At the Digital Asset Compliance and Market Integrity Summit held in New York on December 1, Securities and Exchange Commission (SEC) chairman Gary Gensler finally admitted that Bitcoin is a competitor to the US banking system and its worldwide consensus.

Regulation at the Heart of Discussion

At the event, Gensler joined former SEC chairman Jay Clayton for a broad discussion of the burgeoning crypto sector. Gensler saw his responsibility as mitigating risks of a “spill in Aisle 3”, which may be caused in his view by a financial instability event, stablecoins, the lending sector, or “by the investing public getting hurt by fraudsters or good-faith actors promoting and raising money”.

Gensler repeatedly referred to the sector as the “Wild West” and argued that “whether it’s a trading platform or token, [they] are not going to evolve well outside of the tenets of public policy”. His main concern articulated related to the asymmetry of information:

At the core of our bargain in the securities markets is: investors get to decide what risks they want to take. But the people raising the money, the issuers, should share full and fair disclosure.

Gary Gensler, SEC chairman

On Bitcoin

In his conversation, Gensler drew a distinction between Bitcoin and digital assets, recognising that in the case of the latter, many projects exhibited securities-like qualities.

Repeating prior comments, he reiterated his position that Bitcoin’s innovation was real in that it was “about money and ledgers” and enabled 24/7 instantaneous, transparent and final settlement. He then went on to describe Bitcoin as an “off-the-grid” alternative to the traditional financial system:

We layered over our digital money system about 40 years ago with money laundering and various sanctions and regimes around the globe; we layered that over a digital currency system called our banking system. In 2008, Satoshi Nakamoto wrote this paper in part as a reaction, an off-the-grid type of approach. It’s not surprising that there’s some competition [Bitcoin] that you and I don’t support but that’s trying to undermine that worldwide consensus.

Gary Gensler, SEC chairman

When Gensler was appointed, Bitcoiners were optimistic as he seemed to appreciate the distinction between bitcoin and altcoins.

However, even if his latest pronouncement is disappointing to Bitcoiners, it’s difficult to argue that Bitcoin isn’t threatening US dollar hegemony. Gensler’s sentiment is also shared by Hillary Clinton, who recently described Bitcoin as “undermining the dollar“.

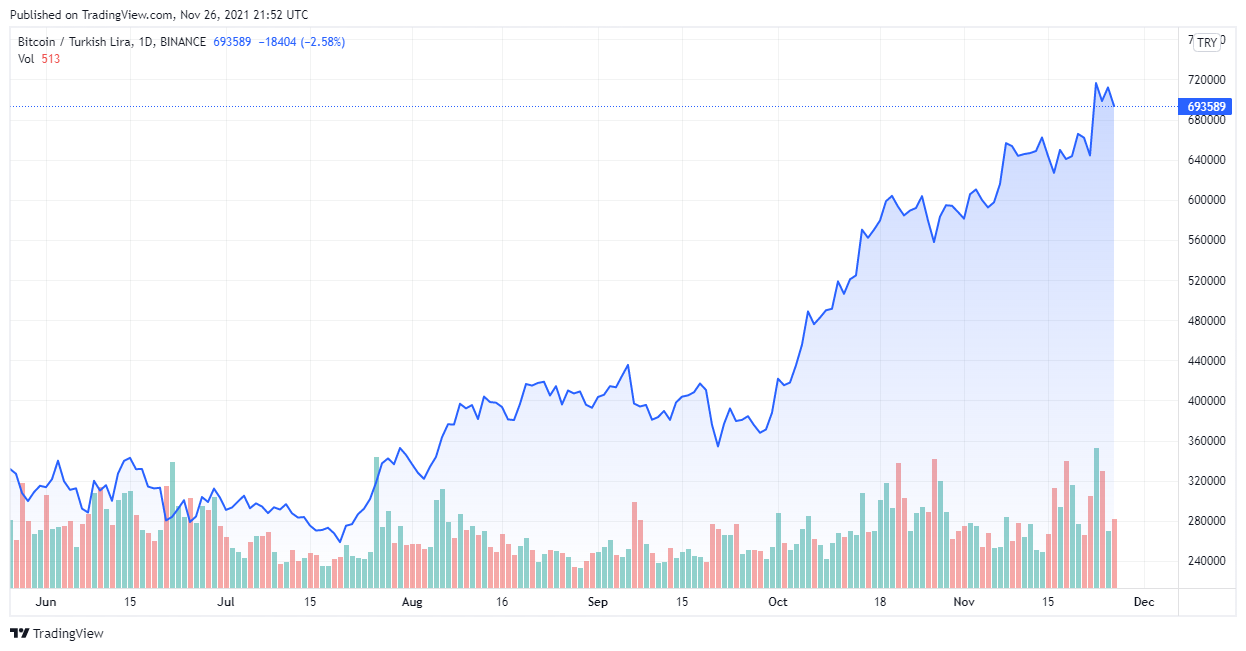

Shifting towards a “Bitcoin Standard”, like El Salvador, is what broadcaster Max Keiser has termed a “speculative attack against the US dollar”.

So far it seems to be working. And perhaps for that reason, Gensler’s concerns are well-founded.