Even though the project didn’t have a website, investors still poured US$60 million into the initial token sale. Twenty hours into the sale, the ETH in the pool was sent to a different address before the smart contract was activated, leaving investors with ANKH tokens and no liquid market for them.

Since October 28, the Anubis official Twitter page has been silent, with no mention of the disappearance of millions of dollars.

Phishing Attack or Elaborate Scheme?

Copper Launch was the token launch platform used by AnubisDAO and it stated in a post that “the launch was configured to last 24 hours, but before the launch finished, the token liquidity was pulled by the creator of the launch from the LBP smart contract that housed the funds”.

Later, @Beerus tweeted under an alternate account called @cryptofan777, attempting to clear the air. The tweeter claiming to be @Beerus said they had not personally drained the funds; they had probably been the victim of a phishing attack, and attached a screenshot of an email with a potentially malicious attachment from an emailer posing as 0xSisyphus.

In a later statement, Copper said that “other accounts on Twitter that are known to be AnubisDAO affiliates claim that the auction creator’s wallet account was either compromised or that they were a bad actor”.

At the time of writing, a Twitter account was under police investigation, though it’s too early to draw any conclusions as the situation is still developing. But the community hopes that the exploiter is identified, and the stolen funds returned soon.

The Importance of DYOR

One investor told CNBC that he lost US$450,000, though admitting that he didn’t investigate the project thoroughly prior to investing. “We, in crypto, tend to have a ‘buy first, do research later’ mentality,” he said:

One of the most important things to do before investing in a project is to do your own research (DYOR), investigate the website, Twitter, team members, and any other information available to verify the authenticity of a project. In June, Mark Cuban called for DeFi regulation after a DeFi token collapsed from US$65 to US$0.00000003 on him, with others taking a starker position: