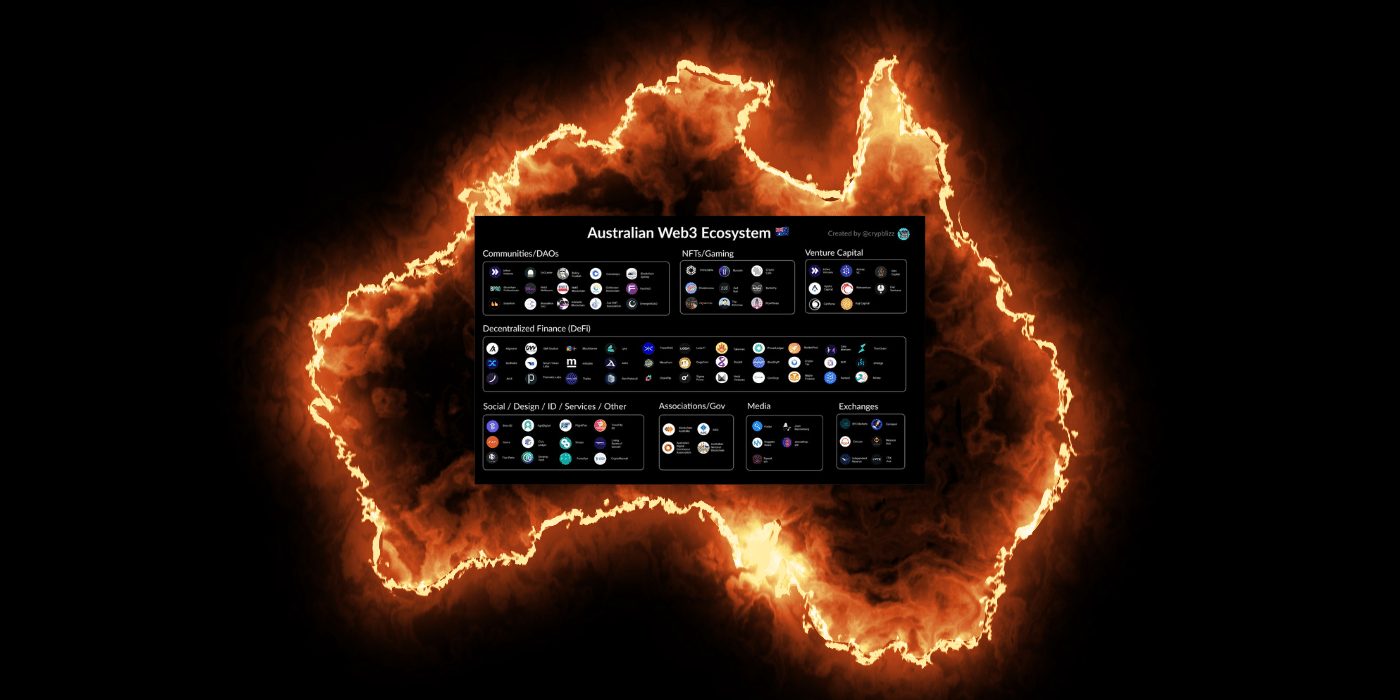

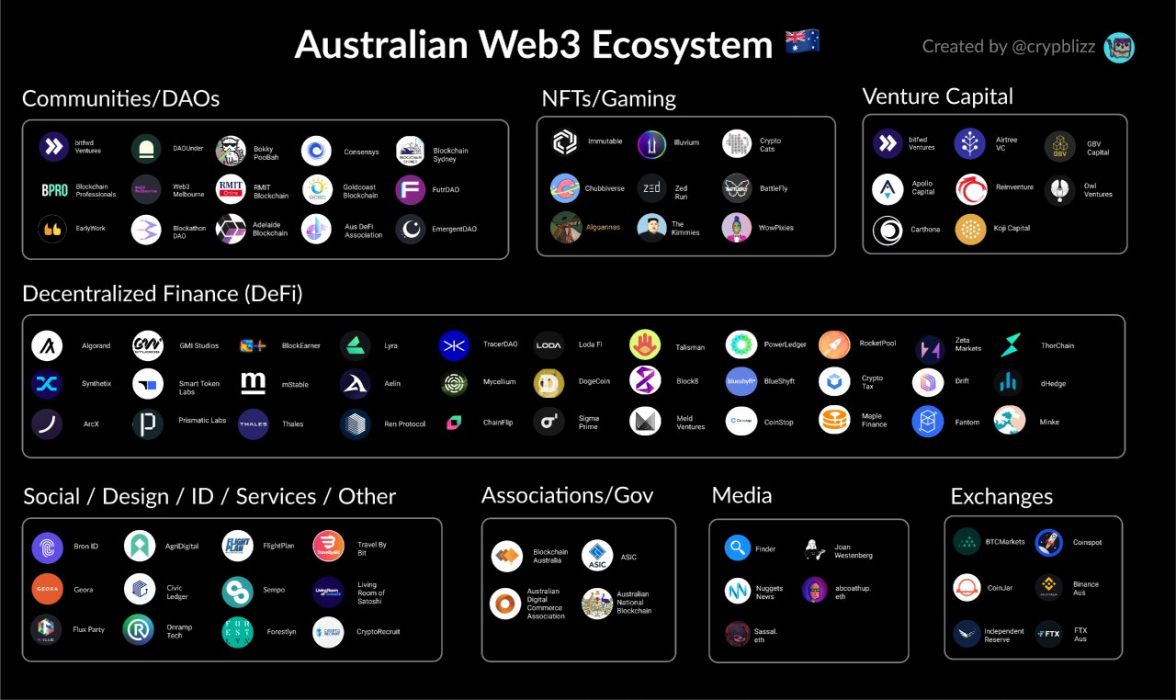

The Australian Web3 ecosystem has grown immensely over the past couple of years and is driven by cryptocurrencies and blockchain technology.

The emergence of NFTs, DeFi, and decentralised autonomous organisations (DAOs) has expanded the space. The days of ICO token raises have been superseded by building meaningful communities. Notable communities/projects in the space include Immutable, Synthetix, Sigma Prime, Maple Finance, and DAOunder, all of which have helped garner increasing interest in the ecosystem.

The branding surrounding Web3 has made the space more inviting than the nuanced word ‘crypto’ would have suggested a few years ago.

Aussie Blockchain History in Brief

- pre-bitcoin 1970 -2000s: cypherpunk movement;

- 2009 – 2013: the birth of Bitcoin and underground knowledge of the space;

- 2014 – 2016: Ethereum launches and early adopters spring up;

- 2017 – 2018: ICO boom and an influx of capital and interest;

- 2018 – 2020: ‘DeFi Summer’, where projects started to build the foundations for decentralised finance;

- 2021: NFTs, DeFi and DAO boom interest; and

- 2022: who knows?

The following categories summarise the activities within the Australian Web3 ecosystem:

Communities/DAOs

These form the backbone that brings people together, and with recent events, many communities have moved online to Discord. In-person events such as Blockchain Week show that people are willing to meet in real life again. By bringing it all together, people feel a sense of community and the ecosystem grows accordingly.

Non-Fungible Tokens (NFTs)/Gaming

NFTs took 2021 by storm and a lot of people are forking out vast amounts of money for expensive JPEGs. However, a lot of great Aussie projects such as Immutable, which was recently valued at US$3.5 billion, and Illuvium have also been making waves in the Web3 ecosystem.

Decentralised Finance (DeFi)

DeFi is such a vast category that it can be been broken down into the following:

- Layer 1 blockchains: Fantom, Algorand, ThorChain;

- Finance layer: Synthetix, Ren Protocol, Maple Finance, Zeta Markets and Drift;

- Infrastructure: Rocket Pool, Chainflip, Sigma Prime; and

- Identity: ArcX and BronID.

Venture Capital

Over the past two years, traditional Web2 funds have been spinning off an extra allocation into the space. Airtree, for example, launched a US$50 million Web3 fund, which is a very healthy sign for the growth of this sector.

Media

The right kind of media is essential in this growing space, with click-bait schemes popping up left, right and centre. Influencers who are voicing their opinions in this space can be invaluable.

Legal/Regulatory/Government

Bodies like Blockchain Australia are helping form relationships and policies within the ecosystem. Collaboration between these associations and regulatory bodies will accelerate the adoption process.

Exchanges and Retail Investors

Retail investors use these exchange platforms to enter the Web3 markets. BTC Markets, Independent Reserves, Coinjar and Coinstop are some of the first Australian native exchanges.