Close to US$100 million has been stolen by hackers from Japan’s Liquid Global exchange, which has since suspended deposits and withdrawals while also moving its assets into offline storage.

According to an August 19 tweet, Liquid exchange confirmed that it had been breached and its hot wallet compromised. The exact amount still needs to be verified, but estimates place it upward of US$90 million.

With such a large amount of crypto compromised, the exchange has moved its digital assets into cold storage. According to Eddie Wang, senior researcher at OKLink, hackers made off with BTC, ETH, TRX, XRP and other ERC-20 tokens.

The cold wallet used for segregation management is safe, and no impact on the assets entrusted to us by our customers has been confirmed.

Liquid (via Quoine)

Blockchain analytics company Elliptic says US$45 million in tokens were being converted to Ethereum through decentralised exchanges – blockchain-based platforms that require no intermediaries – such as Uniswap.

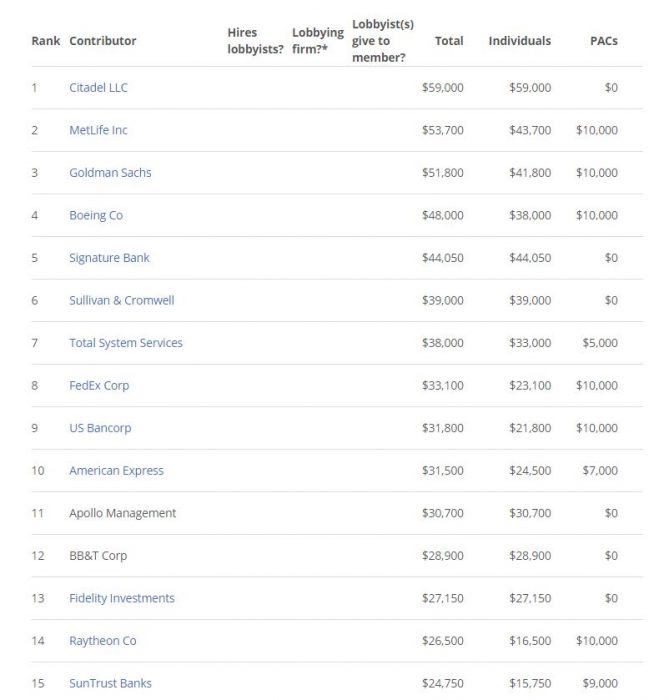

Destination Wallets Blacklisted by KuCoin

In the meantime, the wallets that received the stolen tokens have been blacklisted by KuCoin and other exchanges are expected to soon follow suit.

Liquid exchange also announced that “under these circumstances, we will suspend the warehousing and withdrawal of cryptographic assets until the security of all wallets is confirmed”.

How It Was Done

According to a blog post by Liquid, “the MPC wallet [used for warehousing/delivery management of cryptographic assets] held by our Singapore subsidiary Quoine was damaged by hacking. The impact on us is currently being confirmed.”

MPC is an advanced cryptographic technique in which the private key controlling funds is generated collectively by a set of parties, none of which can see the fragments calculated by the others. Liquid Global’s blog post did not explain how this security arrangement was circumvented. However, an investigation is under way.

This breach comes in the same week as a record-breaking DeFi hack against PolyNetwork, which siphoned off around US$600 million from the protocol.