Interest in Australian sports trading cards has surged and several businesses are hoping to cash in by offering famous sporting moments as NFTs.

Non-Fungible Tokens (NFTs) have been taking the crypto world by storm over the past 12 months, and it’s a trend that most exchanges are exploiting. Binance recently ran the ‘100 Creators’ campaign, which featured Australian artists, sports stars and musicians contributing work sold as NFTs. Crypto.com also recently launched its own NFT marketplace, featuring contributions from music and sports celebrities.

| Moment | Price |

|---|---|

| LeBron James “Cosmic” Dunk | $208,000 |

| Zion Williamson “Holo MMXX” Block | $100,000 |

| LeBron James “From the Top” Block | $100,000 |

| LeBron James “Throwdowns” Dunk | $100,000 |

| LeBron James “Holo MMXX” Dunk | $99,999 |

| Steph Curry “Deck the Hoops” Handles | $85,000 |

| Giannis Antetokounmpo “Holo MMXX” Dunk | $85,000 |

| LeBron James “From the Top” Dunk | $80,000 |

| LeBron James “From the Top” Block | $78,000 |

| LeBron James “From the Top” Dunk | $71,455 |

Booming Market in Sport NFTs

The sports industry is the latest to join the NFT party. The NBA, English Premier League, Major League Baseball and the UFC are among some of the big associations to have taken up the NFT craze. Grand Slam tennis champion Andy Murray has also made his entry into the NFT world, auctioning off a number of his memorable Wimbledon moments, one of which sold for US$177,777 when he won Wimbledon in 2013.

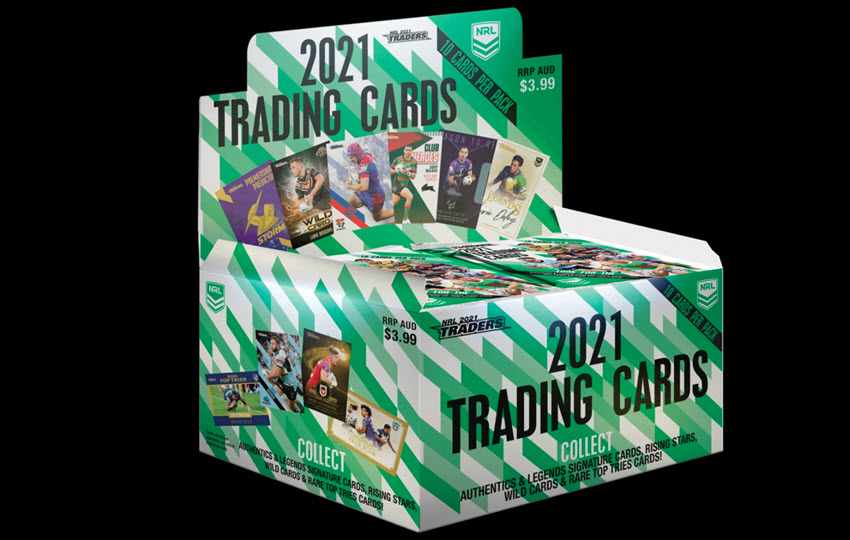

Collectibles Craze In Australia

Australian companies such as Four Points Collectables and Sport Moments are aiming to bring the sports NFT market to Australia for sports such as NRL, AFL and Basketball.

We’re creating a platform specifically built for Australian sporting codes that creates NFTs and brings a new layer of engagement to Australian sporting fans.

Jacob Osborne, Sport Moments CEO

Collectibles in general are experiencing a resurgence. David Miller, the man behind AFL Footy Cards, says the entire 2021 collection had sold out in June. Miller believes NFTs are “where the future will be”. He will be working with Sport Moments to offer AFL fans a new way to engage with their favourite sport.

Popular NRL players such as Ryan Papenhuyzen and Sandor Earl are getting involved in the trading cards action, as they collect and share them on their social media accounts.

The Dark Side of NFTs

Everyone wants a slice of the NFT pie at the moment. The ability to prove ownership is a game changer and no doubt we’re only just scratching the surface of possible applications. However, despite all of the hype about NFTs, they have also received a lot of criticism, primarily around their environmental impact.

NFTs have also been criticised for perpetuating art theft rather than preventing it, which is ironic because the latter was one of the primary arguments promoted by early campaigners of NFT art.

The Future of NFTs is Uncertain

No one knows what the future holds for NFTs. They may prove to be a pivotal part of the next digital revolution or they may prove to be just another fad that fizzles out after a couple of years.

For more on how to buy, sell and transfer NFTs, check this recent story run by Crypto News Australia.