Jamie Dimon, JPMorgan’s headstrong CEO, is well known to be a Bitcoin sceptic. His latest pronouncement, however, may be his most positive yet. According to a recent interview, he now believes that the blue chip digital asset could grow by up to 10 times within the next five years.

A Trip Down Memory Lane

With a market cap of around US$465 billion, JPMorgan is the world’s largest investment bank. When the chief executive speaks, financial markets listen. So what has he historically had to say about Bitcoin?

In 2017, Dimon did not mince his words when asked about what he would do if JPMorgan traders started trading bitcoin:

I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.

Jamie Dimon, CEO, JPMorgan

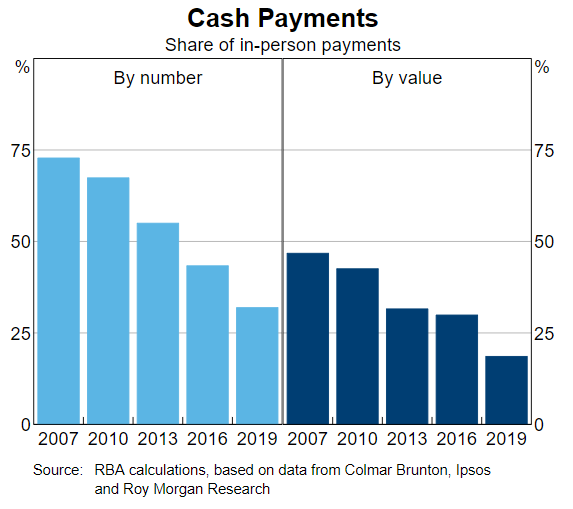

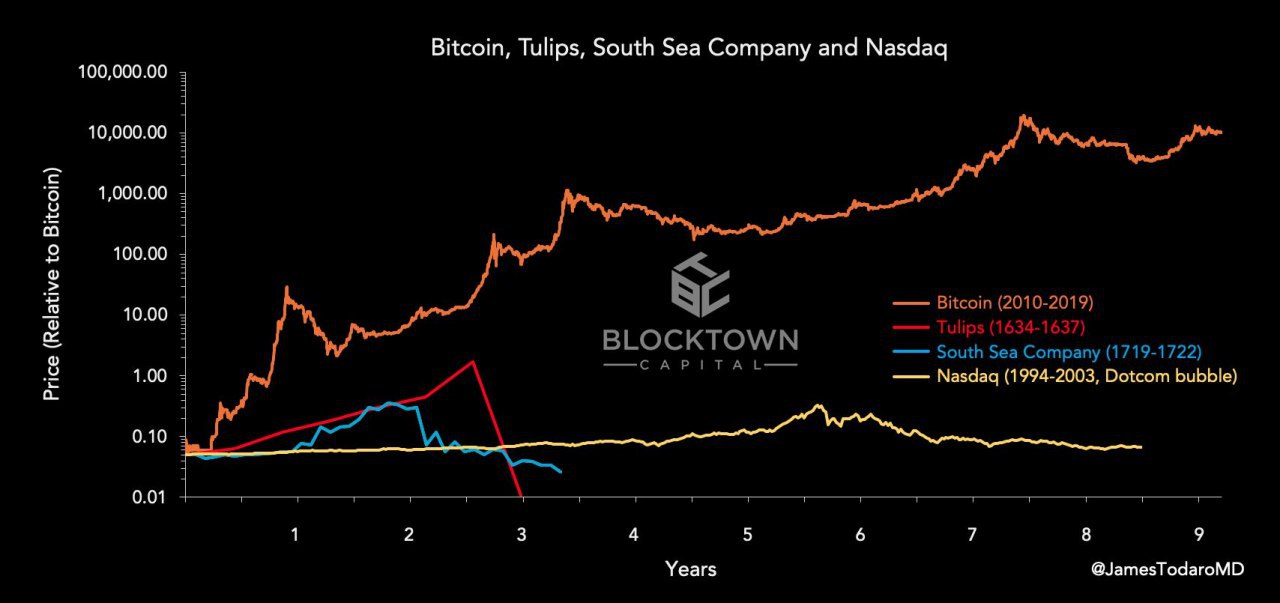

He went further to say that it “won’t end well” and famously declared: “It’s a fraud … and worse than tulip bulbs.”

I couldn’t care less what bitcoin trades for, how it trades, why it trades, who trades it, if you’re stupid enough to buy you’ll pay the price for it one day. I’ve also told people it could trade at $100,000 before it trades to zero. Tulip bulbs traded for $75,000 or something like that … the only value in bitcoin is what the other guy will pay for it.

Jamie Dimon, CEO, JPMorgan

The following year, Dimon expressed regret about calling it a fraud but remained sceptical that it could exist without state oversight. He claimed that he saw value in blockchain but that bitcoin had extremely limited use, save for rogue nations or criminals.

JPMorgan Embraces Bitcoin

Fast-forward to 2021 and the banking giant appears to have made some significant internal policy changes.

In January, one of the bank’s analysts appeared to embrace the “digital gold thesis”, saying that bitcoin could in the long run be valued at US$146,000. Later, the bank noted that retail traders outbid institutions in Q1 of 2021.

In July, it was announced that JPMorgan would be granting its wealth management clients access to cryptocurrency funds, becoming the first major US bank to do so. And just last month, it was revealed that it had launched an in-house Bitcoin fund for private bank clients in partnership with NYDIG.

Much of these changes no doubt are driven by demand from clients who could just as easily shift their allegiance to a more bitcoin-friendly bank. In the end, despite any personal misgivings, Dimon appears to have conceded that bitcoin is here to stay, for better or worse, and his company may as well make hay while the sun shines.