Thailand’s Securities and Exchange Commission (SEC) has flagged that decentralised finance (DeFi) needs to be regulated and future projects may require a licence to operate in the country.

The Bangkok Post reports that soon after Tuktuk Finance, a DeFi farming platform, had its coin and farming service debut on Bitkub Chain, the price quickly shot up to several hundred US dollars and then plummeted to US$1 in just a few minutes.

Regulation Required For Safety of Investors

After this incident the SEC made its first official announcement regarding cryptocurrency, which stated that regulation is needed in order to safeguard potential investors. The SEC stated it would specifically look into DeFi protocols that issue coins.

The issuance of digital tokens must be authorised and overseen by the Securities and Exchange Commission and the issuer is required to disclose information and offer the coins through the token portals licensed under the Digital Asset Decree …

SEC

Dome Charoenyost, founder of security token service Tokenine, added that “we could see SEC-regulated DeFi platforms in the future”, which would be a major bonus for investors looking to use Thai DeFi platforms. These platforms would need to be vetted for the safety of consumers. Projects will also need to be compliant, which will reduce the risk for investors of buying into a fraudulent token, or one whose price can be easily dumped.

However, regulations such as these can be difficult to enforce since the majority of DeFi platforms operate outside Thailand, and if the creator of a DeFi protocol wants to remain anonymous it’s quite possible.

Numbers of Thai Crypto Users On The Rise

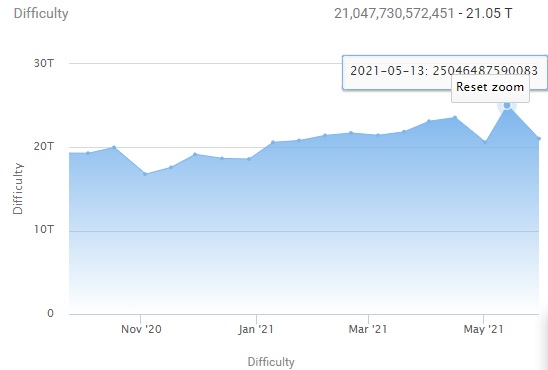

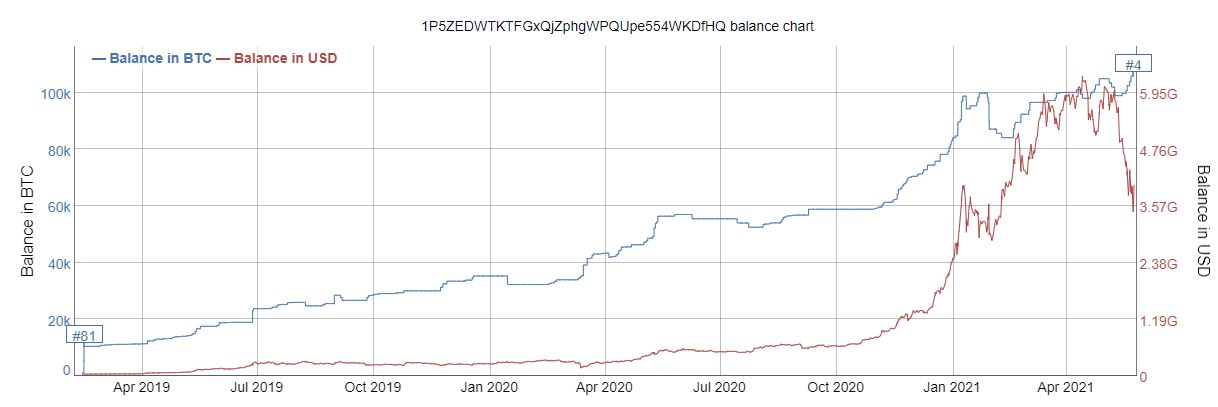

Data compiled by Thailand’s SEC and published by Bloomberg indicates combined volume across licensed Thai crypto exchanges increased from US$574.5 million in November 2020 to US$3.96 billion in February 2021, a jump of almost 600%.

Due to this boom, new know your customer (KYC) regulations will be implemented by September 2021 to block access by foreign investors to Thai exchanges. This will also reduce the number of accounts attached to those exchanges.

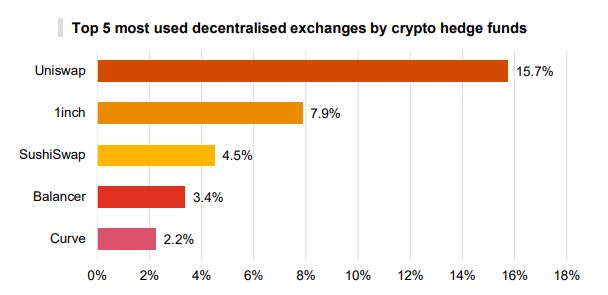

Banks have embraced DeFi in Thailand, with the Siam Commercial Bank announcing a US$50 million investment fund in February, and Kbank experimenting with DeFi services as part of its business expansion plan.