Anthony Scaramucci, CEO of alternative investment firm SkyBridge Capital, has revealed that the fund now holds US$700 million in cryptocurrency. The firm has filed for a crypto-focused exchange-traded fund (ETF) and has revealed plans for an Algorand fund.

This is a technology and a product of the future, and the future is going to come more quickly than people expect.

Anthony Scaramucci, CEO, Skybridge Capital

A long-time believer in Bitcoin, Scaramucci launched SkyBridge Capital’s first BTC fund last year with a US$25 million investment.

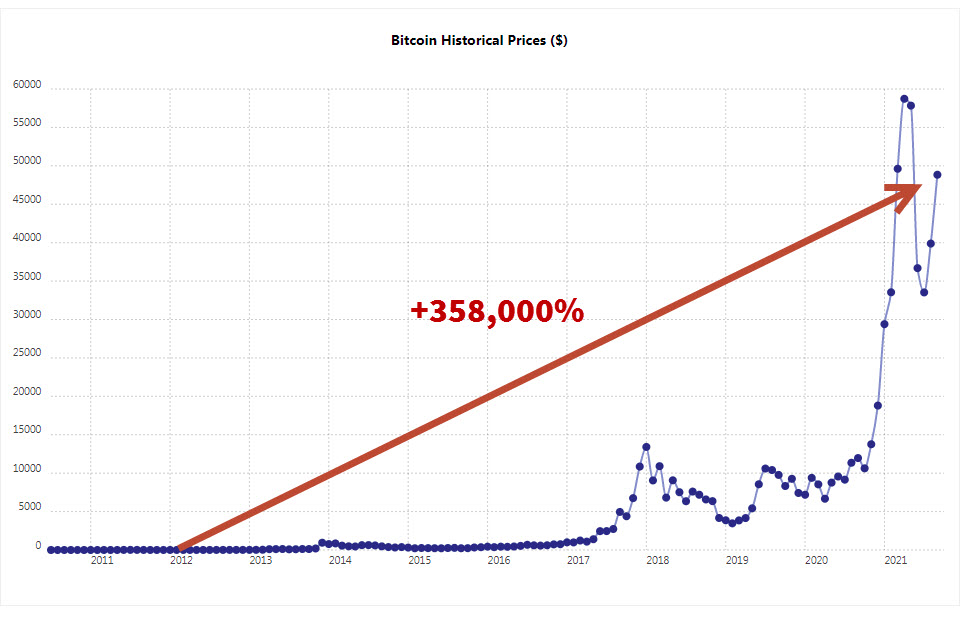

With a US$700 million investment in Bitcoin and Ethereum spread across all SkyBridge products, Scaramucci is convinced that BTC is growing faster than tech giants Google, Amazon and Facebook, and will reach one billion users by 2025.

Scaramucci, a former White House communications director, says the firm has raised more than US$100 million toward its newly announced Algorand fund. He adds that “cryptos are here to stay”, noting that regulators must “act very quickly” if they are to stem the snowballing adoption of cryptos.

A Change is Gonna Come

Scaramucci is of the opinion that cryptos are here to stay and will revolutionise the finance world as Amazon and Facebook did for the internet and e-commerce. Bitcoin and crypto in general will represent a breakaway from an “old economy” that will survive and co-exist in the future, he says.

My eureka! moment was when I recognised that the blockchain is allowing us to transact with each other without a third party, without an authority.

Anthony Scaramucci

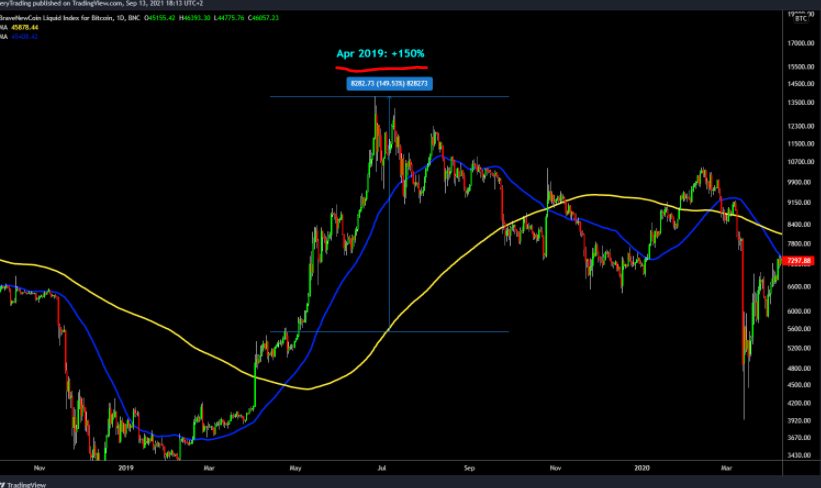

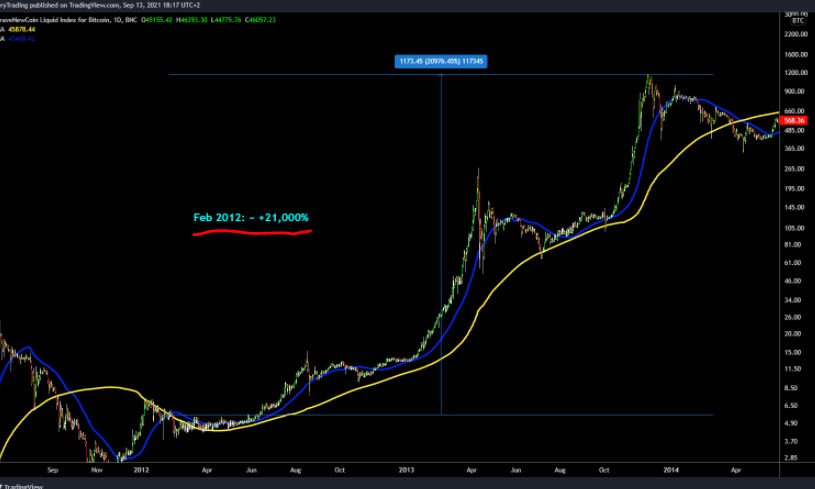

Bitcoin ‘Will Reach $100,000’ Before End of 2021

“As long as I see that, I see those prices rising,” Scaramucci says. “So we’re going to stick with the US$100,000 price target.”

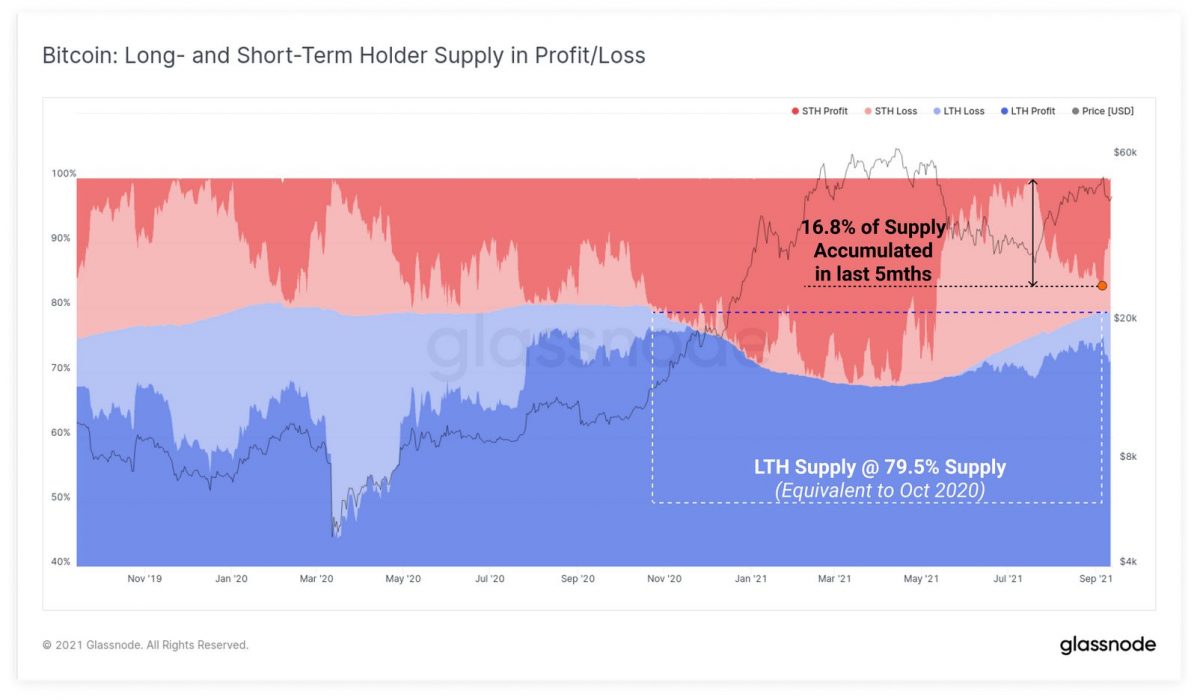

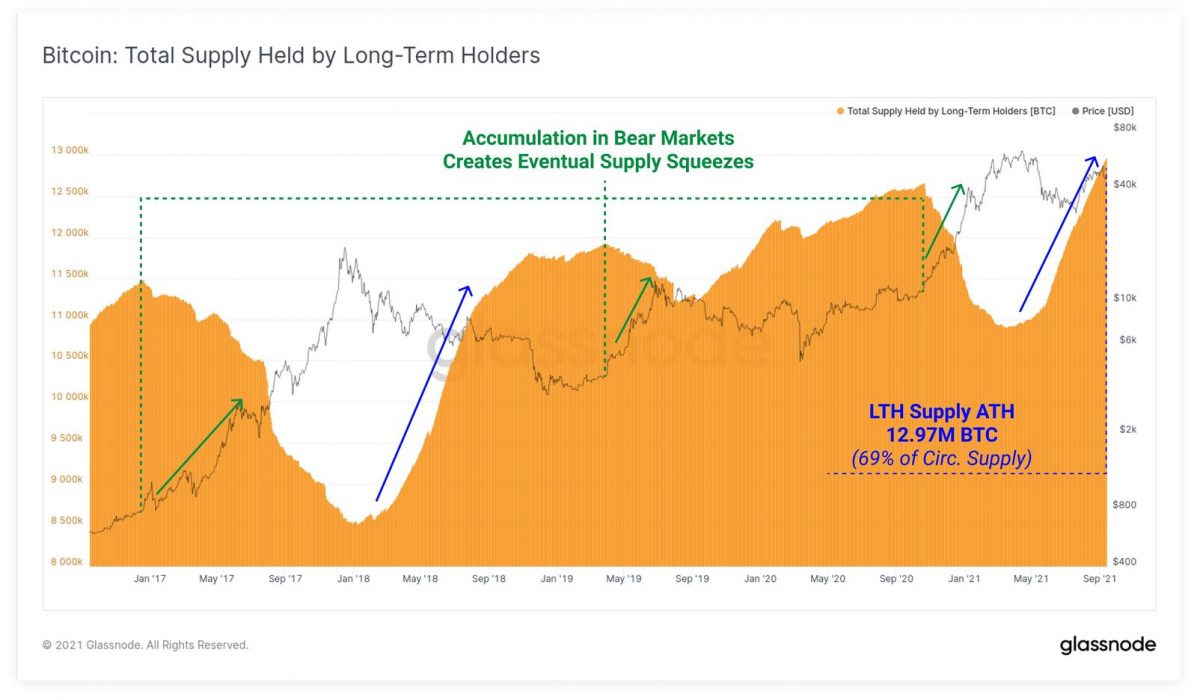

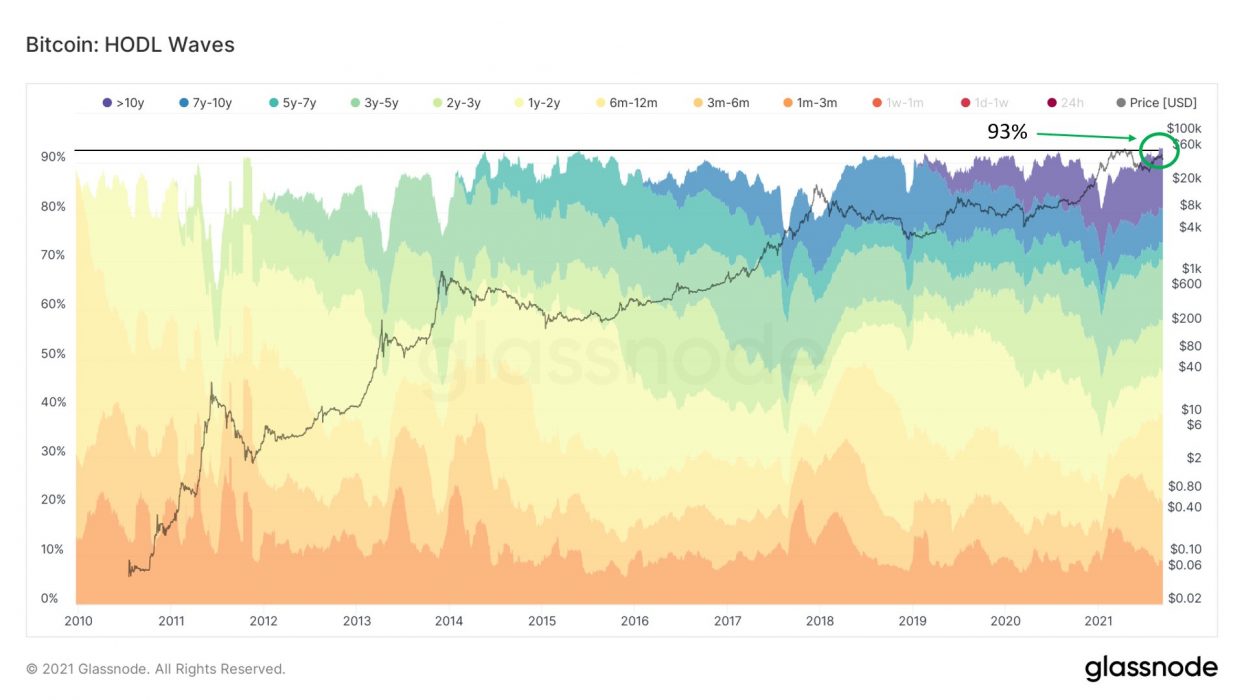

Scaramucci’s prediction is based on BTC’s limited and fixed supply coupled with exponentially bigger demand each month. The fund manager adds that for SkyBridge Capital, BTC is not a trade but rather a long-term investment and store of value.

Bitcoin Can No Longer Be Ignored

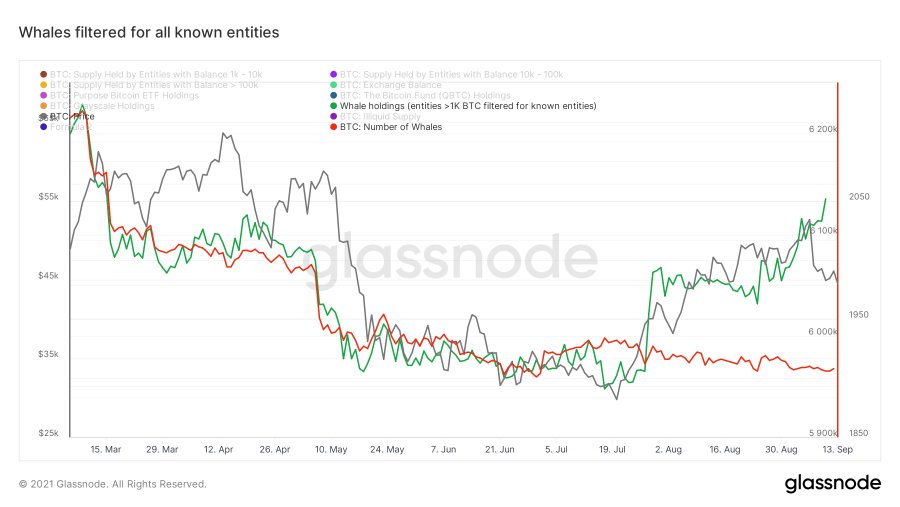

Demand for BTC is on the rise, and financial institutions can no longer ignore it. Banks and financial institutions are slowly accepting this inevitability, albeit with some trepidation.

Morgan Stanley now offers three bitcoin funds to its wealthiest investors but due to the inherent volatility of BTC currently allows clients to invest only 2.5 percent of their capital in bitcoin, citing it as a risky investment. The bank has also recently filed with the US Securities and Exchange Commission (SEC) to allow bitcoin exposure into multiple funds.