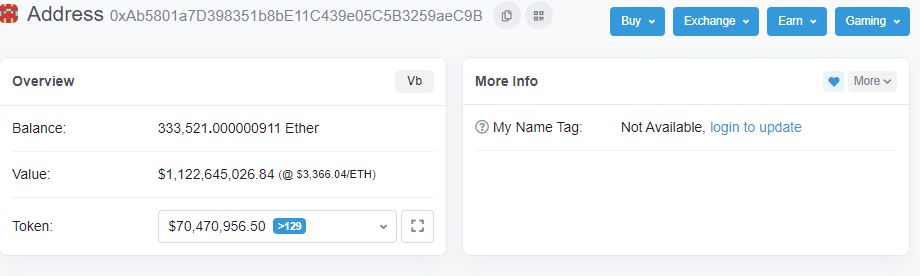

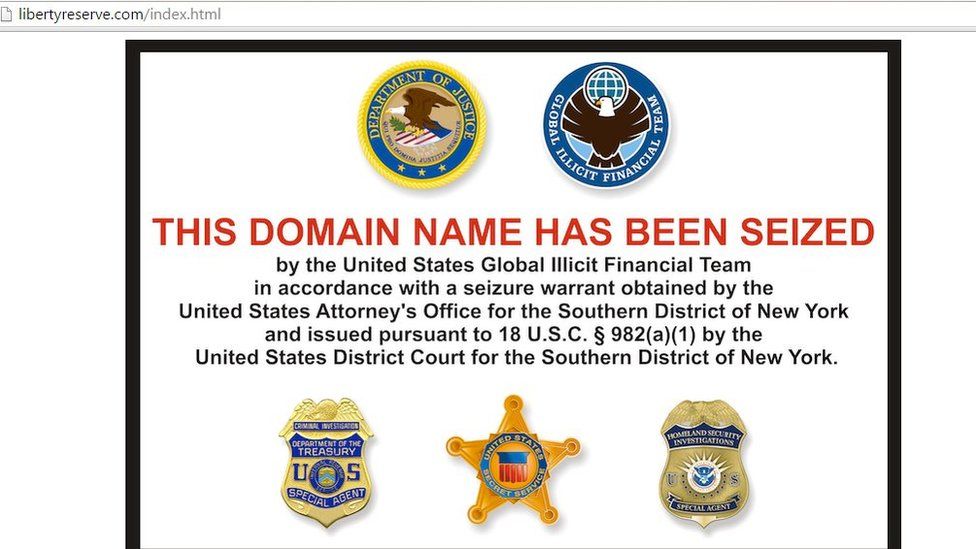

A Federal Court in Northern California has allowed the IRS to require Kraken to provide information on all users who made the equivalent of $20,000 USD in crypto transactions.

Following the announcement on 5 May the IRS has gotten permission “to serve a John Doe summons on Payward Ventures Inc., and subsidiaries d/b/a Kraken.” This summons stipulates that the IRS may obtain records about U.S. taxpayers that have made transactions over $20,000 USD between the years of 2016 and 2020.

This John Doe summons is part of our effort to uncover those who are trying to skirt reporting and avoid paying their fair share.

Chuck Rettig, IRS Commissioner

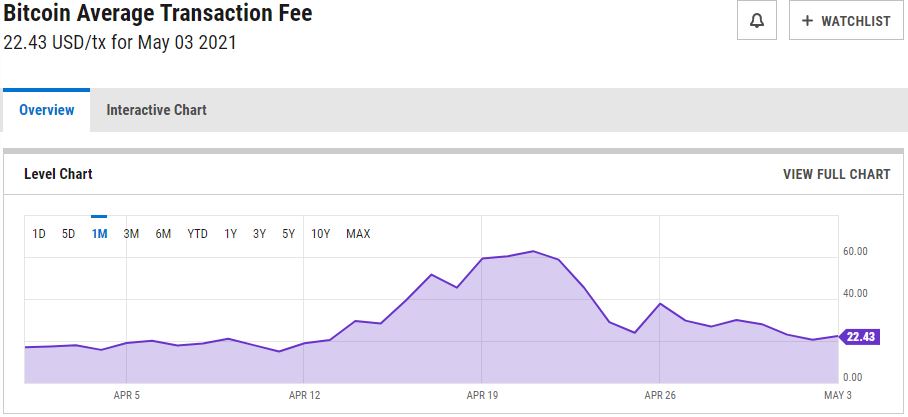

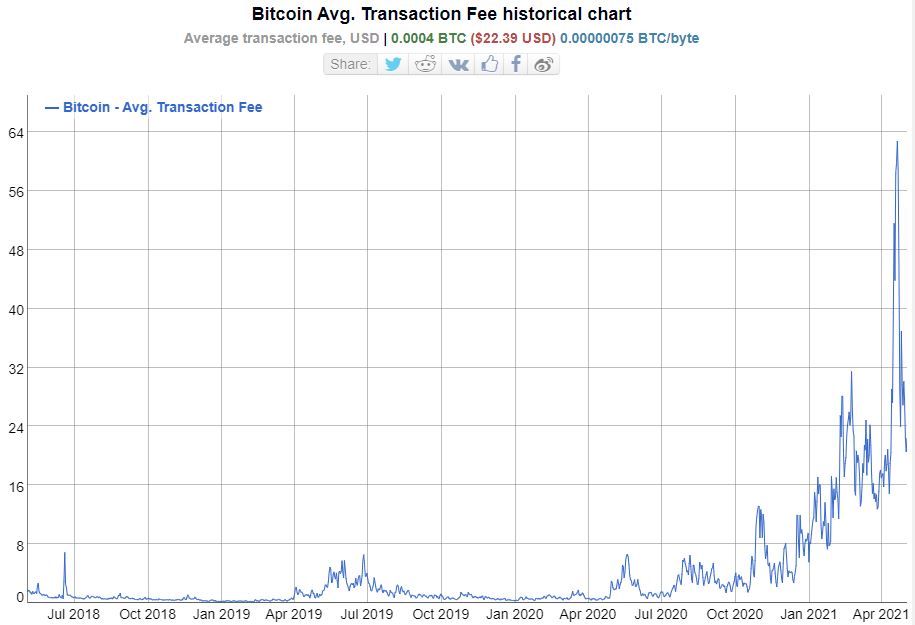

Since transactions in cryptocurrencies can be difficult to trace, taxpayers may be using them to hide taxable income from the IRS.

Cracking Down on Crypto Tax Fraud

Tax guidance has been given to U.S. citizens regarding crypto tax and the treatment of crypto as property. These efforts aim to minimise tax fraud through the use of crypto exchanges and digital currencies in general.

In addition to Kraken, Coinbase was previously served a similar order, “seeking information about U.S. taxpayers who conducted transactions in a convertible virtual currency during the years 2013 to 2015”.

Last month, cryptocurrency payments firm Circle also received an order from a federal court in the District of Massachusetts. The order similarly requested identifying documents from all Circle and Poloniex customers who transacted over $20,000 between 2016 and 2020.

Tools like the John Doe summons authorized today send the clear message to U.S. taxpayers that the IRS is working to ensure that they are fully compliant in their use of virtual currency. The John Doe summons is a step to enable the IRS to uncover those who are failing to properly report their virtual currency transactions. We will enforce the law where we find systemic noncompliance or fraud.

Chuck Rettig, IRS Commissioner [source]