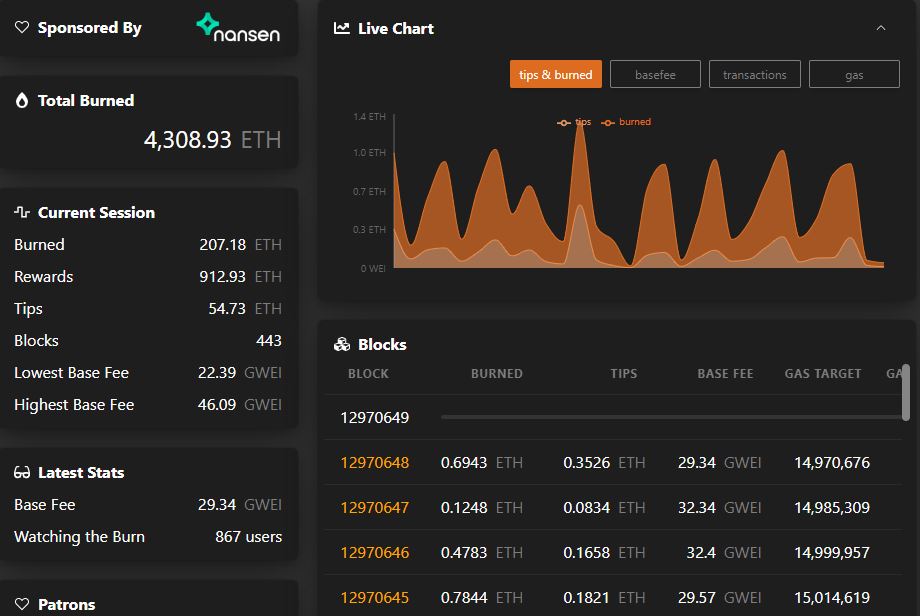

The long-awaited Ethereum hard fork has been operational for a few days now and with a massive amount of ETH already burned, the currency could be well on its way to becoming deflationary.

At the time of writing, the total amount of Ethereum (ETH) burned since the London hard fork had already run up to 4300 ETH, about US$11 million worth of the digital currency. The network is burning the digital currency at approximately 3.68 ETH ($10,295) every minute on average.

The update has integrated a new mechanism that burns a portion of the base fee of a transaction, while the other portion goes to the miner. Shortly after implementation, the price of Ethereum jumped more than 6 percent, adding to its 12-day price gain.

Many other updates were administered in the Ethereum hard fork, and here’s what you need to know.

Change to a Flexible Monetary Policy Aids Deflation

By burning the majority of the base fee of transactions, the mechanism aims to deflate the supply of Ethereum. While a sustained rate of over 2 ETH per block is necessary to see Ethereum’s supply deflate, EIP-1559 is the first step on its road to a deflationary monetary currency.

The much anticipated EIP1559 network upgrade was a huge day for the Ethereum cryptocurrency ecosystem. Now, every transaction, NFT purchase or loan on the Ethereum network will result in ETH being burned out of existence, making ETH a deflationary and inflation-busting asset.

Ross Middleton, chief financial officer, DeversiFi

What Does the Change Mean for Users and Miners?

Looking at user experience, gas fees and Maximal Extractable Value (MEV), topics that usually have a negative connotation when talking about Ethereum are being solved.

Anyone sending a transaction will know the fee in advance; users currently have to submit a bid to miners, which can lead to overpaying or long wait times if the fee is too low. Meanwhile, the block size increase means the queue to get in will be faster during peak congestion […] To avoid being subject to gas price manipulation for gas refunds, smart contracts need access to a decent trustless gas price oracle. That’s another thing EIP-1559 solves.

Justin Drake, Ethereum 2.0 researcher

However, what miners will get from transactions is a fraction of what they used to be. While the current Proof-of-Work consensus mechanism sees Ethereum pay miners more than 12,000 ETH every day, experts believe Proof-of-Stake will reduce that to around 1,000 ETH per day.

When ETH gets burned it becomes more scarce, which benefits all holders. With enough activity on the network, the amount of ETH burned through transactions could surpass the amount issued to validators through Proof-of-Stake. This would make ETH deflationary, or as Drake would say, “ultrasound”.