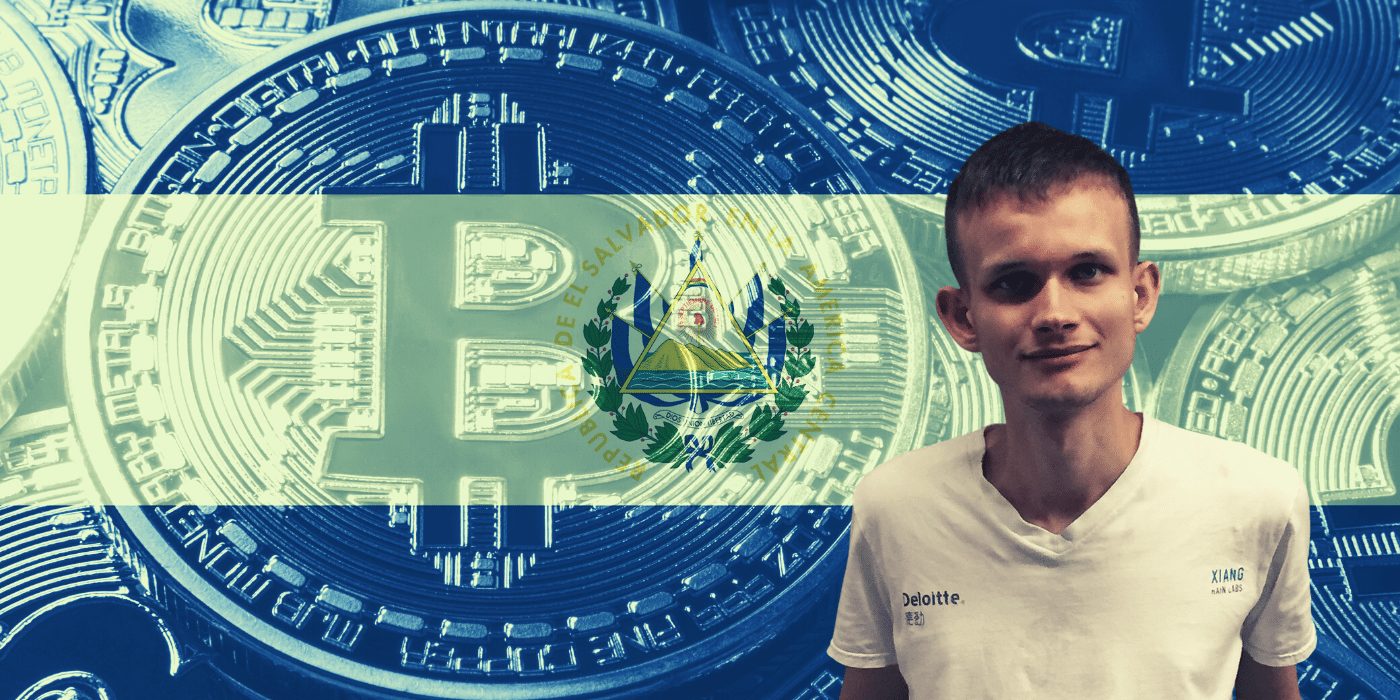

Vitalik Buterin has responded to a post regarding the Salvadorean Bitcoin rollout, calling it “contrary to the ideals of freedom” that the crypto space embodies as well as highlighting some of his own issues on the rollout.

Ethereum (ETH) co-founder Buterin commented on a post in r/CryptoCurrency Reddit titled “Unpopular opinion: El Salvador President Mr Nayab [sic] Bukele should not be praised by Crypto community”. Buterin said there was “nothing unpopular about this opinion”, adding that by “making it mandatory for businesses to accept a specific cryptocurrency”, [El Salvador is] going “contrary to the ideals of freedom that are supposed to be so important to the crypto space”.

According to article 7 of El Salvador’s Bitcoin Law, “Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service […] Those who, by evident and notorious fact, do not have access to the technologies that allow them to carry out transactions in bitcoin are excluded from the obligation.”

As it stands there seems to be some mismatch between the text of the law and what Salvadorean president Bukele wrote in a Twitter thread about the use of bitcoin as legal tender, which was intended to be “totally optional” and that the government would not force any of the nation’s residents to receive bitcoin as a form of payment.

Buterin may also be referring to the fact that only BTC is accepted as legal tender and not a more expansive list of cryptocurrencies. As one Reddit user asked, would he say the same about Ethereum if El Salvador had selected ether (ETH) as its sole digital legal tender?

Bitcoin Maximalists Support President Bukele’s Decisions

Buterin’s post added that: “This tactic of pushing BTC to millions of people in El Salvador at the same time with almost no attempt at prior education is reckless, and risks a large number of innocent people getting hacked or scammed. Shame on everyone (OK, fine, I’ll call out the main people responsible: shame on Bitcoin maximalists) who are uncritically praising him.”

The decision to make bitcoin legal tender in El Salvador was received very well by bitcoin maximalists, individuals who believe bitcoin is the be-all and end-all of the crypto world.

He’s [Bukele] a human being like the rest of us, he just loves being praised by people he considers powerful (ie, Americans). Bitcoin maximalists are a very easy community to get to praise you: you just have to be in a position of power and do or say nice things about them and their coin.

Vitalik Buterin

One Salvadorean business owner, requesting anonymity, told Decrypt: “It crushes my soul to see Bitcoin maximalists around the world cheering this when, if they actually sat down and read the law and regulations, it is completely opposite to everything they preach.”

An Adjustment to Start Using Bitcoin

At this month’s TOKEN2049 conference in London, Blockchain.com co-founder Nicolas Cary said during a panel discussion: “I think there’s some valid criticisms of how the program [has been] rolled out in El Salvador in terms of being top down. [A] main ethos of crypto is that there’s really grassroots adoption, and people are doing it voluntarily.”

Multiple surveys in the country have found that the majority of Salvadoreans are not in favour of bitcoin as legal tender.

Other countries may yet follow El Salvador’s example. Earlier this month, Lord Fusitu’a, a member of the Tongan parliament, made a case for the Pacific island nation to accept bitcoin as legal tender in order to cut down on remittances costs.