The central banks of Australia, Singapore, Malaysia and South Africa, in conjunction with the Bank for International Settlements (BIS), have released a report outlining the results of a project to create two prototype multi-CBDC platforms.

Project Dunbar, which was launched in September 2021, concluded that multi-CBDCs are technically viable but significant coordination, governance and jurisdictional challenges will need to be overcome before they can be fully implemented in real-world situations.

What Did Project Dunbar Involve?

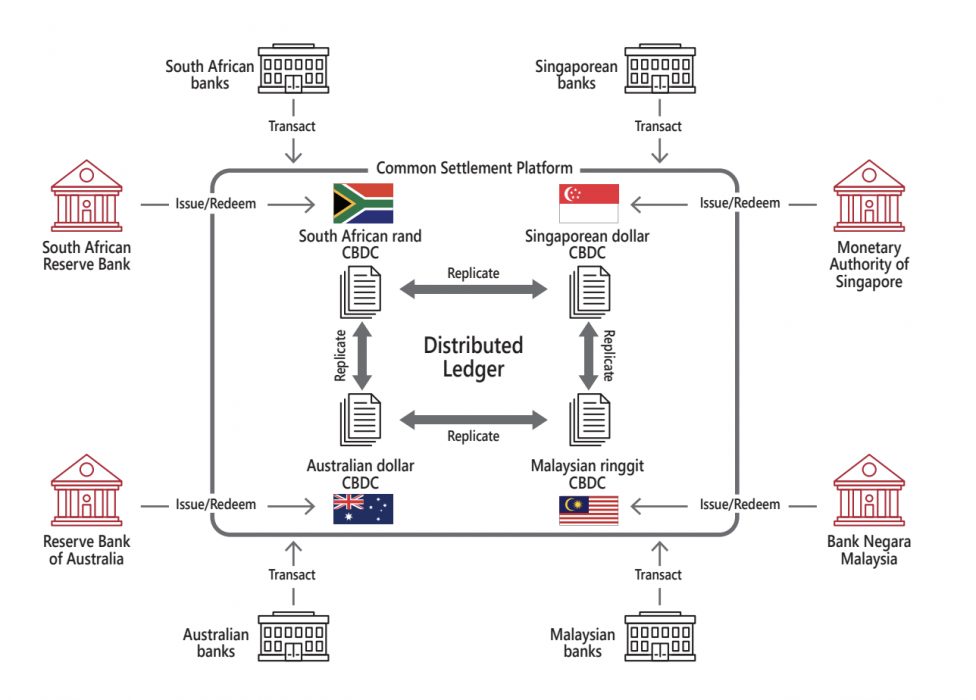

Project Dunbar involved the creation of two multi-CBDC platforms shared by multiple central banks to transact with each other using different digital currencies. The use of such systems could potentially reduce reliance on intermediaries and lead to significant reductions in the cost and time taken to complete international transactions between financial institutions.

The prototypes were built using two different technology platforms – one developed primarily by R3 on the Corda platform, the second developed on the Quorum platform.

The report found that financial institutions could successfully use these shared multi-CBDCs to directly transact with each other, stating that:

This initial phase of the project successfully developed working prototypes and demonstrated practicable solutions, achieving its aim of proving that the concept of multi-CBDCs was technically viable.

Project Dunbar report

Technically Viable But Hurdles Ahead

While the report found that shared multi-CBDCs are technically viable, it also identified governance, jurisdictional and trust issues that need to be solved before the tech can become truly viable.

The report identified three key questions that need to be addressed:

- Which entities should be allowed to hold the digital currencies and access the shared platform?

- How can cross-border payments be simplified while respecting regulatory differences across different jurisdictions?

- What kind of governance arrangement would make countries comfortable sharing access to critical infrastructure such as payment systems?

Michele Bullock, assistant governor of the Reserve Bank of Australia (RBA), echoed these concerns, explaining:

Project Dunbar has provided valuable insights into the opportunities and challenges associated with developing a shared platform for multiple CBDCs to enhance cross-border payments. Allowing entities to directly hold and transact in CBDCs from different jurisdictions could reduce the need for intermediaries in cross-border payments, but it would need to be done in a way that preserves the security and resilience of these payments.

Michele Bullock, assistant governor, RBA

Australia’s involvement in Project Dunbar is another indication of the Reserve Bank’s growing interest in CBDCs, having last year sought to hire cryptocurrency experts to work in its Central Bank Digital Currency research team.